First signs of global industrial recovery

Positive signs for EU inflation, but concerns remain for US inflation

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekInflation Dynamics

The release of new data regarding the European inflation rate has surprised analysts, falling below expectations. The inflation rate in March dropped to 2.4% year-on-year (y/y), compared to the previous 2.6%. The core data also indicates a decrease in prices, moving from 3.1% to 2.9%.

The deflationary contribution from the energy sector has significantly decreased, from -3.7% y/y recorded in February to -1.8%. To continue registering significant reductions in inflation, it will be important to also contain prices in the services sector, which currently remains the most critical sector, with an annual inflation rate of 4%.

Overall, the data on European inflation has been positive, increasing the likelihood of a first ECB interest rate cut in June 2024.

However, the first cut in interest rates by the Federal Reserve is becoming more uncertain, as last week's inflation data did not prove positive. The resilience of the US economy and the stickiness of inflation have made a rate cut in June 2024 more uncertain.

Analysts now believe it is more likely that the FED will only make 2 cuts of 25 basis points by the end of the year, instead of 3. If US inflation data does not show signs of improvement, the first FED rate cut could be postponed, delaying the start of the expansionary cycle to the summer quarter.

Global Industrial Production

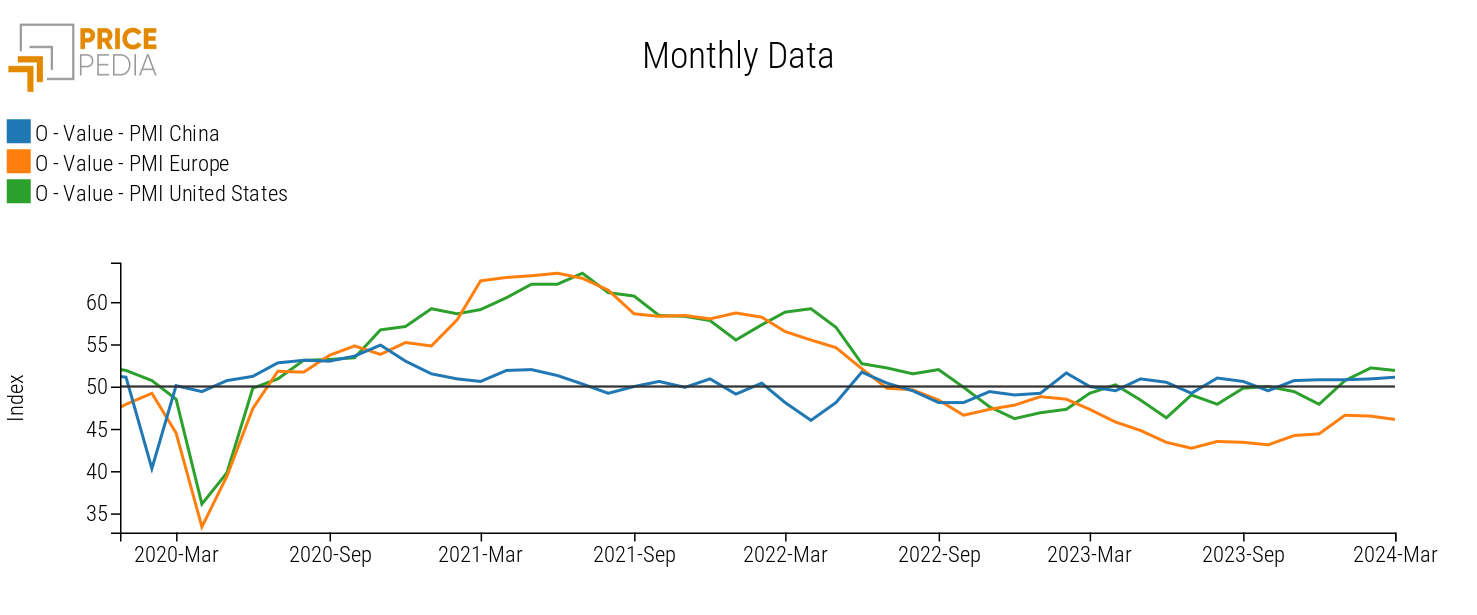

This week, official PMI data for Europe, the United States, and China for March 2024 has been released.

