Commodities, European market weakness and Russia sanctions

The phase of substantial stability in commodity markets continues; only the weather moves prices

Published by Luca Sazzini. .

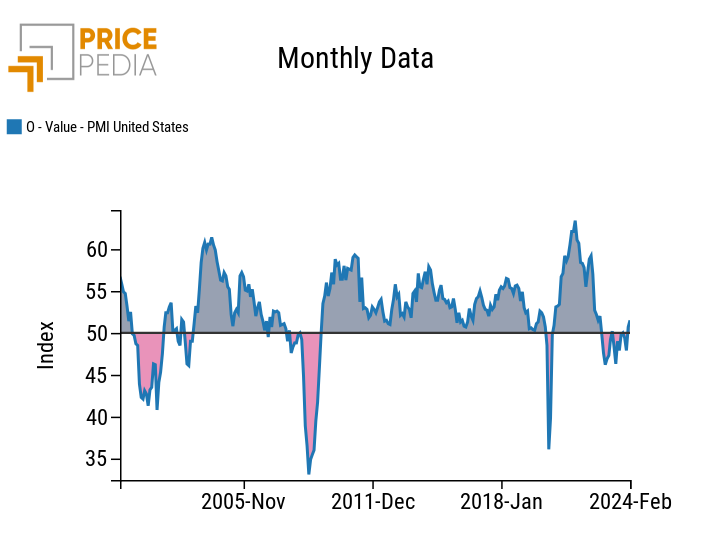

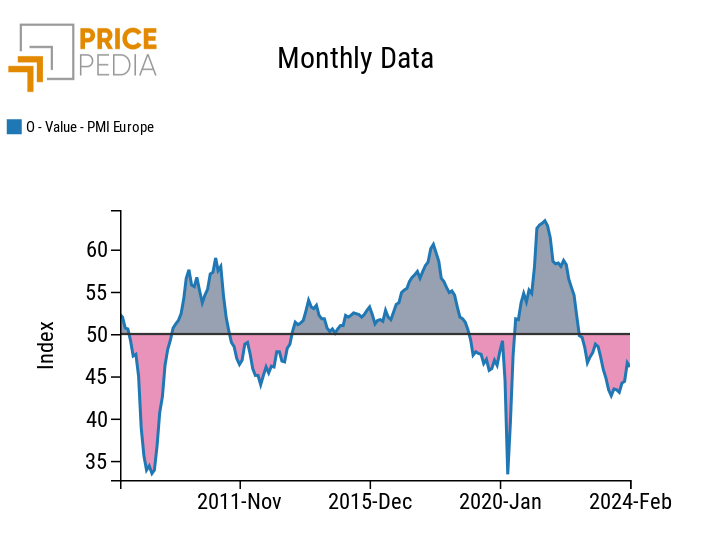

Conjunctural Indicators Weekly energy analysisThis week, new data regarding the PMIs of the United States and Europe have been released.

The composite PMI of the United States in February fell from 52 to 51.4 points, but it remains a positive figure as it stays above the threshold of 50 points. Conversely, the European composite PMI increased from 47.9 to 48.9 but remains below the 50-point threshold, indicating a continuation of European decline, albeit with a progressive attenuation.

As for the manufacturing PMIs, the values for the United States and Europe in February are 51.5 and 46.1 points, respectively.

The US manufacturing PMI continues to remain positive, while the European figure remains negative. These data confirm the current weakness of the European industry compared to the greater resilience of the American one.

Below are the graphs of the two manufacturing PMIs found in the Conjunctural Indicators section on the Pricepedia website.

| US Manufacturing PMI | European Manufacturing PMI |

|

|

Despite the current weakness of the European market, the ECB minutes this week revealed that a cut in ECB rates may still be distant. The ECB has stated that before beginning a rate cut, it will be important to observe whether the upcoming quarterly data confirms the easing of inflation, the weakness of the European recovery, and the reversal of wage growth acceleration.

In contrast, in China, the first cuts in 5-year interest rates by commercial banks have already begun.

