Analysis of differentiated products: the case of paints

How to negotiate a reduction of paint prices?

Published by Luca Sazzini. .

Specialty chemicals Should CostIn the article Purchasing Goods Markets: Commodities Versus Differentiated Products the theoretical distinction between commodity markets and those of differentiated goods was explored.

In this article, we will delve into the analysis by focusing on the differentiated product of paints. We will examine the reasons that make paints a case study of a differentiated good, through both a merchandising and empirical investigation concerning prices. Furthermore, we will discuss strategies to counteract the potential market power of producers, utilizing the should-cost approach as a defense tool.

Differentiation of Paints

Merchandising Aspects

Paints represent a perfect example of a differentiated good, thanks to their production which employs a wide range of chemical formulations aimed at satisfying specific functional and aesthetic needs. This differentiation is manifested through the careful selection and combination of various key components, each of which contributes to determining the final properties of the product. The main components used in this process are:

- Resins: act as binders, providing adhesion between the pigment and the surface to be painted, and determine the durability and resistance of the coating;

- Solvents: used to dilute resins and other components, facilitating the application of the paint and influencing the drying time;

- Pigments: provide color and coverage, as well as contributing to features such as UV resistance and corrosion resistance;

- Additives: improve or modify specific product characteristics, such as flowability, foam resistance, UV stability, and microbial resistance;

- Fillers: inert substances that can be added to modify viscosity, improve stability, increase volume, or influence the final appearance of the paint, such as glossiness or opacity.

By combining these components in varying proportions, paint manufacturers can create highly specialized formulations designed to meet an almost limitless range of technical and aesthetic requirements. This customization capability underscores the differentiated nature of paints, positioning them as highly differentiated products.

Price Dynamics

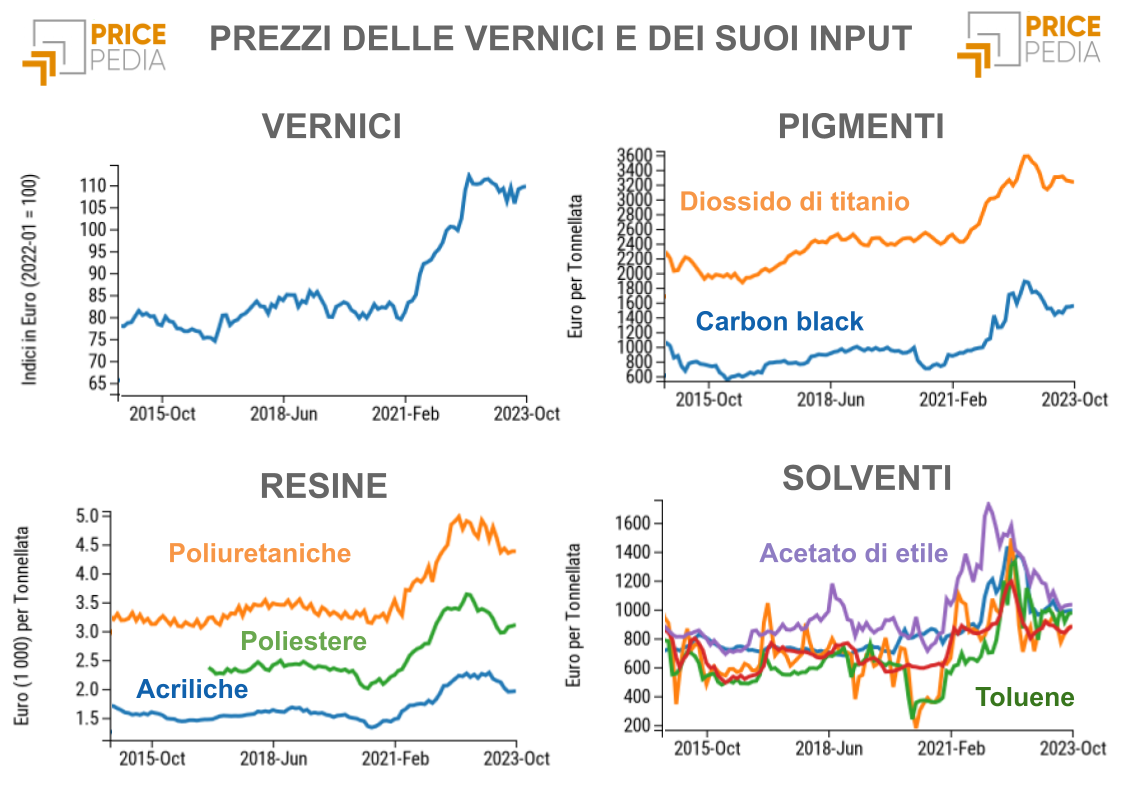

The differentiation of paints also emerges clearly when analyzing the dynamics of their prices over the long term.

