Relative stability for tin prices over the next two years

An overview of tin LME Price Forecasts

Published by Luca Sazzini. .

Forecast Non Ferrous Metals ForecastIn the current phase of declining commodity prices due to the significant weakness in global demand, the prices of copper and tin have remained relatively high compared to their 2019 levels. Both these metals, in 2024, have an average annual price over 40% higher than their average price in 2019. Conversely, other metals have already experienced more intense declines, bringing them closer to the average levels of 2019.

Percentage change in non-ferrous metal prices compared to 2019 levels

These high variations in 2024 compared to 2019 may be due either to the new high price levels or to some possible anomaly that occurred in 2019 that lowered the level in that year.

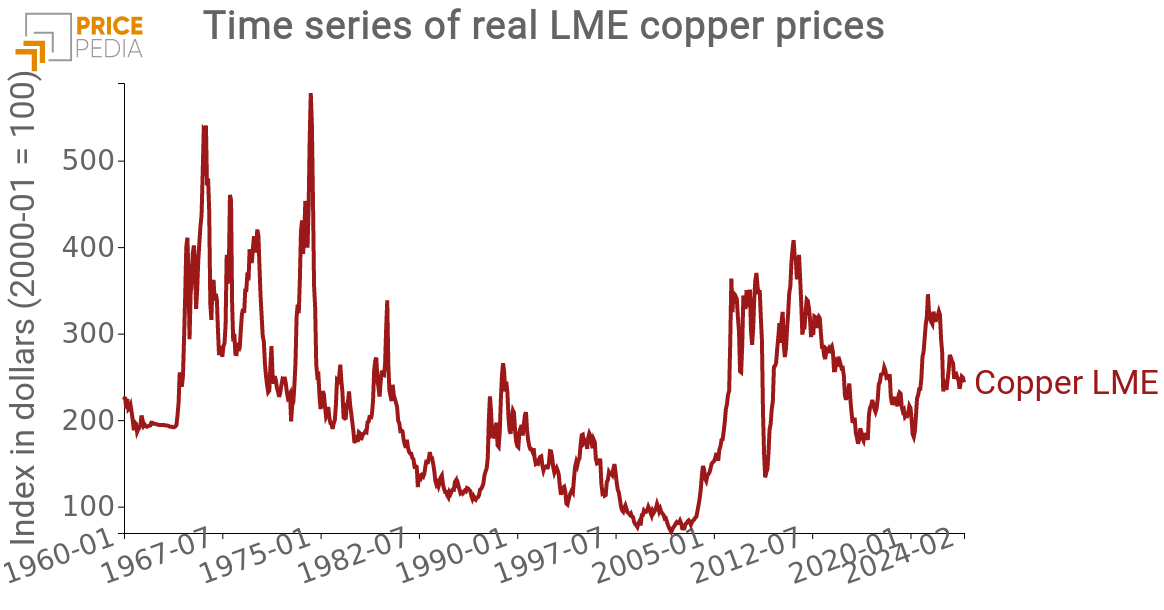

To provide a more robust assessment of 2024 levels, a long-term comparison may be useful. However, it must be noted that the purchasing power of the dollar has changed significantly over time. One way to avoid this "distortion" is to consider prices net of changes in consumer prices. Below are the historical series of copper and tin prices from 1996 to the present day, considered in real terms, i.e., adjusted for changes in consumer prices.

| Historical Real Prices of LME Copper | Historical Real Prices of LME Tin |

|

|

Both of these historical series are expressed as an index and have a base equal to 100 in January 2000. From the analysis of the two long-term historical series, it emerges that the current prices of copper and tin are not even so high compared to their previous levels reached in the seventies and eighties.

The purpose of this article is to delve into the future trend of the LME tin price by providing estimates from various forecasters.

