Non-ferrous price growth accelerates

Effect of overlapping temporary shocks or anticipation of future increases in demand?

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekECB's Inclination Towards an Upcoming Interest Rate Cut

Following the encouraging new data regarding the decline in European inflation, President Christine Lagarde, during the monetary policy announcement, expressed inclination towards an upcoming interest rate cut. The decision of the European Central Bank (ECB) Governing Council to keep rates unchanged at the April 11 meeting will most likely mark the end of restrictive monetary policy decisions.

The ECB avoided explicitly stating the date of the next rate cut. However, given that some members of the Governing Council had already expressed support for a rate cut at this week's meeting, it is expected that, barring any unexpected inflation shocks, a rate reduction at the June 6, 2024 meeting is almost certain.

US Inflation Stickiness

While European inflation is trending towards desired rate levels, the situation is vastly different for the US economy.

The latest data on the Consumer Price Index (CPI) for US households in March once again exceeded analysts' expectations. Both headline and core indices recorded a monthly change of 0.4%, compared to expectations of 0.3%. The headline inflation indicates a year-on-year price increase of 3.5%, higher than the forecasted 3.2%. The core data, excluding energy and food, instead of slowing down as expected, remained stable at a rate of 3.8% year-on-year.

The persistent US inflation seems to be mainly driven by the non-housing services sector, which saw a price acceleration of 0.8% month-on-month in March, compared to the 0.6% monthly rate in the previous two months. This unexpected acceleration in non-housing services, coupled with the absence of deflationary contribution from the energy sector, is increasingly convincing market operators to postpone expected interest rate cuts by the Fed. Expectations for 2024 now suggest the Federal Reserve will only implement two 25-basis-point interest rate cuts, compared to the previously anticipated three cuts.

This shift in market expectations for US rate cuts has been reflected in the dollar exchange rate, which has surged in the past two days, reaching levels not seen since last November.

However, the Fed's delay in rate cuts should not hinder the European Central Bank's first rate cut. President Lagarde herself affirmed that European inflation has different causes from that of the United States, and the European Central Bank is independent of other central bank decisions. Therefore, a timing difference between the first interest rate cuts by the ECB and the Fed seems highly probable.

Short-term Dynamics in Commodity Markets

Commodity markets continue to experience short-term shocks that alter market price dynamics, including:

- The sudden rise in the price of European natural gas on Thursday, April 11, due to a Russian attack on Ukrainian gas storage facilities;

- The rise in tin prices due to increased conflicts in North Kivu, a tin-rich province of the Democratic Republic of the Congo;

- The prices of Chinese iron ore, which had been on a downward trend due to weak Chinese demand, experienced a slight positive shock this week due to increased steel demand expectations in India.

