Should Cost for NMC111 Lithium Ion Battery

How much should NMC111 battery prices fall?

Published by Luca Sazzini. .

Electrical Appliances Should CostOver the last year we have seen sharp declines in nickel, cobalt and manganese prices.

Since the increase in the price of these metals was the determinant of the increase in the price of electric batteries in the 2021-2022 cycle, it may be useful to ask ourselves how much the prices of these batteries could/should decrease in relation to the lower price of the three metals .

According to Goldman Sachs forecasts, the average annual price of automotive batteries is expected to fall by 11% between now and 2030. This would mean that by 2025 the production costs of electric cars (EVs) should equal those of cars with combustion engines without the help of state subsidies.

To observe the price changes of electric batteries you can use the Should Cost tool present in the tools section on the PricePedia website.

In this article we will show a possible use of this tool to evaluate the possible decrease of a specific battery. In order to carry out a detailed analysis, it is necessary to choose a specific battery to focus on and then identify the main materials necessary for its construction.

The battery chosen as the object of this analysis is the lithium battery[1] of the NMC111 type,[2] characterized by the same weight of nickel, manganese and cobalt.

These three metals are combined together with lithium to construct the cathode. Lithium is used together with graphite to form the anode. Two other metals that are used to produce these batteries are:

- the copper which is used to make the external circuit;[3]

- the aluminium used for the external casing of the battery.

Should Cost Calculation

To calculate the should cost we proceed through two distinct phases: the first is the Cost Breakdown Analysis and the second is the actual calculation of the Should Cost through the use of the Cost Drivers.

Cost Breakdown Analysis

Cost Breakdown Analysis involves the detailed breakdown of the total costs of a product or service into specific components. The goal of this initial analysis is to identify and understand the factors that contribute to overall costs.

It is useful to produce this breakdown by distinguishing the production inputs into two distinct groups. In the first group, those inputs that contribute to determining the weight of the final product (for example in this case metals) must be considered. The other inputs must be considered in the second group. In this way the impact of the first group of inputs on the total cost of the product can be done by passing through their weight.

Cost Breakdown Analysis of materials

The table below shows the specific costs of the materials necessary for the production of one kg of NMC111 batteries. The first column shows the weight of the input necessary to produce 1 kg of NMC111 batteries; in the second column the price of the metal in January 2022; in the third column the relative cost and in the fourth the impact on the total cost of the materials used.

Should Cost batterie NMC111

| Material | Weight in kg | Price in euros per kg | Cost in euros to produce 1 kg of battery | % of the total cost of materials |

| Lithium | 0.10 | 15.91 | 1.59 | 10.8% |

| Nickel | 0.18 | 20.55 | 3.70 | 25.0% |

| Manganese | 0.18 | 3.24 | 0.58 | 4-0% |

| Cobalt | 0.18 | 43.29 | 7.79 | 52.7% |

| Copper | 0.08 | 8.68 | 0.69 | 4.7% |

| Graphite | 0.20 | 1.00 | 0.20 | 1.3% |

| Aluminum | 0.08 | 2.81 | 0.22 | 1.5% |

| Total materials | 1.00 | 95.49 | 14.79 | 100.0% |

From the results reported in this table it can be seen that the cost of production materials per kg of an NMC111 battery is, at January 2022 prices, 14.8 euros. Among the materials used in the production process, the price of cobalt affects more than half (52%) of the total cost of the materials used. In addition to cobalt, the other two materials with the greatest impact on the total cost are nickel and lithium, which represent 25% and 10.8% of the total cost of materials respectively.

Cost Breakdown Analysis of non-material inputs

In addition to the cost of materials, other inputs are required for the production of NMC111 batteries, ranging from transport costs, energy costs, labor costs, actual or figurative services such as the use of machinery and plants. Calculating the cost breakdown of these inputs can be very complex. However, it may be reasonable to calculate their impact in successive steps, introducing some approximations. Their impact on the total costs of a kg of battery can, in fact, be calculated from the difference between the selling price per kg of the battery and the cost of materials, previously calculated. We can consider, as an approximate price, the average price of EU imports of lithium ion batteries, equal to 30 euros per kg.

From this information it can therefore be deduced that the cost of the total materials and the total non-material inputs each accounts for 50%.

To break down the total non-material inputs, it is possible to consider that all these inputs are composed of energy and work, partly carried out internally by the company, partly carried out externally, included in the purchased services. It is reasonable to hypothesize that the division between energy and work is 1/5 and 4/5 respectively.

Cost Drivers

As Cost Drivers we used the market prices of the various metals considered, a price index for energy and for labor the consumer price index in the Euro area, under the hypothesis that the cost of labor is substantially stable at constant prices.

Should Cost

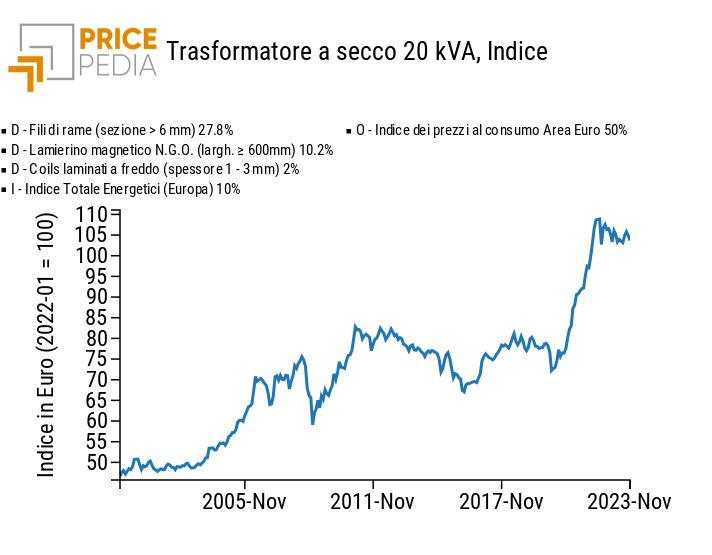

By inserting the results of the Cost BreakDown Analysis and the Cost Drivers described above, we used PricePedia's Should cost tool to calculate the dynamics of the probable production costs of NMC111 lithium ion batteries.

The following graph shows the results obtained.

The graph shows that in November 2023 the production costs of NMC111 batteries decreased by 16% compared to the values recorded in November 2022.

In terms of the annual average, the change in 2023 was -12.4%.

Conclusions

The analysis described in this article justifies on a cost basis an increase in annual lithium ion battery prices of 18% and 35.6% in 2021 and 2022 respectively.

Again based on cost dynamics, it is possible to estimate a decrease in the price of these batteries of -12.4% in 2023.

Through the should cost tool it is possible to translate the information available on the market prices of commodities and consumer inflation into robust estimates of the cost dynamics of complex products such as NMC111 lithium ion batteries.

[1] In lithium ion batteries, during battery charging the ions move from the cathode to the anode generating an electrical potential difference between the two parts of the battery. This potential difference (or electrical voltage), is what provides the push for the electrons to flow through the external circuit, thus generating an electrical current.

[2] We considered this specific battery only as a case study. We could have considered many other specific batteries. The calculations made for the NMC11 battery can be replicated for any other battery.

[3] The "external circuit" of a battery refers to the electronic components external to the chemical cell, such as connectors, cables, control circuitry, battery management electronics (BMS), and other management system components and battery check.