Commodity Markets Performance

In this macroeconomic framework, commodity markets are stabilizing after the reduction phase at the end of 2023, but they will not recover before the next interest rate cut by the two main Western banks (FED and ECB).

Currently, most commodities remain at similar price levels as in recent months. However, the category of foodstuffs stands out with strong opposing trends.

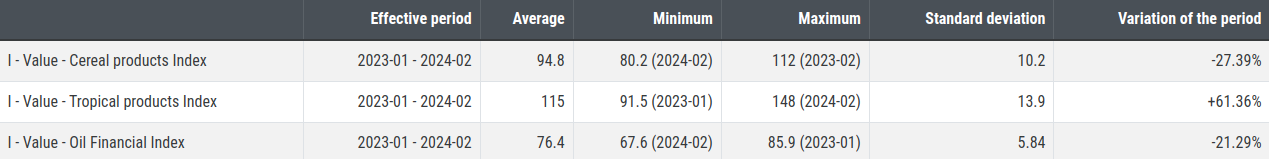

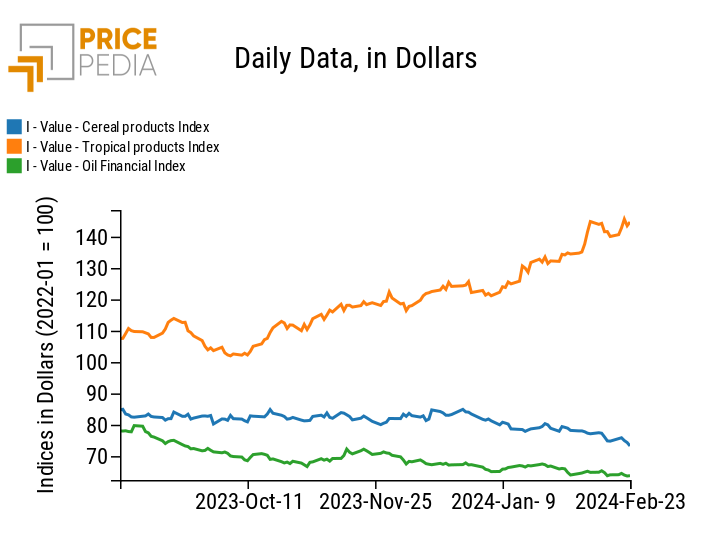

The table below shows the statistics of the past year for the three main categories of foodstuffs. The last column shows the cumulative variation rate over the last 12 months, from January 2023 to January 2024.

Price Statistics of Foodstuff Indices, from January 2023 to February 2024

The table highlights the significant growth in the prices of tropical foods over the past 12 months. Due to particularly adverse weather conditions, their prices have increased by over 60% in a year. Conversely, the prices of cereals and oils have decreased, with variations of -27% and -21% respectively, compared to January 2023.

The sharp downward trend in cereal markets, which has been ongoing for over a year, is attributed to increased supply and simultaneous global demand decline.

In 2022, cereal prices reached record highs due to the war in Ukraine and severe drought that ruined crops. In response to this price hike, consumers reduced cereal demand while farmers expanded their supply in hopes of higher profits. These divergent dynamics led to an oversupply that significantly impacted cereal prices.

Meanwhile, the European lifting of customs duties on Ukraine has brought a greater quantity of low-cost wheat to Europe, further contributing to the decline in cereal prices.

New Sanctions by the US and the EU against Russia

For the second anniversary of the war in Ukraine, new sanctions will be imposed by the United States and the European Union against Russia. The thirteenth package of EU sanctions, combined with additional sanctions declared by the United States, aims primarily to combat the circumvention of sanctions against Russia. Indeed, China and other countries have been taking advantage of European and American sanctions against Russia to buy arms and technologies from Europe and the United States with the aim of reselling them in Russia. With this new package, in addition to Russia, all the various companies that have taken advantage of this historical period to strengthen their commercial ties with Russia, profiting from the war in Ukraine, will also be targeted.