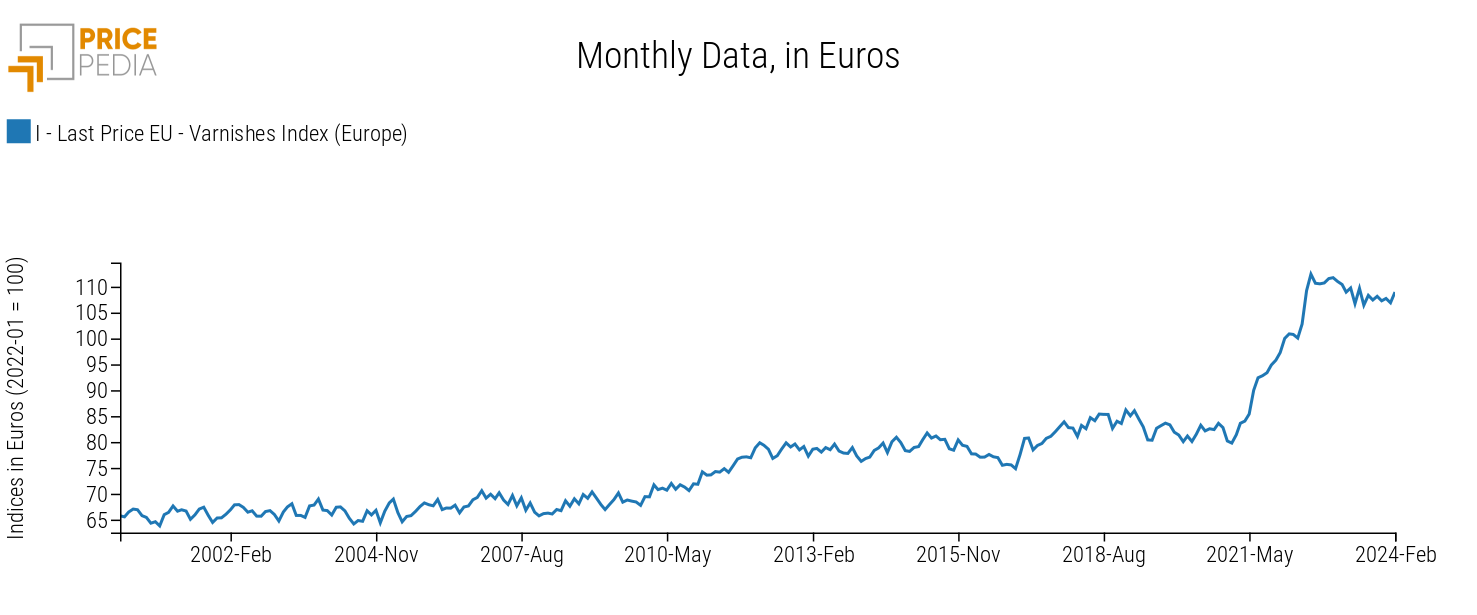

The following graph shows the aggregated PricePedia index of paint prices in Europe from January 2020 to February 2024.

Paint Prices Index Europe

Analysis of this dynamic reveals the absence of significant price reduction phases. This aspect is consistent with the characteristics of differentiated prices, which, unlike commodity prices, do not follow a "sinusoidal" dynamic. In commodity markets, periods of price increase are observed, caused by demand exceeding supply, followed by a subsequent decrease in prices when the increased supply satisfies market demand again. Such price fluctuation dynamics do not occur in the case of differentiated products because the market power of producers allows them to gradually adjust prices, avoiding significant decreases. This aspect is evident in the trend of the paint index (Europe), which presents only periods of increase followed by price stability phases.

Should Cost

A useful tool that can be used by companies during price negotiations is Should Cost. This tool allows for the analysis of the production cost dynamics of a good, including the cost of materials, labor costs, and additional associated costs, both direct and indirect.

