Uncertainty in commodity financial markets between Chindia's growth and countering inflation

An overview of current trends in the commodity landscape

Published by Giulio Corazza. .

Energy Ferrous Metals Food Non Ferrous Metals Commodities Financial WeekEconomic analysis is increasingly uncertain between signs of a slowdown in the current negative phase of the global industrial cycle and expectations of growth in the world economy in 2023, driven by the locomotive Chindia. In the International Monetary Fund's recent forecast scenario, China and India are the only two economies to grow more than 5 percent in 2023, more than 4 percent higher than the growth forecast for the Advanced Economies bloc.

Fears of a sharp slowdown in the economies on both sides of the Atlantic have found confirmation in the continuation of the monetary tightening process implemented by the various Central Banks.

In recent days, the European Central Bank, Bank of England and Federal Reserve have raised the cost of money again by 50, 50 and 25 basis points, respectively.

Monetary policies undertaken by central banks have begun to produce the desired effects: inflation data in the United States and Europe signal a slowdown. Subsequent increases in benchmark rates in the coming months are therefore expected to be smaller in magnitude than the increases seen so far. However, the effects in terms of slowing activity levels, which tend to occur later than the timing of monetary policy intervention, are unclear.

ENERGY PRODUCTS

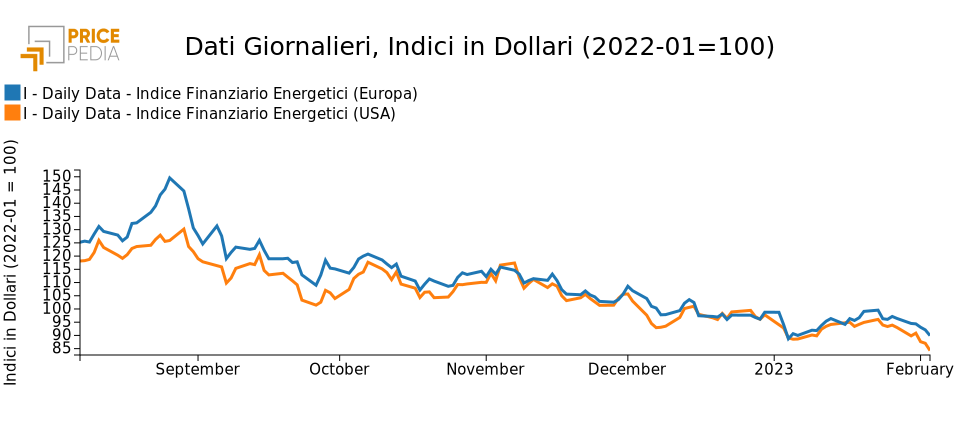

The following graph shows the PricePedia financial indices of energy product prices in Europe and the United States, expressed in dollars.

Over the past week, both indexes have fallen sharply against the positive trend that had characterized them at the beginning of the new year.

PricePedia financial indexes of energy prices in Europe and the U.S.