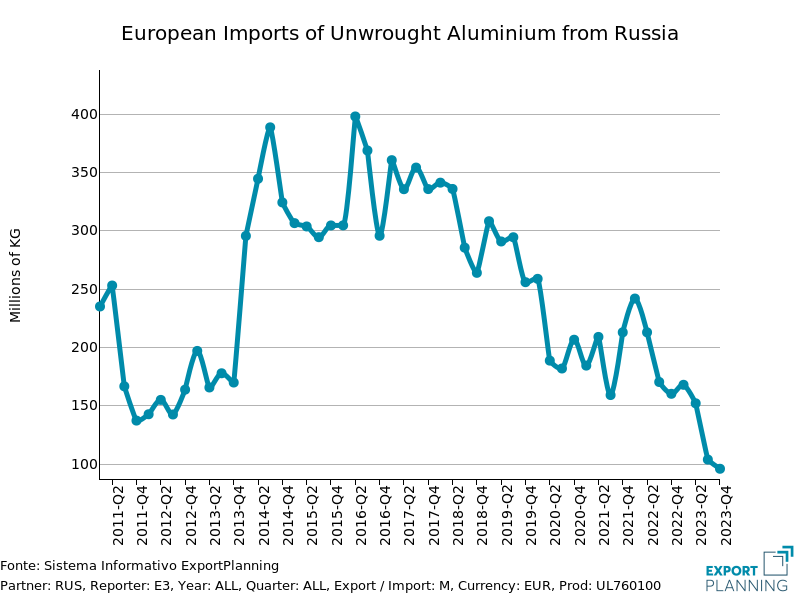

It is interesting to note that this package does not include more severe restrictions on aluminum, except for those on aluminum capacitors, which have a wide range of military applications.

The debate regarding further sanctions on raw aluminum remains heated, especially in Europe, as not all countries agree to completely block aluminum imports from Russia, considering that in recent years aluminum imports have already decreased significantly.

Below is a graph showing the quantity of kilograms of aluminum imported by the European Union from Russia.

European Imports of Raw Aluminum from Russia

Currently, Europe has only partially replaced aluminum imports from Russia with increased imports from India. The reduced supply of aluminum in the EU market has not affected prices because it has been associated with a strong weakness in demand.

Based on the currently available information, it is not clear what the European decisions will be regarding aluminum from Russia when aluminum demand in the EU returns to growth.

ENERGY

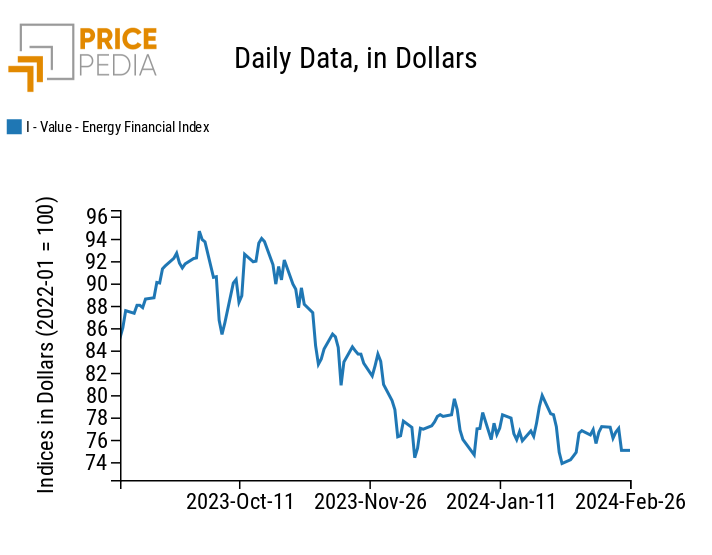

This week, PricePedia's financial index of energy products remained relatively stable, recording only short-term fluctuations.

