Sources of detection of the Raw Material Prices

In order to carry out its business, the Procurement department needs reliable information on market prices

Published by Luigi Bidoia. .

Strumenti Management Analysis tools and methodologiesAmong the many tasks of the Procurement of a modern company, one of the most important is to guarantee the company the supply of raw materials and basic goods at a price that is not penalizing compared to that paid by direct competitors. In the face of highly volatile prices, achieving this objective requires an adequate negotiation process and the optimization of purchase times.

The negotiation is aimed at paying a "fair and reasonable" price. This price, however, can change quickly, also making it necessary to optimize the distribution of purchases over time. In practice, this optimization almost always results in purchasing volumes greater than optimal reorder1 when prices are in a growth phase, and lower volumes when prices are trending down.

If during the negotiation phase what matters most is the price level, in the optimization of the distribution of purchases over time, however, their dynamics are more important.

In order to carry out these activities adequately, the Procurement should have an adequate knowledge of the functioning of the supply market, of the factors that determine price changes and the intensity of the forces that push towards the formation of a single price or, conversely, generate scattered prices. This knowledge cannot be separated from updated and reliable information on the prevailing prices on the procurement market. Using only price information deriving from past purchases or occasionally collected from other buyers or provided by suppliers, can lead to incorrect decisions, with increased costs for the company.

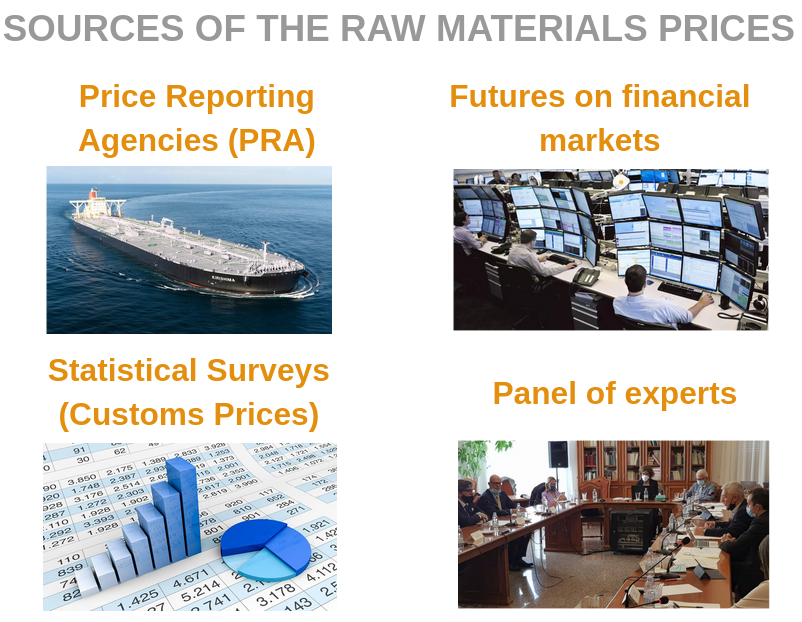

Sources of detection of the raw materials prices

The external sources on prices, most used by the Procurement function, are four, described below.

Price Reporting Agencies (PRAs)

Price Reporting Agencies are publishers who publish assessments of the prevailing price level in the markets

physicists of energy, agricultural, chemical and metal raw materials, following specific and transparent methodologies. They provide the necessary transparency, enabling markets to function efficiently, eliminate surpluses and optimize costs.

The best known PRAs are Platts, Argus and ICIS, which are active in detecting the price of oil.

Financial Future Prices

Commodity price financial futures are contracts to buy or sell a fixed quantity of a commodity, at a predetermined price and future date. At the expiration of the contract, this can be settled through the physical exchange of the goods against the agreed monetary amount, or through monetary compensation defined by the difference between the agreed price and the spot price on the expiry day.

In this century, the number and importance of exchanges trading futures on commodity prices has increased. The oldest exchanges of the Chicago Board of Trade (CBOT), New York Mercantile Exchange (NYMEX), Chicago Mercantile Exchange (CME) and the London Stock Exchange Specialized on Non-ferrous Metals (LME) have been joined by Chinese exchanges (led by Shanghai Futures Exchange-SHFE) and online exchanges, such as Intercontinental Exchange (ICE).

