Market optimism and the effects on commodity prices

An overview of current trends in the commodity landscape

Published by Giulio Corazza. .

Energy Ferrous Metals Food Non Ferrous Metals Commodities Financial Week

In the preceding months, there has often been talk of a slowdown in the world economy, fears of a recession and a possible widespread decline in financial commodity prices.

However, with the arrival of 2023, what the financial markets expect, already by the end of the year, is a recovery in the global business cycle.

The positive signs are there: China has decided to abandon its zero covid policy, and after it has discounted the consequences of this choice, it will be ready to resume full force; central banks around the world are dealing with inflation and will sooner or later ease the restrictive measures they have undertaken. This change in sentiment has occurred, however,

without any reduction in the high uncertainty that has characterized commodity financial markets for more than two years.

The scenario that the financial markets seem to be projecting for Europe and the world economy in general is still a recession, but one that is much less severe than what was expected a few months ago. Moreover, a recovery is expected as early as the end of 2023.

In light of this, the coming months may see an upward trend in financial prices, supported

by expectations of future recovery. In physical trading markets, conversely, the price level of many commodities has not yet adjusted from the high levels reached in the summer. In this case,

prices will tend to trend downward in the coming months.

Also making the reading of signals from commodity markets uncertain, a significant role

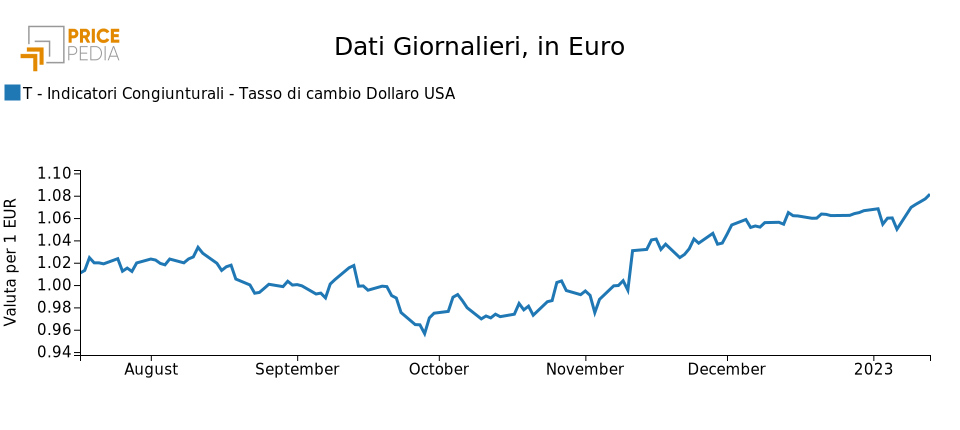

are being played by changes in the dollar exchange rate.

Signs of recovery in financial commodity prices are, in fact, clearly evident in dollar price indexes. The depreciation of the dollar against the euro (which has risen over three months from $0.96 per euro to the $1.08 exchange rate reached this week) makes these increases in euro prices, on which the PricePedia heatmaps are based, less obvious.

Dollar/euro exchange rate

ENERGY PRODUCTS

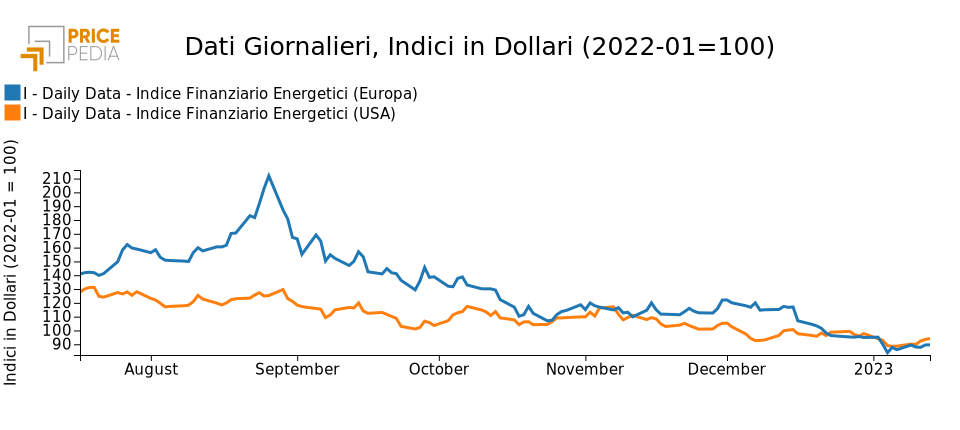

The following chart shows the PricePedia financial indices of energy product prices in Europe and the United States, expressed in dollars. After declines last week, there are some signs of recovery this week.

PricePedia financial indexes of energy prices in Europe and and the U.S.

