Purchasing Goods Markets: Commodities Versus Differentiated Products

Optimal procurement management requires different information for the two types of products

Published by Luigi Bidoia. .

Competitive Markets Should Cost Procurement ManagementFor a procurement professional, it is crucial to understand the workings of the purchasing goods markets to monitor price dynamics and anticipate their potential evolutions. The first step in this understanding involves recognizing the different nature of the goods to be purchased, distinguishing between commodities and differentiated goods. The mechanisms governing these two types of markets are significantly different, influencing strategies and decisions.

Commodities versus Differentiated Goods

Commodity

A commodity is defined as a good that has standard features and is interchangeable with other goods of the same type, regardless of who produces them. These goods are considered homogeneous or nearly homogeneous and have substantially uniform quality and characteristics. As a result, producers are in strong competition with each other and are price-takers. That is, they cannot practice prices different from the unique price that has formed in the market.

In the case of commodities, the unique price is "discovered"[1] by the market through the interaction between buyers and sellers who, through their purchase and sale operations, exchange information until they arrive at defining a single price accepted by all.

Most raw materials are commodities. Many semi-finished products and many goods or manufactures produced through standard production processes are also commodities. For example, many plastic and chemical materials, or many semi-finished metal products such as copper wires and galvanized sheets, are considered commodities.

Differentiated

A good or product is classified as differentiated when its producer can decide the price, acting as a price-maker. In this context, the producer is not limited to accepting the prices imposed by the market but has the ability to influence them, albeit within certain limits. This ability stems from the unique characteristics of the product, which may include superior quality, innovation, branding, or specific after-sales services. These factors confer an added value perceived by the user, which translates into the possibility for the producer to set a price that reflects this distinctive value perception. Ultimately, the degree of product differentiation allows the producer to distinguish itself from the competition and to exercise greater control over its pricing strategies, adjusting them in response to market demand, competitive strategies, and general economic conditions.

Price Formation Mechanisms

The different nature and characteristics of various purchased goods lead to distinct market models, with different price formation mechanisms.