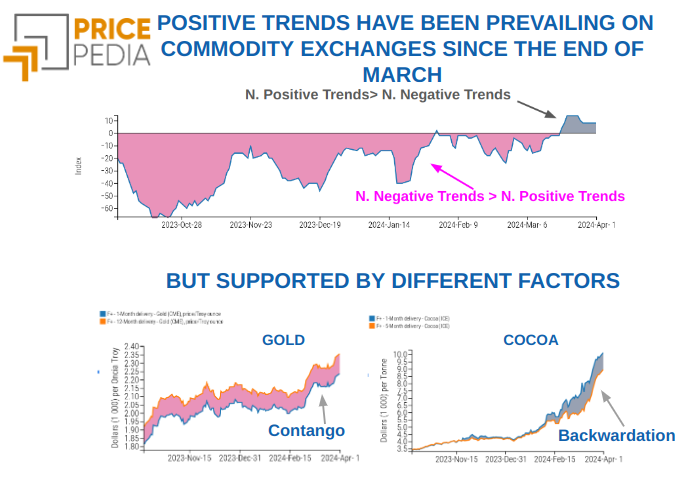

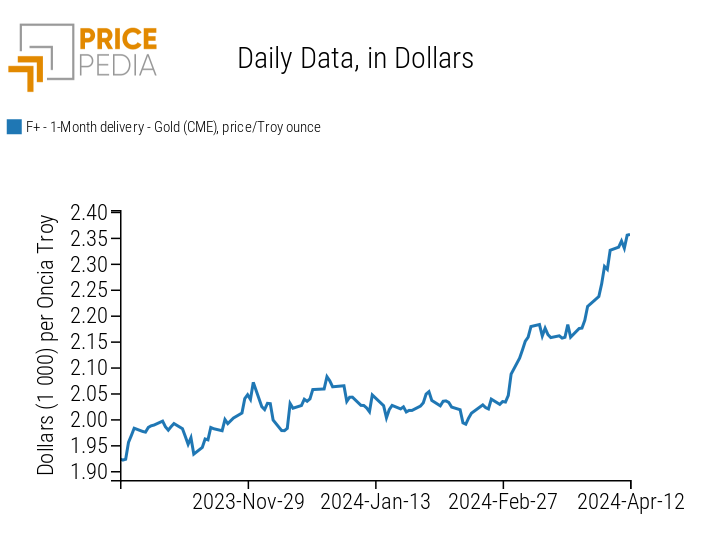

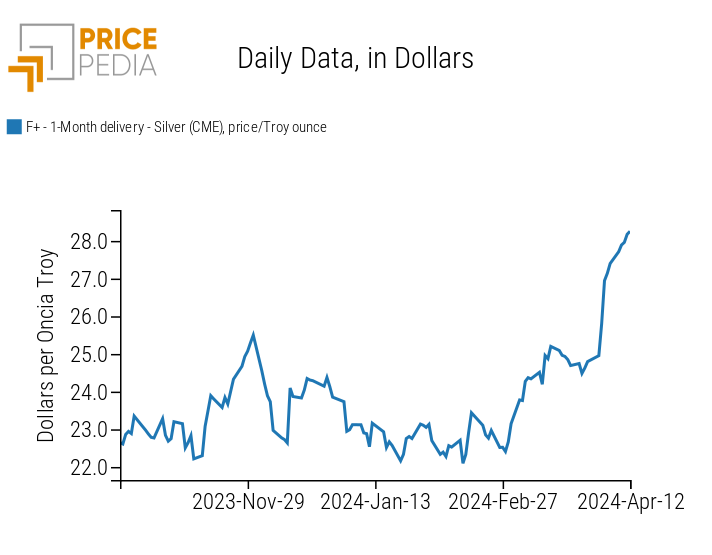

The only trends remaining solid for now, showing no signs of weakening, are those of tropical foods, led by cocoa, and precious metals. In particular, gold and silver prices, supported by poor US inflation data, continued to reach new highs this week. Below are the spot price quotations for the two metals, taken from the Chicago Mercantile Exchange (CME).

| Spot price of gold quoted at the Chicago Mercantile Exchange (CME) | Spot price of silver quoted at the Chicago Mercantile Exchange (CME) |

|  |

ENERGY

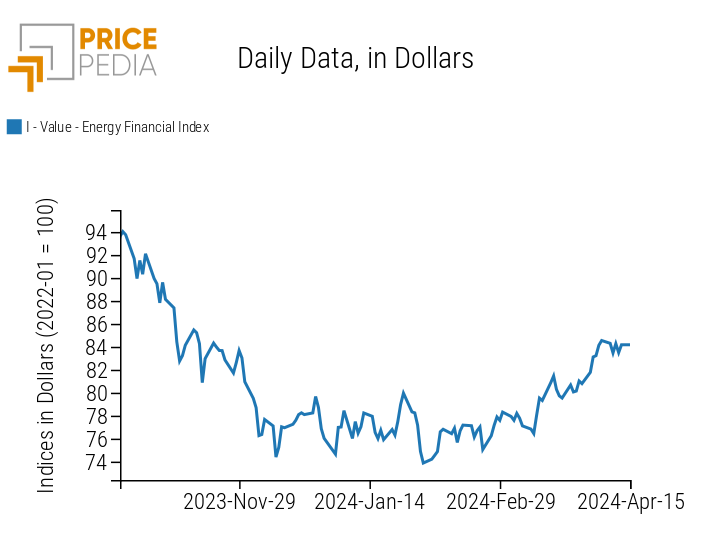

This week, the financial index of energy prices compiled by PricePedia recorded several fluctuations, but overall remained sideways.

