HRC: A Partially Globalized and Financialized Market

Toward a regional division of the HRC market?

Published by Luca Sazzini. .

Ferrous Metals HRC Price DriversIn last week's article: Drivers of hot rolled coil prices in the 2025-2026 biennium, a forecast scenario was provided for hot-rolled coil prices, highlighting the main upside and downside risks that could influence future price dynamics. Among the upside risks was the possible reaction of the EU to the 25% U.S. tariffs on imported steel. The new U.S. protectionist measures have, in fact, reignited trade tensions in the steel sector, increasing the risk of countermeasures from the EU aimed at protecting the European steel industry.

As analyzed in the article: The steel trade war: from 2018 to the new phase of 2025, during President Trump's first term, the European Union had already protected its steel industry by applying new additional, anti-dumping and countervailing duties.

In this new context of trade tensions, the EU has once again strengthened its internal steel market defense measures by increasing safeguards through implementing regulation 2025/621 of March 24, 2025. The new steel protection measures adopted in the latest EU regulation are:

- Reduction the rate of liberalisation: starting July 1, 2025, the annual increase in tariff rate quotas[1] will be reduced from 1% to 0.1%.

- Introduction of country-specific caps in residual quotas:[2] the Commission has introduced percentage limits on imports from individual countries within the residual tariff rate quotas, varying by product category; in the case of hot-rolled steel, the cap is set at 13%. Once this ceiling is exceeded, additional imports from that country will be subject to a 25% safeguard duty.

- Prohibition on carrying over unused HRC volumes: starting July 1, 2025, it will no longer be permitted to roll over unused duty-free import quotas from one quarter to the next.

It is very likely that these measures to protect the European steel market will lead to a supply containment within the EU market. However, it is difficult to assess whether this containment will be enough to prevent future oversupply phases, given the expected global supply growth, especially from China.

Upside risks via rising futures prices

A second risk factor lies in the transmission mechanisms linking futures prices to spot prices and, subsequently, to physical prices.

Contagion between financial markets makes it possible for the expectation of a future imbalance in the U.S. market to drive up futures prices in the United States. This increase may in turn affect futures prices in the European market, ultimately impacting European physical prices. As a result, physical price increases in Europe may also stem from expectations of possible future imbalances in the U.S. market. This transmission channel is stronger the more globalized the market is.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Coil market: regional or global?

The hot-rolled coil market occupies an intermediate position between a global and a regional market. It cannot be considered a truly global market, as there is no single, globally recognized benchmark. However, it is not purely regional either: the price dynamics of one benchmark can influence others, generating convergence phenomena across different geographic areas.

To better understand this hybrid nature of the HRC market, it may be useful to analyze the dynamics of the main financial benchmarks to identify periods when prices moved in tandem and others when they diverged.