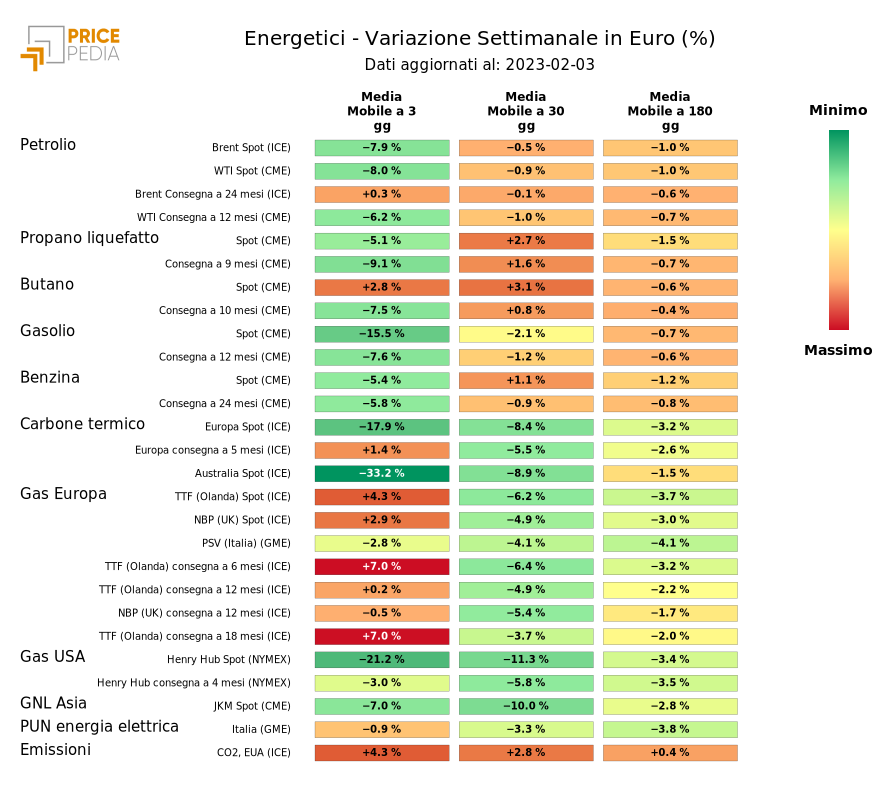

The heatmap below provides an overview of energy product price trends, expressed in euros.

This week reports the sharp decline in the price of coal, oil, its derivatives and gas

in non-European markets. Conversely, gas in Europe, reflecting determinants unrelated to the world business cycle,

seems to have found a floor at 60 euros/MWh.

HeatMap of energy product prices in euros

METALS

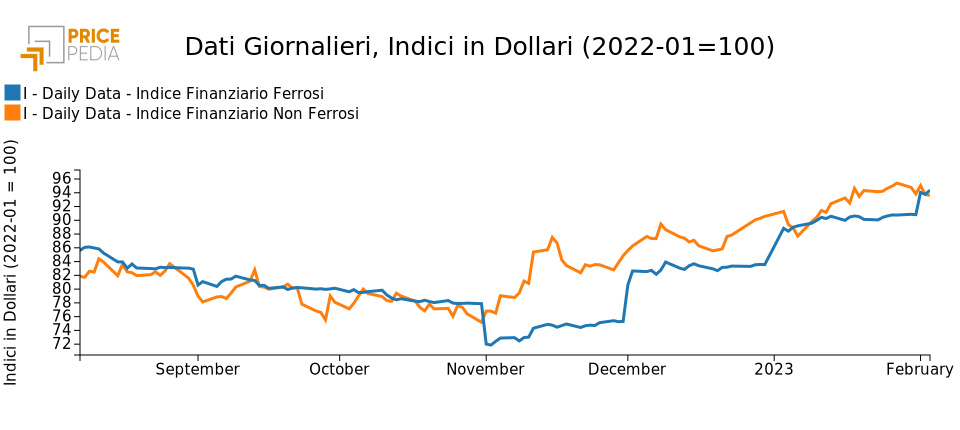

The following graph shows the PricePedia financial indexes of ferrous and nonferrous metals prices, expressed in dollars.

This week, the nonferrous index reverses its positive performance of the past few weeks; increasing, however, is the ferrous index.

