Chaos Nickel

A case study of the failure of the financial market to form a single price

Published by Luigi Bidoia. .

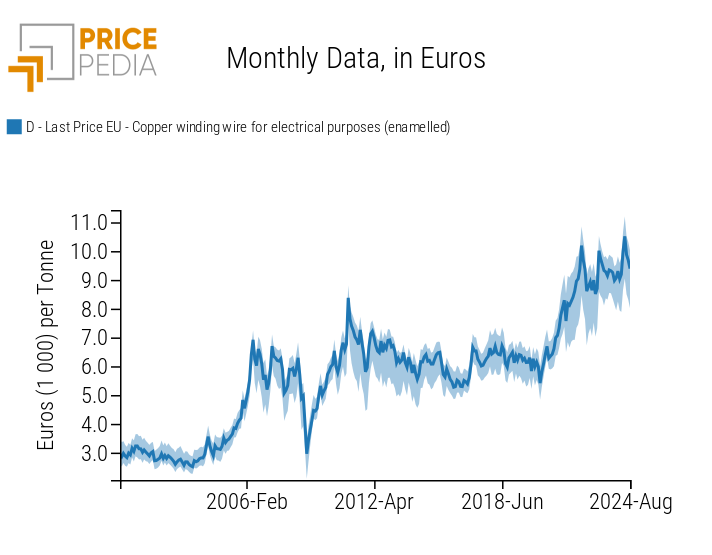

LME Nickel Range Price Drivers

There are recent reports of legal cases initiated by some investment funds against the London Metal Exchange (LME) for damages suffered due to the suspension on March 8 of trading on nickel futures and the cancellation of transactions carried out during the day.

This article first reports the facts that have characterized the nickel market in recent months. Then the prices recorded by the various nickel futures on the LME are analyzed, comparing them with the corresponding prices on the Shanghai Futures Exchange (SHFE).

If the dynamics of prices can account for the various facts, then it is possible to have a first measure of how much the high turbulence in nickel prices can be attributed to market fundamentals (demand, supply and costs) and how much, vice versa, it must be attributed to phenomena that originate in the peculiarity of the financial markets. On the basis of this attribution of causes between fundamentals and financed markets, it is finally possible to try to investigate the possible evolution of prices in the near future.

The facts reported by the mass media

The relevant facts that have characterized the recent events of the real market and the financial market for nickel are the following.

Use in the steel industry and for the production of batteries

70% of the nickel consumed in the world is used to produce stainless steel; only 5% is used to produce electric batteries, but this percentage is set to grow at a rapid pace, in line with the growth in battery production.

Purity classes of nickel

The nickel listed on the financial markets (LME and SHFE) is of high purity (class 1). This is required to produce the batteries. For uses in the steel industry, a less pure nickel (class 2), contained in iron-nickel alloys and in nickel cast iron, can be used. The nickel for which strong growth in demand is expected is therefore class 1 nickel. The expected growth in demand for class 2 nickel is significantly lower.

Tsingshan announces a revolution

In 2021, one of the leading Chinese nickel producers (Tsingshan Holding Group, the world's largest producer of stainless steel) announced a technology capable of extracting a grade of nickel from cast iron that can be used for the production of nickel. electric batteries. If this technology is sustainable, the supply of class 1 nickel could increase at high rates, exceeding those of the demand.

Tsingshan tries to lead the financial market

Following the announcement of the new technology, Tsingshan increased its operations in the LME and SHFE by entering into futures contracts, thereby taking a short position for significant amounts, with potential lower price effects of the metal.

The doubts of investment funds

Western operators and investment funds have expressed doubts about the economic and environmental sustainability of the new technology, increasing the number of nickel futures contracts held, thus increasingly assuming a greater long position and supporting the price of nickel.