The composite PMI (relating to the entire economy) of the EU (50.3) surpasses the threshold value of 50 points again, indicating economic growth in the Eurozone.

The composite PMI of the United States (51.7) continues to signal growth, although it is slowing down, as the index value has dropped compared to the February figure (52.3).

Both composite PMIs for China, reported by NBS and Caixin, align at a value of 52.7, both increasing compared to February's data (50.9 and 52.5).

Analyzing the manufacturing PMI data, more moderate values are obtained compared to composite indices.

Below is a graph showing the values of the manufacturing PMI indices for Europe, the United States, and China1, from the beginning of 2020 to March 2024.

Manufacturing PMI of Europe, United States, and China

Positive values for China (51.1) and the USA (51.9) are evident from the analysis of the manufacturing PMI data, indicating growth in the manufacturing sector in March.

In Europe, however, the manufacturing sector continues to remain weak, once again settling below the 50-point mark (46.1).

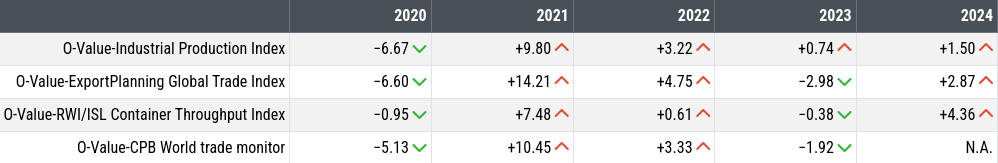

Overall, global industrial conditions are increasingly turning towards growth. The estimate of global industrial production published by PricePedia this week indicates a 1.5% growth in global industrial production in the first three months of 2024 compared to the 2023 average, confirmed by the increase in global goods trade by 2.9% in the first months of 2024 (source ExportPlanning) and by 4.6% in global container trade (source Leibniz Institute for Economic Research). When comparing the dynamics in 2024 of various volume-based business cycle indicators and global trade levels shown in the table below, the change from 2023 is evident.

This growth in global activity levels and the resulting commodity demand, however, seems to represent a constraint on generalized commodity price declines rather than a factor capable of initiating a new phase of increases.