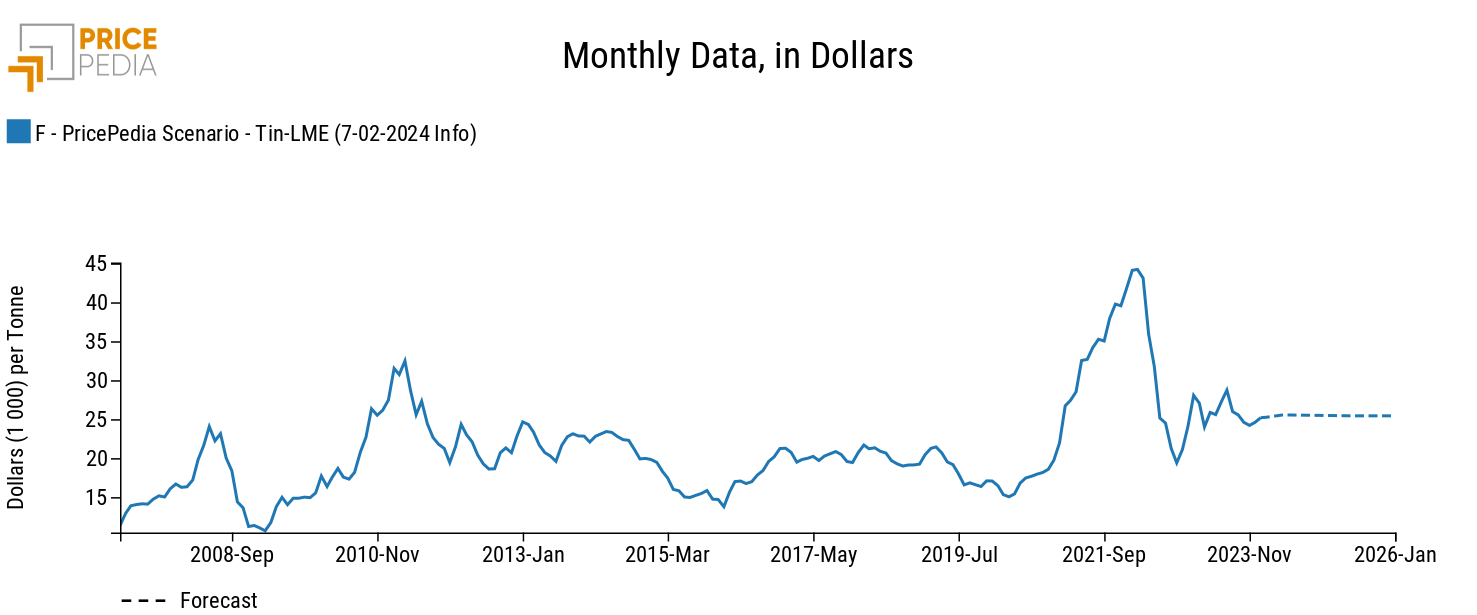

PricePedia Scenario

Within the PricePedia scenario, the price forecast over the next two years for tin is provided, updated with information available as of 7 February 2024.

According to the forecast scenario, tin prices will remain relatively stable in the next two years. This forecast indicates that the new price levels of tin are already consolidated, and, net of further sudden shocks, they will not return to the levels recorded in 2019.

For a more comprehensive view of future estimates of LME tin prices, it may be useful to compare the results of this forecast scenario with those reported by other sources to see if they are aligned or not with this forecast.