Possible supply shortages

With Moscow's invasion of Ukraine and the West's decision to sanction Russia (a key nickel producer), fears of possible future nickel shortages have increased, leading to a sharp rise in purchases and prices. The operators who had opened short positions (committing to a future sale), including Tsingshan, tried to close their positions by entering into opposing purchase contracts, accepting ever higher prices. Many operators began to suspect Tsingshan of making sales commitments without actually being able to honor them with physical deliveries.

LME suspends the market

In the face of prices that exceeded $ 100,000 per ton, the LME authorities at 12 noon on March 8 suspended the market and canceled the transactions already carried out in the morning, believing that the prices of the transactions that took place that day "do not reflect the underlying physical market. "After 12 days of market suspension and a" false start "on March 22, the LME only managed to quote the nickel price on March 25. It is evident that for many days the LME is not managed to build 1 a single price for nickel.

The facts revealed by the prices

It may be useful to retrace what has happened in recent months on the nickel market, using the prices of the metal quotations at the LME compared with those recorded at the SHFE as an information source.

This analysis allows us to verify what may be the warning signs that herald a possible failure of the market in the construction of a single price and the importance of market fundamentals with respect to phenomena related to the functioning of the financial markets.

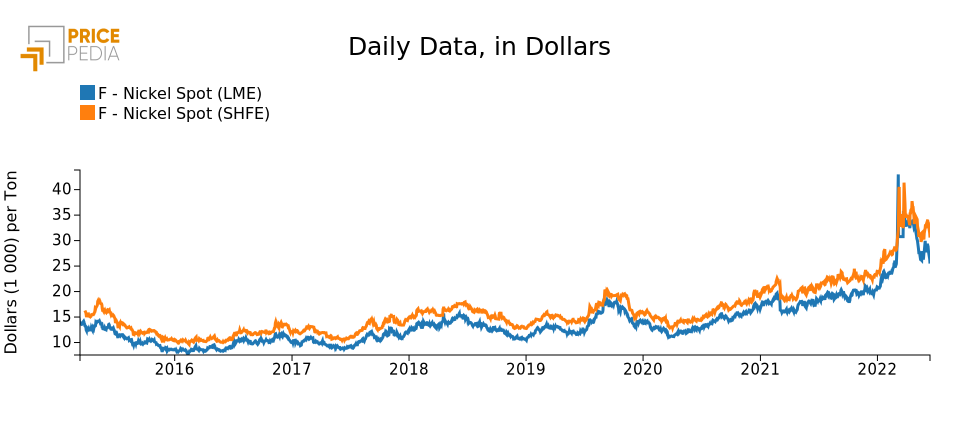

One way to highlight the facts of those days and the dynamics that affected the nickel market is to compare the prices of the metal quoted on the LME and the SHFE. The chart below compares these two prices.

Fig. 1 Nickel prices at LME and SHFE (dollars per ton)

As can be seen very clearly, there has been a strong alignment between the prices listed on the LME and the SHFE for many years. Through arbitrage carried out by specialized operators, the price of nickel at the SHFE was almost always higher than 15% of the price at the LME. The methods of managing VAT and other administrative specificities justify this differential and indicate how the fundamentals of a market considered global have been reflected in the construction of the price in both exchanges.

The effect of a fundamental, such as the announcement of a new technology by Tsingshan, emerges clearly in early March 2021, when the price of nickel in the space of two days has lost more than 2,000 and 500 dollars a ton, passing from 18 thousand and 500 to 16 thousand dollars. However, if we compare these movements with those that characterized the month of March 2022, there is no comparison in their intensity.

The relationship between nickel prices on the two exchanges collapsed following the February 24 invasion of Ukraine by Russia. It may be useful to specifically analyze this period, shown in the graph below.

