Sticky and elastic prices: the case of thermoplastics

Published by Donatella Talucci. .

basic thermoplastics technopolymers Price Drivers

In PricePedia scenario published at the end of September "Commodity prices between sticky inflation and weak business cycle", average commodity prices in Europe are expected to fall only slightly between the 2023 average and the 2024 average. There are also significant differences between the price dynamics of different commodities, but on average the projected rising prices tend almost to offset the decreasing ones. There is substantial consensus among most analysts on this senario of weak reduction.

At the same time there is a broad consensus that the near future will be characterized by a high uncertainty, resulting in high predictive risks. In other words, the relative stability of prices presented in the forecast scenario is the average result of possible dynamics of both price increases and their reductions, equally probable in the face of possible future events.

The existence of high risks of prediction makes necessary their analysis, in order to draw the different possibilities, so as to refine the ability to recognize them from their first signals. For this purpose it is useful to distinguish between risks due to common factors and those due to specific factors.

Common predictive risk factors

Common predictive risk factors are those macroeconomic variables that influence the price dynamics of all commodities. The most classic example is the business cycle and the associated industrial cycle that determines the dynamics of commodity demand. Another important example is exchange rates, particularly the dollar. Equally important are inflation and interest rates. The dynamics of oil prices are also considered a common predictive risk factor because of the effects unexpected changes can have on the prices of all other commodities.

Specific predictive risk factors

The specific risk factors concern the possibility of events materializing that lead to an unexpected change in the price dynamics of specific commodities. In the article "Sticky prices and future risks" was highlighted that the prices of many commodities were sticky in the recent price-cutting phase, registering in September 2023 price levels significantly higher than the 2019 average. These prices are supported by factors that could disappear in the coming months, leading to an unexpected and significant price reduction.

The case of thermoplastics

In the following table the prices of thermoplastics (available in the PricePedia platform), distinguished between elastic and sticky prices1, were examined. These second ones have been in turn subdivided between prices "partially differentiable" and "non differentiable".

| Elastic prices | Sticky prices | |

| Partially differentiable | Not differentiable | |

| Polypropylene (PP) | Saturated polyesters | Polyvinyl chloride (PVC) |

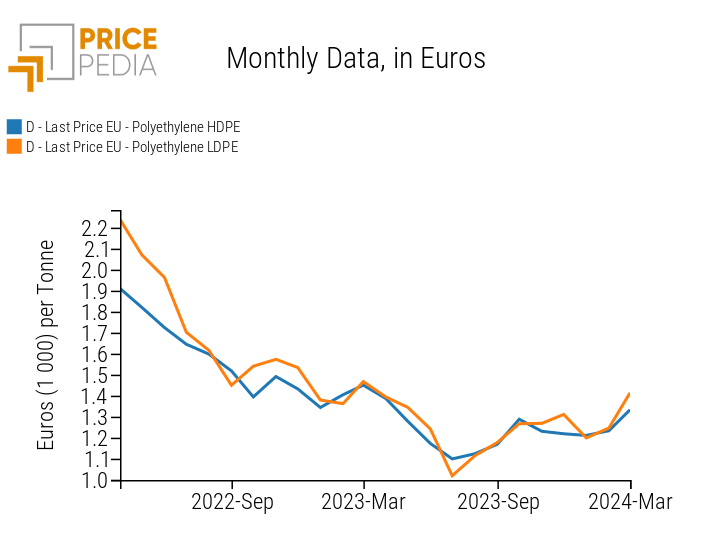

| Polyethylene (HDPE) | Copolymers of ABS | Polystyrene |

| Polyethylene (LDPE) | Polylactic acid | Polystyrene, not expanded |

| Linear polyethylene (LLDPE) | Polimal Resina | |

| Copolymers of SAN | Plasticized polyvinyl chloride (PVC) | |

| Propylene | Acrylic resins | |

| Polyamide (PA) | Acetal resin (POM) | |

| Polyethylene terephthalate (PET) | Cellulose acetate | |

| Ethylene | Copolymers of vinyl acetate | |

| (Ethyl, propylene and its polymers + SAN) | Polytetrafluoroethylene (PTFE) | |

| Polycarbonates (PC) | ||

Commodities polyethylene, ethylene, propylene, etc.. were elastic, as their price tends to be very sensitive to changes in supply and demand. If there is an excess of supply in the market, for example, prices fall rapidly. Similarly, a sharp decrease in supply can lead to a rapid increase in prices. These materials are often subject to price fluctuations based on factors such as changes in raw material costs, global economic conditions and decisions of major manufacturers.

"Viscous and differentiable" thermoplastics are designed for specific applications and can have very special or unique properties. These materials can vary greatly between manufacturers in terms of expected properties, performance and applications. The stickiness of their price is therefore determined by the relative market power of the different producers. Even in cases of significant changes in supply or demand, the prices of these materials do not decrease rapidly. This is because customers are willing to pay a premium for the unique or specialized properties that these materials offer. The downside forecasting risk associated with it is limited, unless demand falls sharply.

The resulting "vischiose not differentiable" commodities are, instead, produced in huge volumes and, although they may have different grades of quality or properties slightly different between manufacturers, tend to have similar general properties. The stickiness recorded in their price is therefore not dependent on a hypothetical market power of the different producers. In the case of the thermoplastics shown in the table, their stickiness is justified by the still high prices of production inputs: chlorine and styrene. The particularly interesting case is that of styrene and the polymers derived from it, because their sharp increase and subsequent stickiness to the reductions stemmed from a reduction in supply on the EU market, caused by the need to replace imports from Russia with imports from other countries.

1. For further details, see "Determinants of the stickiness of commodity prices".