Implicit Forecast in Future Prices

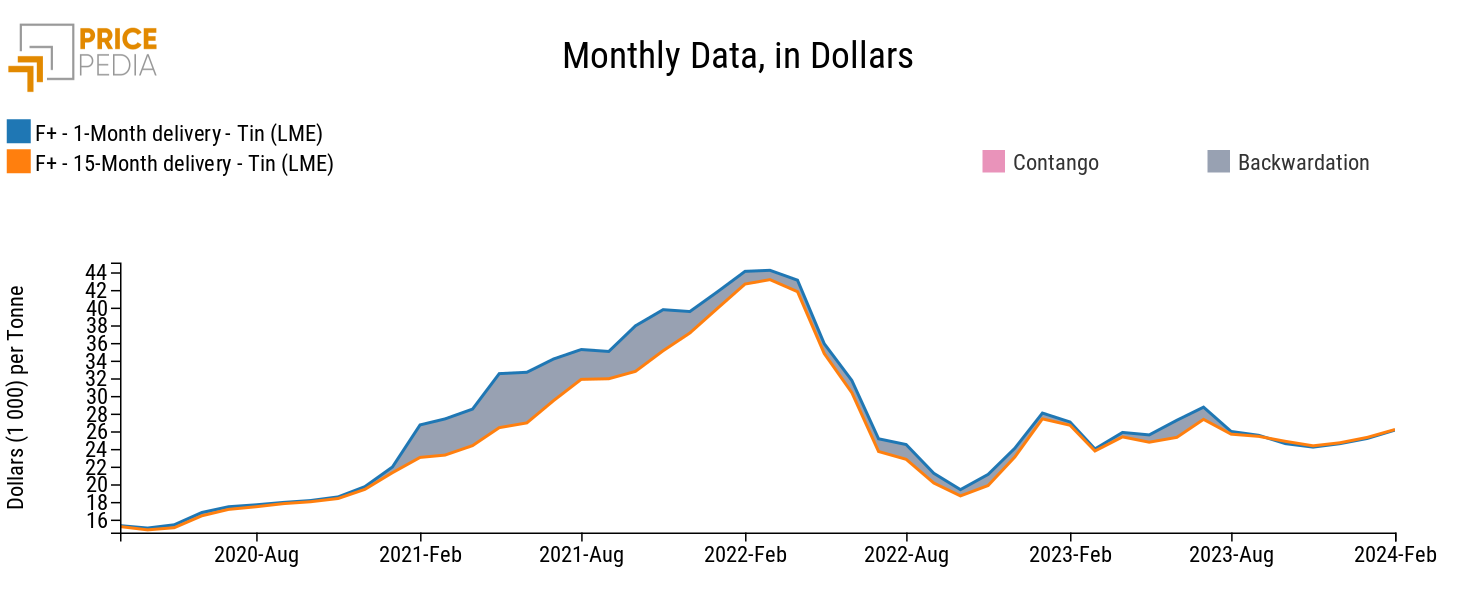

As the first alternative forecasting source, the implicit forecast contained in tin future contracts quoted on the London Metal Exchange is analyzed.

From the comparison between spot price and future price, it is evident how, in this recent historical period, the two prices have been very similar. From the analysis of future contracts, it is therefore highlighted that financial operators do not expect significant variations in tin prices in the next 15 months.

World Bank Forecasts

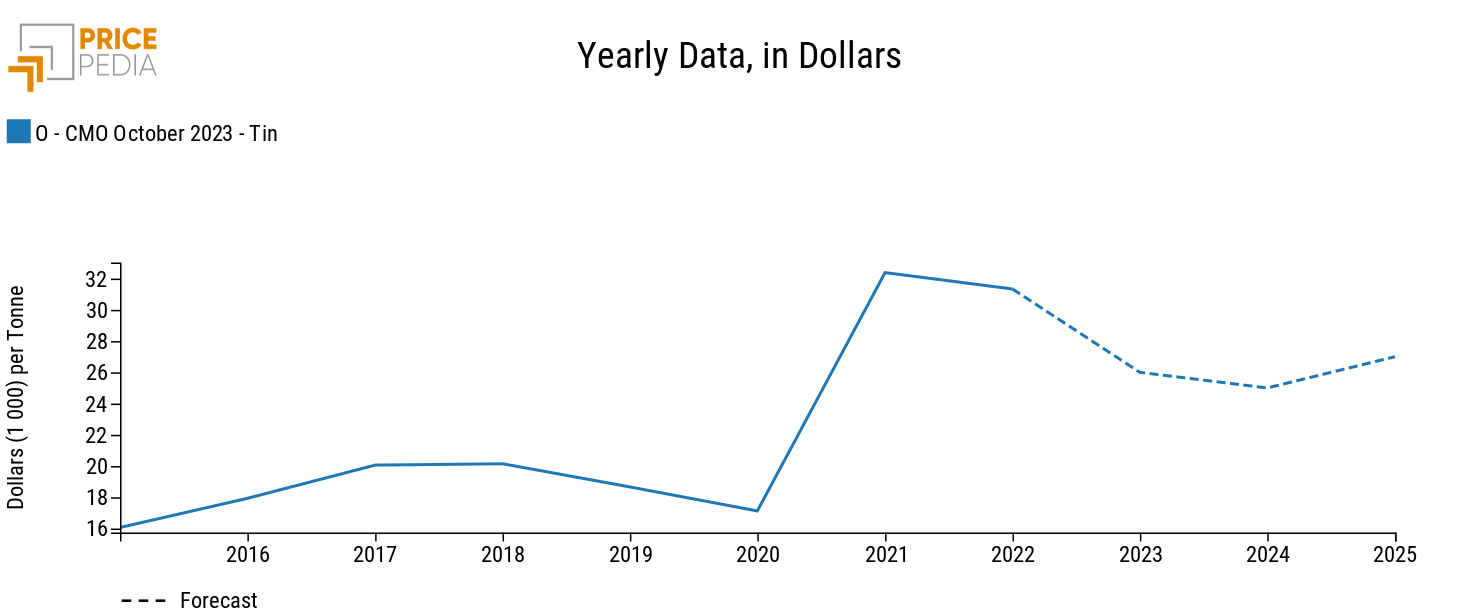

A second forecasting source available on PricePedia is the World Bank (see the World Bank Forecasts section), which updates its forecasts in April and October of each year. Below is the World Bank's forecast for the next two years updated to October 2023.

