Fed rate hikes and the effects on commodity prices

An overview of current trends in the commodity landscape

Published by Giulio Corazza. .

Energy Ferrous Metals Food Non Ferrous Metals Commodities Financial Week

Rising inflation in both Europe and the United States has prompted central banks to implement restrictive monetary policies by raising the cost of money.

This week, the U.S. central bank raised its benchmark rate by 75 basis points, bringing the cost of money to 4 percent, confirming that the goal of central banks in the world's major economies is to lock in inflation, even at the cost of bringing about a sharp economic slowdown, if not a recession.

According to shared economic thinking, this increase in the cost of money should have the effect of reducing the levels of both economic activity and, consequently, commodity prices. Conversely, since the increase in the cost of money in the U.S., there has been a wide dispersion in the dynamics of commodity prices: some prices that were already discounting in their levels the rate hike reacted to news from China of greater government commitment to support economic growth; others, such as ferrous metals, continued their descent toward price levels more defensible by different competitors.

ENERGY

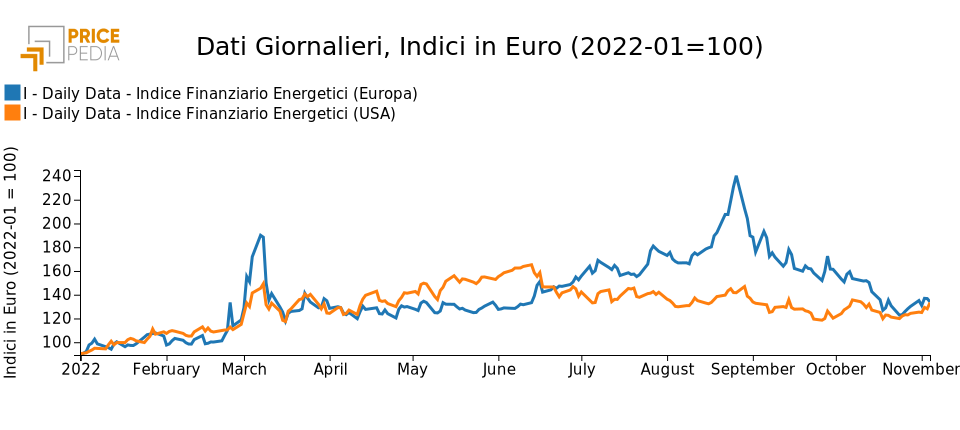

The following chart shows the PricePedia financial indexes of Europe and U.S. energy product prices. Both indexes this week report an increase.

PricePedia financial indexes of energy prices Europe and the U.S.