At the same time, commodities quoted through futures increased. The main constraint to the extension of futures contracts to other raw materials is given by the need to be able to specify in detail the product characteristics of the asset and the related contracts, and to activate a sufficiently high number of transactions.

Statistical Survey Prices

The central statistical institutes of the different countries of the world periodically produce statistics on prices,

broken down by distribution phase: producer prices, wholesale prices, consumer prices. Generally these data are of little use to Procurement because they are too aggregated.

The statistical institutes also detect foreign trade flows at a high level of disaggregation, very often corresponding to the product category of a specific raw material or basic good. From these streams it is possible to obtain a price (called customs price) relating to goods subject to international trade. Prices calculated in this way, they have the advantage of being objective (they concern actual transactions) and robust, that is, they are the result of a large number of transactions, such as not to be significantly modified from the addition or cancellation of some transactions.

Expert Panel Prices

The importance of information on raw material prices has led many individuals, both private and public, to organize panels of experts capable of periodically providing information on prices. The composition of the panel, the methods and frequency of the surveys vary from case to case. Many Italian Chambers of Commerce have organized Commissions to record prices, generally of agricultural goods and building materials. The findings of the Chambers of Commerce of Milan cover a greater number of commodities, including energy, metals and chemicals.

Evaluation of the different sources

Below is a table with an analysis of the pros and cons of the different sources of price detection.

Pros and Cons evaluation of the different sources

| Robustness | Product specification | Actual transactions | Update speed | Dissemination | Overall rating | |

| Weight | 40 | 20 | 10 | 15 | 15 | |

| Source | ||||||

| Price Reporting Agencies (PRAs) | 7 | 10 | 10 | 8 | 1 | 7.15 |

| Financial Futures | 7 | 10 | 10 | 10 | 10 | 8.8 |

| Statistical Surveys (Customs Prices) | 9 | 6 | 10 | 1 | 8 | 7.15 |

| Expert Panels | 5 | 10 | 5 | 7 | 4 | 6.15 |

For each source, an evaluation, expressed by a score from 1 to 10, of the following aspects was reported:

- Robustness: indicates the ability of the detection method to avoid possible distortions between the actual market price and its measurement;

- Product specification: concerns the detail and specification of the product characteristics of the product in question;

- Actual transactions: concerns the way in which the price was formed: this may be the result of a negotiation between two parties with opposing interests, or the result of subjective evaluations of a party, which expresses its opinion on what could be the point of agreement of a hypothetical transaction. It is clear that, depending on the party (seller or buyer) and the context, the subjective assessment can be distorted;

- Update speed: indicates the time that on average elapses between the moment in which the transaction (real or hypothetical) between a seller and a buyer takes place and the moment the information is available to third parties;

- Dissemination: evaluates the public's accessibility to information.

A weight is given in the table for each of these aspects. This was used to calculate an average score for each of the four sources.

On the basis of this analysis, the source that presents the greatest positive and the least negative aspects is that of Financial Futures, capable of providing relatively robust price measures quickly, accessible to the general public. The prices produced

by the Reporting Agencies and the Customs Statistics have on average equivalent strengths and weaknesses. The Expert Panel source is the one with the least advantages (or the greatest weaknesses), penalized by the lack of robustness and limited diffusion.

The combination of Financial Future sources with Customs Statistics represents a solution capable of obtaining price measurements with the highest possible quality for all aspects considered.

Conclusions

The volatility and uncertainty that are increasingly characterizing the prices of raw materials and basic goods represent an important risk factor for processing companies. The Procurement department is called upon to manage this risk, starting with the collection and use of reliable measures on price levels and variations. In this respect, financial futures are the source of information with the greatest benefits. If this source is combined with Customs Statistics then it is possible to obtain price measures of maximum quality according to all possible aspects.

[1] The inventory optimization models allow you to calculate the optimal reorder point and volumes based on various parameters. However, these models often do not take into account the variability of purchase prices over time. It can be taken into consideration by modifying the reorder volumes, at the same level of precautionary stocks.