PricePedia Financial Index of Energy Prices in Dollars

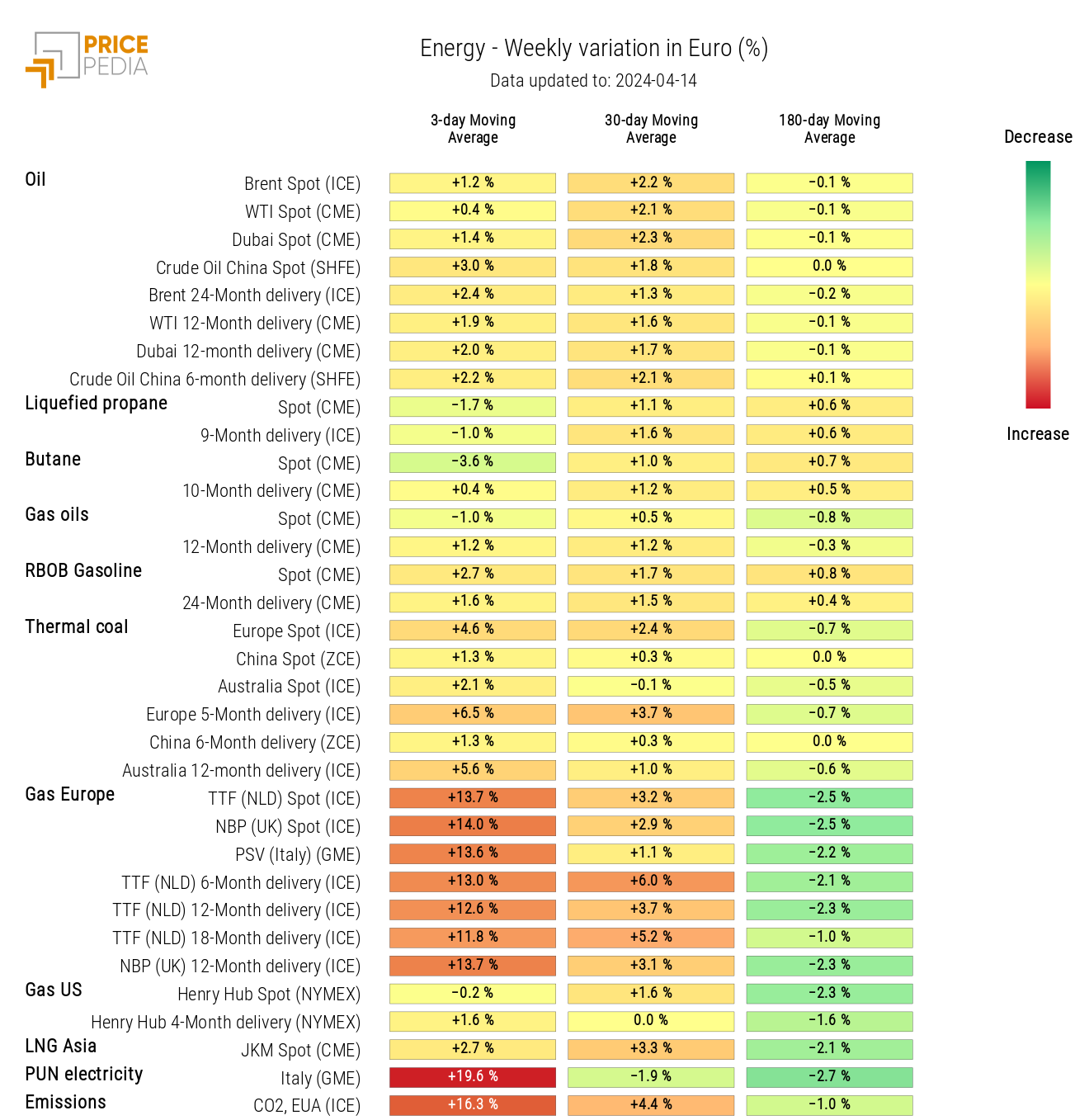

The energy price heatmap highlights a significant increase in European natural gas prices (Dutch TTF), which saw a daily change of over 8% on Thursday alone. This contrary market trend is attributed to Russia's attack on Ukrainian gas storage facilities. Despite market concerns about increased supply risk, fundamentals continue to suggest a downward trend in gas prices in Europe, given the current high storage levels.