PricePedia Financial Index of energy prices in dollars

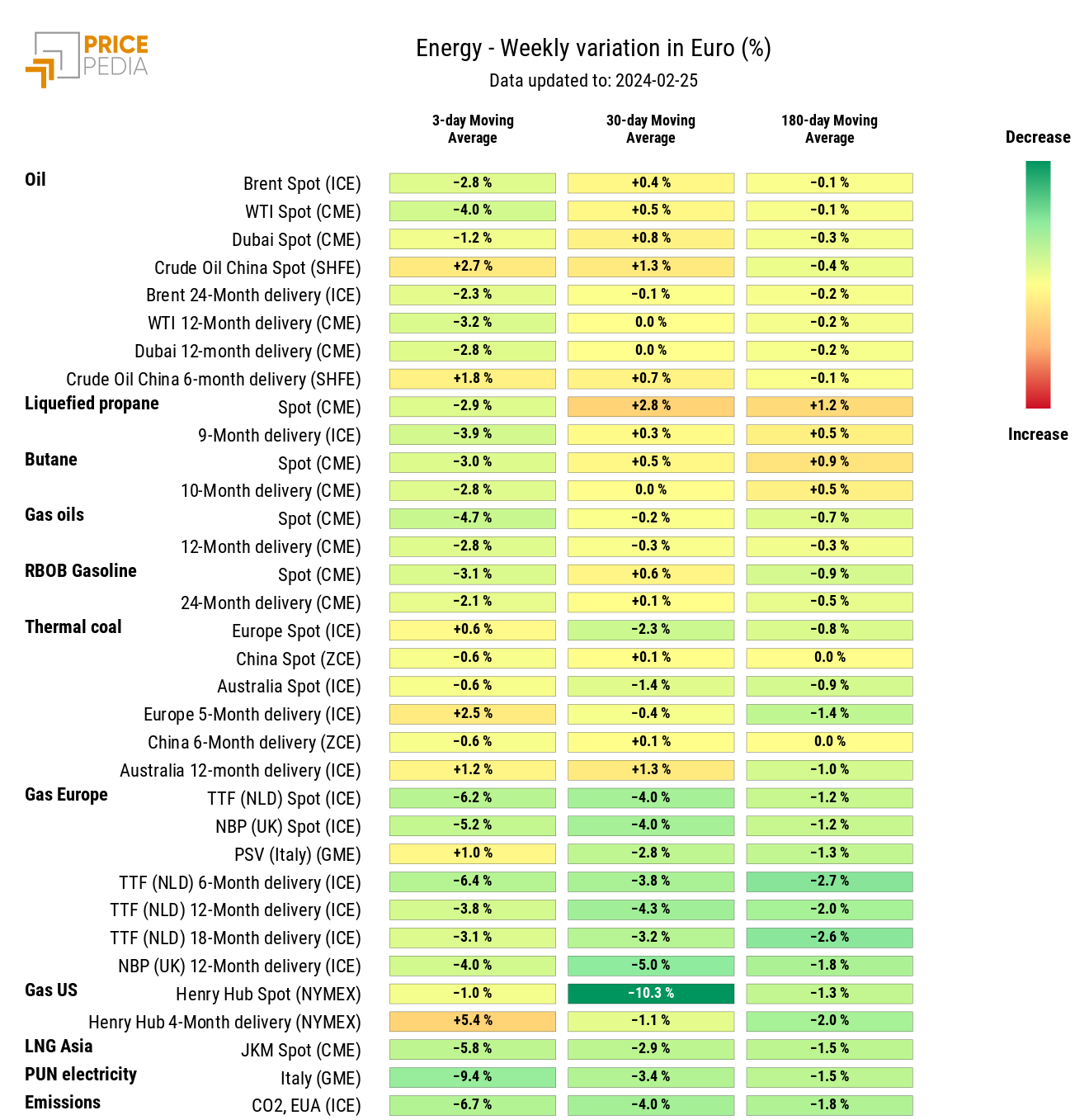

The energy heatmap highlights the decline in prices of liquefied propane, butane, and European gas, alongside an increase in American gas due to Chesapeake Energy's announcement of production cuts.

