PricePedia Last Price

A measure of market prices in real time

Published by Luigi Bidoia. .

Natural Gas Hot-Rolled Coils Analysis tools and methodologiesWhen economic conditions change rapidly, it becomes essential to have reliable information, as up-to-date as possible, on the phenomenon of interest. This is the case with the prices of basic goods.

Customs prices have many qualities. They are, in fact:

- objective, because they are the result of effective transactions between parties with opposing interests;

- robust, because they are derived from a large number of transactions;

- analytical, because they allow to measure the prices of all transactions (at the reporting country / partner country level) and to derive, therefore, the dispersion (range).

However, they measure the change in market prices of a given month with some delay. The prices of goods that pass through customs reflect prices that were not necessarily negotiated in the month in which the goods passed. They are the result of negotiations that also took place in previous months. It is possible, through statistical techniques, to extract from the customs price of a given month the price associated with the negotiations and contracts that took place in that specific month1. We have called this price Last Price to indicate that it is the price of the last contracts entered into in the same month that the goods passed through customs.

The signaling capacity of the Last Price can be understood by considering some case studies.

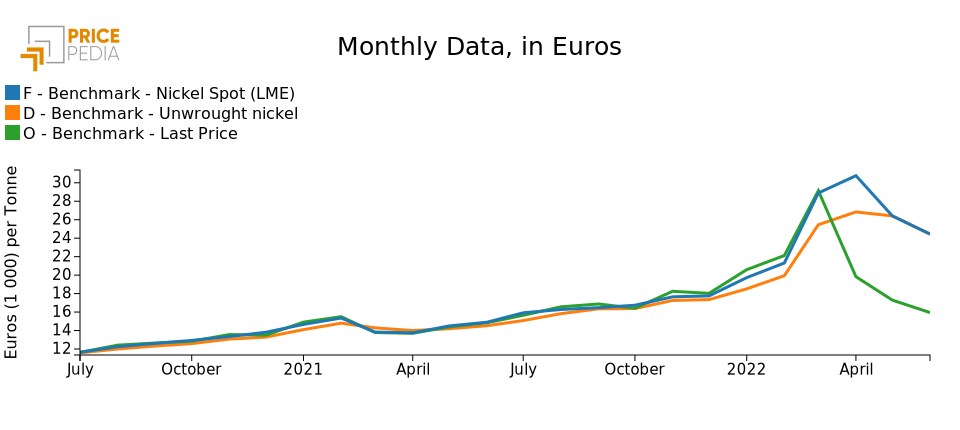

Case study: nickel

The price of nickel has been characterized in recent months by strong turbulence, especially as regards the prices on the LME (see in this regard the article Chaos Nickel). It may be useful to verify how this chaos has been transferred in the negotiations and contracts carried out between operators on the real market. The graph below shows the dynamics from January 2020 to today of the customs price, its Last Price and the price of nickel listed on the LME (financial price).

From the analysis of this graph it is clear that the Last Price is practically equal to the nickel quotation at the LME, up to March 2022. Until that month, the "real" traders have entered into contracts using the LME price as a reference point. The customs price, on the other hand, reflecting the prices of contracts that took place over a longer period than the last month, recorded a less pronounced trend.

Particularly interesting is what has happened in recent months. In the face of the chaos that characterized the nickel market at the LME from 8 March onwards, the price on the real market has abandoned the LME price as a reference point.

On the other hand, the exchanges of nickel in the industrial world could not be interrupted only because speculation had led the price of nickel to the LME to exceed 100 thousand dollars per ton, forcing the LME authorities to intervene by blocking transactions and suspending the market. for over 10 days.

Once the LME benchmark was abandoned, the price of nickel on the real market fell sharply, anticipating what would also happen on the financial markets, from May 2022 onwards.

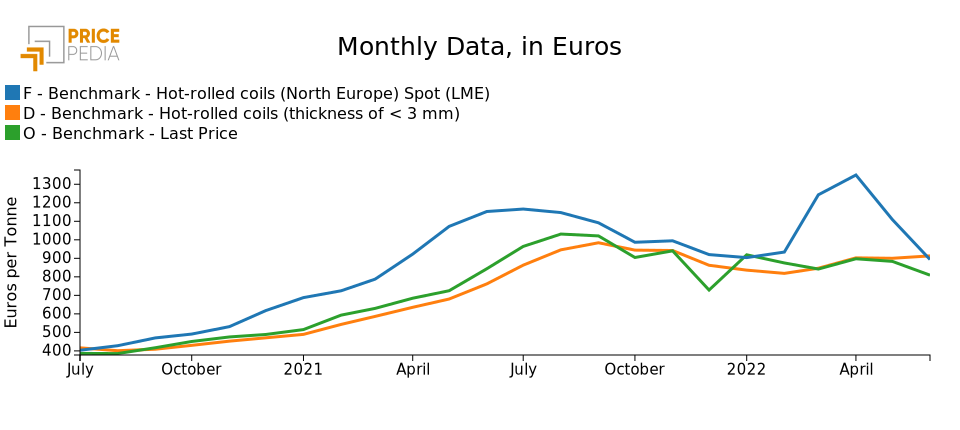

Case study: hot steel coils

The graph below shows the dynamics of the customs price, the Last Price and the financial price of coils in Europe. The latter was used as a benchmark to "extract" the Last Price of the last two years from the customs price.

What clearly emerges from this graph is the higher growth that the Last Price (which reflects the contracts signed in the month) recorded, in the recovery phase of the world industrial cycle in the second half of 2020, compared to the customs price (which reflects the prices). of contracts entered into over a longer period). In line with the recovery of industrial activity, the Last Price is more in line with the strong growth recorded by the listing on the LME. Unlike in the case of nickel, the Last Price of coils is not perfectly equal to the financial price, given the lesser ability of the LME market for coils to represent the real market.