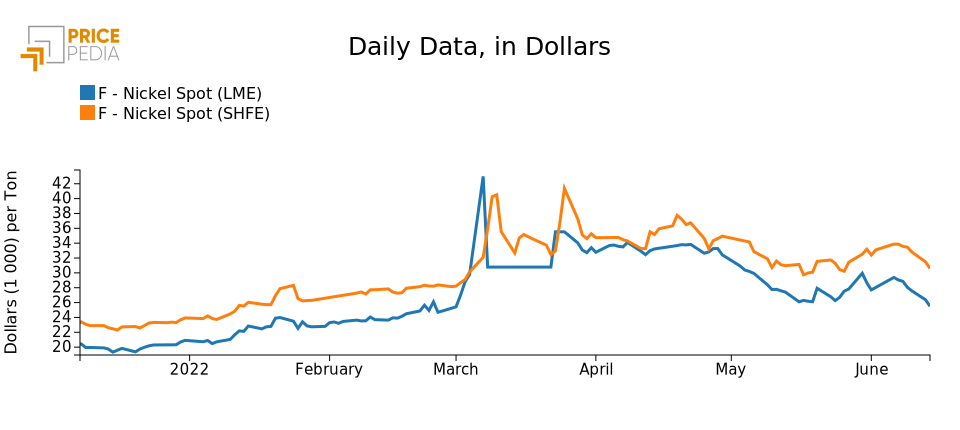

Fig. 2 Nickel prices at LME and SHFE (dollars per ton)

Analyzing this chart, a first sign of misalignment is seen on February 24th, where there is a small ripple in LME prices which does not correspond to any movement in SHFE prices. It is known that in the first days of the invasion, the financial markets had bet on a blitzkrieg. In the following days, the unexpected resistance of the Ukrainian army and population led to consider more and more probable the failure of the initial Russian plan and the continuation of the conflict for a not short period.

The day the markets took notice of this outlook is Monday 7 March. On that day, the price of gas at the Dutch TTF reached 217 euros / Mwh (see Fundamentals of the gas market). On the same day, the price of nickel on the LME reached $ 43,000 / mt, against a moderate growth of the metal on the SHFE.

But this was only the prelude to the chaos that engulfed the LME the next day. On Tuesday 8 March, in a few hours of negotiations, the price of nickel increased to exceed $ 100,000 per ton. At 12 noon, LME decided to suspend the market and cancel all previously made transactions.

Unfortunately, these prices are not present in the graph because, on the basis of the LME regulation, the "official" prices for all the days the market is closed are the same as those of the first day in which the market managed to form the price again. Beyond this technical choice, from the comparison between the prices recorded at the LME and the SHFE, it is evident that, during March and also April, the LME and SHFE financial markets were unable to construct a single price for nickel. The risks were so high as to discourage arbitrage transactions even when the price differential would suggested the possibility of obtaining very high earnings.

If you look at the chart carefully, even after May the alignment between the two prices is only partial.

In fact, in many days the prices of nickel in the two markets have moved in the opposite direction, signaling the persistence of a high degree of uncertainty.