HeatMap of energy prices in euros

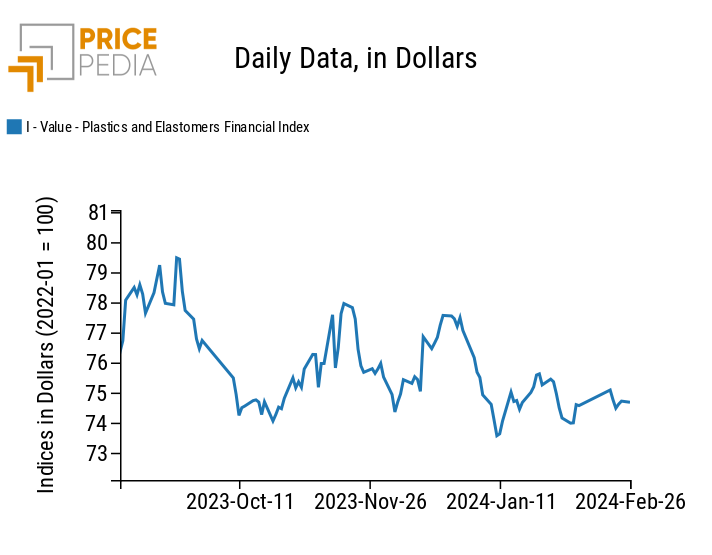

PLASTICS

This week, the financial index of plastics quoted in China started the week with a slight increase before recording weak price declines that did not alter its levels.

PricePedia Financial Index of dollar prices of plastic materials

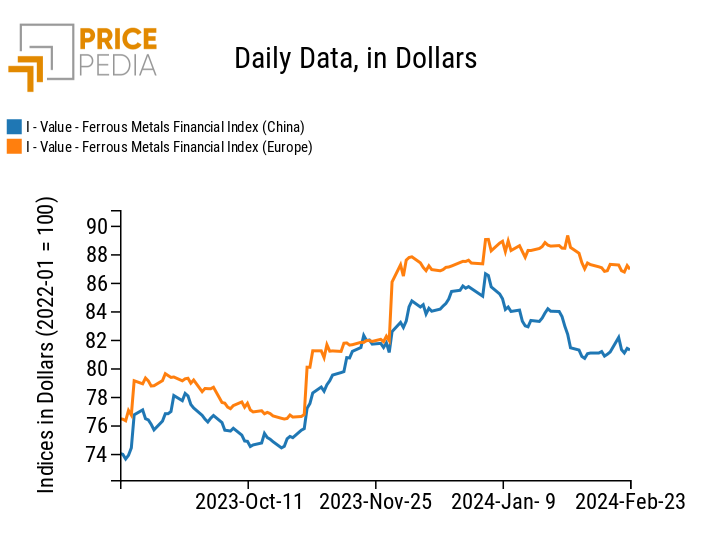

FERROUS METALS

The two PricePedia ferrous indices continue to remain relatively stable, although the China ferrous index appears more likely to begin a downward trend.

