Formaldehyde Prices at Historic Highs

The Paradoxical Effect of Regulatory Pressure

Published by Luigi Bidoia. .

Organic Chemicals Cost pass-throughFormaldehyde is a key chemical intermediate widely used across various industrial sectors. Employed in the synthesis of numerous chemical products, its toxic nature and classification as a potentially carcinogenic substance have triggered increasing regulatory scrutiny. In many jurisdictions, tighter restrictions are progressively limiting its use, pushing companies to seek safer or more sustainable alternatives.

Despite its strategic industrial role, formaldehyde is rarely traded on international markets. Global demand remains modest, transportation is complicated—being a gas under standard conditions—and its low unit price amplifies the impact of logistics costs. As a result, long-distance shipments are often uneconomical, and production tends to remain confined to local or regional markets.

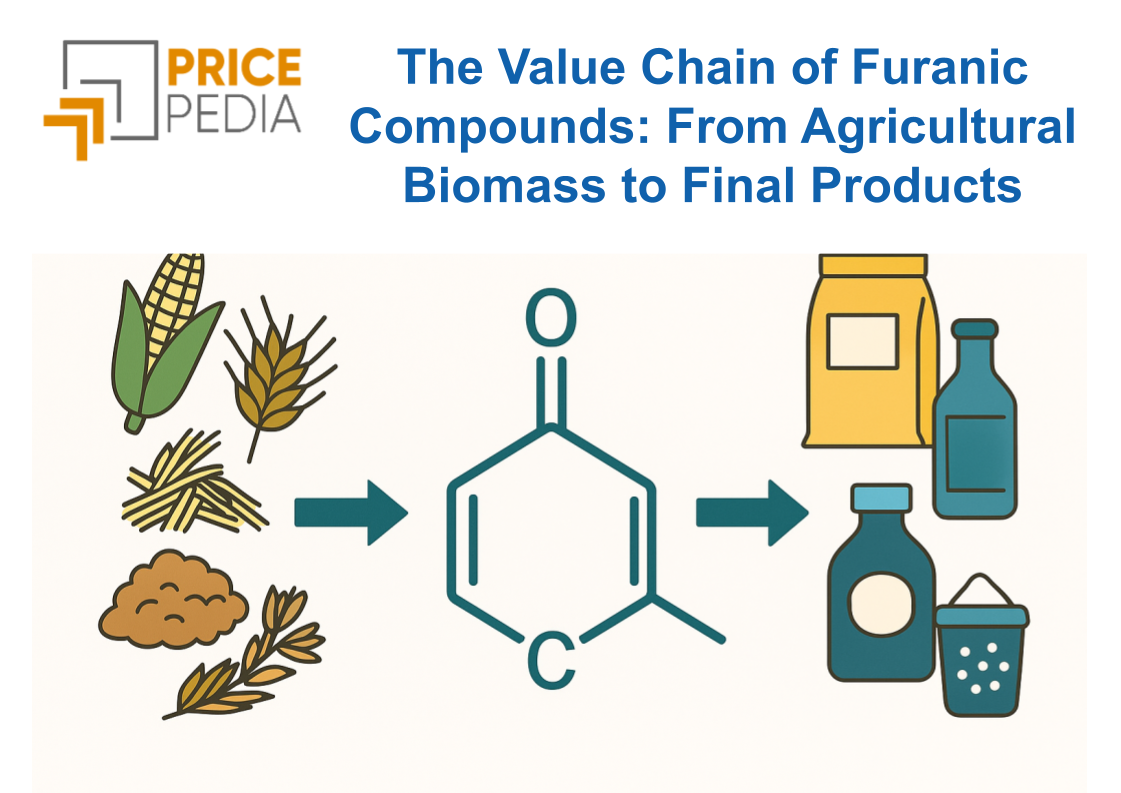

The main applications of formaldehyde fall into two broad categories:

- Thermosetting resins, used in wood products, construction, and automotive sectors.

- Chemical intermediates, including isocyanates, 1.4-butanediol, and paraformaldehyde, where formaldehyde serves as a building block in synthesis.

