Widespread decline in commodity prices continues

An overview of current trends in the commodity landscape

Published by Giulio Corazza. .

Energy Ferrous Metals Food Non Ferrous Metals Commodities Financial Week

The global economic slowdown and concerns of a recession are having their effects on commodity prices. According to the World Bank's October report released these days(

Commodity Markets Outlook - October 2022), this slowdown will continue in the coming months, translating into sharp declines in commodity price levels.

Financial markets and real markets turn out to be highly connected. Monitoring trends in financial prices can help to understand how fast prices will move in real markets as well.

ENERGY

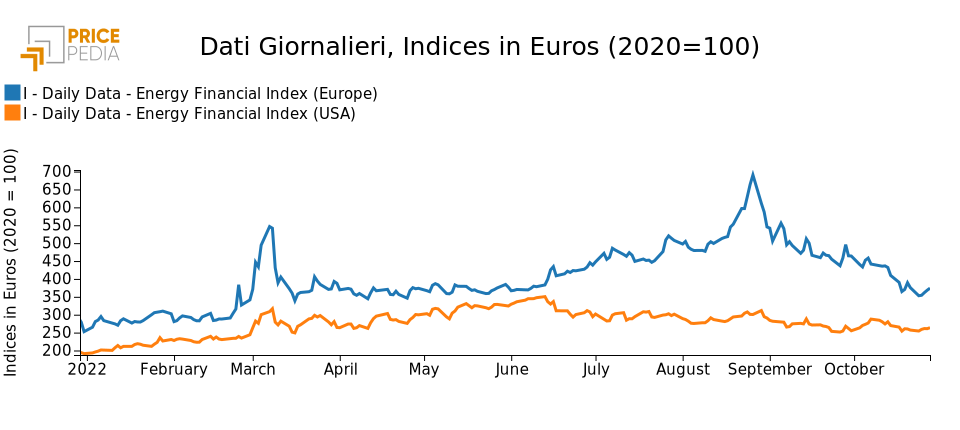

On the energy products front this week, the PricePedia Europe financial index is down while the U.S. index reports a slight increase.

In Europe, above-average seasonal temperatures and high levels of natural gas storage are producing lower gas prices. There continues to be a risk, however, that Russia will cut off natural gas supplies, resulting in higher price levels.

As for the price of oil with the realization of an unfavorable economic situation and lower industrial activity, it is difficult for price levels not to fall significantly. The price structure clearly presents

a backwardation situation, with 12 and 24-month futures $10 and $20 per barrel lower than spot prices.

PricePedia financial indexes of energy prices in Europe and in the U.S.

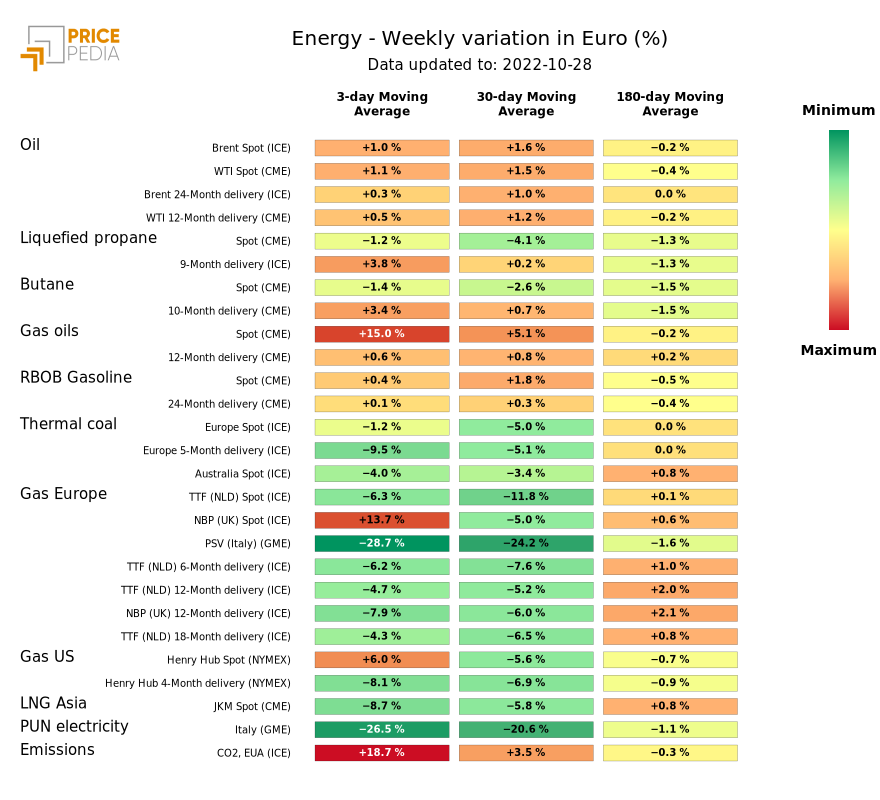

The heatmap below provides an overview of energy product price trends. It shows the sharp decrease in the price of gas quoted at the TTF on the different maturities. Even more pronounced is the reduction of gas on the day-ahead market at the Italian Virtual Trading Point (PSV), which is matched by an equivalent drop in the PUN price of electricity Italian.

