Should cost and knowledge of hidden curves: two tools for negotiation

How to move price negotiation from the level of opinions to that of facts

Published by Luigi Bidoia. .

Hidden curves Should Cost

When the prices of raw materials, and more generally of commodities, increase, suppliers report the cost increases suffered to justify requests for price increases. It is the common experience of many buyers that these requests often exceed the necessary cost coverage and hide increases in margins. On the other hand, it is the nature of businesses to look for every opportunity to increase their profitability.

On the contrary, when commodity prices decrease, few suppliers enter a negotiation by informing the supplier of the actual decrease in their costs and consequently reducing their prices.

During the negotiation phase for a supplier it becomes important:

- knows the dynamics of commodity prices that represent the production inputs of the products being traded;

- translate the dynamics of these prices into a realistic assessment of the change in production costs.

Knowledge of hidden curves

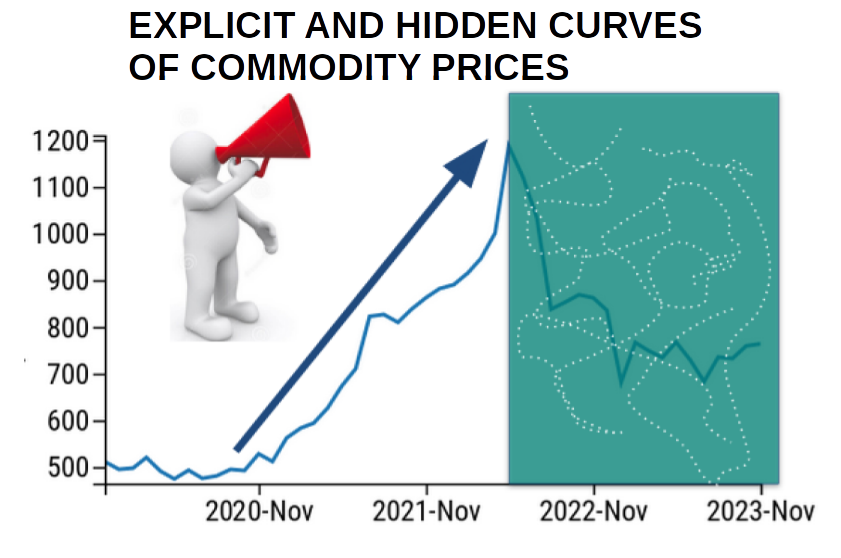

During price increases, information about increases tends to be more abundant and circulate more quickly. This is for two reasons:- The general public is more concerned about price increases than about price decreases. This leads the mass media to favor information on increases rather than decreases;

- Commodity producers invest more resources than users in governing market information and commodity prices. Their greater interest in communicating increases rather than decreases leads to a prevalence of communications regarding increases rather than decreases;

The lesser disclosure of information on the phases of price decrease makes these curves "hidden" from the eyes of suppliers. In this case, the purchasing office, to stay informed, must equip itself with additional tools compared to the mass media and the information collected from suppliers. In this case the maxim that seems particularly appropriate

knowledge is money

Knowledge of the hidden curves allows, in fact, to negotiate price agreements, other conditions being equal, that are more favorable to the supplier.

Over the last year, there have been many curves potentially hidden from the eyes of suppliers. A representative selection of them can be given by these two articles:

- Hidden curves: 2024 profitability also depends on their discovery;

- Hidden curves: new cases of analysis.

The should cost tool

Knowledge of the hidden curves of the market prices of the commodities that enter the suppliers' production process is certainly a fundamental element for conveniently managing a price negotiation with a supplier.

An additional, equally important tool is the should cost. This tool allows you to move from generic information on changes in commodity market prices to a precise estimate of how much these changes have impacted the specific costs of the product being traded. In this way it is possible to have an accurate assessment of the change in production costs of the good in question.

- analysis of materials: identification of the materials that contribute to making up the good in question; calculation of their incidence in terms of weight, valorization of the different inputs through the prices of a base period (for example January 2022) and calculation of their incidence on the total cost of materials;

- estimated costs of non-materials, this estimate can be made by subtracting the cost of the materials calculated in the previous point from the selling price of the good considered;

- cost breakdown of non-materials: inputs other than materials (such as transport, work, electricity, heat, actual or figurative services, etc.) can be traced directly or indirectly, with just two inputs: energy and work. If the product does not require particular energy inputs, a reasonable breakdown of these two inputs is an incidence of work equal to 6 times that of energy, which corresponds to the incidence of the total cost of labor on energy costs for an industrialized economy like the one 'Italian. In cases of greater use of energy, the impact of work can drop to a value equal to twice the cost of energy.

- using PricePedia's Should Cost: given the cost breakdown calculated in the three previous points, PricePedia's Should Cost tool allows you to easily calculate this indicator using market prices as Cost Drivers for materials of commodities, for the cost of energy the average price of energy in Europe and for the cost of labor the consumer price index of the Euro area.

In the article Should Cost for NMC111 Lithium Ion Battery this process was used to calculate the should cost of a specific lithium ion battery.

Conclusions

Knowledge of the hidden curves of commodity market prices and their use through should cost models to estimate the dynamics of the costs of one's suppliers is the best way to bring price negotiations from the level of opinions, often conflicting, to the level of shared data and information.

To be useful, should cost does not require sophisticated cost breakdown analyses, based on the search for precise information regarding the supplier's production processes. Even more approximate cost breakdowns, to be improved in subsequent stages with the help of the supplier itself, can provide an optimal negotiation basis for the supplier.