Commodity Markets

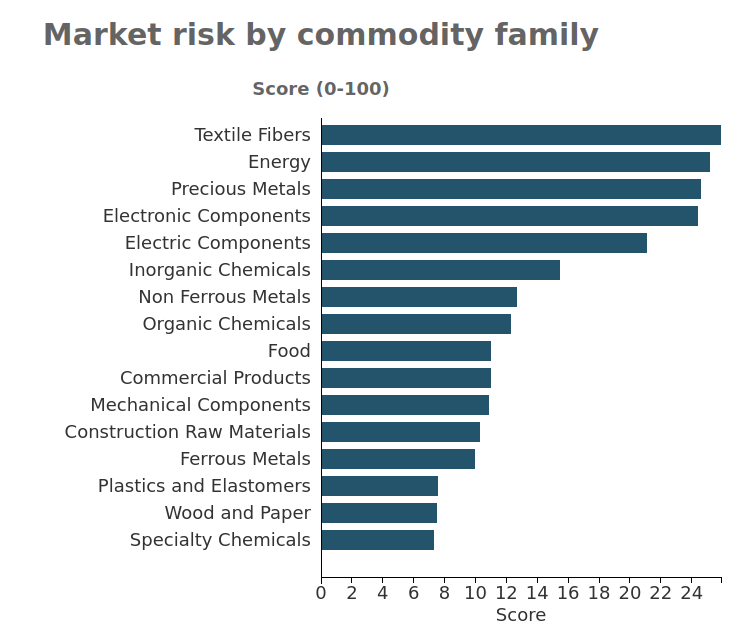

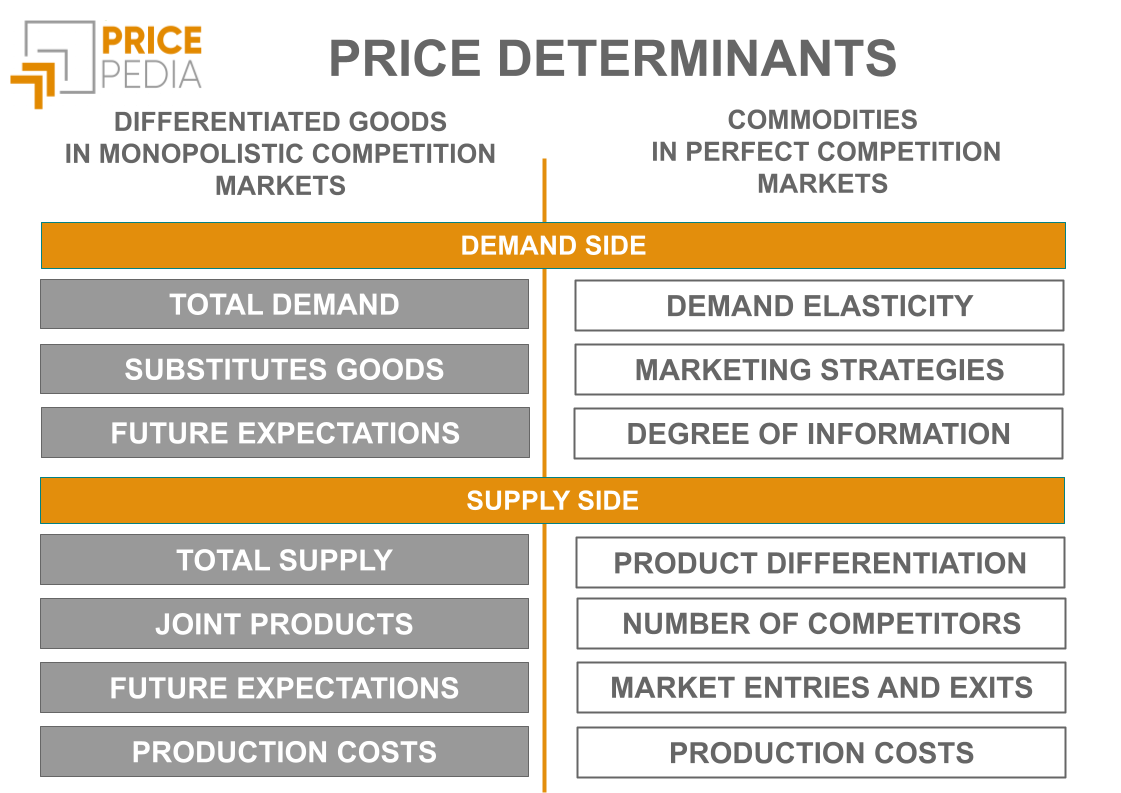

In commodity markets, market mechanisms lead to the formation, as already indicated, of a single price. In this case, it is possible to speak of a true market price. Economic literature has extensively studied the mechanisms governing these markets as perfect competition markets. In these markets, the factors contributing to price formation include:

- from the demand side:

- Total market demand: the total quantity that users are willing to purchase at various price levels significantly influences price formation. If demand increases and supply remains constant, the price tends to rise. Conversely, if demand decreases, the price tends to fall.

- Substitutes and complementary goods: the presence of substitute goods imposes constraints on the price variations of a commodity. Additionally, changes in the demand for complementary goods can affect the demand for the commodity in question.

- Future expectations: users' expectations about the future can influence current prices because they lead to variations in the timing of their purchases.

- from the supply side:

- Total market supply: the total quantity of the good that producers are willing to sell at various price levels is a fundamental determinant of price formation. If supply increases without a corresponding increase in demand, prices tend to fall. If supply decreases, prices tend to rise.

- Jointly produced goods: Variations in the demand for a good produced jointly can lead to variations in the supply of the considered commodity.

- Future expectations: producers' expectations about the future can influence current prices because they lead to changes in the timing of their supply;

- Production costs: the marginal costs to produce an additional unit of the good represent the minimum price at which a producer is willing to sell their product.