Annual Changes in Global Industrial Activity and Trade Indices

Commodity Market

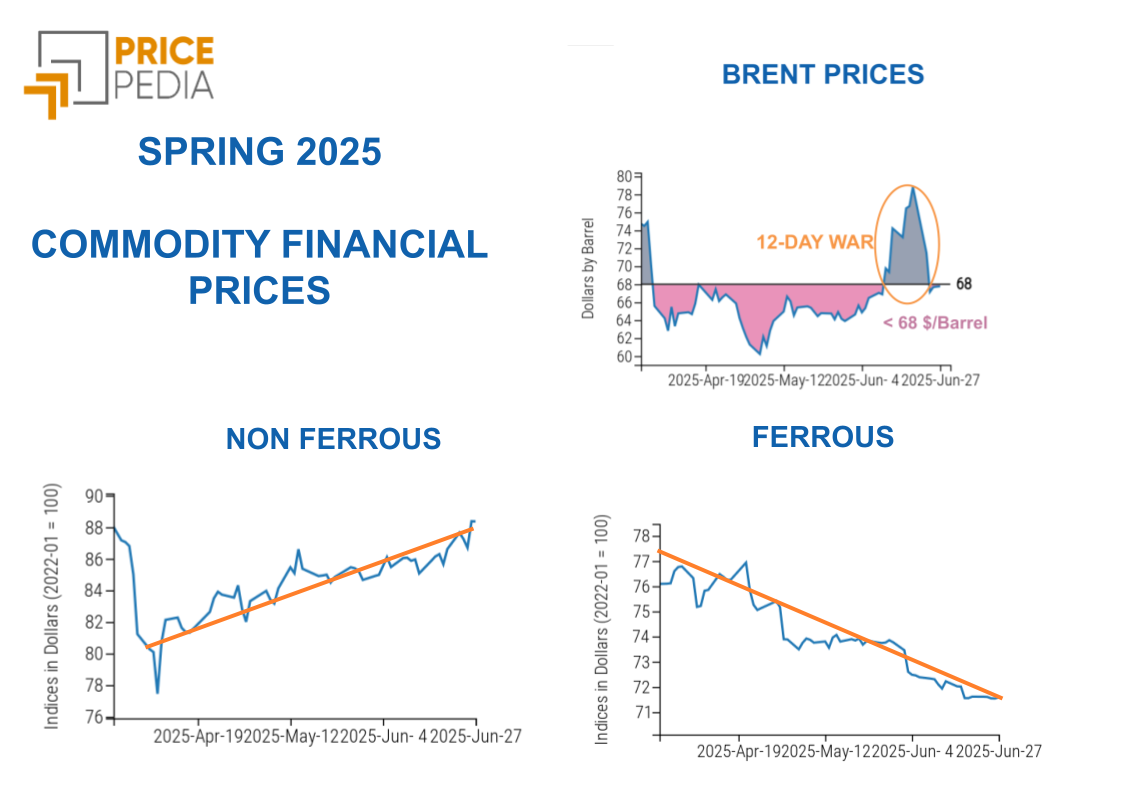

The commodity market situation remains uncertain, especially for energy products, which continue to experience fluctuations linked to short-term temporary shocks. The metals market is characterized by very different dynamics:

- Ferrous metals continue to experience a price reduction trend, particularly accentuated by iron ore prices;

- Non-ferrous metals continue their upward trend, which was strengthened this week by traders' expectations of a possible production cut in China;

- Gold continues its growth phase, reaching new highs, supported by still elevated US inflation data.

[1] The data for the manufacturing PMI index of China is from Caixin

ENERGY

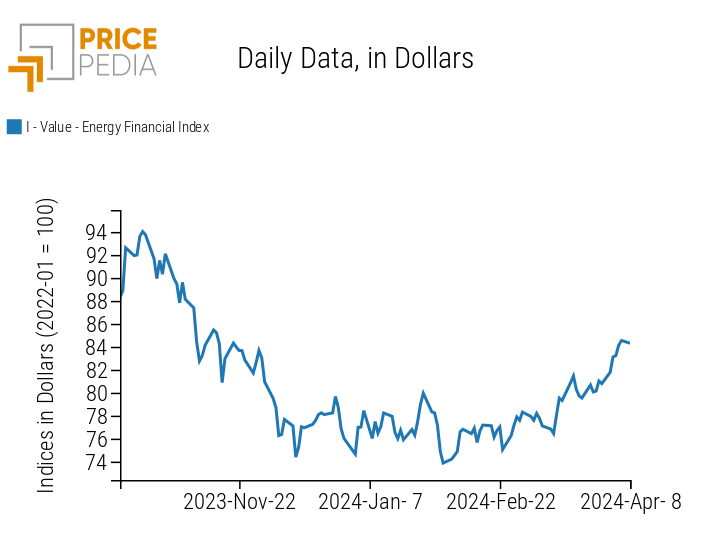

The recent increase in Brent prices due to escalating geopolitical tensions has resulted in a weekly rise in the energy index. The latest increase was caused by escalating tensions between Iran and Israel,

following Israel's airstrike against its embassy in Syria, killing 3 members of the Iranian Revolutionary Guards.

The increase in tensions, coupled with OPEC+ production cuts, are the main factors keeping Brent prices high, counteracting the downward trend due to weak demand.