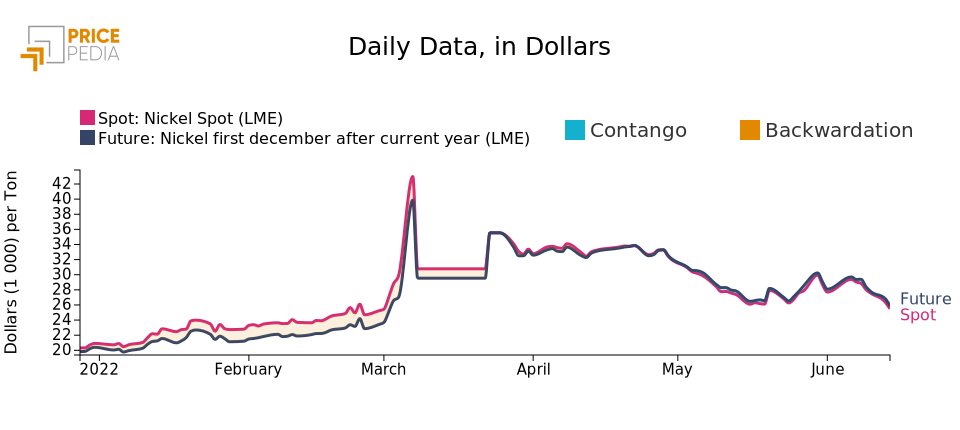

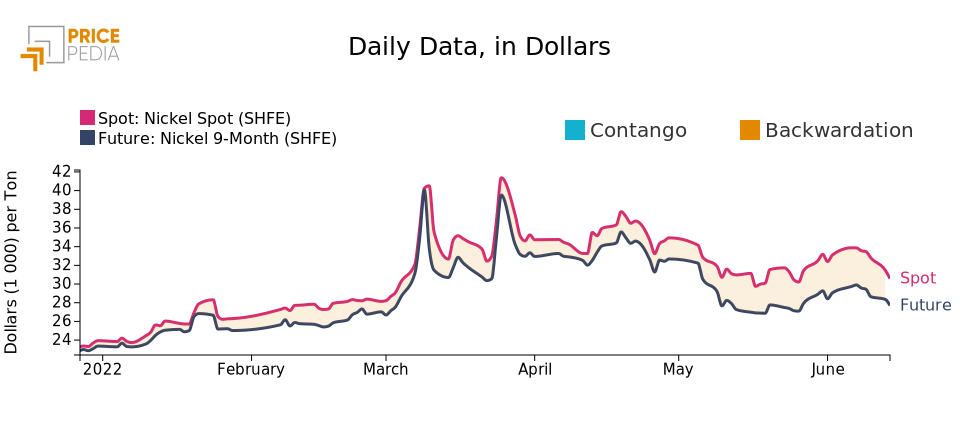

This uncertainty is heightened when comparing the maturity structure of nickel prices on the two exchanges. The two graphs below show the comparison between the spot nickel price and the price of a futures contract, nine months for the SHFE and December 2023 for the LME.

| LME | SHFE |

|

|

From the two graphs it is evident that, in the face of a weak contango at the LME, the nickel market presents a significant backwardation at the SHFE. This means a different opinion on the possible price dynamics in the near future between the operators of the two exchanges, but above all the absence of arbitrage operations capable of aligning prices for future maturities.

Conclusions

The analysis described in this article suggests a high sensitivity of the price of nickel listed on the LME and SHFE not only to market fundamentals but also to specific financial phenomena concerning the contractual arrangements between the various stock brokers, which have little to do with dealing with the fundamentals of supply, demand and costs of the real market. Companies that sell and buy physical nickel parts and need a reference benchmark for their transactions can, therefore, use the prices of the financial markets only with prudence and in situations of relative normality. In situations of greater uncertainty, precisely those in which a shared benchmark becomes particularly important, the financial markets, at least as regards the price of nickel, seem to be in great difficulty in building a single price.

The nickel market seems to have not yet overcome the evaluation contrast on the price outlook, between expectations of increases linked to the possible strong growth in demand for uses in electric batteries and possible falls caused by the use of class nickel in the production of batteries 2. In this situation of precarious equilibrium, only a "neutral" forecast of relative stability is possible, but bearing in mind that a high probability can be associated with both the growth and decline scenarios. However, it may be useful to point out that in the scenario published last April by the World Bank, the price of nickel in 2023 is forecast at $ 22,000 / mt, with a decrease of more than 20% compared to current levels.

It is evident that in this situation it is useful to continuously monitor both the spot and future prices of both the LME and SHFE markets, in order to capture any alignment phases that could anticipate the direction in which the world nickel market will move.

[1] In financial economics, an important concept is that of price discovery. With it we mean that process of interaction between agents that leads to the definition of a price that makes the offer equal to all those who, at that given price, are interested in selling, with the demand of all those who, always at that price, are interested in buying. Through this process, therefore, the market comes to define a single price which corresponds to an equality between supply and demand.