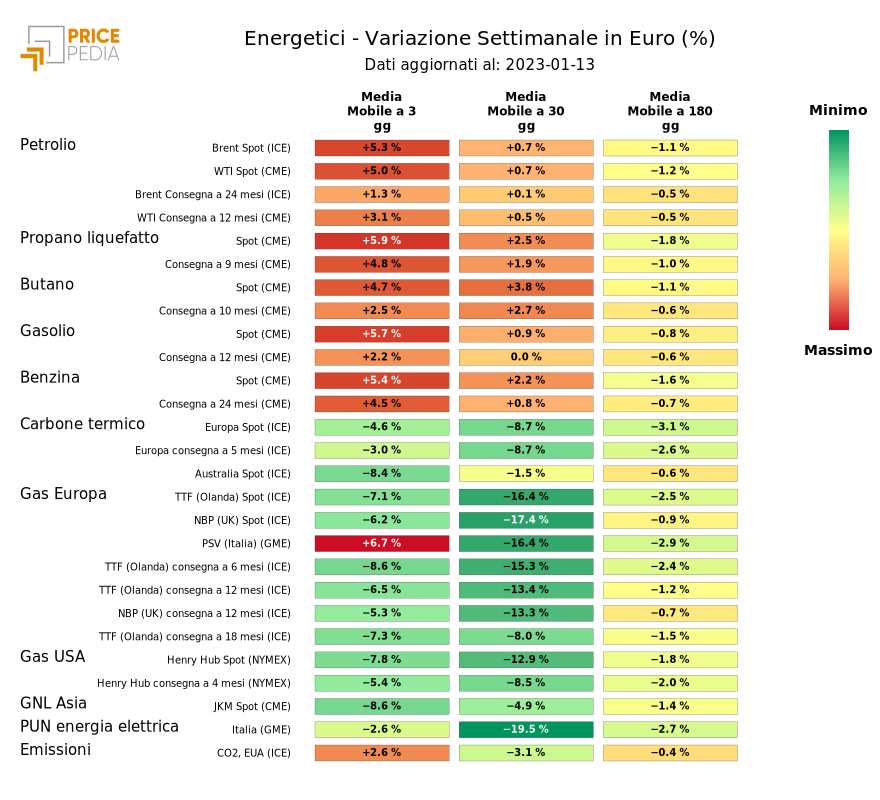

The heatmap below provides an overview of energy product price trends in euros.

The increase is generalized to the prices of oil and its derivatives. Natural gas prices, on the other hand, are for yet another

week in a downward trend.

HeatMap of energy prices in euros

METALS

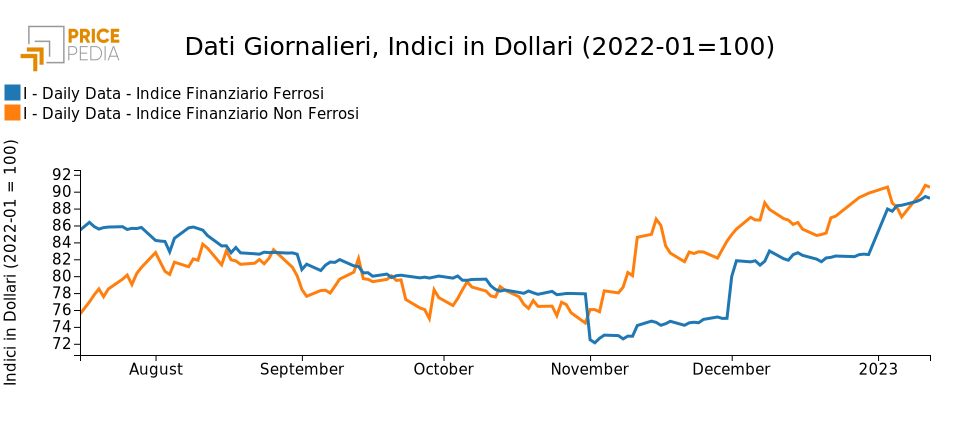

The following chart shows the PricePedia financial indexes of ferrous and nonferrous metals prices, expressed in dollars. This week both indexes show an increase. More pronounced is the increase in the non-ferrous index.

Financial PricePedia indices of ferrous and nonferrous metals in dollars

FERROUS

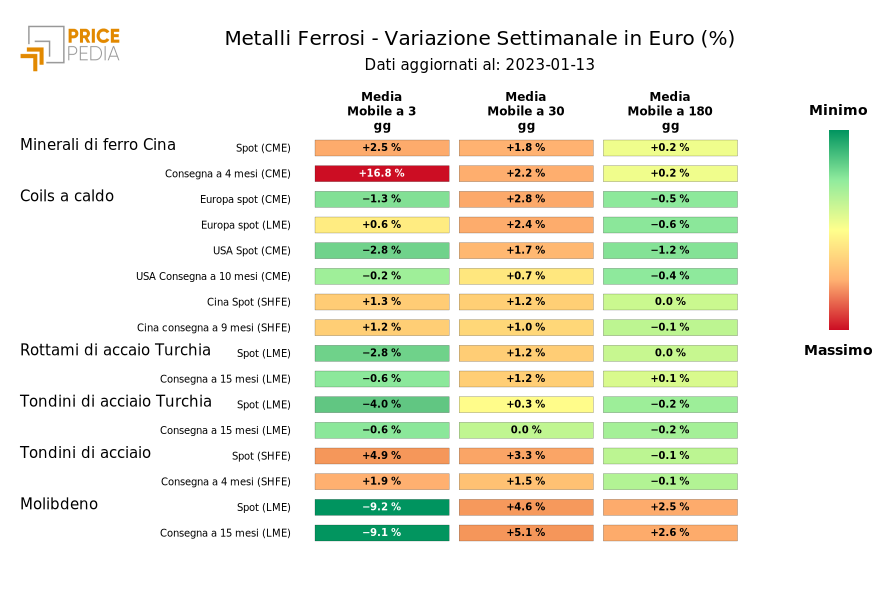

The heatmap below provides an overview of ferrous metal price trends in euros. The significant increase in China iron ore and steel rebar is noted.