From the World Bank's forecast, it emerges that the price of tin is expected to slightly increase over the next two years. In particular, the price of tin will move from the average value of $25,000/ton in 2024 to $27,000/ton in 2025. According to the World Bank, this growth is mainly attributed to the subsequent increase in demand due to the importance of tin in the energy transition. Indeed, tin uses in the electronics sector, electric vehicles (EVs), and photovoltaic cells are expected to increase.

This forecast is aligned with PricePedia's estimate, which predicts a tin price slightly below the threshold value of $26,000/ton by the end of 2025.

Consensus Economics

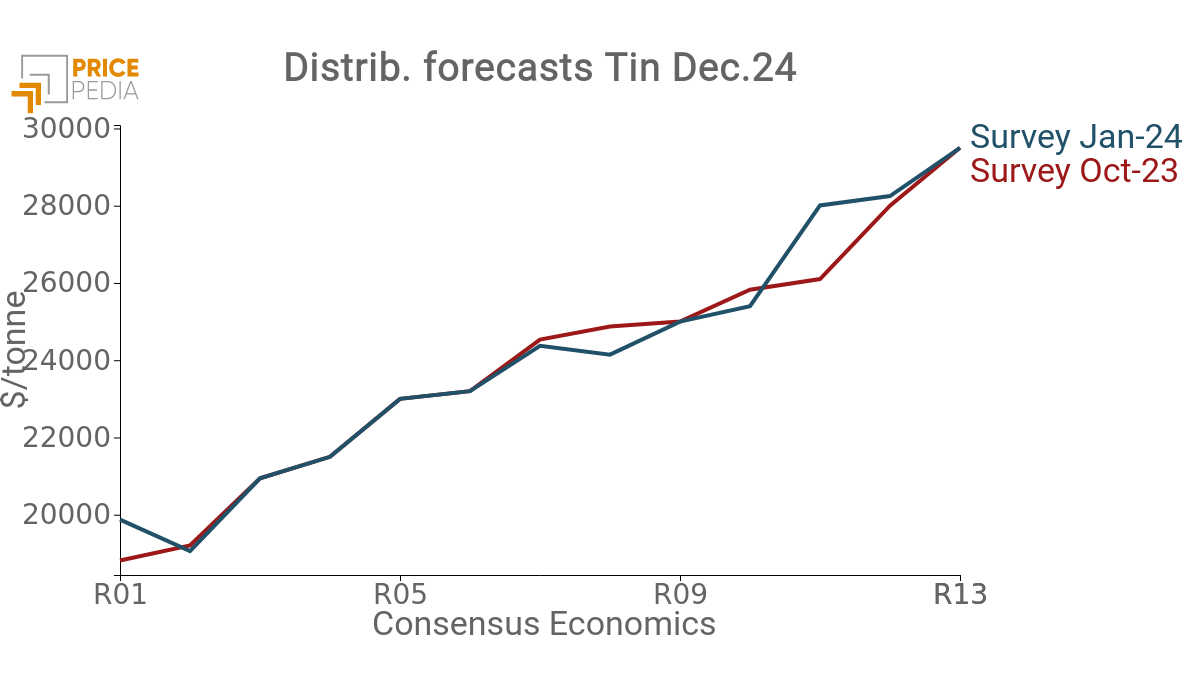

The last forecasting source reported in this analysis is Consensus Economics, which offers the advantage of being able to build a range of forecasts and monitor the volatility change between one survey and another. Below are the results of the last two surveys conducted by Consensus Economics on the forecasts of tin prices for December 2024, by 13 different forecasters.

The Consensus survey shows a very wide range for prices at the end of this year, between 20000-30000 $/tonne. This high range signals the high uncertainty that is characterising the world tin market.

The central value of the Consensus Economics forecast is in line with both the PricePedia and World Bank forecasts, both of which expect an average price of around $25,000/tonne in December 2024.

Conclusions

From the analysis of the different forecasters, a relative stability of tin prices for the next two years has emerged. For the month of December 2024, all predictors confirm a tin price close to $25,000/tonne, with a very wide range of estimates, however, confirming the high uncertainty in this market.

As far as 2025 is concerned, PricePedia's estimate and the estimate implied by future prices agree on a tin value of just under $26,000/tonne, while the World Bank predicts a slightly higher value of around $27,000/tonne.

Even for 2025, however, it must be considered that these prices are central values of very wide probability distributions.

Continuous monitoring of price dynamics is therefore necessary in order to avoid being confronted with

actual price dynamics that are very different from those expected.