Commodity markets: the importance of independent information sources

The role of information in shaping expectations

Published by Luigi Bidoia. .

Strumenti Analysis tools and methodologiesIn every negotiation, the buyer's expectations regarding future price changes play a decisive role in influencing the outcome, especially in terms of the agreed price. Aware of this influence, the seller might attempt to shape these expectations by presenting future scenarios predicting price increases or supply reductions, which may not necessarily reflect reality. Faced with this tactic, it is vital for the buyer to critically assess the information provided by the seller and actively seek additional, reliable information to form an independent and well-founded judgment. This caution and independence in forming one's expectations are fundamental for successful negotiation, yielding more favorable outcomes.

Expectations as economic determinants of prices

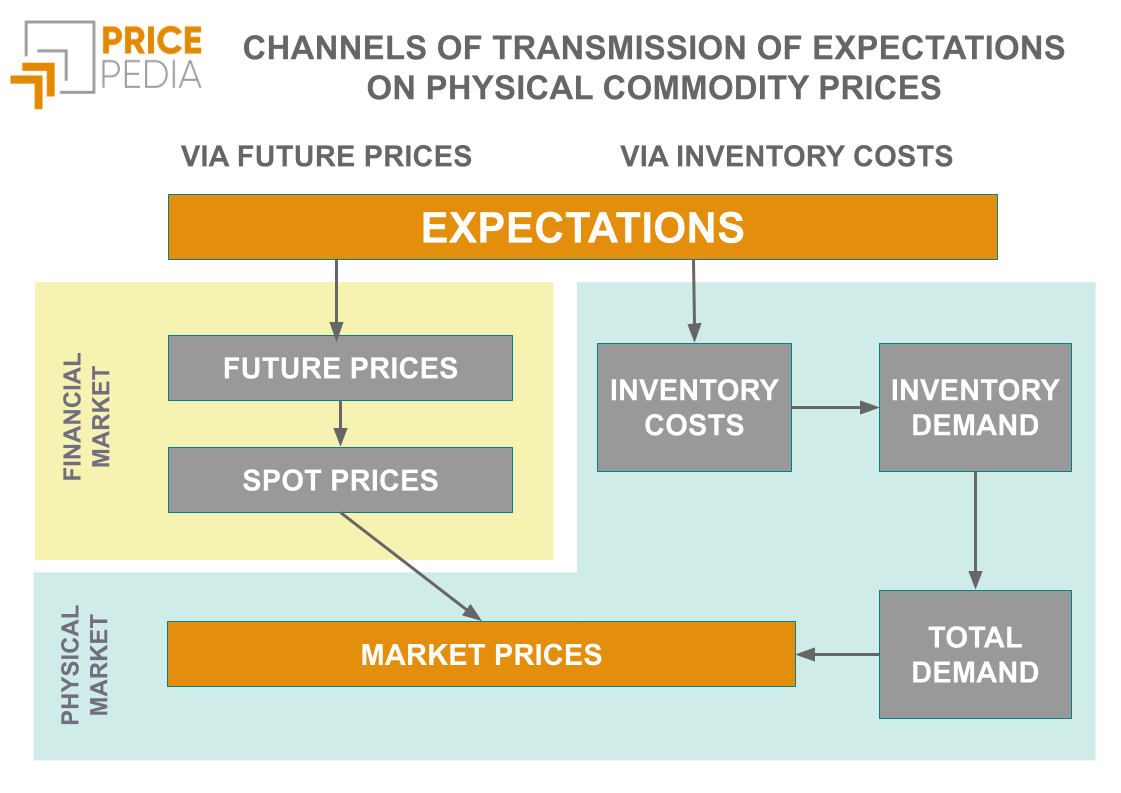

Expectations about future market dynamics play a role not only during negotiations. They are also economic determinants capable of altering actual market conditions. Their effect is primarily manifested through two channels: the first passes through financial markets and future prices; the second affects physical markets and the cost of inventories.

Effects via future prices

The theory regarding the role of expectations in financial markets is well-established. Future prices reflect traders' expectations about future price levels. In turn, future prices, through intertemporal arbitrage operations, contribute to the formation of spot prices. In many cases, financial spot prices represent the benchmark towards which prices on physical markets converge, establishing a cause-and-effect relationship between expectations and price variations on physical markets.