Differentiated Goods Markets

In differentiated goods markets, the competitive dynamics among producers have distinctly different characteristics compared to those prevailing in perfect competition markets. The market structure that describes the interaction among firms in these contexts is indicated, in economic literature, as monopolistic competition. In this type of market, each producer offers a product that, while competing with others in the market, is distinguished by certain features, thus allowing the firm to exercise a certain degree of price-setting power.

In monopolistic competition markets, the factors that contribute to price formation are:

- from the demand side:

- pricing and marketing strategies: in a monopolistic competition market, marketing and product positioning strategies can significantly influence consumers' perception of value and, consequently, the price they are willing to pay.

- price elasticity of demand: demand elasticity with respect to price is a critical factor. If a firm increases the price too much and the users perceive valid alternatives, they can easily switch to other products. Therefore, elasticity affects a firm's ability to raise prices;

- degree of information: how easily users can compare products and prices affects the market power of firms. Greater transparency and ease of comparison reduce the market power of firms;

- from the supply side:

- product differentiation: in a monopolistic competition market, each firm offers a product that is perceived as different from others available on the market. A firm's ability to differentiate its product affects its pricing power, allowing it to demand a higher price for unique or perceived-as-unique features;

- number of competitors: the presence of numerous competitors offering differentiated products limits each one's power to decide their price;

- market entry and exit: the relative ease of entering or exiting a monopolistic competition market affects the behavior of existing firms, which must consider the possibility of new entries in determining their prices;

- production costs: similarly to competitive markets, production costs establish a lower limit to the price a firm can practice without incurring losses. However, while in competitive markets prices tend to follow cost variations in both directions, in monopolistic competition markets prices follow cost variations only when they increase;

Implications for Optimal Purchasing Management

In optimal purchasing management, the type and relevance of information needed change radically depending on the type of good in question.

Information for Commodity Purchases

When it comes to purchasing a commodity, the essential information is closely related to the single market price: knowing its current level, monitoring trends, and predicting potential fluctuations become fundamental information in the decision-making process regarding the modes, timing, and quantities of purchase.

Information for Purchasing Differentiated Goods

Conversely, in the purchase of a differentiated good, where each product is distinguished by specific characteristics, the analysis must extend well beyond price alone. In this case, a understanding of the distinctive features of the good and a comparison with the characteristics and prices of competitors' offerings is necessary. In this type of market, the relevant information concerns the product features of competitors and their prices.

Should-Cost to Balance the Producer's Market Power

However, even in monopolistic competition markets, the user company can balance the producer's market power by discussing price variations through an analysis of the production costs of the good in question.

This approach, known as Should-Cost[2] analysis,

allows the purchasing company to estimate the cost of a differentiated good based on

a detailed assessment of materials, labor, and other direct and indirect production costs,

providing a solid basis for negotiation.

By adopting a should-cost strategy, the purchasing company can challenge suppliers' price increase requests or support price reduction requests when market conditions or production efficiencies justify it. This not only ensures greater transparency and fairness in the relationship between buyer and supplier, but also identifies opportunities for cost reduction collaboration that can benefit both parties.

Thus, Should-Cost becomes a strategic purchasing management tool that, by going beyond simple price comparison, allows assessing the real value of a differentiated good in relation to its production costs.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Conclusions

In the context of purchasing processes and price negotiation, it is crucial to distinguish between commodity-type goods and differentiated goods. The price formation mechanisms of the two types of goods are very different. The former relate to perfect competition markets; the latter to monopolistic competition markets. The information useful for supporting the purchasing process is very different in the two cases. In the first case, it is essential to know and monitor the level and dynamics of the single market price; in the second case, information on the characteristics and prices of products offered by competitors is more important.

In the purchase of differentiated goods, a useful tool for the purchasing company to limit the producer's market power is should-cost, which allows estimating the level and dynamics of the production costs of the good under negotiation.

[1] In economic literature, "price discovery" is the market process by which the price of a good, service or financial security is established.

[2] For a more in-depth look at Should-Cost calculation techniques see the article Should-cost and knowledge of hidden curves: two tools for negotiation.