In the case of differentiated products, the strategic approach of should cost becomes fundamental for the buying company in order to negotiate the best price at which to purchase the product. Thanks to this tool, it is possible to assess whether a price increase request is justified by an increase in market costs or not. Furthermore, it offers the buying company the opportunity to request price reductions when market conditions or production efficiencies justify them.

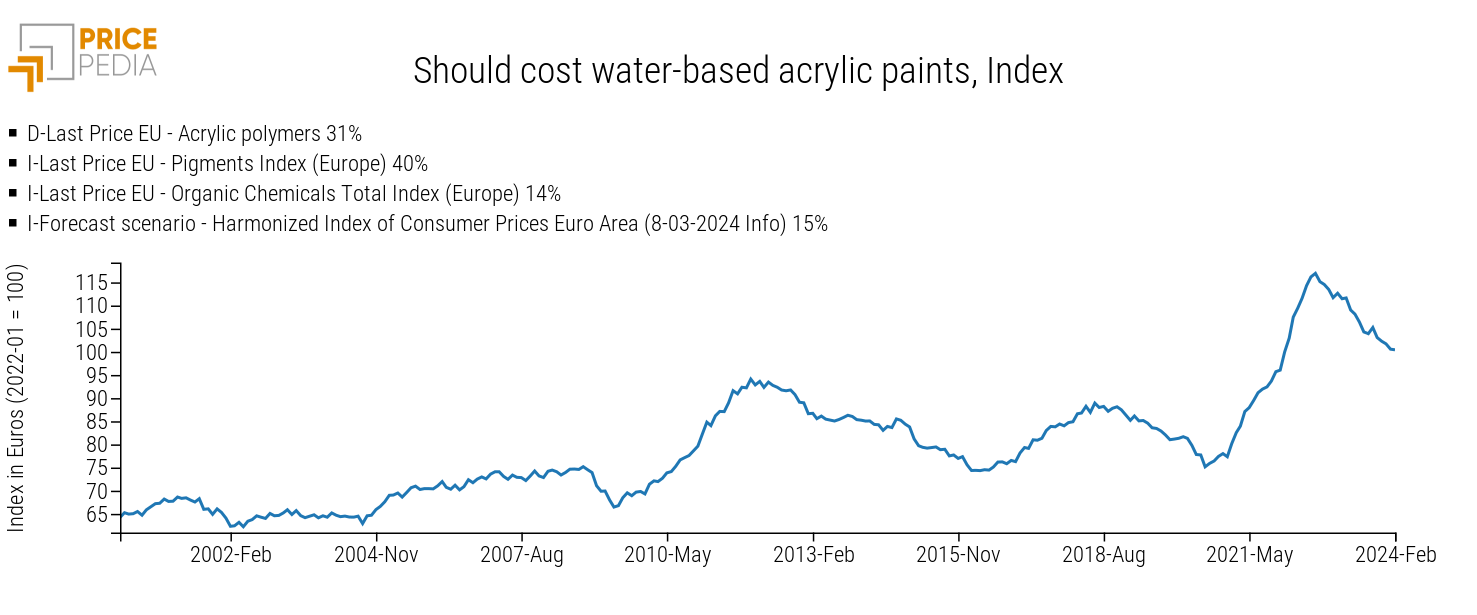

Below are two cases of should cost: the first concerns water-based acrylic paints and the second concerns solvent-based polyurethane paints. The method used to calculate both should costs is the one reported in the article: Should Cost for NMC111 Lithium Ion Battery. The cost drivers used in the should cost of water-based acrylic paints are: acrylic resins, pigments, additives, and labor costs. While the cost drivers used in the should cost of solvent-based polyurethane paints are: polyurethanes, pigments, additives, and toluene.

| Should cost water-based acrylic paints | Should cost solvent-based polyurethane paints |

|

|

From the graph of both should costs, several phases can be observed where paint production costs have experienced reductions. Particularly in the recent period: since July 2022, the production costs of water-based acrylic paints and solvent-based polyurethane paints have decreased by -14% and -15%, respectively. This means that during this phase, buying companies have the opportunity to negotiate a reduction in the purchase price of paints.

Conclusions

From the analysis conducted, it emerges that paints are a differentiated product both for their merchandising characteristics and for their price dynamics.

This characteristic translates into significant market power for producing companies.

A useful tool for buying companies to negotiate the best price at which to purchase paints is the should-cost approach. From the results of the two calculated should costs, it emerged that since July 2022, the costs for the production of water-based acrylic paints and solvent-based polyurethane paints have decreased by -14% and -15%, respectively.