The gas market situation in April 2024

Downward fundamentals, susceptible to distortions from geopolitical tensions.

Published by Redazione PricePedia. .

Natural Gas Price Drivers

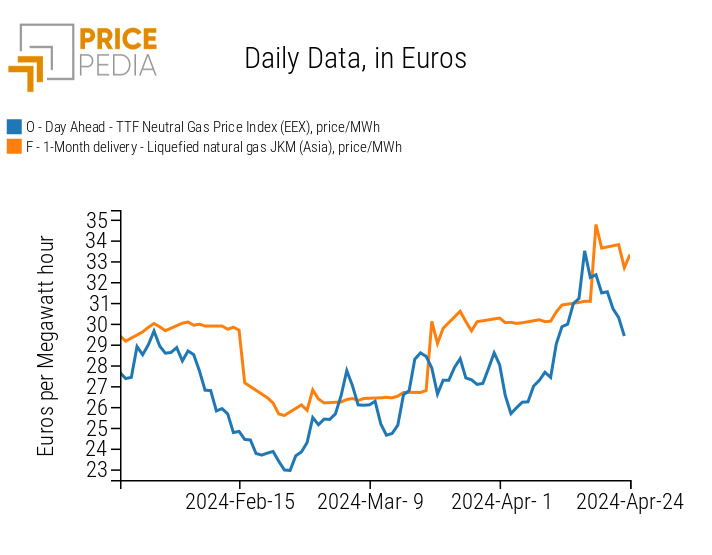

After reaching a low point on February 24, 2024, with a price below 23 euros per MWh, the Dutch TTF gas trading point recorded a series of increases, reaching 33 euros/MWh on April 16. However, in the following days, the price trend reversed, dropping below 30 euros/MWh on April 24.

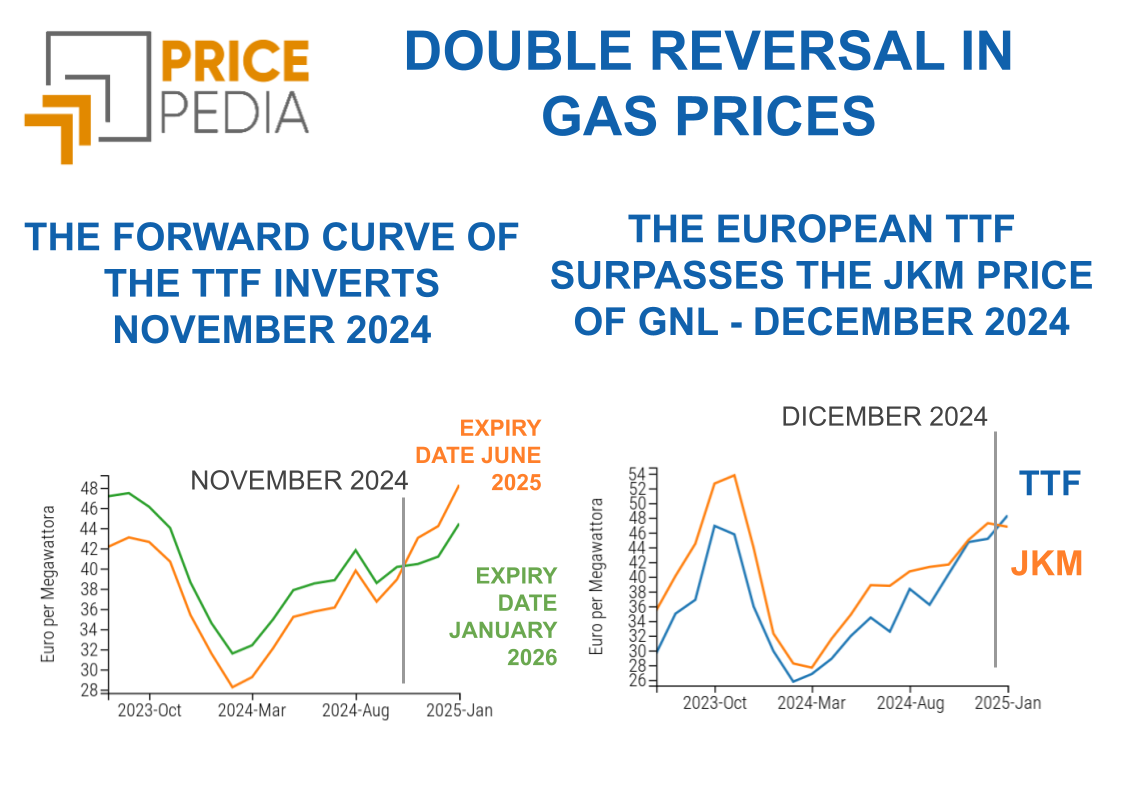

As shown in Chart 1, the price increase over the last two months has affected both natural gas at the TTF and liquefied natural gas (LNG), traded at the JKM, which concerns imports of Japan and South Korea.