Effects via inventory costs

There is an intrinsic mechanism within physical markets that links price variation expectations to their actual formation, mediated by the cost of holding commodity inventories. Since the actual cost of inventories depends on future price variations, expectations of price increases (or decreases) translate into decreases (or increases) in inventory costs. All else being equal, a decrease in inventory costs boosts demand and, consequently, prices; conversely, increases in inventory costs result in lower demand and, therefore, prices. In summary, expectations of price changes influence the cost of holding inventories and, through this channel, determine the physical price of commodities, outlining a direct transmission channel within physical markets.

The role of information in guiding expectations

Given the importance of expectations in determining future price variations, it is logical to expect that all operators who benefit from driving prices in one direction or another will tend to emphasize, in their communication, the information that can steer expectations in the desired direction. It is not necessary for them to produce false information. It is sufficient for them to filter it, disclosing only what is considered useful.

Viewed in this light, it is easy to see how the information released by commodity producers (and all those who benefit from price increases, such as distributors and hedging instrument companies) is primarily aimed at fueling expectations of possible supply reductions and/or cost and price increases. Furthermore, considering the greater benefits that guiding price expectations can bring to commodity producers compared to user companies,

it is not surprising that there is an absolute prevalence of news that induces expectations of price growth compared to expectations of reductions.

How to counteract the influence of biased information

The tools available to user companies of commodities to avoid being overly influenced by biased information are essentially two:

- Use predominantly information from neutral sources;

- Contextualize individual pieces of information within a comprehensive model of determinants that can influence the variations of the price under examination.

Information from neutral sources

Among the various neutral sources of information on commodity markets, an important role is played by public sources[1], including:

- Regulated exchange markets: official platforms where various types of commodities, such as metals, energy, and agricultural products, are traded;

- Customs declarations related to exported or imported commodities: provide detailed information on the values, volumes, and prices of commodities crossing national borders;

- Statistical price surveys at production: conducted by national or international statistical agencies, providing data on the production prices of specific commodities.

Comprehensive determinant models

It is often relatively easy to establish the direction of a possible price variation due to a specific event. Conversely, it is always very complicated to assess the magnitude of the variation. This assessment requires information on both the overall relevance of the determinant under consideration and the price elasticity[2] of the commodity to the variation of the determinant.

Such information can only be derived by defining a complete model that expresses the price of interest as a function of all its determinants and estimating the model's coefficients using econometric tools.

Consider, for example, information regarding the maintenance shutdown of a major commodity production plant. The likely effect of this event is an increase in the commodity's price. However, the magnitude (marginal or significant) of this increase will depend on a multitude of factors, including:

- The reaction of other producers to the reduction in production of the competitor;

- The overall reduction in supply;

- The characteristics of demand, both in terms of price elasticity and in terms of substitutability with other commodities.

Only by considering a complete model, estimated with actual data, is it possible to reliably assess the likely market price effect of the plant's closure.

Conclusions

Expectations about future price variations of commodities play a crucial role both during negotiations between producing and using companies, and as determinants in the formation of both financial and physical market prices.

Commodity markets are complex and interconnected, with effects that propagate from financial to physical markets through mechanisms such as future prices and inventory costs. Operators who can accurately decipher these dynamics, avoiding reliance solely on biased information, can navigate the market more effectively and achieve more advantageous negotiation outcomes. Furthermore, an informed and considered approach not only facilitates more fruitful negotiations but also contributes to the overall stability and efficiency of commodity markets.

[1] Information on commodity prices from public sources can be either primary (such as prices from regulated exchange markets and production prices) or secondary (such as customs prices).

For a description of the different sources of commodity price detection, see: Sources of detection of the Raw Material Prices

For an in-depth look at primary sources, see: Commodity Prices: Detection from Primary Sources

For an in-depth look at secondary sources, see: Commodity Prices: Detection from Secondary Sources

[2] In the economic analysis of a market, the elasticity of a variable to changes in one of its determinants expresses the intensity of the connection between the two variables within a cause-and-effect relationship.