HeatMap of Energy Prices in Euros

PLASTICS

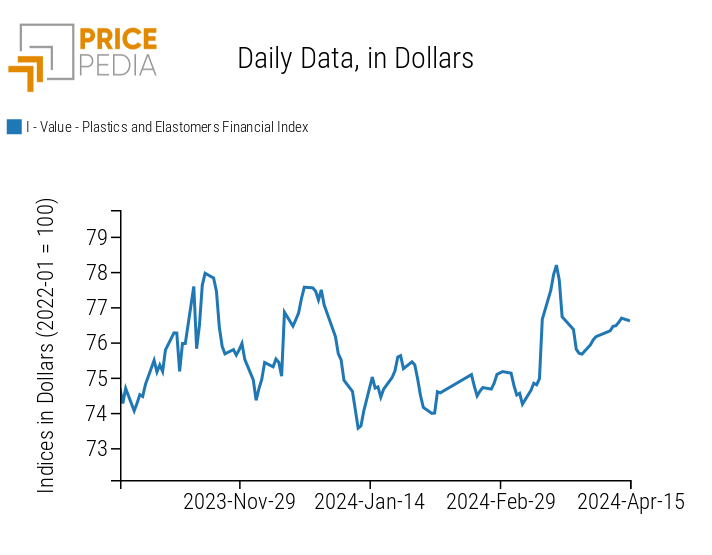

The financial index of plastics quoted in China continues to rise, driven by the recovery of RSS3 natural rubber prices.

