Inflation in the spotlight

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

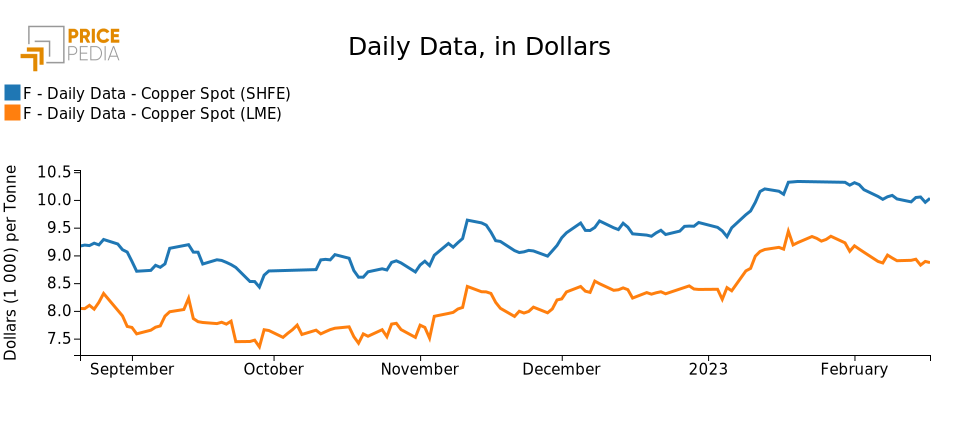

LME Copper Non Ferrous Metals Macroeconomics Doctor Copper SaysCopper price dynamics have not shown significant fluctuations in recent days. Compared to last week's closing values, we can see a further modest decline in dollar prices (-0.4%) at the London Metal Exchange (LME); the price recorded at the Shanghai Futures Exchange (SHFE) has proven stable, in the face of Chinese demand that remains tepid.

Thus, financial markets seem to remain cautious, waiting for a concrete growth in demand from the Dragon Country after optimistic bets at the beginning of the year.

Let us then broaden our gaze to the macroeconomic picture, to keep track of the latest data that help us monitor the health of the economy.

US inflation: stickier than expected

It dates back to Tuesday the release of the latest US inflation data for January. The downward trend already inaugurated in recent months, and reported in a previous article, has been confirmed. However, the index did not experience a marked contraction: commentators speak of inflation being “stubbornly high”, “stickier than expected”.

According to data from the US Bureau of Labor Statistics, the consumer price index increased 0.5% in January compared to the previous month, and +6.4% year-on-year. Thus, this is only a moderate decline compared to the 6.5% increase recorded in December; this is, in any case, the smallest rise since late 2021. Excluding the food & energy sector, January inflation halts at +5.6 percent.

Also more dynamic than expected were producer prices (Producer Price Index), up 0.7 percent in January compared to the previous month: there hasn’t been such a large increase since last June.

The FED's reaction. In the face of this data, signals from the Federal Reserve hinted that interest rates might remain higher for longer. While the last 25 basis points hike raised hopes for a normalization, the latest inflation data, on the other hand, suggested the possibility of a return to the 50 basis points increase. Toward this direction, for example, are the statements of Bullard (FED St. Louis) and Mester (FED Cleveland), who would have preferred to opt for a 50 basis point hike even at the February meeting.

Meanwhile, on the other side of the Atlantic...

Inflation for the Eurozone remains higher compared to the US, which preceded the euro area in ushering in the post-Covid restrictive monetary policy era.

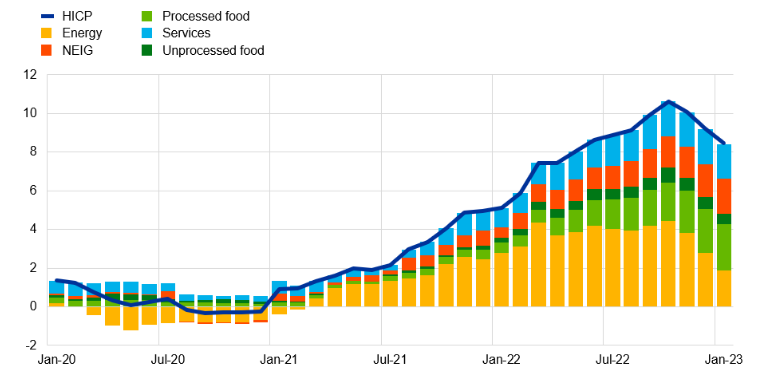

However, the latest Eurostat data reported a lower-than-expected inflation increase of 8.5% for January, down from +9.2% in December. As can be seen from the chart below, the decline in the energy component, the main driver of the increase in the prices of goods and services, clearly emerges.

Eurozone inflation

(y-o-y % change)

Source: European Central Bank.

NEIG = Non-energy industrial goods; HICP = Harmonised Index of Consumer Prices

Although price levels are therefore still high, according to recent statements by ECB Executive Board member Panetta, inflation brings signs of cautious optimism: in fact, the Eurozone inflationary trend could fall below 3 percent by the end of 2023, if the decline in energy prices is sustained.