HeatMap of energy product prices

METALS

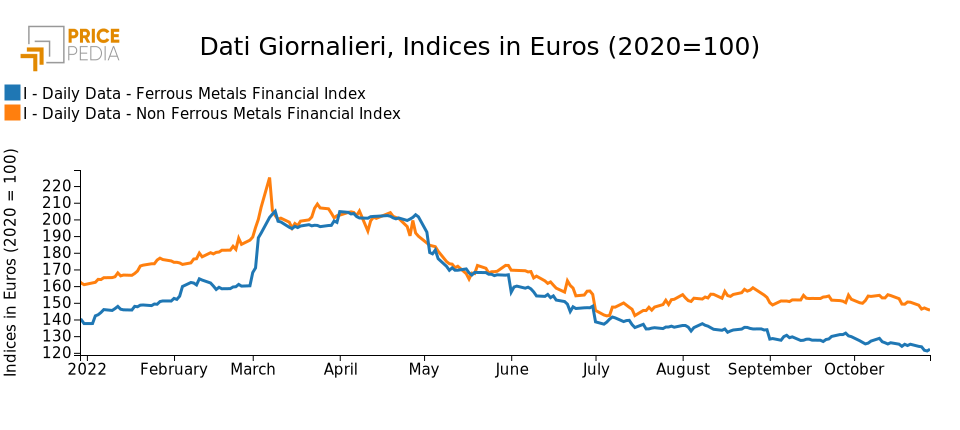

The following chart shows the PricePedia financial indexes of ferrous and nonferrous metals prices. The PricePedia indexes also show a decline this week.

As the global economic slowdown intensifies and industrial activity levels decline as a result,

metal prices will tend to trend downward. The energy transition, however, if implemented soon, could support the prices of those metals most used in the production of the products most involved

in the transition: electric cars, photovoltaics, wind power, etc.

Financial PricePedia indexes of ferrous and nonferrous metals

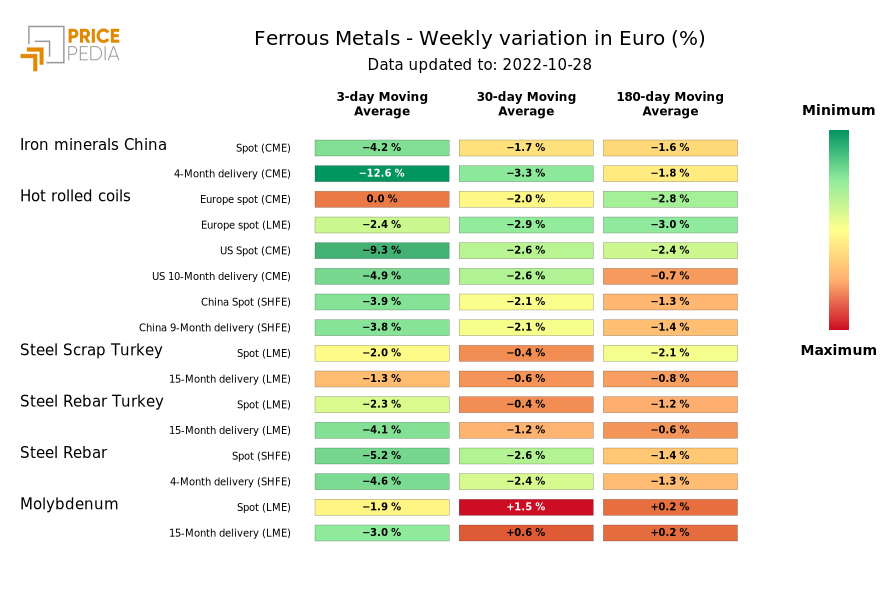

FERROUS METALS

The heatmap below provides an overview of ferrous metal price trends. At the individual product level, the decline in ferrous metal prices appears generalized. The change in U.S. hot coil prices is particularly pronounced.