PricePedia Financial Indices of Plastic Prices in Dollars

FERROUS

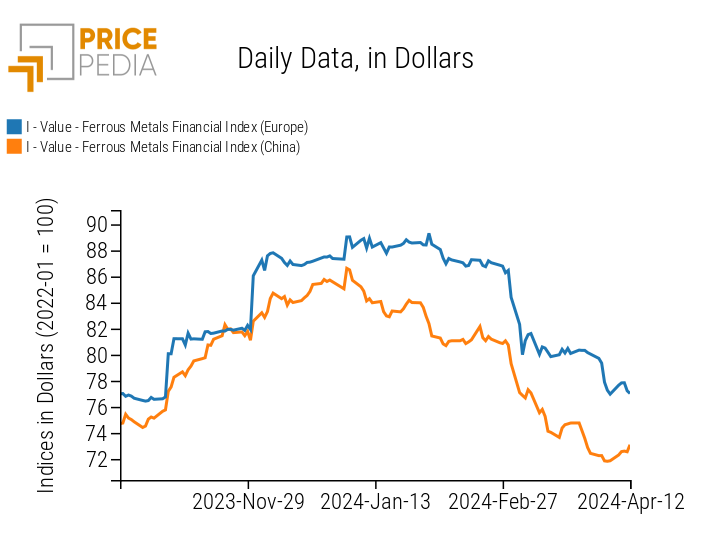

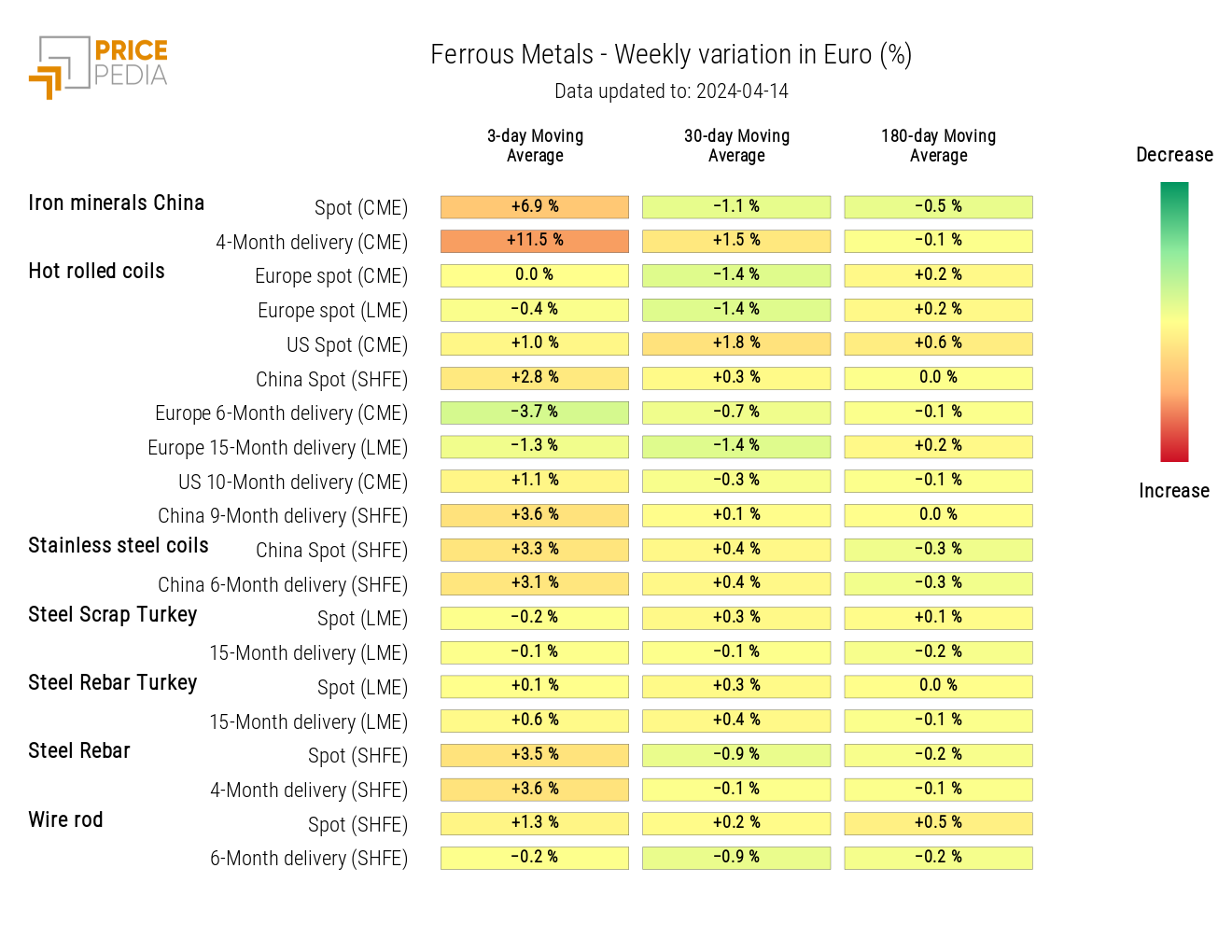

The downward trend in the two financial indices of ferrous metals has eased this week, indicating price stability. The halt in price declines was primarily led by Chinese ferrous metals, which saw a recovery in recent days despite their strong medium-term downward trend.

PricePedia Financial Indices of Ferrous Metal Prices in Dollars

From the ferrous heatmap, it is evident that the most sustained price increase, albeit still slight, has been in Chinese iron ore. This cessation of iron ore price declines is due to the latest forecasts from the World Steel Association (WSA), which project annual global steel demand growth of 1.7% and 1.2% in 2024 and 2025, respectively. Given the current weakness in the Chinese market, demand growth is being driven by India, with projections indicating 8% annual demand growth in both 2024 and 2025, thanks to ongoing infrastructure expansion.