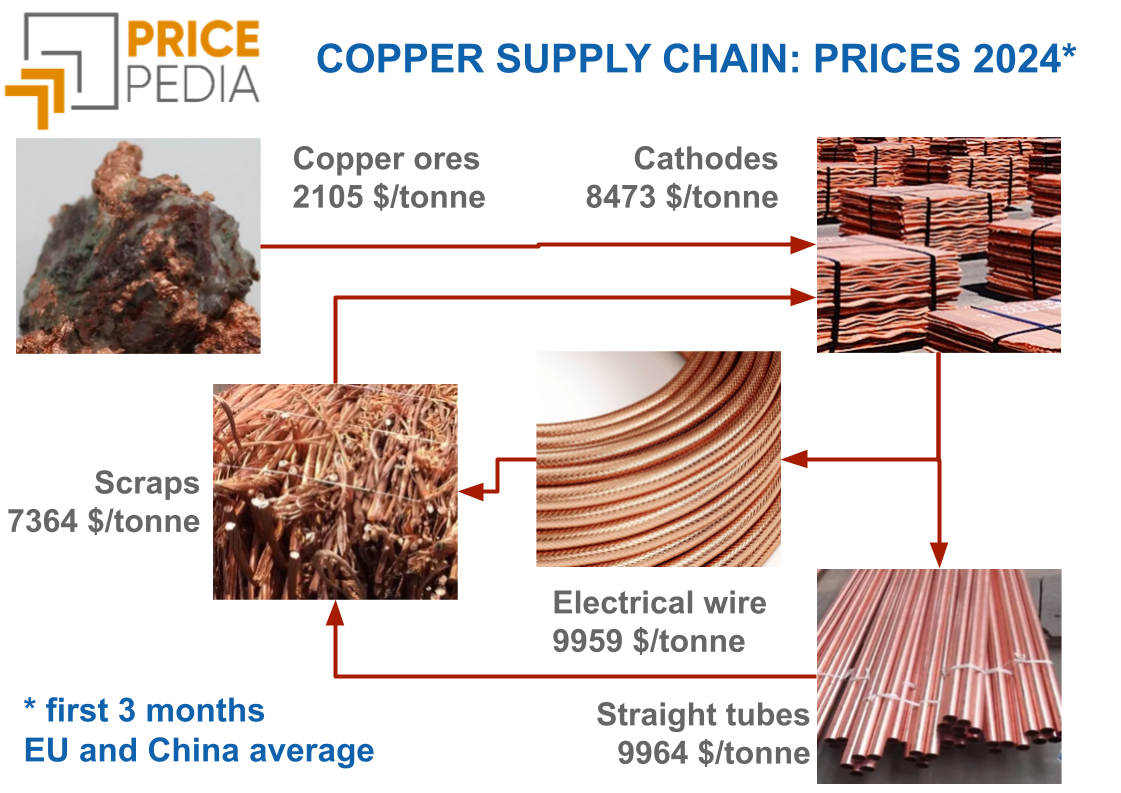

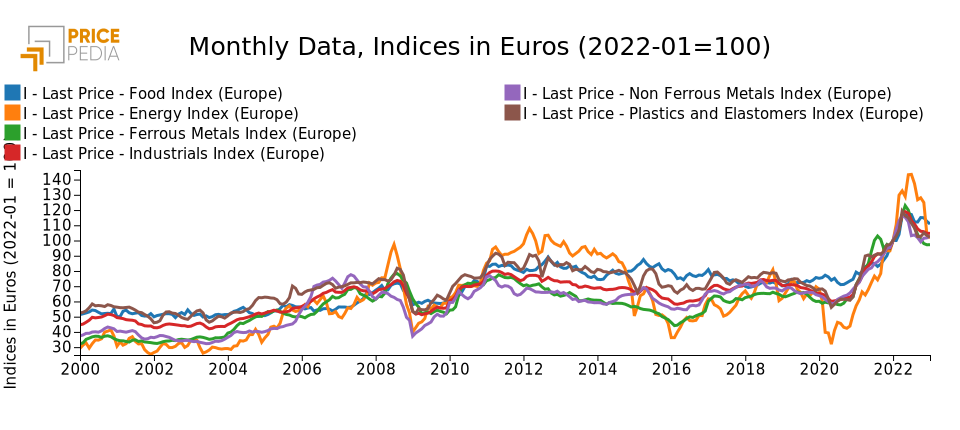

The dynamics of commodity prices confirm the start of a downward phase: as can be seen from PricePedia data, since the second half of 2022 a slowing trend has been taking place for all the various price indexes considered, especially for energy which had marked the sharpest increase, in line with a gradual loosening of supply-side bottlenecks.

Against a backdrop of economic and geopolitical uncertainty on a global scale, Panetta therefore suggests calibrating monetary policy using a data-dependent and forward-looking approach, and trying hard to avert the risk of overtightening, that could seriously damage the recovery prospects of the economy.