Stabilisation of FTT prices as a primary EU objective

If speculation succeeds in moving prices in the desired direction, a body with adequate resources and credibility could set itself the goal of stabilising them

Published by Luigi Bidoia. .

Energy cost Natural Gas Electric Power Price Drivers

While the slow decision-making process of the EU on the price cap continues, one cannot fail to observe how in the last month it has clearly emerged that the most critical area of the energy price system in Europe is the Dutch market for the Title Transfer Facility ( TTF).

The effects that this market has on other energy markets (primarily electricity, but also coal and petroleum products) are particularly relevant, so much so that the TTF can be considered as the prime, if not exclusive, driver of energy prices in Europe.

It may seem paradoxical, but the price quotations at the TTF have little to do with the real demand and supply of gas on the physical market.

On the other hand, the expectations that operators active on the TTF have about what will happen in the future are fundamental. If traders expect supply to be low compared to expected demand in the coming months, then the price will rise; conversely, if they expect the supply to be relatively abundant. The characteristic feature of the financial markets is that the "objective" probability of realization of the various scenarios is not as relevant as the "subjective" probability attributed to them by the various operators. In other words, it is not relevant that an event is "objectively" probable, but rather that it is believed to be so by most operators. These characteristics have two important consequences:

- the more volatile the "beliefs" of the operators, the more the market presents prices;

- the more sensitive the "beliefs" are to public information, the more the market can be manipulated to steer prices in the desired direction.

In the specific case of the TTF, the history of the quotations of futures at different maturities indicates a strong volatility of "beliefs" and their high sensitivity to public information. It is reasonable to expect that there have been and may be information actions aimed at changing "beliefs" and consequently prices.

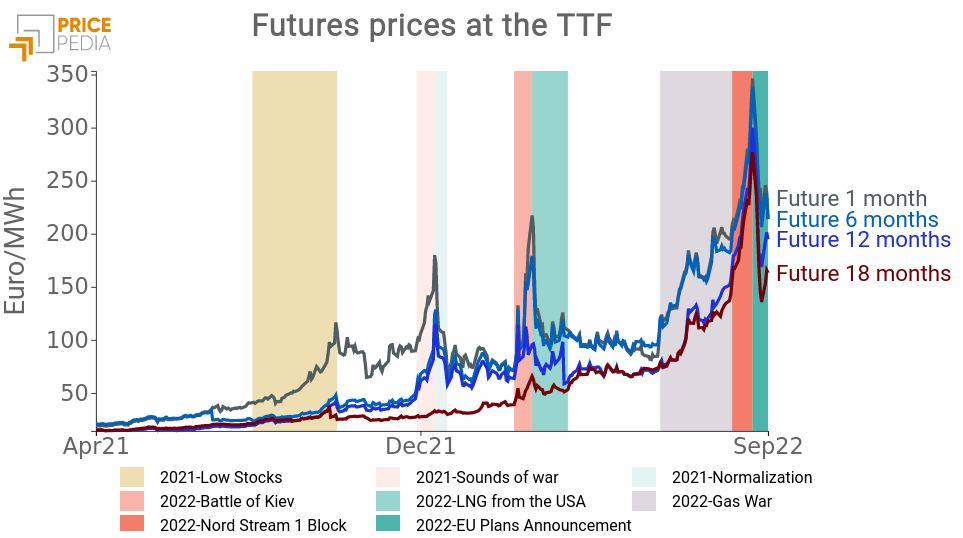

The graph presented here shows the future gas prices at the TFF of the last year and a half for deliveries at 1, 6, 12 and 18 months following the current month. By analyzing these data it is possible to derive the "beliefs" that have guided the operators over the last two years. The graph also shows some periods in which a "belief" seems to have prevailed. Sometimes this "belief" had a foundation based on objective data; at other times, it has developed from declarations of intent.

A qualitative analysis

At a qualitative level, it is possible to identify many periods in which the price at the FTT fluctuated greatly against information that did not necessarily concern short-term conditions in the European gas market, but possible future developments.

The periods of particular interest are:

- August-September 2021: low stocks. During the summer, distributors and large users of gas fill the storage sites to meet the greater winter demand. The process of stockpiling in 2021 was much slower than in previous years, so much so that at the beginning of October, when stocks generally peak, they were more than 20% lower than in year before. As expected, the increase in prices concerned only short-term contracts. The prices of contracts over 6 months, on the other hand, recorded only slight increases.

- First 20 days of December: rumors of war. These are days when the United States began to publicly speculate that the Russian exercises taking place in Belarus were not entirely peaceful, urgently asking Germany to block the commissioning of the Nord Stream 2 pipeline. At the same time, Belarus threatened to block the Yamal-Europe pipeline, if the West had not canceled the sanctions introduced after the Biellorussian repression of the opposition and the crisis of migrants from Kurdistan. In the space of two weeks, prices have more than doubled; not all contracts though. The duration of a possible crisis is estimated not to exceed one year, and contract prices with 18-month deliveries have increased only slightly.

