The reform of the European electricity market

The reform does not disrupt the European electricity market, but introduces many instruments that could significantly change it

Published by Luigi Bidoia. .

Electric Power Price DriversOn June 26, Regulation 1747 and Directive 1711 were published in the Official Journal of the European Union, representing the legal formalization of the electricity market reform decided by the Parliament and the Council, based on a proposal from the Commission.

The EU Electricity Market Before the Reform

The European electricity market has been shaped over the first decades of this century through various and successive regulatory interventions (directives and regulations) by the Parliament and the European Council, up to the last interventions of 2019, prior to the current ones. The objectives that the EU has always pursued in terms of the electricity market are the following:

- Creation of an electricity market that, through the competition of multiple operators, leads to a continuous increase in production efficiency with a consequent reduction in prices;

- Security of supply to meet consumer demand;

- Support for the growth of investments in electricity production plants from renewable sources.

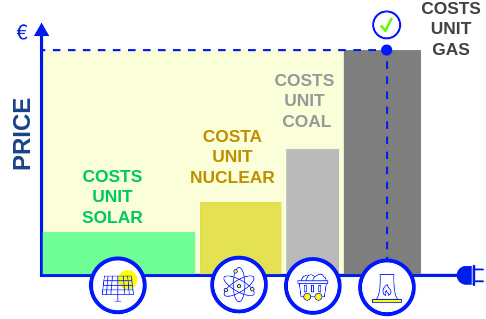

The technical solution implemented in the EU has been an emphasis on the day-ahead market, where operators offer and purchase electricity for each hour of the following day, accepting a price given by the last accepted selling offer in the auction process (marginal price).