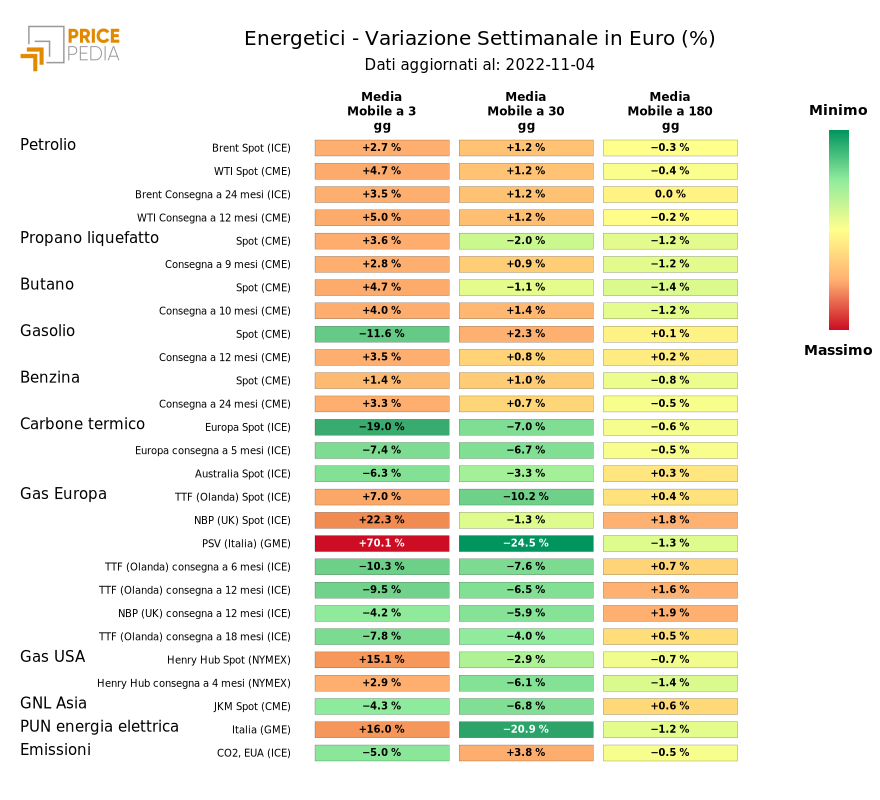

The heatmap below provides an overview of energy product price trends.

On the natural gas front, the price of the shortest maturity contract listed on the TTF rose sharply this week. The delayed reopening of the Freeport plant, a U.S. liquefied natural gas exporter, had a supportive effect on the price level.

However, the price that has seen the largest increases is that of gas at the Italian Virtual Trading Point (PSV) and, consequently, the PUN of Italian electricity. With the arrival of cold winter weather, gas consumption will increase significantly, bringing the balance between supplies and withdrawals from storage sites back into deficit. The gas spot price will then tend to realign with December future prices, which more closely reflect the structural deficit conditions in the European gas market.

HeatMap of energy prices

METALS

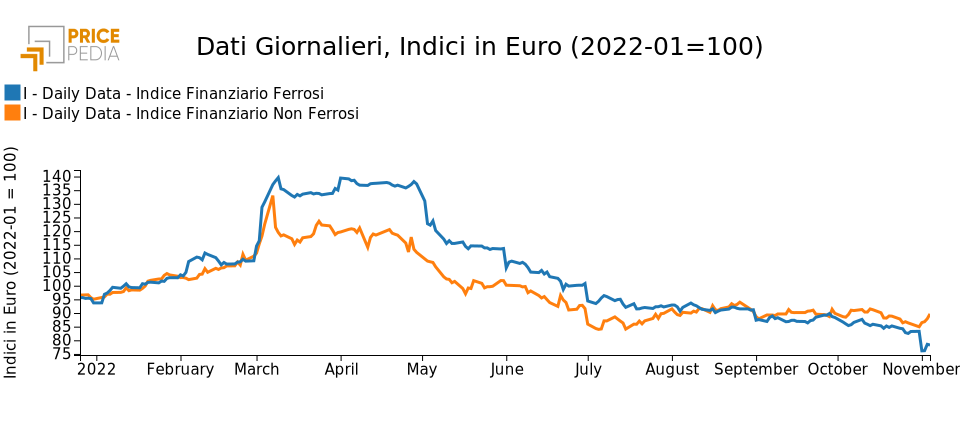

The following graph shows the PricePedia financial indexes of ferrous and nonferrous metal prices.

While the nonferrous index shows an increase, the ferrous index marks a significant decrease.

Recent news has raised hopes for an easing of China's anti-Covid policies,

fueling bullish sentiment in financial markets and driving the price of major nonferrous metals

to a significant rise.