PricePedia Financial Index of Energy Prices in Dollars

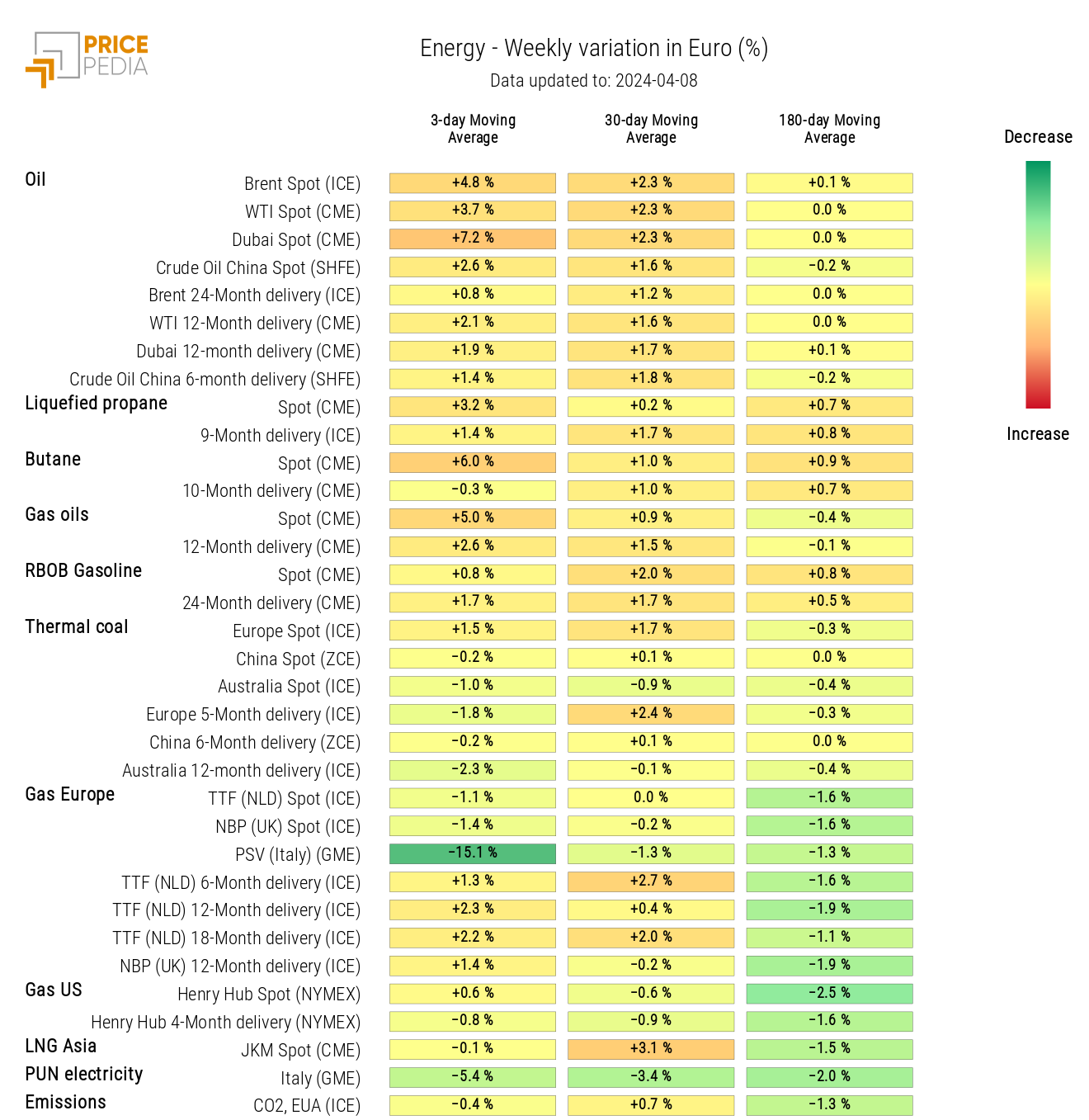

The energy prices heatmap shows an increase in oil prices and its derivatives, alongside a reduction in Italy natural gas prices (PSV).

HeatMap of Energy Prices in Euro

PLASTICS

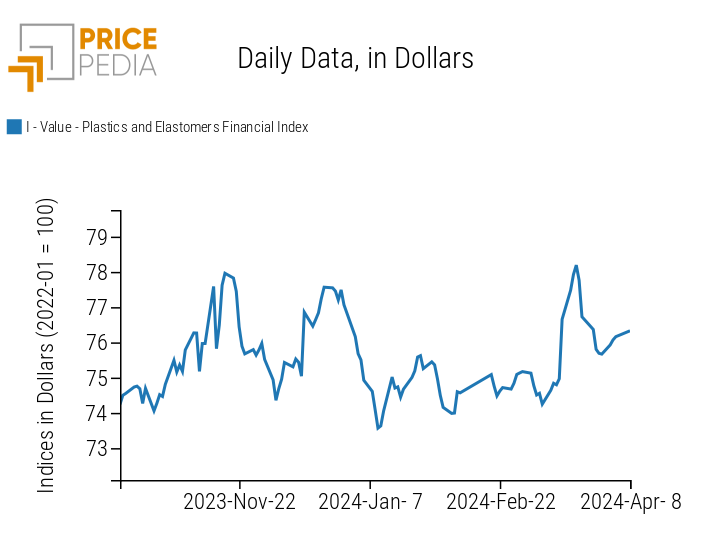

This week, the prices of listed plastics in China started to recover thanks to rising oil prices.