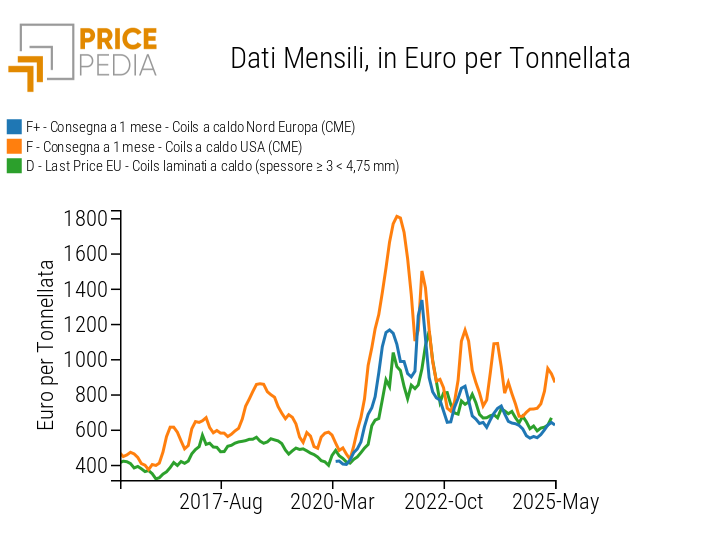

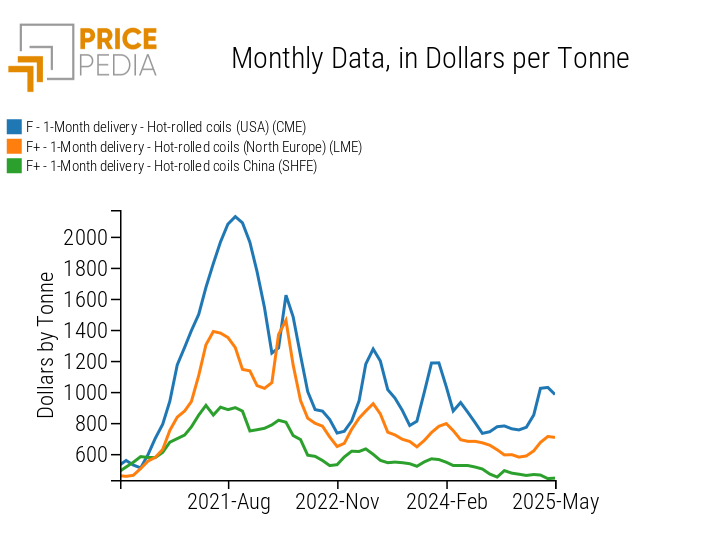

The following chart shows the historical series of the three main financial benchmarks for hot-rolled coil prices in the United States, the European Union, and China, expressed in dollars per ton.

Financial benchmarks for HRC in the USA, EU, and China

From the chart analysis, the last 5 price cycles in the U.S. financial market (blue line) and their more or less marked impact on other main financial benchmarks are highlighted.

In the first cycle, the strong price increase linked to the post-COVID industrial recovery affected all three markets, although much more strongly in the United States and more moderately in China. As the demand-supply balance gradually normalized, prices began to fall, only to rise again at the start of the second cycle following Russia’s invasion of Ukraine. In this phase, the European price anticipated the American one, recording a nearly equivalent change, while the Chinese price showed a much smaller increase. The subsequent slowdown in global industrial demand, combined with falling energy prices, pushed prices back down.

The third and fourth price cycles, seen in the U.S. market between 2023 and 2024, had marginal effects on the European benchmark and almost none on the Chinese one.

The third cycle was fueled by expectations of a global recovery triggered by the end of China’s zero-COVID policy. These expectations mainly involved U.S. financial operators, with limited influence on the European and Chinese financial markets.

The fourth cycle was supported by expectations of a global upturn due to interest rate cuts by the FED and the ECB, along with new stimulus measures introduced in China.

The 2025 cycle was finally triggered by the introduction of new trade barriers by the Trump administration, which affected the European price but not the Chinese one.[3]

The analysis of these cycles shows that upward price phases in the U.S. financial market sometimes also spread to the European and Chinese benchmarks, while in other cases the contagion is only partial. In some phases, price movements in the markets are completely misaligned: in 2025, while financial prices in the United States and Europe rose due to protectionist measures, Chinese financial prices recorded a decline.[3]

Towards what equilibrium?

As highlighted by the financial benchmark analysis, while in 2020 coil prices were essentially aligned across major geographic regions, in recent years we have witnessed a growing divergence among the various benchmarks. In particular, the U.S. market has experienced significantly higher volatility compared to the European and, above all, the Chinese markets. The new protectionist measures introduced by the Trump administration, combined with the safeguards adopted by the European Union, risk further widening the price gap against the Chinese benchmark. The intensification of trade barriers therefore contributes to fragmenting the global coil market, accentuating its trend toward regionalization.

In this macroeconomic context characterized by high uncertainty, in which globalization and the financialization of markets manifest only partially, it becomes essential for purchasing companies to constantly monitor a plurality of benchmarks.

[1] A tariff rate quota is a trade policy instrument that allows the importation of a specified quantity of goods at a reduced or zero duty; once that quantity is exceeded, imports are subject to higher duties.

[2] Residual quota: the portion of the tariff rate quota not reserved for a specific country.

[3] Similar effects had already occurred following the protectionist barriers of the first Trump administration. See the article: The steel trade war: from 2018 to the new phase of 2025