PricePedia financial indices of ferrous and nonferrous metals in dollars

FERROUS METALS

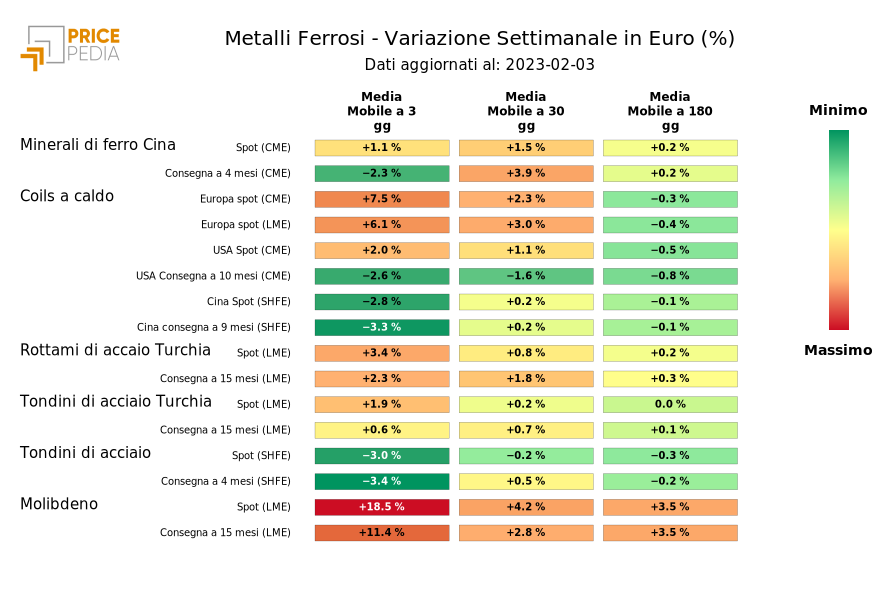

The heatmap below provides an overview of ferrous metal price trends, expressed in euros. The increase is generalized to several products, significant is that of hot coils Europe.

HeatMap of ferrous metal prices in euros

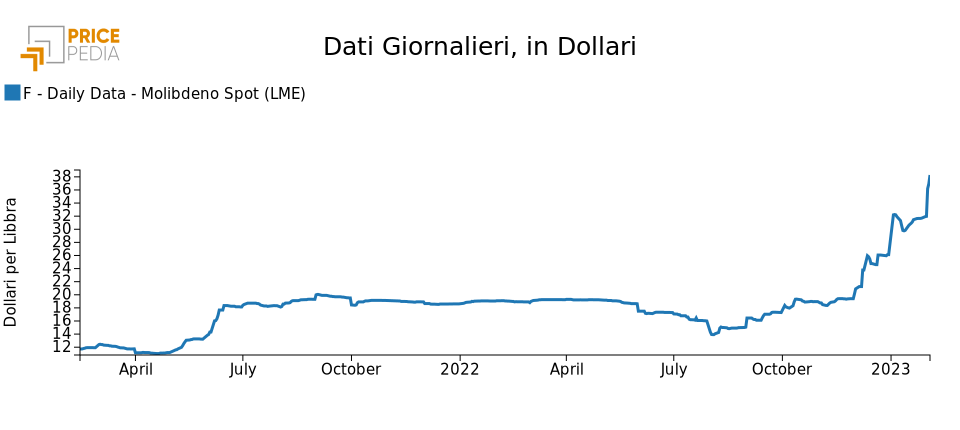

However, the most sustained growth is once again recorded by molybdenum, which on Friday, Feb. 3, surpassed $38/lb, corresponding to more than 77,000 euros/tonn, at the LME. Never has its price been so high, not even during the severe market imbalance of the three-year period 2004-2006.