HeatMap of ferrous metal prices in euros

NON FERROUS

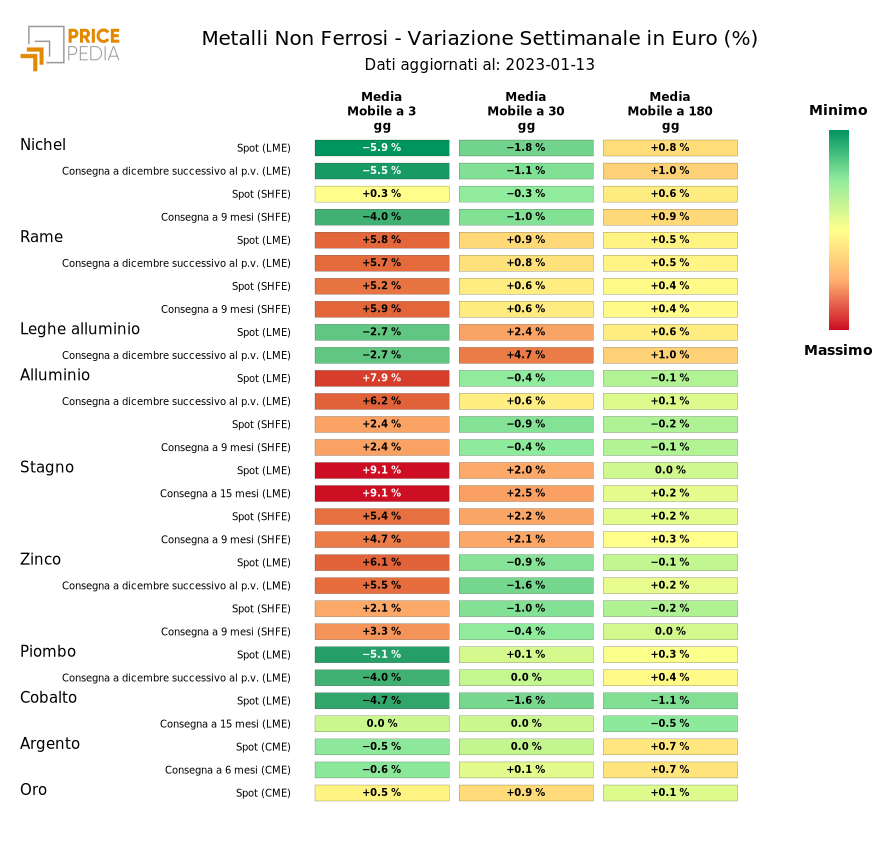

The heatmap below provides an overview of price trends for nonferrous metals in euros. Across the industry there are strong increases in price levels, with a few exceptions, represented by nickel and lead.

HeatMap of non-ferrous metal prices in euros

FOOD PRODUCTS

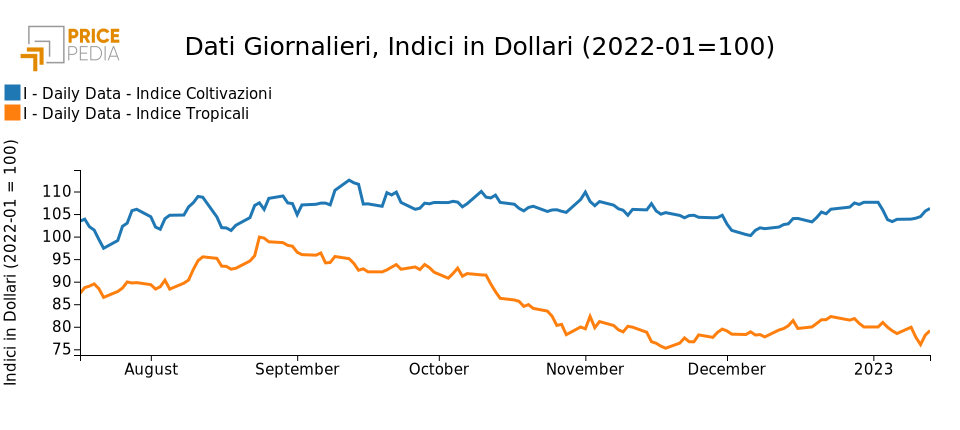

The following chart shows the PricePedia financial indices of food prices in U.S. dollars. This week the crop commodity indices returned to an upward path, while the tropical commodity index has been showing a downward trend for several weeks.

PricePedia Financial Indices of Food Products in Dollars.