- End of December 2021: normalization. The news is spreading that 15 ships loaded with US liquefied fuel are crossing the Atlantic to the European coasts. The greater supplies of LNG seem to be able to offset the effects on the market of the lower gas inventories at the storage sites. Furthermore, during the Christmas period, the thesis largely prevails that joint Russian-Belarusian military exercises are not the first step in invading Ukraine. Contract prices fall fast. The drop in the prices of 6 and 12-month contracts in January 2022, however, stops at a level equal to double that of November 2021. The risks of a crisis longer than one year are therefore embedded in the gas price structure by maturity.

- End of February - beginning of March 2022: the battle of Kiev. The Russian army, after invading Ukraine, it surrounds the capital Kiev, which however resists. The unexpected capacity of resistance of Ukraine and the compact reaction of the NATO countries are upsetting Moscow's plans. On 3 March, the price of gas for deliveries in April exceeds 200 euros / MWh. The sharp increase also affects delivery prices for the whole of 2022, but not those for 2023, indicating how the possible duration of the conflict is still considered limited.

- March 2022: LNG from the USA . News spread of agreements by various EU countries for alternative gas supplies to Russia, leading to a new collapse in the price of gas. At the end of March, the US and the EU announced an agreement for additional US LNG exports to the EU of 15 billion m3 in 2022, with the aim of reaching 50 billion m3 by 2020. Thanks to these news, on March 21 the price for deliveries in April returns below 100 euros / Mwh.

- Summer 2022: gas war. Gazprom's threats begin to block gas supplies to the EU. From 27 July 2022 the Nord Stream 1 reduces its capacity from 40% to 20% of its maximum. The EU is also contributing to the tensions on the gas market, which at the end of June adopts the regulation on gas storage, which provides that the storage sites of the Member States must be at least 80% full by the 1st. November 2022, with an average EU level of 85%.

In the next few years, this level will have to reach 90%. The effect that this regulation has had on gas prices are clear if we consider that in the first half of June, before its publicity, the price of gas for deliveries in July not only was always lower than 100 euros / MWh, but it was also more than 10 euros / Mwh lower than the price for deliveries in December, signaling a relative abundance of gas on the European market.

A trend starts with the end of June which in less than two months brings the price above 200 euros / Mwh. Unlike previous "snags", the whole price structure goes up. In mid-August, contracts with 18-month deliveries also exceed 200 euros / Mwh, 10 times the average price of gas in the five-year period 2014-2019. In mid-August, therefore, market expectations are for a long crisis, with gas prices for years above 200 euros. - End of August 2022: Nord Stream 1 temporary block. Gazprom announces the need to shut off the gas flows of Nord Stream 1 for a 3-day maintenance, from 1 September to 3 September. In response, the German government denounces the speciousness of references to Siemens Energy turbines, made by Gazprom. At the same time, fears spread that once interrupted, the flows would never be restored. On August 26, the price of gas for deliveries in September reaches the astronomical level of 347 euros / Mwh; that for deliveries in March 2024 the level of 277 euros / Mwh .

- September 2022: Announcement of EU Plans. Various EU countries present their own plans to reduce gas consumption and, above all, within the EU, an agreement is reached to set the meeting of EU energy ministers on 9 September to jointly find a solution to the energy prices, discussing the various proposals that different countries have presented. Although Nord Stream 1 was not reopened on 3 September, the determination of the EU countries to find a solution together reduces the price of gas in a few days back to 200 euros / Mwh, with a reduction of over 100 euros for deliveries in the 2024.

Conclusions

This analysis, albeit still at the qualitative level [1], suggests a high relationship between the dissemination of information for or against possible future shortcomings on the physical gas market, often far ahead in time, and changes in the spot prices for deliveries as early as the following month. If we consider that it is the spot prices of the FTT that drive prices to European end users of both gas and electricity, then stabilizing the spot prices would have an immediate and significant effect on the energy costs borne by companies and households in the EU.

If this analysis contains elements of truth, then a possible temporary solution to the energy price problems in Europe could be entrusting an entity with the task of stabilizing the spot price of gas at the TTF, intervening directly on the market in compliance with its same regulations. This body should have an EU mandate, adequate resources and be supported by plans to reduce energy consumption. Given the volatility that characterizes the TTF market, it is only a credibility problem.

[1] A quantitative analysis of the relationship between the dissemination of news for or against possible gas shortages and price changes at the FTT would allow a more precise and robust measurement of the relationship between information and gas price. However, the time needed to carry out this analysis is not short.