Electricity price determined by the least efficient marginal offer

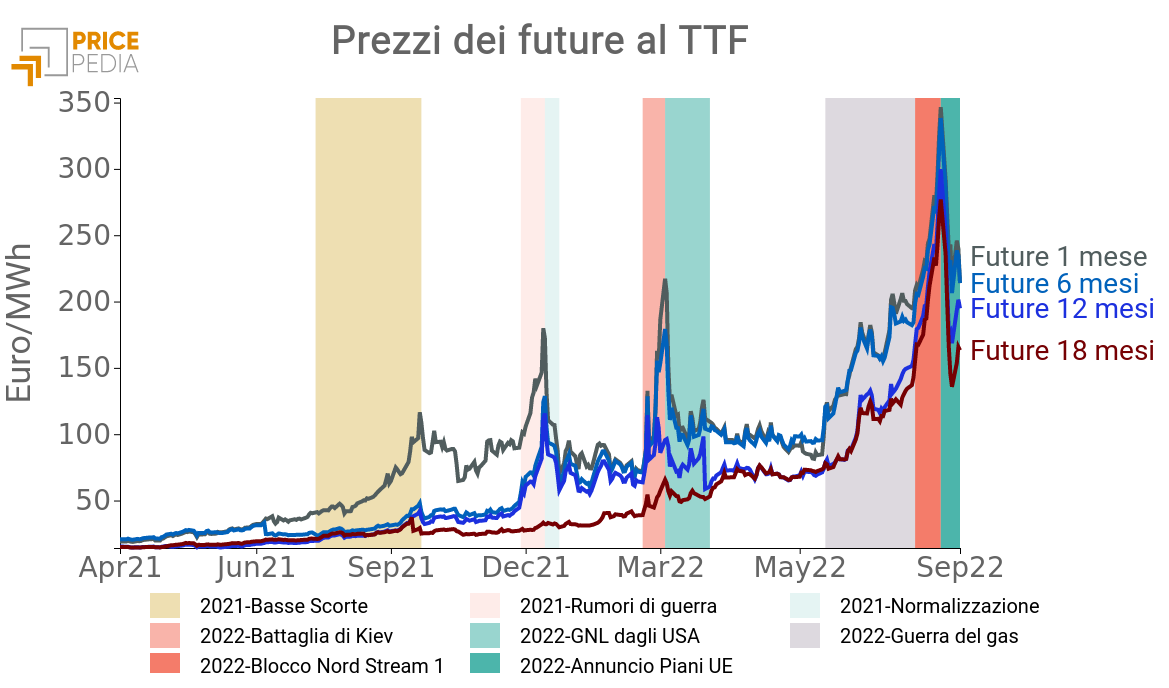

The 2021-2022 Crisis

This technical solution showed its limitations during the 2021-2022 period, when the European gas crisis resulted in a sharp increase in gas prices and consequently in the production costs of gas-fired power plants, which have consistently been the least efficient operators in the electricity market, leading to a significant increase in electricity prices as well[1].

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Faced with a wholesale electricity price that in the summer of 2022 exceeded 700 euros per MWh in many European countries, a heated debate arose among economists and specialists in the Union on how to reform the electricity market with the aim of avoiding the contamination effect between the gas market and the electricity market. The most potentially interesting proposals that emerged from the debate were essentially four:

- Division into two segments of the energy market, with a separate market for electricity from renewable and nuclear sources;

- Subsidies for gas-fired power plants to reduce the cost of the least efficient plant;

- Levy on the revenues of non-gas power plants and use of the surplus revenue to reduce downstream costs for households and businesses;

- Introduction of a public Central Buyer tasked with purchasing the necessary energy, contracting with various suppliers, and reselling it at an average price to distributors;

EU decision-making process of Electricity Market Reform

The Market Reform

The reform that the EU has formally initiated these days does not represent a radical change in the EU electricity market. In practice, it has been decided not to drastically modify the process of determining electricity prices, maintaining the current marginal price methodologies. Instead, the focus is on reducing volatility by investing more in renewable energies and using contractual instruments to mitigate the short-term effects of possible energy shocks, taking advantage of the long-term price benefits of the market.

The reform includes several important measures that should improve the resilience, sustainability, and transparency of the European energy market.

The main points of the reform concerning non-energy companies are:

- Introduction of long-term contracts to protect consumers from price fluctuations. Among these, the following play a key role:

- Power Purchase Agreements (PPAs): These contracts allow suppliers and consumers to set fixed prices for extended periods, reducing the uncertainty associated with market fluctuations;

- Futures contracts: Financial agreements made between two parties for the purchase or sale of a commodity at a price agreed upon today, but with delivery and payment set at a future date;

- Use of Contracts for Difference (CfDs) to stabilize the revenues of renewable energy producers, incentivizing investments in new renewable capacities;

- Introduction of dual contracting, meaning that user companies can enter into two different contracts simultaneously. One of these contracts can be "dynamic"[2], to better meet their needs and leverage the potential of renewable energies;

- Implementation of measures to facilitate self-consumption and energy sharing among consumers, including incentives for energy communities;

Types of contracts introduced by the reform

Conclusion

It is not easy to immediately assess the impact of this reform on wholesale electricity prices. Long-term contracts and contracts for difference can certainly create a link between the low variable production costs of renewable sources and wholesale electricity prices. Much will depend on the success of these contractual instruments. A fundamental role will be played by the guarantee systems that the states will develop to protect operators from potential counterparty defaults.

Certainly, the ability for a company to enter into two different contracts, even with different suppliers, is a contractual tool that can prove very useful. Companies could cover their standard and continuous needs with a fixed or variable price contract and cover temporary high consumption with dynamic contracts. In this case, a fundamental role will be played by smart meters that allow real-time monitoring and recording of energy consumption. This is essential for managing dynamic contracts, where energy prices can vary throughout the day. More generally, all technological innovations related to Smart grids and meters[3] will play a crucial role not only in dual contracting but also in the development of energy communities and in achieving the goal of greater non-fossil flexibility.

On paper, the potential of this reform is high. More uncertain is its actual implementation.

[1] For an analysis of the effects of gas price increases on electricity prices, see:

- Determinants of the PUN

- Electricity PUN: not just gas and CO2 certificates

- Decoupling and Windfall Profits

[3] See the European Commission's page on Smart grids and meters.