HeatMap of Ferrous Metal Prices in Euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

INDUSTRIAL NON-FERROUS

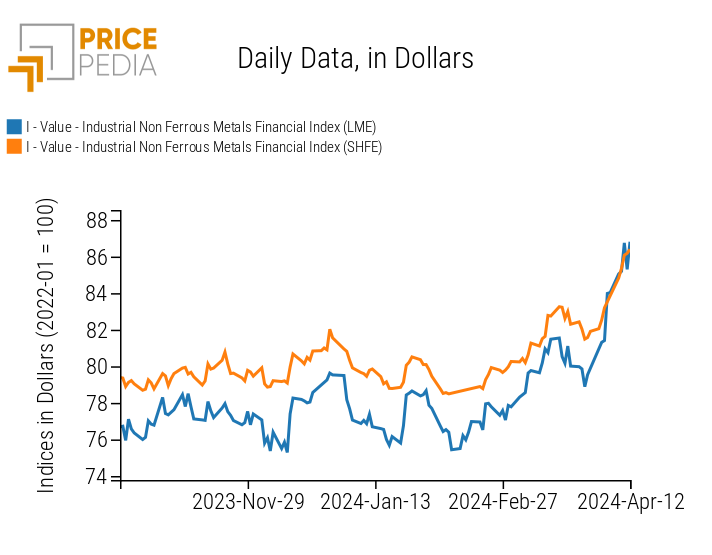

The two financial indices of non-ferrous metals quoted on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE) continue to indicate price growth. However, there was a initial price correction within the LME market on Thursday.