HeatMap of ferrous metal prices

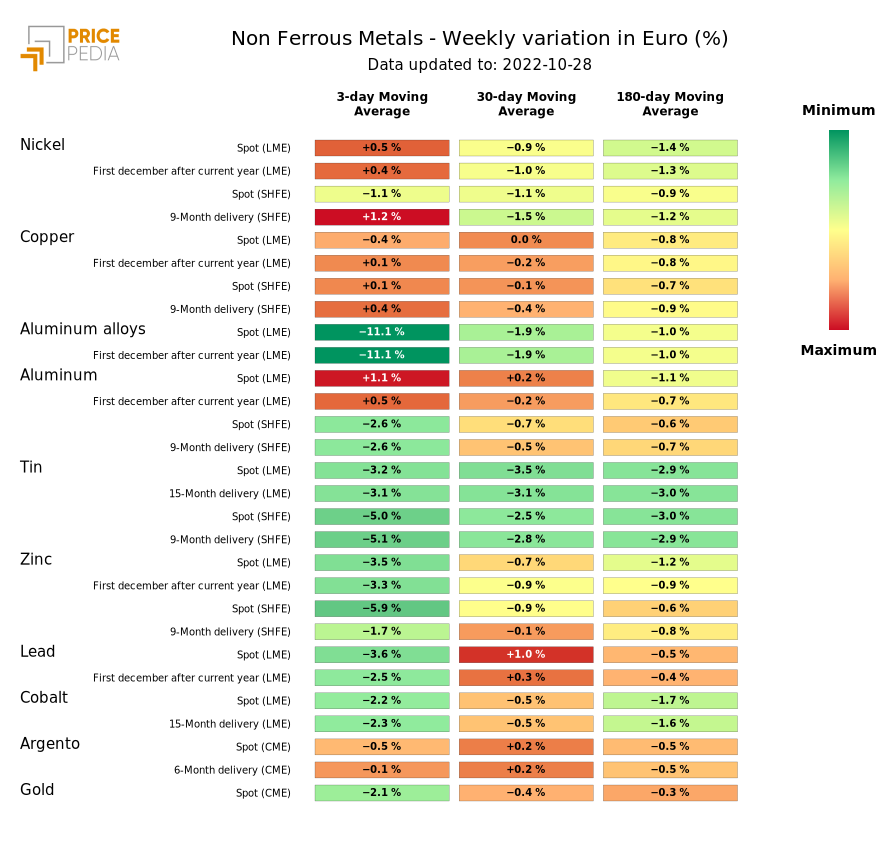

NON FERROUS METALS

The heatmap below gives an overview of the price trends for nonferrous metals. The declines for nonferrous metals mainly concern metals other than the main three (copper, aluminum and nickel), whose prices are relatively stable. Particularly strong is the decline in aluminum alloy prices. However, it should be noted how quotations on the LME of this type of aluminum are based on very low transactions and volumes which limit their significance.

HeatMap of non-ferrous metal prices

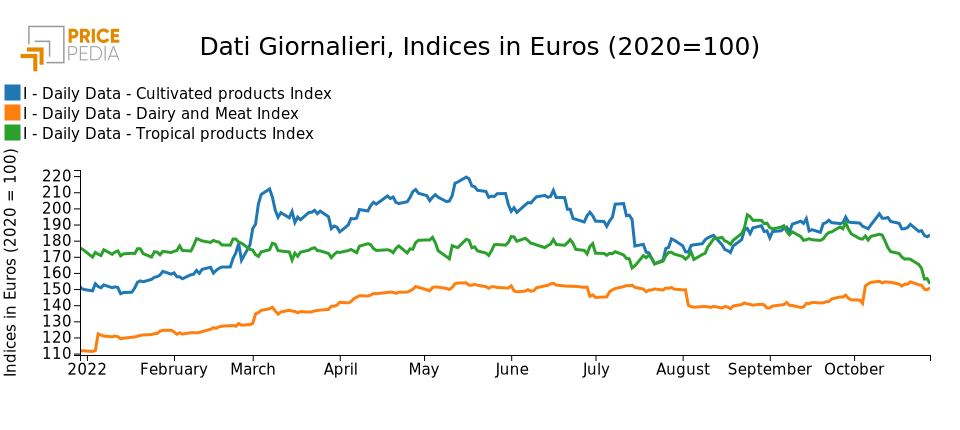

FOODS

On the food front for the second consecutive week PricePedia financial indexes record a decline.

In the case of tropical food prices, the downward phase has accelerated sharply.

