Analysis of European prices for steel semi-finished products

A comparison of price levels based on product characteristics

Published by Luca Sazzini. .

Ferrous Metals Price DriversPrimary steel Semiproducts are Semiproducts obtained directly from the melting and casting of liquid steel, which require further mechanical or thermal processing, such as rolling, drawing, forging, or hammering, before becoming intermediate Semiproducts or finished industrial goods.

In the European customs classification, primary steel Semiproducts are mainly categorized based on their geometric shape, carbon content, and steel type.

The most commercially common geometric shape is rectangular, with a width less than twice the thickness. Both billets and blooms may fall into this category, which differ in size, with billets being significantly smaller than blooms. Both of these Semiproducts are used in the production of long steels, with billets used for bars, rods, or light profiles, and blooms for beams or heavy profiles.

Also within the rectangular section are slabs (or slebs), which, unlike billets and blooms, are distinguished by their greater width, a feature that makes them particularly suitable for the production of flat steels. In addition to rectangular Semiproducts, there are also circular or polygonal sections, used for specific rolled products or for special mechanical processing.

A second classification criterion is carbon content, which distinguishes mild steels from medium or hard steels, characterized by a higher carbon content. Mild steels, with a carbon content below 0.25%, are more ductile and easier to work but have relatively low mechanical strength. In contrast, steels with higher carbon content offer greater mechanical strength, while being less deformable.

The third distinguishing factor concerns the type of steel, particularly the distinction between free-cutting (automatic) and non-free-cutting steels. Free-cutting steels are carbon steels with small additions of elements such as sulfur, which improve machinability, making the metal easier to work and shape on machine tools.

This article will first analyze the aggregated price dynamics of primary steel Semiproducts in Europe, and then examine price levels according to the commodity characteristics described above.

Analysis of Primary Steel Semiproduct Prices

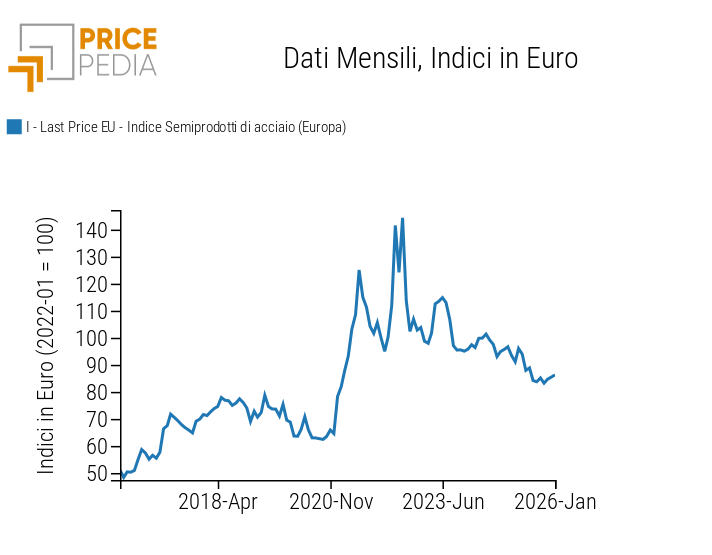

The following chart shows the dynamics over the last ten years of European prices for the aggregated index of primary steel Semiproducts, calculated by aggregating the prices of raw steel Semiproducts available on the PricePedia platform and weighting them according to their respective European import values.

Historical Series of the European Primary Steel Semiproducts Index

Analysis of the chart shows that, starting from 2022, European prices of primary steel Semiproducts began to decline, in line with the downward trend in ferrous metal prices. From the end of 2025, however, a potential recovery is emerging after the low recorded in October.

As highlighted in the article: “PricePedia scenario for ferrous metals 2026-2027”, this price recovery is expected to continue throughout 2026 and 2027, with increases of over 5% anticipated in both years.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Analysis of Primary Steel Semiproduct Prices in the EU

The table below shows the annual average prices of various primary steel Semiproducts from 2022 to the present. For 2026, only the January average has been considered, corresponding to the latest available update of last price data in the EU Customs section of PricePedia.

Annual Average Prices of Primary Steel Semiproducts Traded in the EU

| EU Prices of Primary Steel Semiproducts | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|

| Compact section Semiproducts (width < 2× thickness) of steel | |||||

| Blooms C < 0,25% | 660 | 564 | 516 | 489 | 468 |

| Billets C < 0,25% | 902 | 813 | 736 | 666 | 650 |

| Compact section Semiproducts (width < 2× thickness) of free-cutting steels | |||||

| Billets and blooms – free-cutting steels (C < 0.25%) | 1073 | 978 | 998 | 869 | 728 |

| Billets and blooms – free-cutting steels (C ≥ 0.25%) | 1074 | 839 | 730 | 680 | 680 |

| Carbon steel Semiproducts – Other geometries | |||||

| Wide rectangular section Semiproducts (slabs) | 680 | 636 | 600 | 540 | 534 |

| Other circular section Semiproducts (rounds) | 844 | 762 | 683 | 642 | 634 |

Analysis of the table shows that prices of the various primary steel Semiproducts have followed a progressive decline since 2022. Overall price levels are relatively homogeneous, although differences can be attributed to commodity characteristics, summarized as follows:

- Billet prices are on average about €200/ton higher than bloom prices, due to the additional processing steps required for their smaller cross-section.

- Whether the steel is free-cutting or not is the main factor affecting product cost.

- Prices of mild free-cutting billets and blooms are on average €130/ton higher than those of free-cutting billets and blooms with carbon content ≥ 0.25%.

- Prices of circular section Semiproducts are approximately €100/ton higher than slabs; both are priced below billets but above blooms.

Conclusions

Annual average prices of primary steel Semiproducts show a general downward trend since 2022. In terms of level, prices of different Semiproducts are relatively similar, although some differences arise due to steel type, carbon content, and geometric shape.

The most significant cost factor is whether the steel is free-cutting, which is considerably more expensive than “standard” steel.

All else equal, mild steel Semiproducts are on average €130/ton higher than steels with carbon content ≥ 0.25%.

Regarding geometric shape, billets have the highest prices due to additional processing steps, followed by circular section products, slabs, and finally blooms.