PricePedia Financial Indices of Non-Ferrous Industrial Metal Prices in Dollars

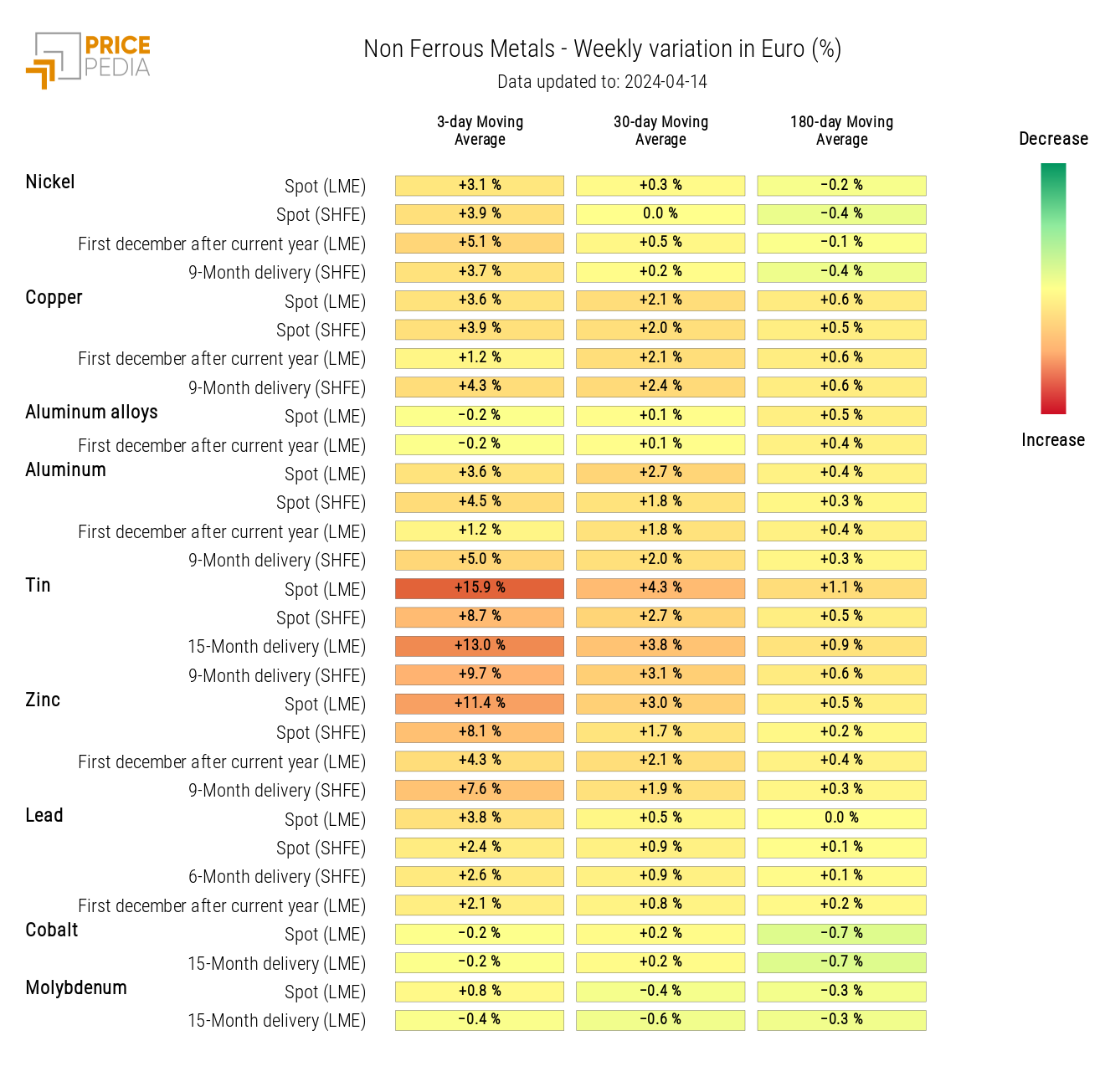

The non-ferrous heatmap shows a general price increase. The most significant rise was observed in tin prices, which, due to continued inventory declines and growing supply-side issues, saw double-digit weekly growth in moving averages.

Increased conflicts in North Kivu, a tin-rich province of the Democratic Republic of the Congo, have started to raise concerns about potential tin export reductions. While there is currently no evidence of halted tin exports, delays in shipments can be anticipated, according to the International Tin Association (ITA). This concern adds to the existing uncertainty regarding the status of the Man Maw mine in Myanmar, which has suspended mining activities since last August.

