Analysis of margins of European coated sheet manufacturers

Coated sheets: an example of incomplete cost pass-through

Published by Luca Sazzini. .

Ferrous Metals Coated sheets Analysis tools and methodologiesIn the article: Analysis of margins of European coated sheet manufacturers, an analysis of the prices of coated sheets was carried out, divided into 3 groups based on the type of coating used.

In this article, we will continue the analysis by examining the trend of European prices of coated sheets in relation to hot-rolled coils, their main production input.

According to the economic theory of cost pass-through, changes in input prices are partially or fully transferred to the price of the finished product. In perfectly competitive markets for homogeneous products, this transfer tends to be complete, while for differentiated products, like coated sheets, cost pass-through is often incomplete. Producers, in fact, try to maintain price stability to remain competitive by absorbing temporary increases in production costs.

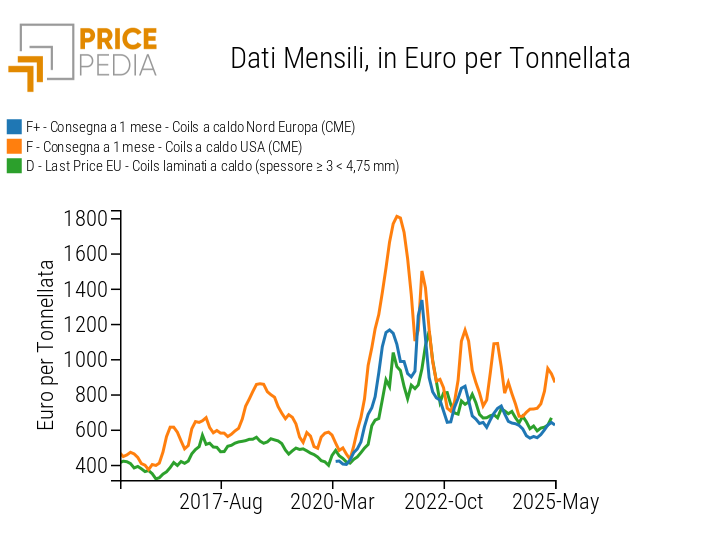

Since in recent years coil prices have shown high variations, it may be useful to assess to what extent these variations have affected the structure of European mark-ups for coated sheets.

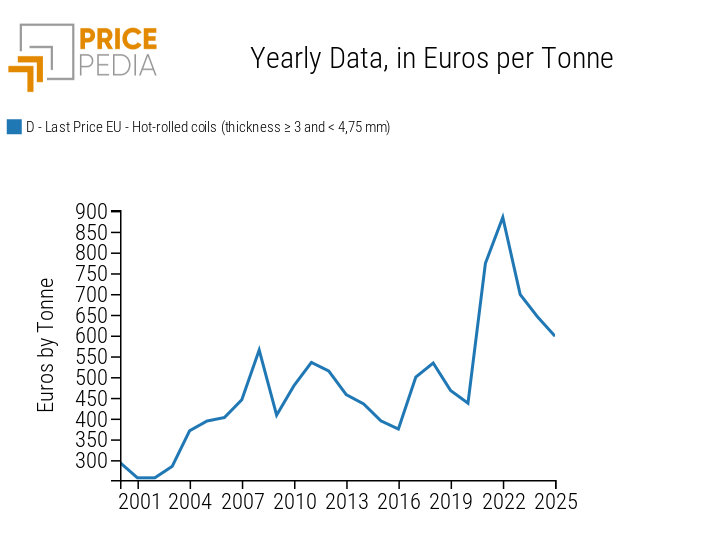

The following chart shows the annual trend of hot-rolled coil prices in the European market, expressed in euros per ton.

Historical Series of Annual Hot-Rolled Coil Prices on the European Market

The analysis of the historical series shows that, in the 2021-2022 period, hot-rolled coil prices saw strong increases, of 77% and 14%, respectively. After the historical peak in 2022, a reversal occurred, with reductions of 21% and 8% in the following two years.

In the following analysis, we will show how these variations significantly impacted the margin structure of coated sheets, calculating the mark-up of producers in relation to the price trends of coils in the European market.

Comparison of Margins in the 2021-2022 Period versus 2019-2020

The following chart compares the margins of European producers of coated sheets in two successive periods. The vertical axis shows the percentage mark-up between the average price of coated sheets and the price of hot-rolled coils in the 2021-2022 period, while the horizontal axis represents the percentage mark-up for the 2019-2020 period.

The chart is interactive: when hovering the mouse over a product, a table with related information appears.The scatter ball analysis reveals that all coated sheets are positioned below the bisector, indicating that margins in the 2021-2022 period were lower compared to the 2019-2020 period for all coated sheets considered. This suggests that producers partially absorbed the sharp rise in coil prices in 2021-2022, reducing their margins to maintain competitiveness.

The three types of coated sheets that saw the greatest margin contraction were plastic-coated, chrome-coated, and electro-galvanized sheets. In these cases, the mark-up over coils decreased by as much as 30%. For example, in the 2019-2020 period, the price of plastic-coated sheets was 90% higher than that of hot-rolled coils, while in 2021-2022, the gap was reduced to 60%.

On the other hand, producers of galvanized sheets (excluding electro-galvanized ones) only reduced their profit margins by 20% following the rise in coil prices. These products, in fact, have more modest margins compared to more complex sheets, such as those coated with chrome or plastic. In these cases, therefore, producers absorbed the rise in the cost of hot-rolled coils to a lesser extent. Consequently, the increase in production input costs in 2021-2022 was transferred more heavily to the final price of these products, weighing more on the end users.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Comparison of Margins in the 2023-2024 Period versus 2019-2020

The following chart compares the margins of coated sheet producers in 2023-2024 with those of the pre-crisis 2019-2020 period.

Since in 2023 and 2024 coil prices have recorded significant reductions, it is expected that producers' margins have started to grow again, approaching those of the 2019-2020 period.

The analysis of the chart confirms the theoretical expectations, highlighting that the mark-ups for coated sheets are closer to the bisector. In the case of chrome-coated sheets, the mark-up is even higher in the 2023-2024 period, with an increase in the margin from 80% to 90%. The mark-up for plastic-coated sheets, however, shows only a partial recovery of margins, reaching around 70% in 2023-2024, up from 60% in the 2021-2022 period, but still well below the 90% recorded in 2019-2020.

Another notable case is that of aluminum and zinc alloy-coated sheets, the only product that did not experience a margin recovery in the 2023-2024 period. From a mark-up of almost 50% over coils in 2019-2020, the margin fell to 31% in 2021-2022 and further decreased to 29% in 2023-2024.

In all other cases, margins recovered in 2023-2024, with mark-ups nearly identical to those recorded in 2019-2020.

Conclusions

This analysis highlighted that, in the case of complex goods like coated sheets, the transfer of variations in input costs to the final product price is not generally complete.

During the period of rising coil prices in 2021-2022, producers of coated sheets absorbed part of the price increases, compressing their margins, and then recovered them when coil prices fell in the following two years. This approach allowed for greater price stability, preserving competitiveness during periods of high production costs and restoring margins in 2023-2024 as coil prices returned to more normal levels.