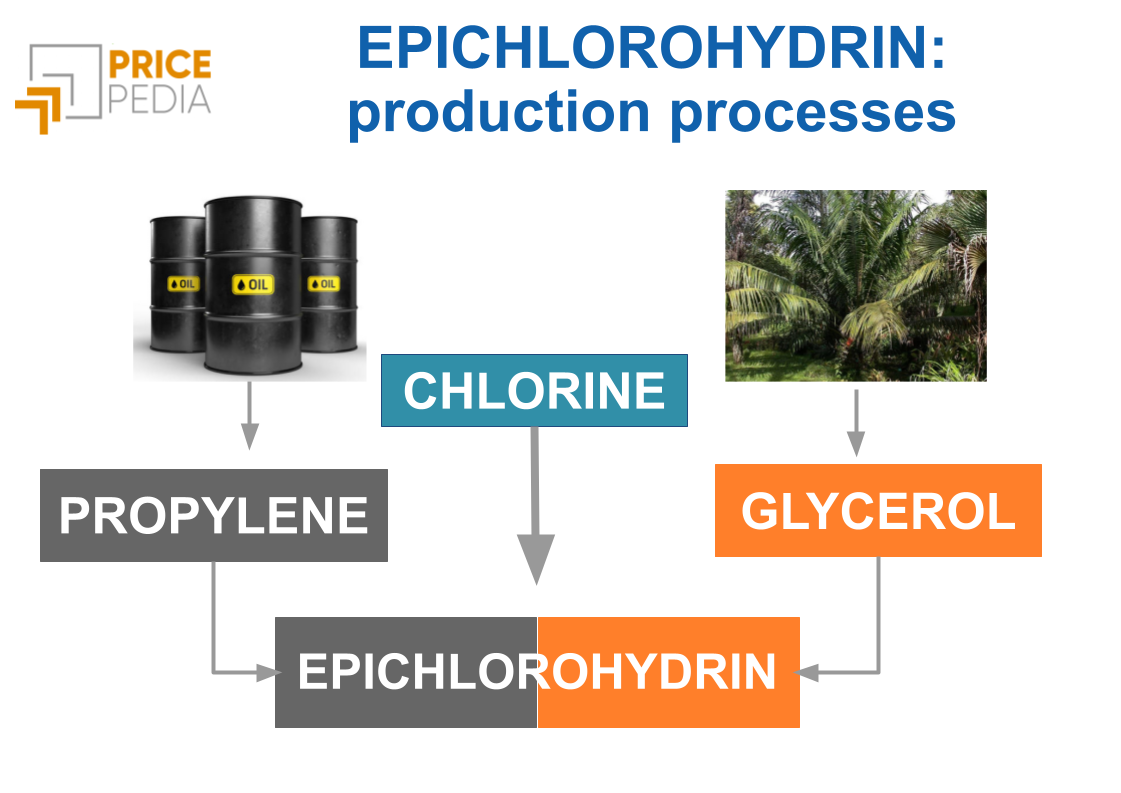

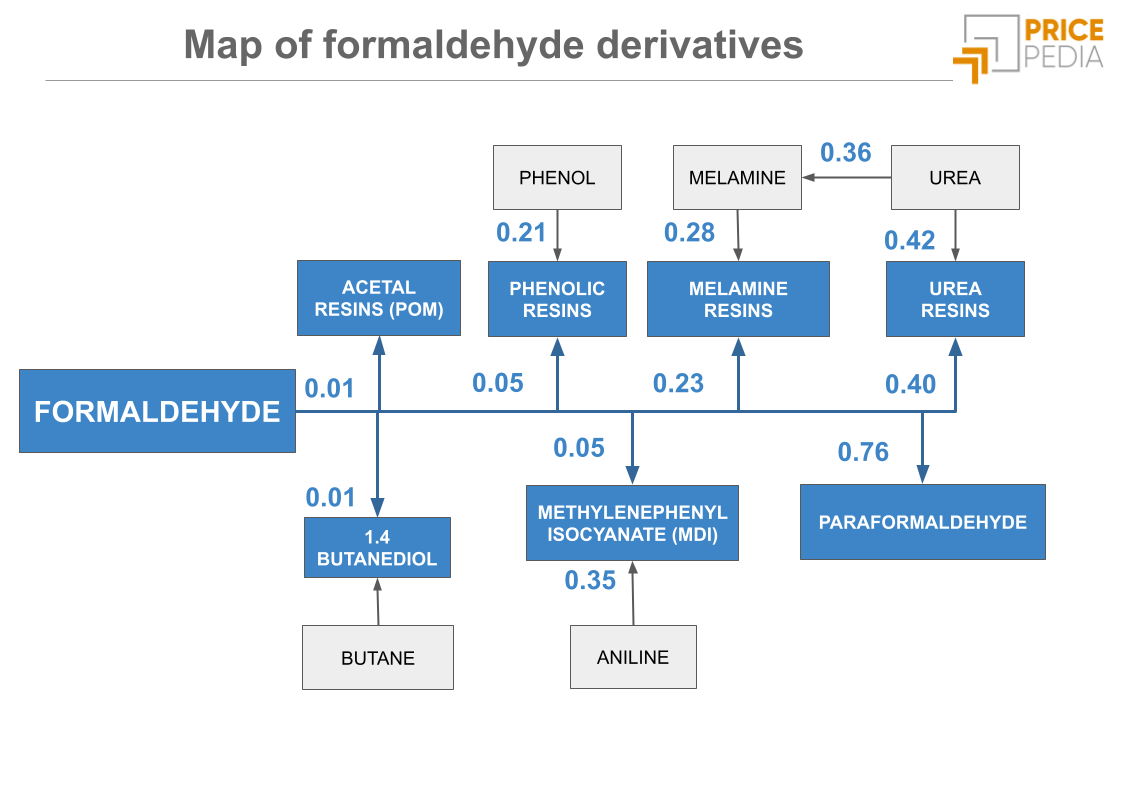

The map below shows the relationship between formaldehyde and its derivatives. It also includes cost pass-through elasticity values, indicating how changes in formaldehyde prices affect the pricing of downstream products.