PricePedia Financial Indices of Plastics Prices in Dollars

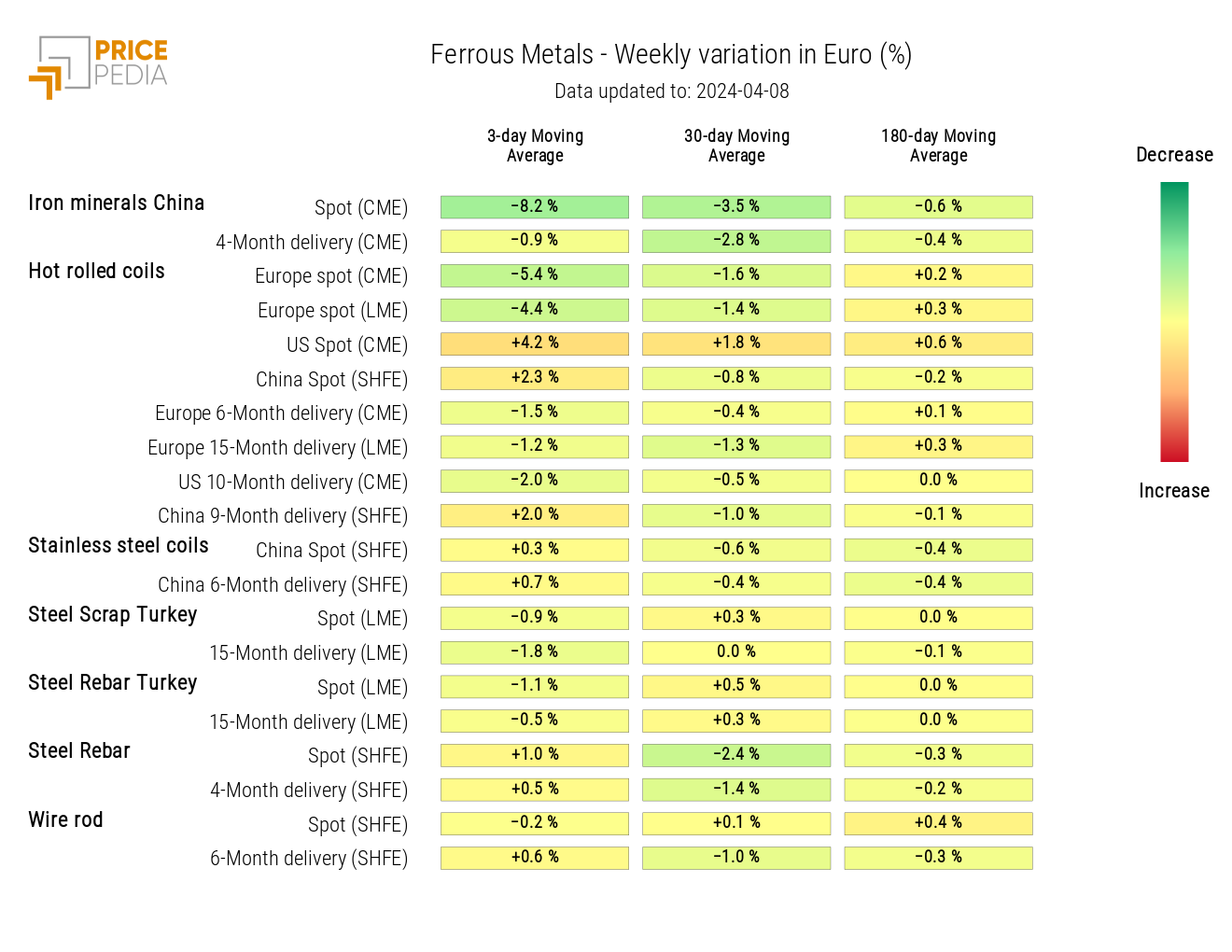

FERROUS

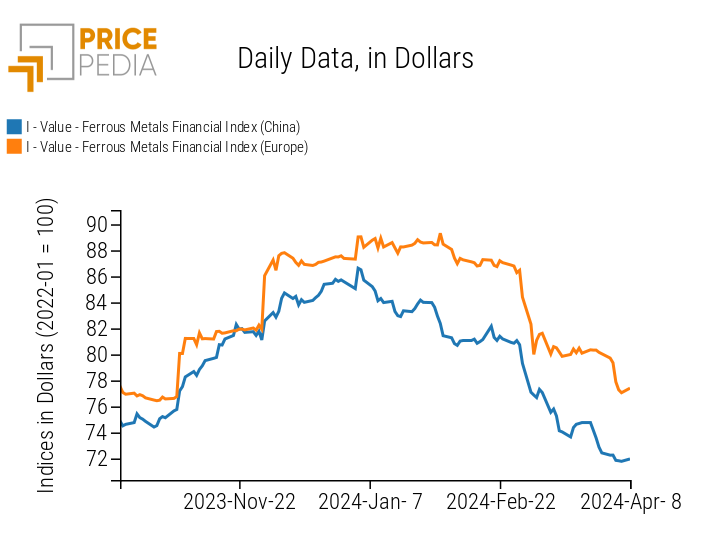

The downward trend of ferrous metals financial indices continues.

This week, there is a more pronounced decline in the Europe ferrous index, which still registers significantly higher levels compared to the China ferrous index. The continued reduction trend is again attributed to oversupply in the iron ore market, due to both ample supply and weak demand for end uses.

PricePedia Financial Indices of Ferrous Metals Prices in Dollars

The ferrous prices heatmap highlights the fall in iron ore prices, alongside an increase in US hot-rolled coil prices.