Financial PricePedia indexes of ferrous and nonferrous metals

FERROUS

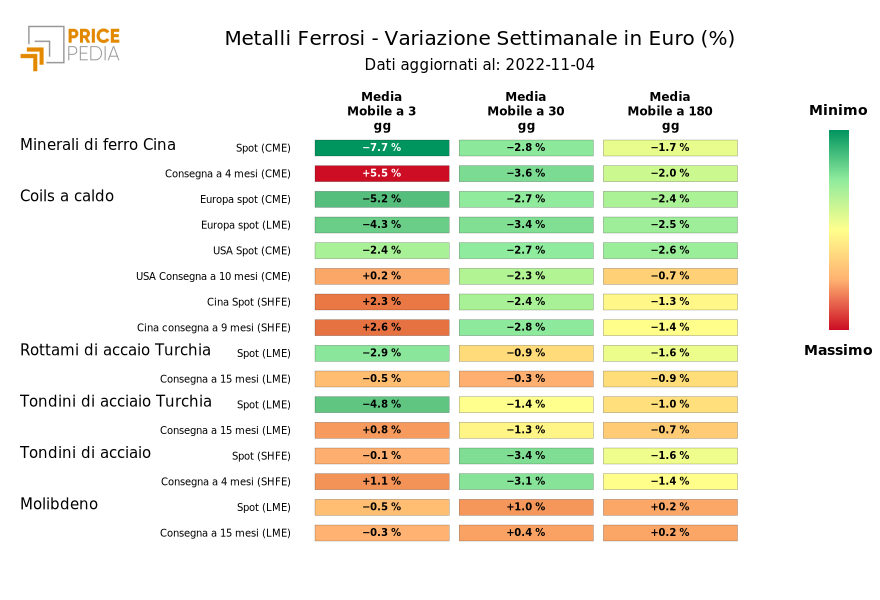

The heatmap below provides an overview of ferrous metal price trends. It shows the sharp decline in China iron ore and Europe hot coils listed on the CME.

HeatMap of ferrous metal prices

NON FERROUS

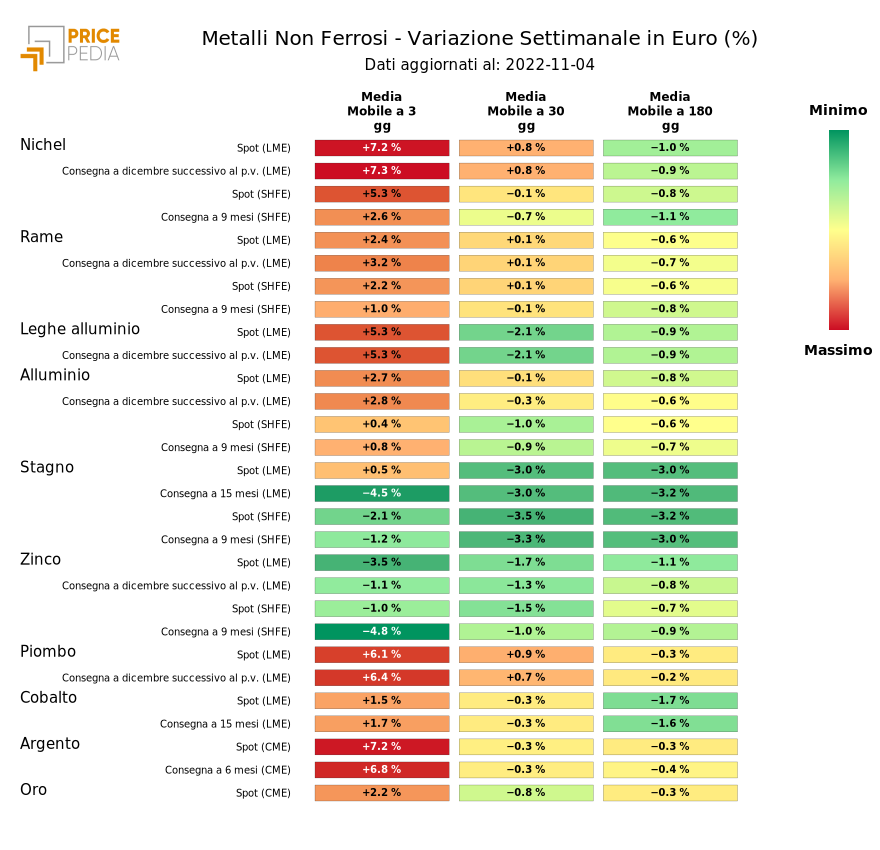

The heatmap below provides an overview of nonferrous metal price trends. At the level of individual products, the price trends for nonferrous metals are highly differentiated. We note, on the one hand, the sharp increase in the price of Nickel and Lead, which is contrasted, on the other hand, by a sharp decrease in Zinc prices.