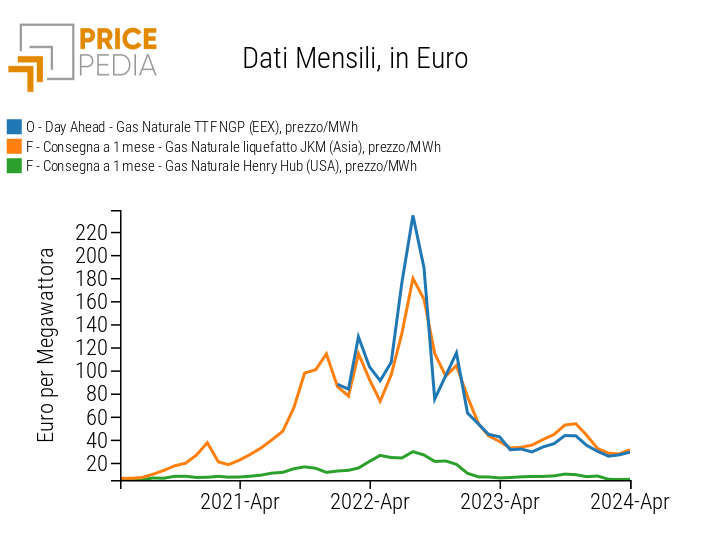

Chart 2 compares the monthly prices of natural gas at the TTF, LNG at the JKM, and natural gas at the American Henry Hub. This comparison highlights a strong correlation between the Asian and European markets, while showing a significant difference with the American prices. Therefore, it is essential to analyze the European and Asian markets and their interactions to understand the dynamics affecting TTF gas prices, which are crucial for European companies.

Daily and monthly gas prices

| Chart 1: Daily price of gas in Europe and LNG in Asia | Chart 2: Monthly world gas prices |

|

|

In order to understand what is happening in the European and Asian markets, the IEA's report on the world gas market in Q2 2024 (IEA (2024), Gas Market Report, Q2-2024, IEA, Paris, Licence: CC BY 4.0), published recently, is particularly useful.

The report highlights the following points:

- Throughout 2023, the gas markets of the northern hemisphere have reached a new equilibrium, following the severe turbulence of 2021-2022;

- in the winter of 2023-2024, mild average temperatures were accompanied by strong cold spells that led to record-breaking peaks of demand in northern hemisphere markets;

- The industrial and energy sectors in rapidly growing Asian economies will drive the growth of gas consumption in 2024;

- The growth in gas consumption will be limited by the increase in electricity production from renewable and nuclear sources;

- The effects on prices from demand growth will be limited by high storage levels;

- Geopolitical tensions represent the greatest risk to the short-term outlook;

Severe cold spells

Despite an unusually mild winter on average, the 2023/24 heating season experienced several cold spells, which led to record-breaking demand peaks in key markets of the Northern Hemisphere.

In the United States, Winter Storm Heather drove natural gas consumption to an all-time high of nearly 4 billion cubic meters a day on January 16, 2024, about 30% above the average daily demand during the December-February period.

In Europe, daily gas demand surged by nearly 40% in just six days, reaching about 2.5 billion cubic meters a day in early January. The colder weather coincided with lower wind power output, increasing demand for both space heating and gas-to-power requirements.

China faced several cold spells during the 2023/24 winter season, with gas demand rising to an all-time high of 1.42 billion cubic meters a day in mid-December 2023. The cold spell drove transmission pipeline utilization rates to over 90% of capacity for the first time.

These events highlight the critical importance of gas supply flexibility for energy security, especially in markets increasingly reliant on weather-sensitive renewable energy production, while using gas-fired power plants as a backup option.

Gas Consumption Growth in 2024

It is estimated that during the winter of 2023/24, natural gas consumption increased by 2%, or nearly 40 billion cubic meters, year-on-year (y-o-y) in the markets covered by the EIA Report. Demand growth was largely supported by increased gas use in the power and industrial sectors, while a mild winter reduced heating requirements in key markets of the Northern Hemisphere.

Lower prices supported higher natural gas consumption in industrial sectors. Initial estimates suggest that the combined industrial gas demand in China, Europe, India, and the United States, which accounts for more than half of the global industrial gas consumption, increased by nearly 8% year-on-year. Industrial gas demand in Europe is showing signs of recovery with preliminary data indicating an increase of about 15% year-on-year through the winter of 2023/24, although remaining 10% below the levels of 2020/21.

According to EIA forecasts, natural gas demand is expected to increase by 2.3% in 2024, largely due to rapid growth in Asian markets. The industrial and energy sectors in these fast-growing Asian economies are set to drive the increase in gas consumption.

The industry is expected to account for nearly 45% of the global gas demand growth in 2024. This is partly driven by the expected recovery in Europe and by Asian markets with price-elastic industrial demand. A significant contribution is also expected from structural growth in China and India;

More Energy from Renewable and Nuclear Sources

Natural gas consumption in Europe decreased by 1% (or 3 billion cubic meters) year-on-year during the 2023/24 heating season. The mild winter weather reduced gas demand in the residential and commercial sectors, but above all, the strong expansion of renewables along with improved nuclear availability led to a reduction in gas demand for electricity production.

In 2024, gas consumption for electricity production is expected to decrease by nearly 10%, thanks to improved nuclear availability in France and the rapid expansion of renewable energies.

High Storage Levels

Storage sites closed the 2023/24 heating season well above the five-year average in both Europe and the United States. The European Union ended the 2023/24 heating season with storage levels at historic highs, which means that the need for injections this summer could be 35% below the five-year average. Lower injection demand in summer 2024 could contribute to a further easing of market fundamentals.

Thus, high natural gas storage levels are expected to buffer the effects of rising demand on prices. With substantial reserves available, any sudden spikes in demand can be more easily managed without causing significant price volatility, thus ensuring market stability.

Geopolitical Tensions

Geopolitical tensions represent the greatest risk for the short-term outlook. Earlier this year, LNG shipping through the Red Sea was disrupted by Houthi attacks. In recent months, attacks by Russia on Ukraine's energy infrastructure, including storage, have threatened the supply security of European countries.

Geopolitical tensions can lead to supply disruptions, regulatory changes, and unpredictable shifts in international relations. All these factors can deeply influence gas availability and prices on a global scale.