HeatMap of Ferrous Metals Prices in Euro

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

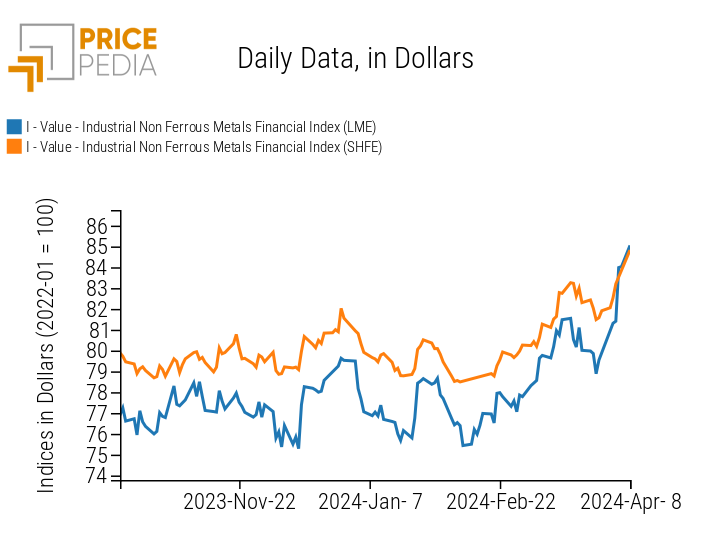

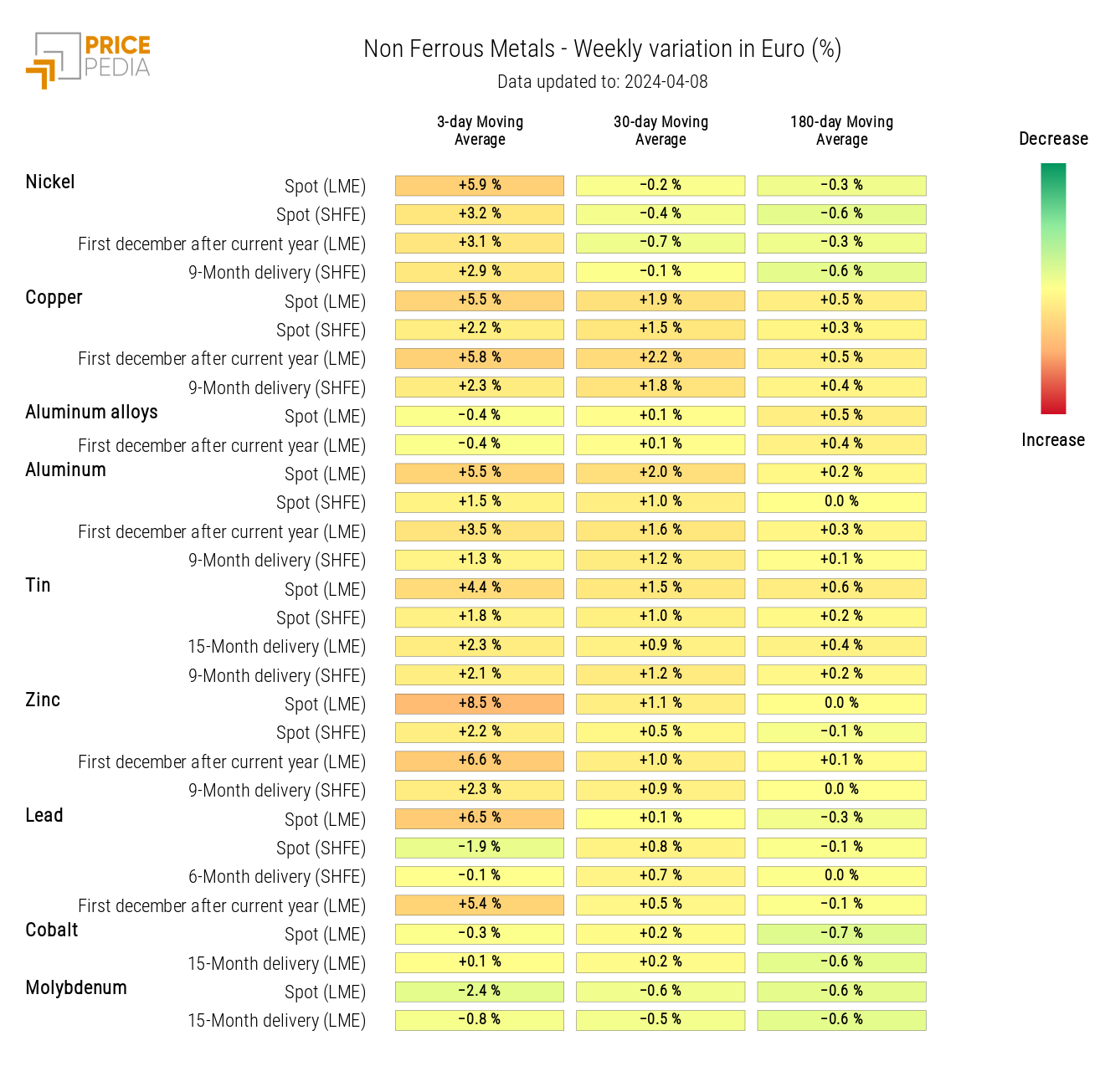

INDUSTRIAL NON-FERROUS

This week, the non-ferrous metals financial index, listed on the London Metal Exchange (LME), rose sharply to outperform the SHFE non-ferrous index.

PricePedia Financial Indices of Industrial Non-Ferrous Metals Prices in Dollars

The non-ferrous industrial prices heatmap shows a general weekly increase in non-ferrous metals prices.

Increased expectations of potential production cuts in China have led traders to increase long positions, accentuating the already bullish market dynamics.