The Last Price of coils also records with greater clarity the phase of reduction in the price of coils in the second half of 2021, always in line with the dynamics indicated by the listing on the LME.

Particularly interesting is what happened in March and April 2022, when neither the customs price nor the Last Price recorded the strong increase signaled by the listing on the LME. These data suggest that at the LME the price of coils in March and April suffered strictly "financial" determinants, not deriving from market fundamentals.

Considering what happened in the nickel market at the LME, it is not difficult to think that in March and April 2022 trading on the LME was affected by factors other than the strong slowdown, already underway in those months, of the global industrial cycle. With the months of May and June, the prices of coils on the LME also aligned themselves with the new market conditions, characterized by an increasingly weaker demand for coils on a global level.

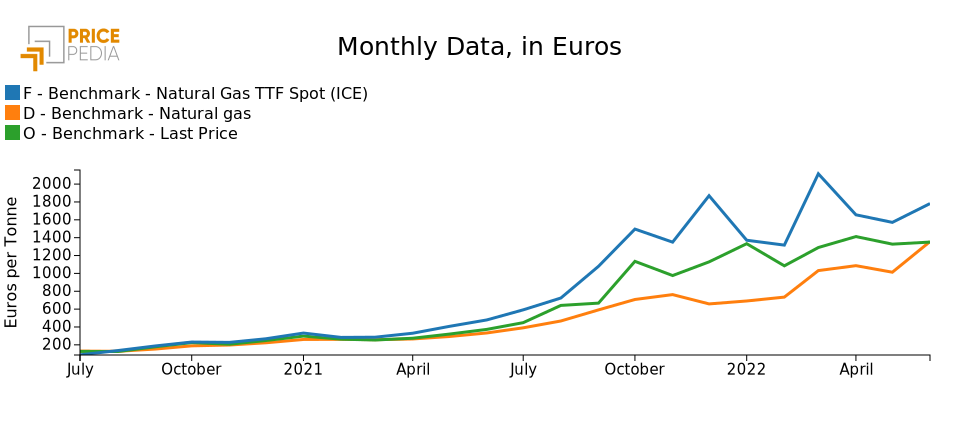

Case study: natural gas in Europe

The latest case study concerns natural gas prices in Europe. It is well known that, although they have been largely reduced, there are still transactions governed by medium / long-term contracts on the gas market. According to some estimates, the share of transactions from this type of contract it is equal to about a quarter of the total European gas exchanges.

The existence of these contracts tends to "plane" the price of customs exchanges. The greater stickiness of customs prices clearly emerges from the graph below, which shows customs prices, last prices and quotations at the TTF for European natural gas.

In addition to the stickiness of customs prices, the important fact that emerges from the graph is the maximum level of prices reached by the Last Price, always less than 1.5 euro / Kg2, much lower than the maximums reached by the quotations at the TTF that have exceeded 2 euros / kg. The TTF is clearly guiding the new contracts on real transactions that the operators of the sector are entering into, but not in a way so directly as to transfer all the speculative factors that are characterizing trading at the FTT to the real market.

Conclusions

The availability of the Last Price measure, which is added to the others already present in PricePedia, will make it possible to monitor and analyze in a more timely manner the continuous changes that are characterizing the markets for the prices of raw materials and goods. base. There is no doubt that, amidst material shortages and unprecedented price dynamics, the complexity of the Procurement function has increased enormously in recent years. The ability to manage this complexity has become one of the fundamental competitive factors of all processing companies, making Procurement an increasingly strategic function in the process of creating corporate value.

[1] To extract the price relating to the contracts of the last month only, it is possible to start from the hypothesis that the customs price (PDog) in month t is given by the weighted average of the prices of the contracts (PCon) stipulated in the previous n-months, with a decreasing weight expressed by the power of a parameter η (between 0 and 1):

1) PDog = SUM (i=0,∞) (η*L)i*PCon / SUM (i=0,∞) (η)i

where L is the delay operator and SUM (i = 0, & infin;) represents the sum for i ranging from zero to infinity. With some algebraic passages we obtain:

2) PCon = (1 -η*L*PDog) / (1-η).

If we consider the first differences of 2), we obtain:

3) Δ(PCon) = Δ(PDog) + η/(1-η) * (Δ(PDog)- L*Δ(PDog))

where Δ is the prime differences operator.

The 3) defines a relationship between the variation of the Contract Prices and the variation of the Customs Prices: the variation of the Contract Prices is equal to the variation of the Customs Prices plus an acceleration / deceleration factor given by the difference between the variation of the Customs Prices at time t and their change in the previous month. If this difference is positive, ie the changes in the Customs Price are accelerating, the change in the Contract Price is greater than the change in the Customs Price; vice versa, if the Customs Price decelerates and its variation at time t is less than that of the previous month. The & eta; governs the intensity of the effect that the accelerations / decelerations of the Customs Price have on changes in the Contract Price.

This parameter can be estimated by considering the relationship between the Contract Price and its benchmark price. For example, to estimate the η associated with the Contract Price of copper wires, the price of copper quoted on the LME can be used as the benchmark price.

The Contract Price calculated on the basis of 3) therefore becomes the Last Price obtainable for each month from the monthly Customs Price.

[2] To make the prices of the various surveys comparable, all prices have been expressed in euro / kg. The price levels of 1.5 and 2.0 euros / kg correspond, respectively, to 92 and 123 euros per megawatt hour.