Financial PricePedia indices of food products

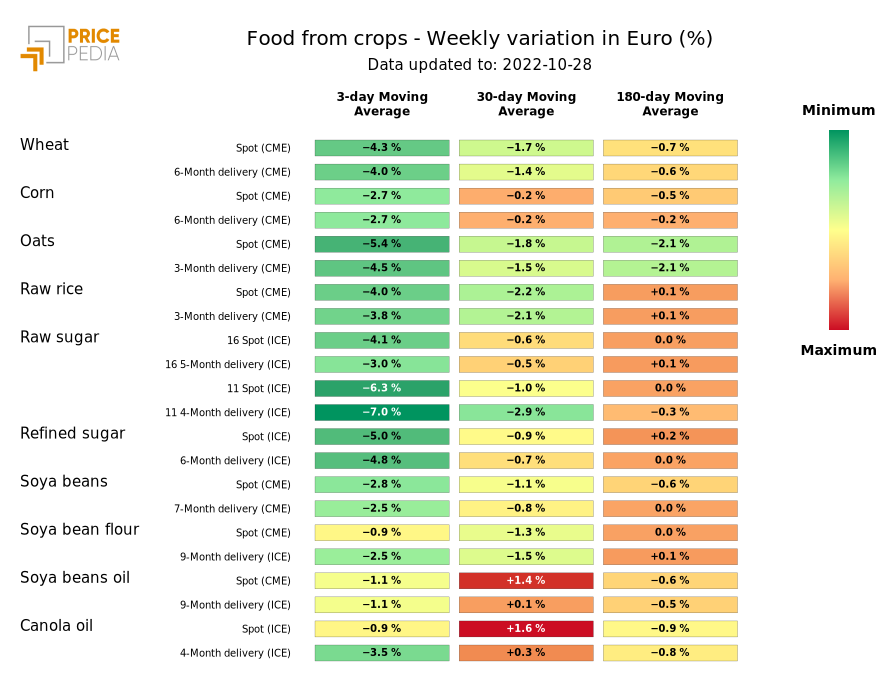

FOOD FROM CROPS

The heatmap below provides an overview of the trend in crop food prices. The reduction is particularly significant for cereals and sugar. It is more contained for soybeans and derivatives.

HeatMap of crop food prices

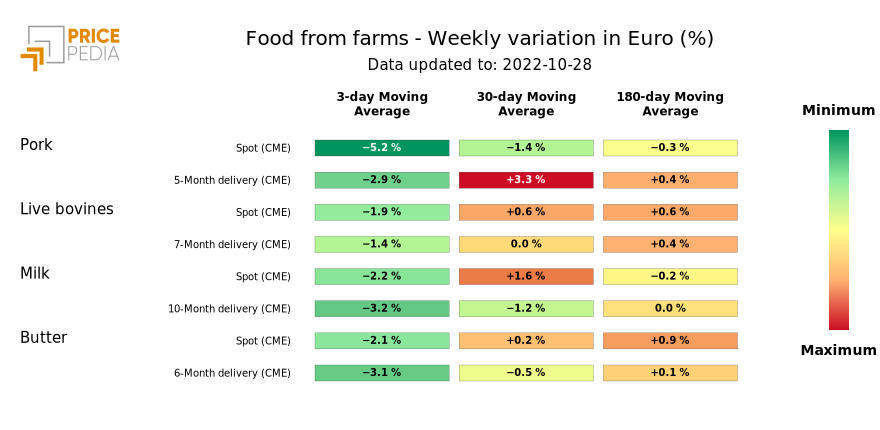

FOOD FROM FARMS

The heatmap below provides an overview of the trend in farm-gate food prices. The reduction is across the board, with higher peaks for pork prices.

HeatMap of food prices from farms

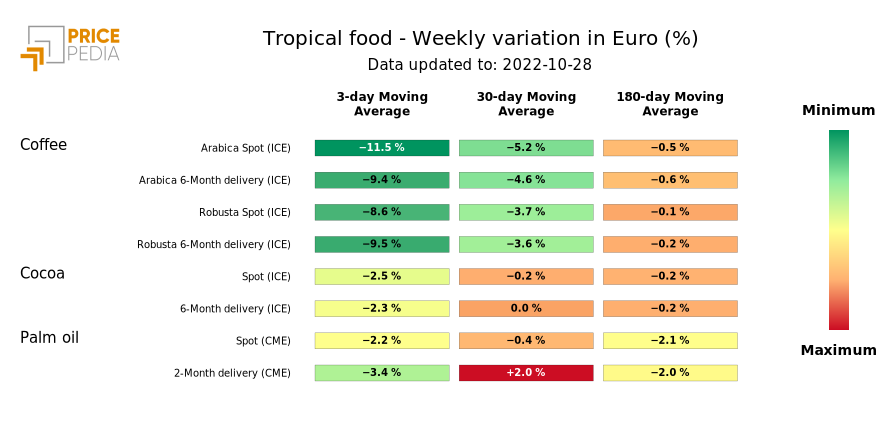

TROPICAL FOOD

The heatmap below provides an overview of tropical food price trends. Coffee prices are experiencing a real collapse. Arabica coffee, in particular, has seen a change close to 30 percent over the past 30 days.

HeatMap of tropical food prices