NON FERROUS METALS

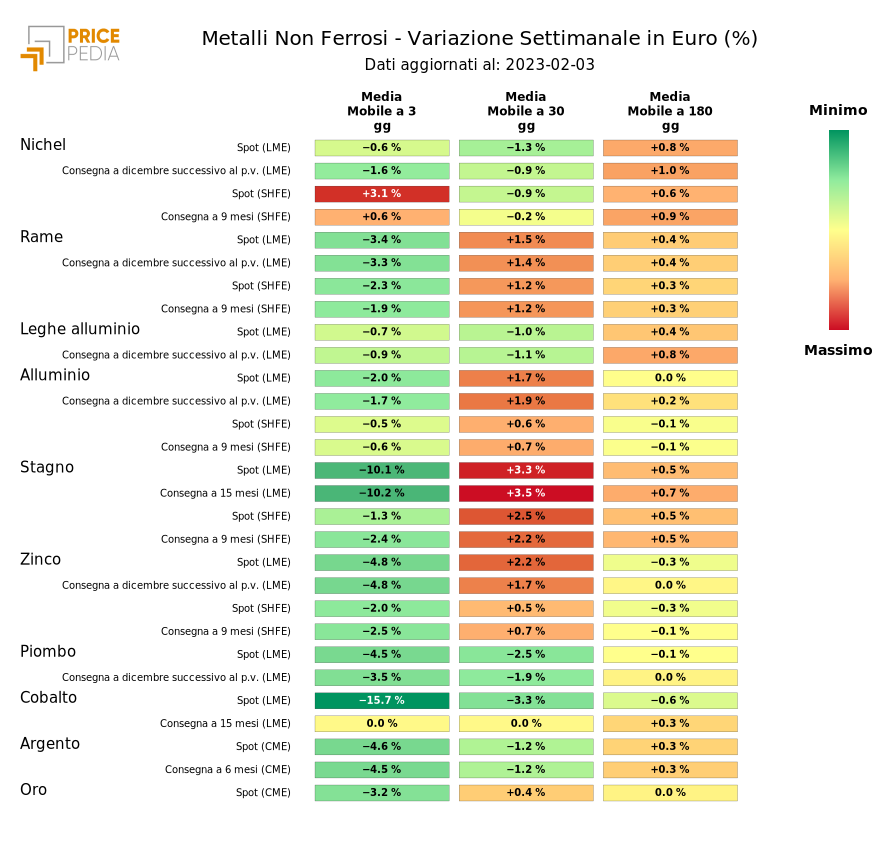

The heatmap below provides an overview of the trend in nonferrous metals prices, expressed in euros. As is easy to see, this week, the decrease is across the board. Accentuated is the decrease in tin and cobalt prices.

HeatMap of non-ferrous metal prices in euros

FOOD PRODUCTS

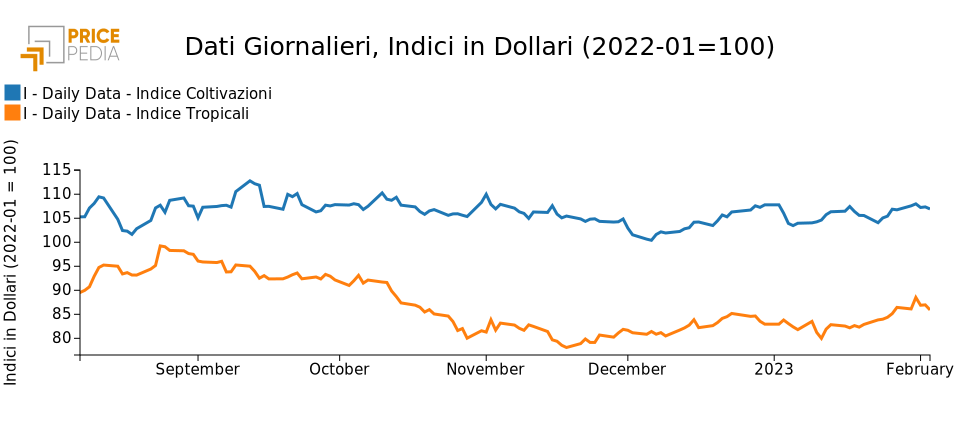

The following chart shows the PricePedia financial indexes of food prices, expressed in dollars. This week the indexes for both crop and tropical food products are up, consolidating the increases recorded since the end of the year.

PricePedia Financial Indices of Food Products in Dollars

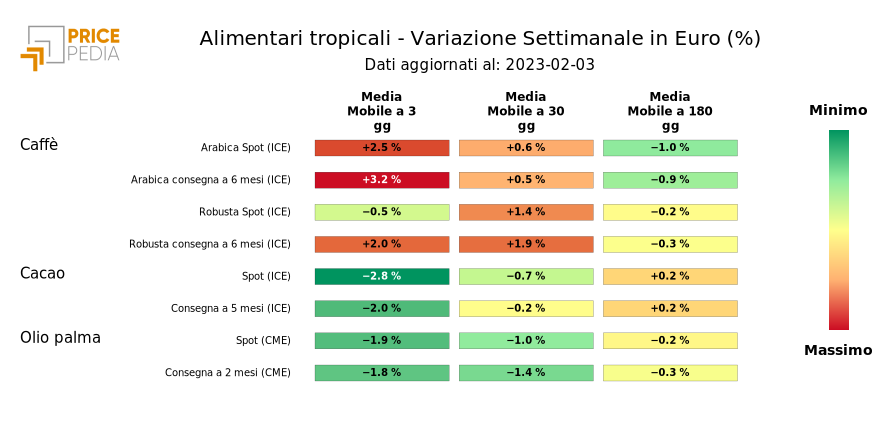

The heatmap below provides an overview of tropical food price trends, highlighting the different dynamics of the rising coffee prices from those of cocoa and palm oil prices.

HeatMap of tropical food prices