HeatMap of Industrial Non-Ferrous Metal Prices in Euros

FOODSTUFFS

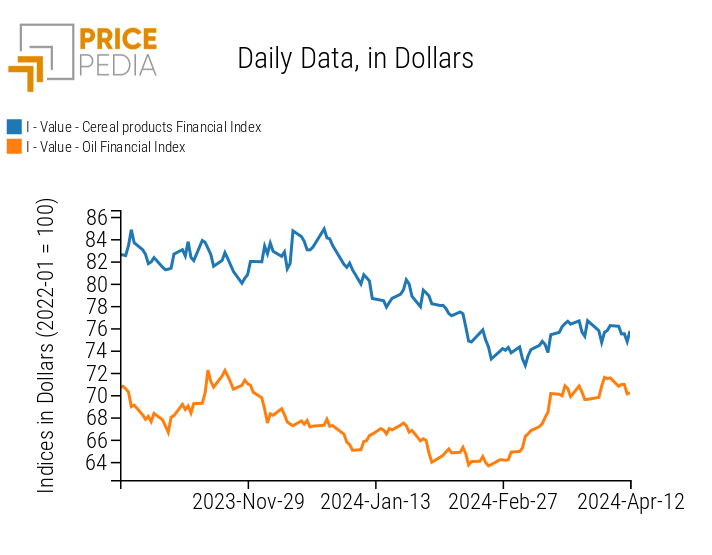

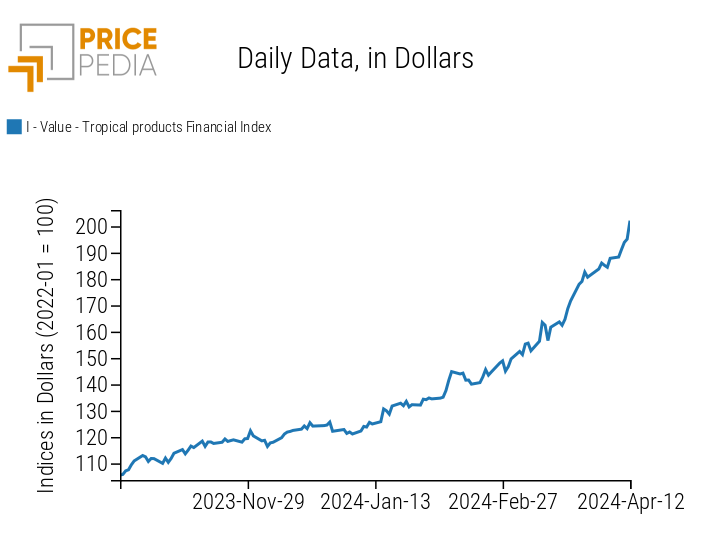

The financial indices of agricultural products recorded different weekly trends: the tropical index continues its strong upward phase, the cereal index remains relatively stable, and the oil index shows a slight decline that does not appear to be a reversal of the upward trend observed in March.

| PricePedia Financial Indices of Food Prices in Dollars | |

| Cereals and Oils | Tropicals |

|  |

TROPICALS

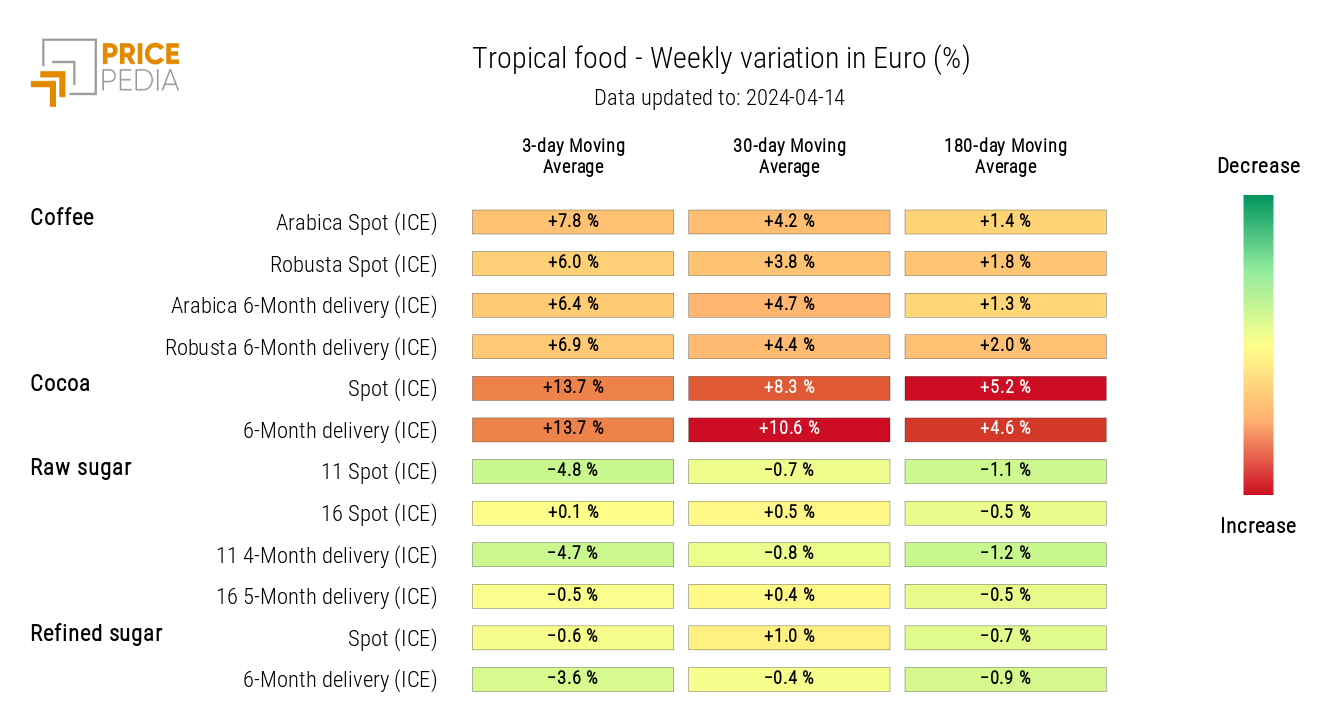

The tropical heatmap indicates an increase in both coffee and cocoa prices.

HeatMap of Tropical Food Prices in Euros