PricePedia Financial Indices of dollar prices of ferrous metals

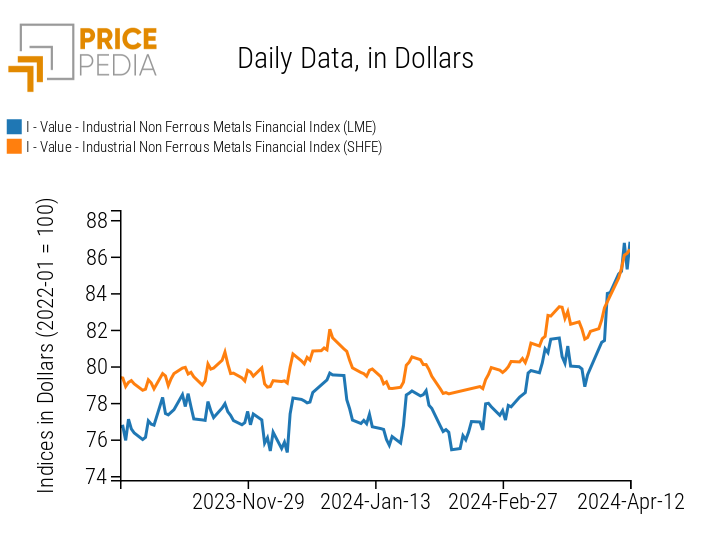

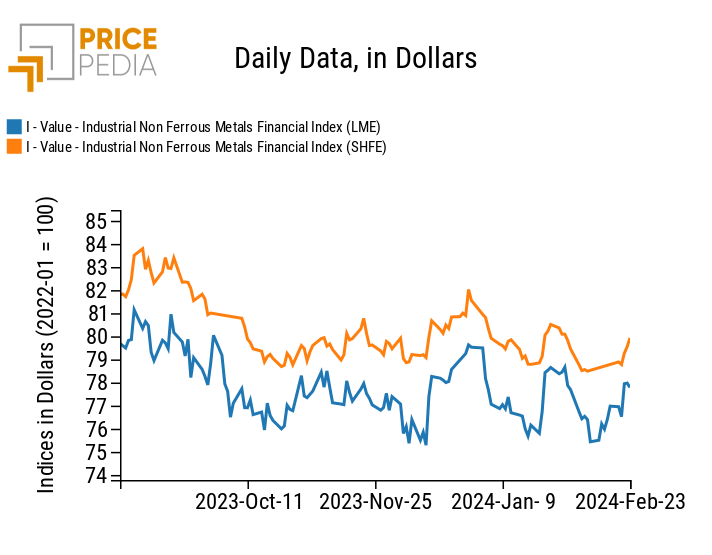

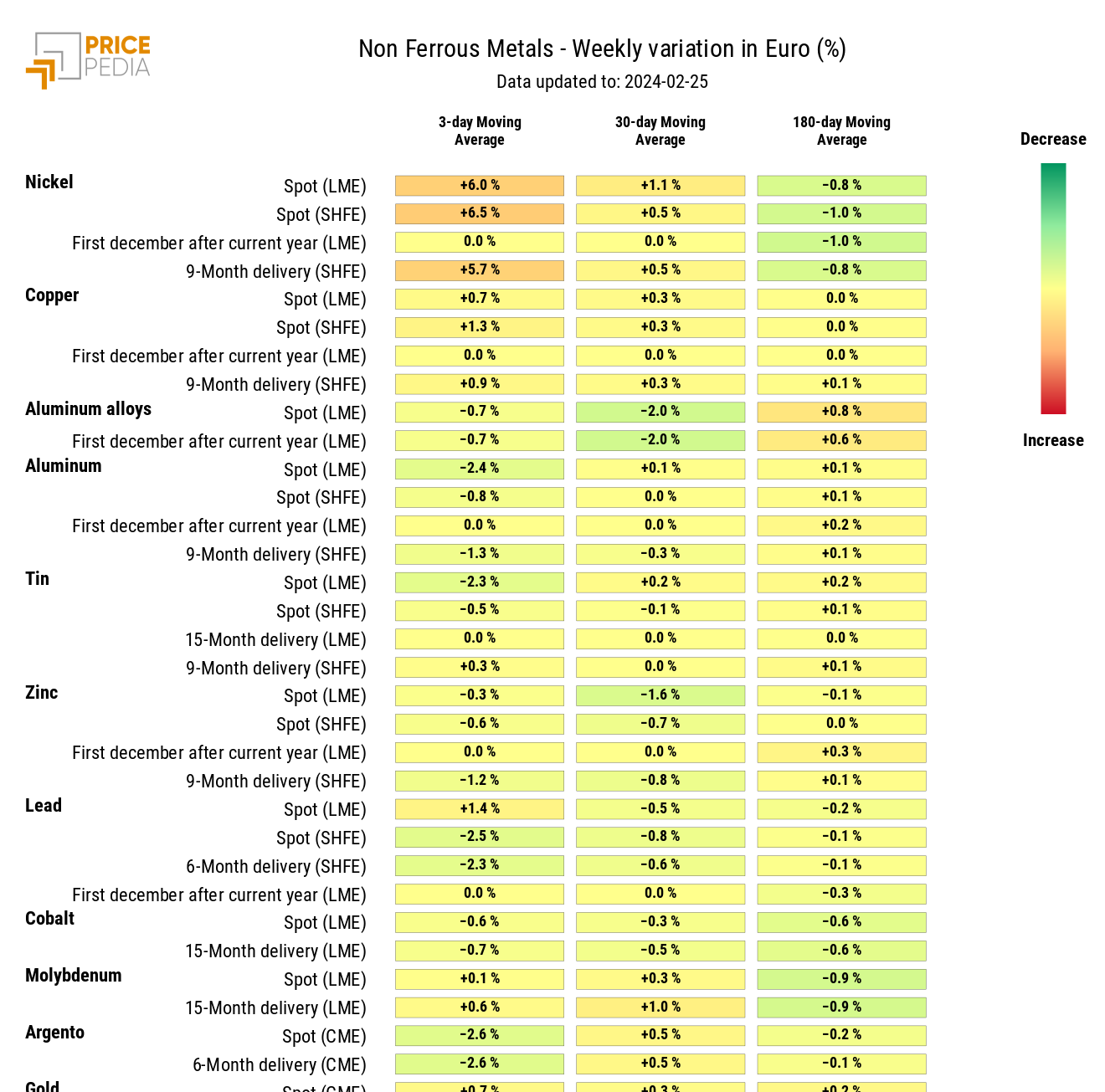

INDUSTRIAL NON-FERROUS

This week, the LME non-ferrous index returns to previous price levels, moving closer to the non-ferrous index quoted on the Shanghai Stock Exchange.

PricePedia Financial Indices of dollar prices of industrial non-ferrous metals

The non-ferrous metals heatmap shows an increase in nickel prices and a decrease in tin prices, stabilizing after last week's increase.

HeatMap of industrial nonferrous metal prices in euros

FOOD

The upward trend of the tropical food index is slowly weakening, while the downward trends of cereals and oils continue.

