Attention to prices decreases when they fall, but it is not an optimal choice

Even during price reduction phases, the benefits of information outweigh the costs

Published by Luigi Bidoia. .

Strumenti Procurement Management

For over 5 years the PricePedia magazine has become a precious source of information for purchasing offices. From the first article on September 29, 2017 to December 31, 2023, 1209 articles were published by 16 authors.

Overall, visits to the articles exceeded 1.7 million. Assuming an average of 10 articles per reader/visitor, this means that since 2017 the PricePedia magazine has had almost 200 thousand readers (or more precisely visitors). If we consider that the professionals who work in Procurement in Italy are just over 100 thousand, we can hypothesize that the PricePedia magazine has reached almost all of its target audience in the last 5 years.

It is therefore possible to use the data on visits to the magazine's articles to get some information on what the interest of the procurement world has been in recent years for information and analysis on international commodity prices.

To this end, an index of interest was constructed for PricePedia articles, eliminating the effect due to the number of days from the number of visits to an article elapsed since its publication. It is clear, in fact, that an article published a year ago, under the same conditions and interest, was able to total a greater number of visits than an article published more recently.

The formula used is very simple:

Interest= 2* Visits / (120 + Days from publication)

Interest is proportional to visits by a factor of 2, to give more importance to this measure. With the same number of registered visits, the interest is inversely proportional to the days that have passed since the article was published, corrected for a constant of 120 days. Given the hypothesis that, with equal interest, an article tends to be more visited in the first days of publication[1], this constant allows us to increase the weight of the first days of publication compared to those subsequent.

Using this formula it is possible to calculate a measure of the interest that the article has aroused in the public of procurement professionals.

Changes in interest over time

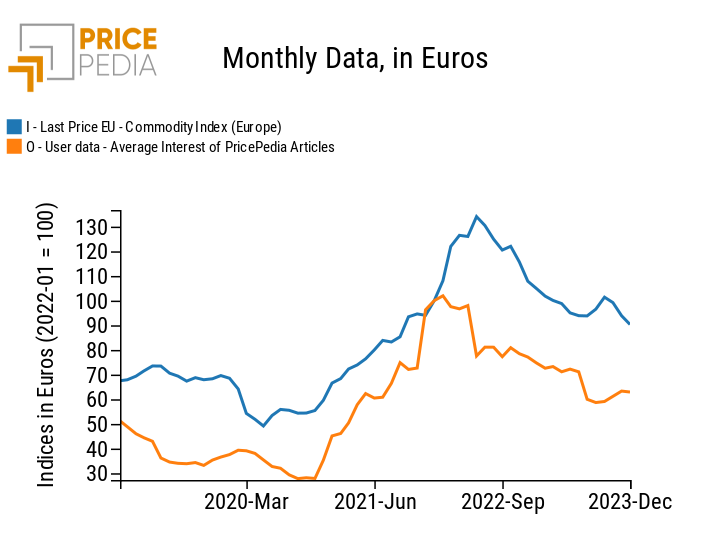

If we consider the average of the interest of all the articles published in a given month, we can have a synthetic measure of the interest that the PricePedia public has expressed in the articles published in that month and more generally in the topic of commodity prices. By comparing this measurement month after month it is possible to describe the evolution over time of the procurement world's interest in the dynamics and analysis of commodity prices. The following graph shows this dynamics, represented by the orange line.

Interest in PricePedia articles and commodity price index

The graph, in addition to the average monthly interest in PricePedia articles, also shows the PricePedia index of the dynamics of commodity prices. The two indices are highly correlated with each other: when prices increase, the procurement world's interest in price information and analysis increases; when prices drop, interest in these topics also drops.

Without prejudice to all the relevant caveats, from the existence of many other factors that may have contributed to determining the dynamics of the index of interest to the limited series of analyzes of this type with which we can compare, the signal that emerges from this comparison seems very clear:

Procurement seeks information on commodity prices especially when prices increase; its interest decreases when prices fall

I believe that any supplier would agree with this statement because it is the experience that all purchasing departments usually have. However, it is not the result of a process of optimal choices.

Certainly the benefit that can derive to a purchasing office (and more generally to a company) from timely information on the dynamics of the market prices of purchased goods is greater when prices increase. But this does not make the choice to reduce the effort on collecting information in phases of price reduction optimal. This choice would be optimal only if, in the price reduction phase, the cost of collecting and organizing the information was greater than the benefits that could derive from it.

However, this is almost never true because:

- on the one hand, the cost of collecting, analyzing and organizing information on markets and related prices has drastically reduced in parallel with the development of digital technologies;

- on the other hand, the benefits due to greater information on prices in the phase of their reduction can be

significant in many situations:

- during a negotiation when direct information on market prices can make it possible to overcome the barriers to price reductions raised by the supplier;

- in decisions on purchase quantities and times: in a phase of decreasing purchase prices, increasing the frequency of purchases with reducing the quantities per purchase can lead to savings in excess of that possible by concentrating volumes in a few purchases;

- information on decreasing purchase prices can support coherent pricing policies, preventing the company from suffering losses in competitiveness, or allow the company to gain market shares, in case where competitors do not adjust their prices to the lower costs.

Conclusions

The data collected on visits to PricePedia articles and their transformation into an Interest index allows us to broadly document an aspect that is part of the experience of the majority of suppliers: the attention on price dynamics is much greater in the phases of increase of prices compared to the phases of decrease. This fact, however, does not appear to be an optimal choice, especially in the case in which information on prices has limited costs and there are many opportunities to translate information on their selling dynamics into benefits.

[1] All other factors being equal, including the objective interest in the contents covered, an article has the probability of being visited more in the first days of publication because the article is advertised both through posts on LinkedIn and through the PricePedia newsletter.