HeatMap of non-ferrous metal prices

FOOD

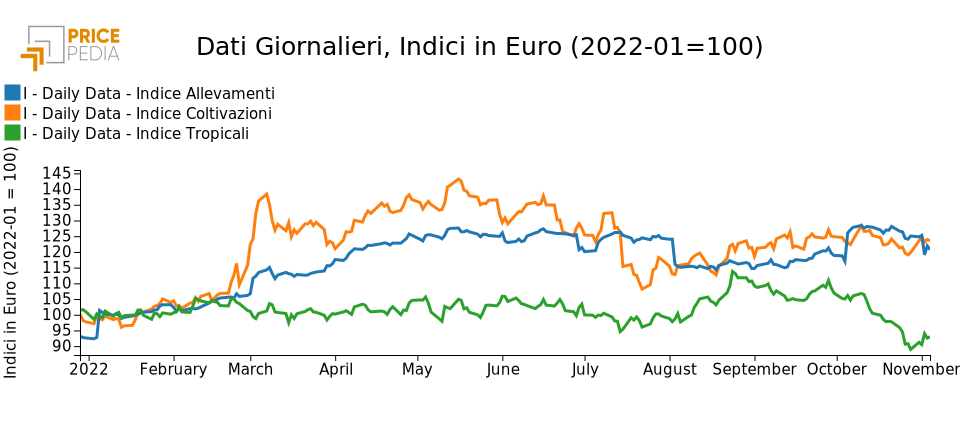

The following graph shows the PricePedia financial indexes of food prices.

While the indexes from crops and tropicals show an increase, the index from livestock farms reports a decrease.

Russia recently suspended the agreement to export grain through the Black Sea. Reducing grain supply will help support the price level.

Financial Indices PricePedia of food products

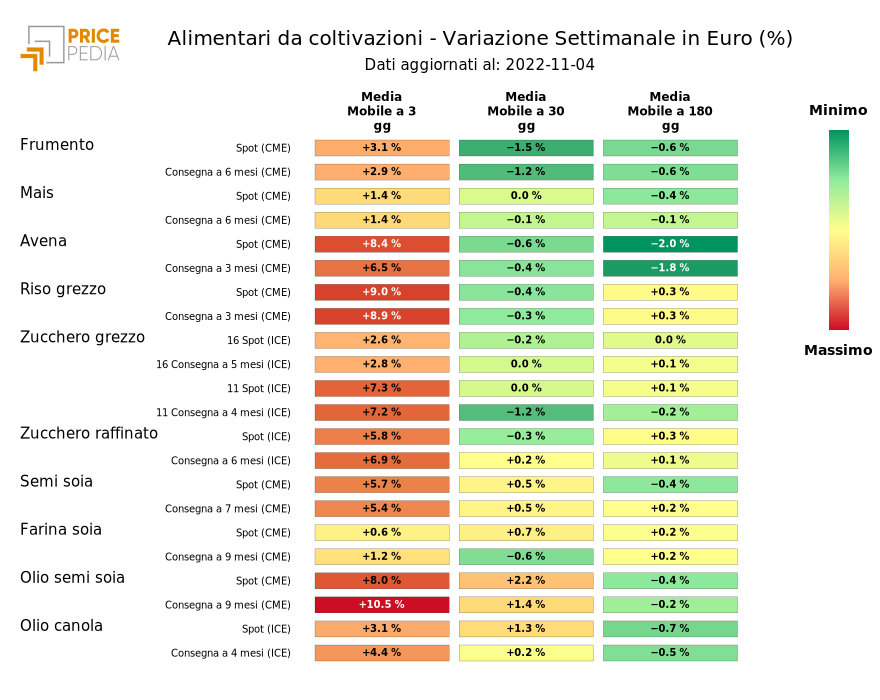

FOOD FROM CROPS

The heatmap below provides an overview of the trend in crop food prices. Particularly pronounced is the increase in the prices of raw rice and oats, soybeans and their oil.

HeatMap of crop food prices