In some cases, changes in formaldehyde prices—even when the substance is involved in the production process—do not significantly impact the price of the final product. This is partly due to formaldehyde’s low average price, which limits its cost share in the overall production chain, and partly because of the increasing use of alternative production processes. A clear example is 1.4-butanediol, which is now often produced from butane instead of formaldehyde-based methods.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Formaldehyde-Based Thermosetting Resins

Among thermosetting resins, four types require formaldehyde as a raw material. Regulatory measures aimed at reducing airborne formaldehyde emissions have triggered significant innovation in production processes. In some resins, such as acetal resins, innovation has enabled very low emission levels[1]. In others, like urea-based resins, improvements have been more limited.

Interestingly, the price levels of different resins have tended to align based on their emission performance. Similarly, the global demand trends have reflected the effectiveness of product innovation: resins that successfully reduced emissions have experienced demand growth, while others have remained stagnant or even declining.

The following table shows the key characteristics of the four resins under consideration.

Formaldehyde-Based Resins: Global Demand, Prices, and Minimum Emissions

| Resins | Global Demand | Global Demand | Customs Price | Minimum Release | |

|---|---|---|---|---|---|

| (thousand tonnes) | var% CAGR | Euro/tonne | formaldehyde | ||

| 2007 | 2024 | 2007–2024 | 2024 | ppm | |

| Acetal | 663 | 1243 | 4.0 | 2200 | 100 |

| Phenolic | 915 | 965 | 0.3 | 1460 | 1000 |

| Melamine | 449 | 429 | -0.3 | 1151 | 2000 |

| Urea | 1616 | 1196 | -1.9 | 471 | 5000 |

Formaldehyde Prices in the EU

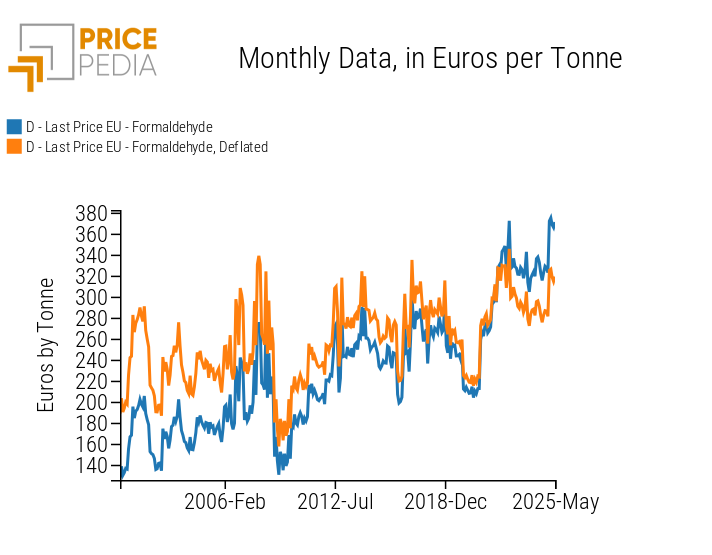

The price of formaldehyde has traditionally been low, largely driven by the cost of its main feedstock (methanol) and the local supply-demand balance. However, in recent years, a reduction in supply—due to capacity rationalization and the exit of several producers from the market—has had a significant impact, even amid weak demand.

As shown in the graph below, formaldehyde prices in Europe climbed to 370 euros per ton at the beginning of 2025, marking the highest level ever recorded.

The chart also presents formaldehyde prices adjusted for inflation, highlighting how even the "real" price of formaldehyde has increased over the past 25 years. This positions formaldehyde among the rare group of commodities able to outperform inflation and achieve long-term price growth above the general economic average.

Formaldehyde: EU customs price

Summary

In commodity markets, declining demand can lead to rising prices when it is preceded by a gradual reduction in production capacity. Formaldehyde is a striking example: throughout the 21st century, its prices in the European market have steadily increased in parallel with tightening regulations limiting its applications.

[1] During the production of acetal resins, formaldehyde is polymerized into a stable structure. If the resin is properly produced and stabilized, the formaldehyde is chemically bound and not free, and emissions of formaldehyde from the finished material are very low or negligible.