PricePedia Financial Indices of food prices in dollars

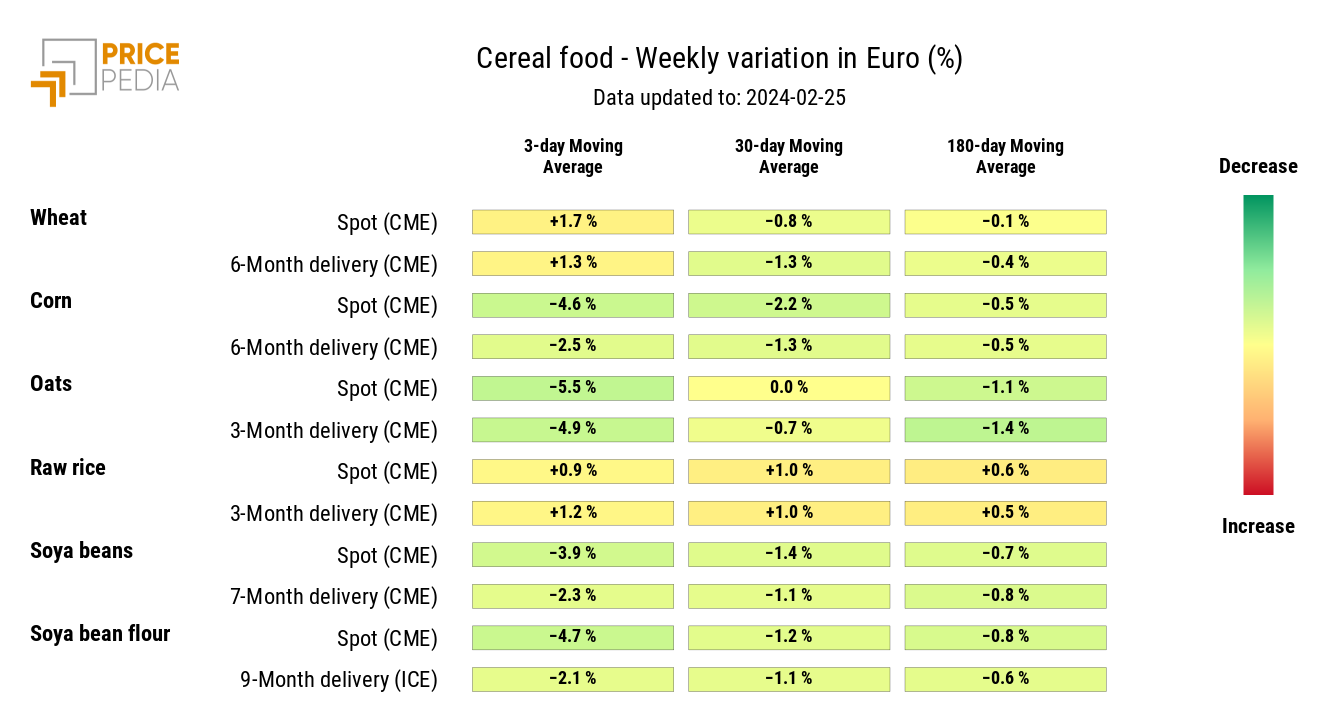

CEREALS

The heatmap shows a decrease in cereals, particularly oats and maize.

HeatMap of Cereal Prices in Euros

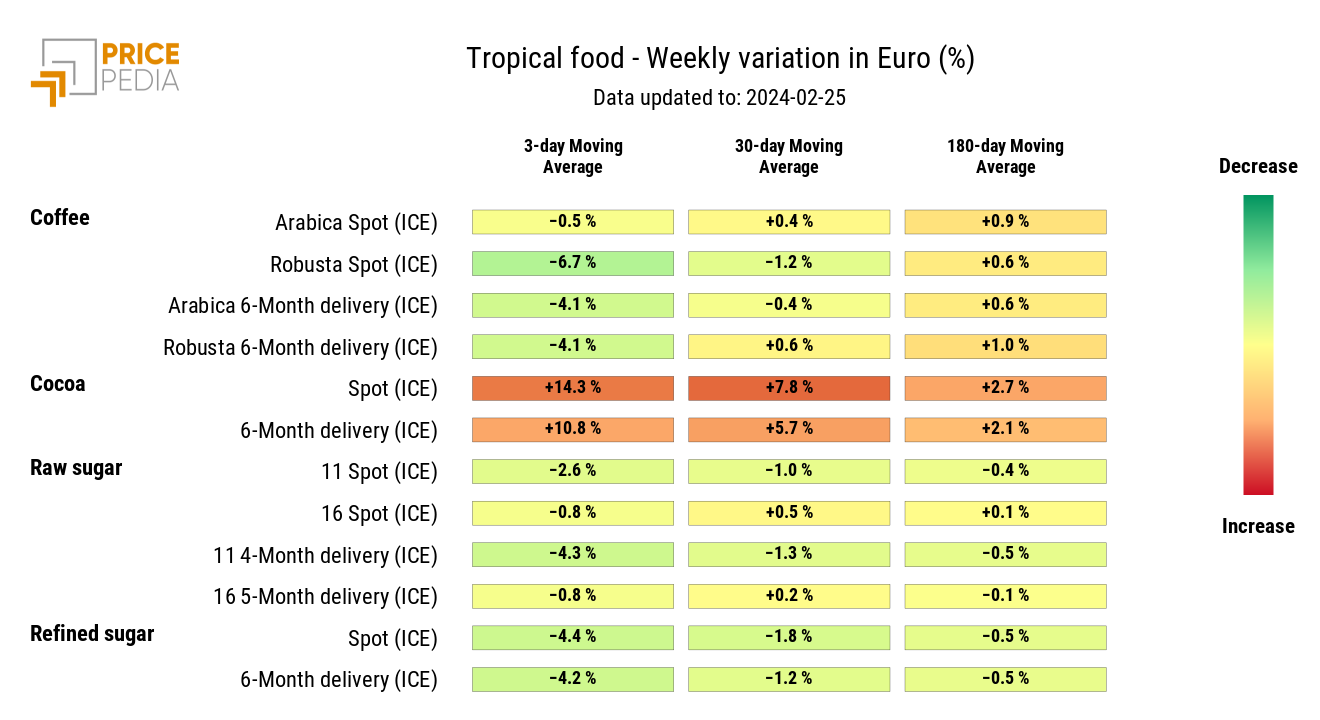

TROPICAL

The tropical food heatmap signals a further increase in cocoa prices, which this week have reached new record highs. This additional increase is caused by recent estimates from the Ghana Cocoa Board, which have further revised downwards cocoa production, affected by particularly unfavorable weather conditions.

HeatMap of tropical food prices in euros