HeatMap of Industrial Non-Ferrous Metals Prices in Euro

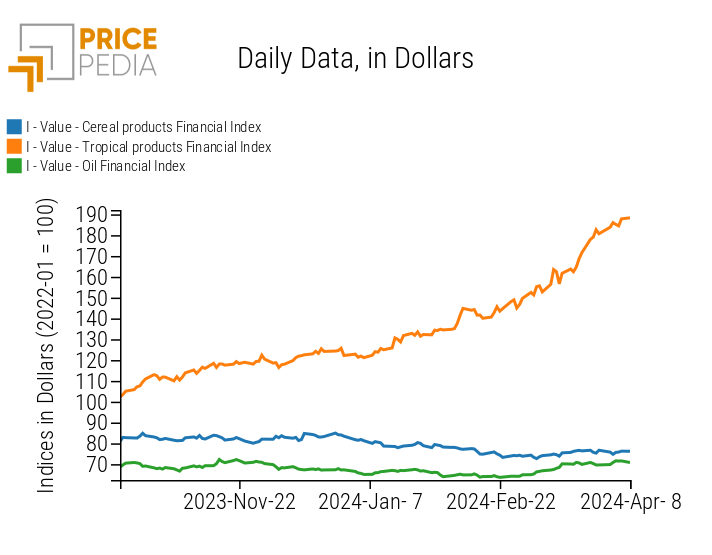

FOOD

The three cereal indices show a weak oscillation, starting the week with an increase followed by a subsequent price decrease. The tropical and oil indices continue their upward price trend, while the cereal index is beginning to stabilize after the recent bearish phase.

PricePedia Financial Indices of Food Prices in Dollars

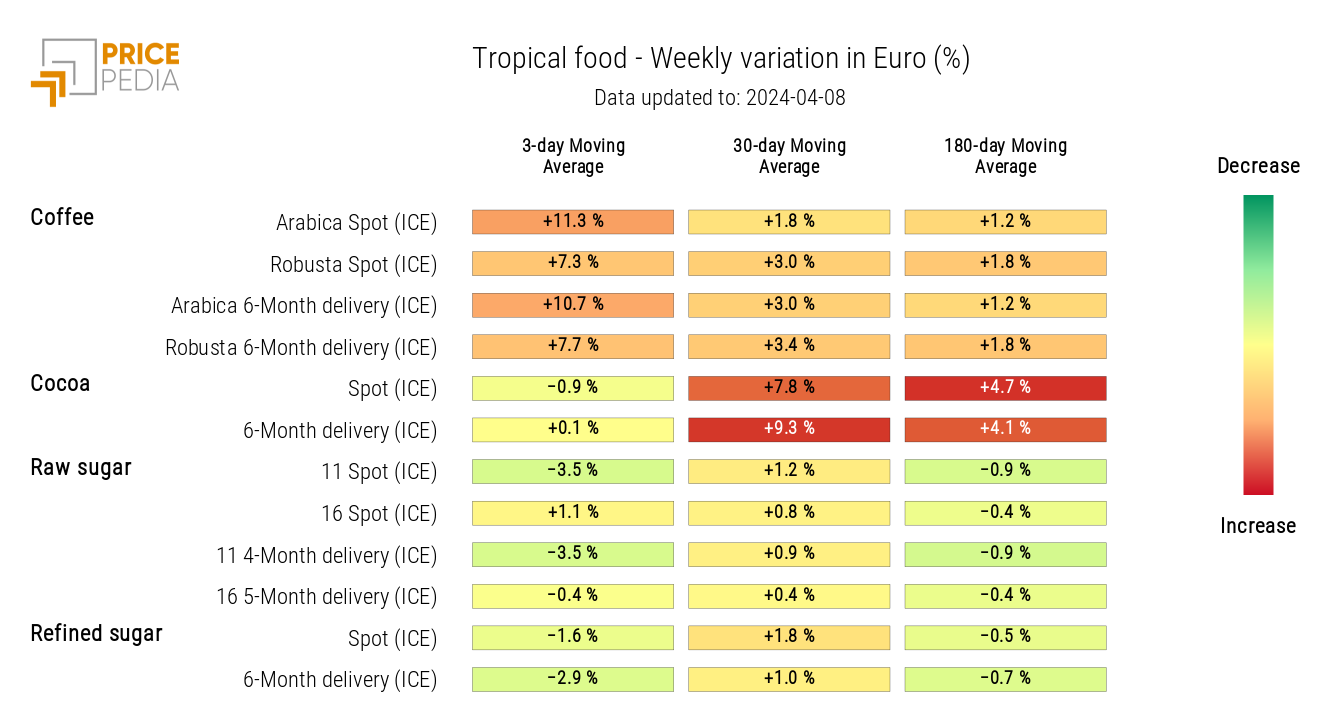

TROPICALS

The tropical food prices heatmap shows an increase in coffee prices.

HeatMap of Tropical Food Prices in Euro