The price of lithium did not follow the sharp increases recorded by the prices of non-ferrous metals

The poor development of a financial market for lithium limits the effects on current prices of scenarios of strong increases in its demand

Published by Luigi Bidoia. .

Non Ferrous Metals Lithium Price DriversThe impact of energy transition projects on metal prices

One issue that has found wide coverage in the media around the world is the growing strategic importance of lithium, nickel and cobalt for the energy transition. These three metals are critical to the production of the lithium-ion batteries that exhibit the best yields. Expectations of strong increases in demand for nickel and cobalt have been reflected in their prices, which are relevant to the London Metal Exchange. Both prices have been oscillating for months at an all-time high, not only for short-term deliveries, but also for future ones, signaling that their high price is not supported by shortages of short-term material, but by evaluations on the equilibrium price of medium-long term, the result of the expected conditions of costs, supply and demand.

Conversely, for the price of lithium, the situation is more uncertain, since there are no “robust” financial quotations for its price.

In June 2019, the LME entered into a collaboration with the PRA (price reporting agency) Fastmarkets to develop a future market that can be a reference point for lithium prices. To date, this project is only partial and the exchanges of futures contracts[1] are very limited, certainly not sufficient to give depth to the market. In fact, the prices of futures contracts are equal to those defined weekly by the average price of CIF imports of China, Japan and Korea of lithium hydroxide monohydrate 56.5% LiOH.H2O min, found by Fastmarkets. However, imports of this specific type of lithium do not always have significant volumes, creating the conditions for an arbitrary definition of their price.

The bottom line is that there is still no future listed on a financial market capable of driving lithium prices on real markets, unlike many other non-ferrous metals.

The benchmark represented by financial prices

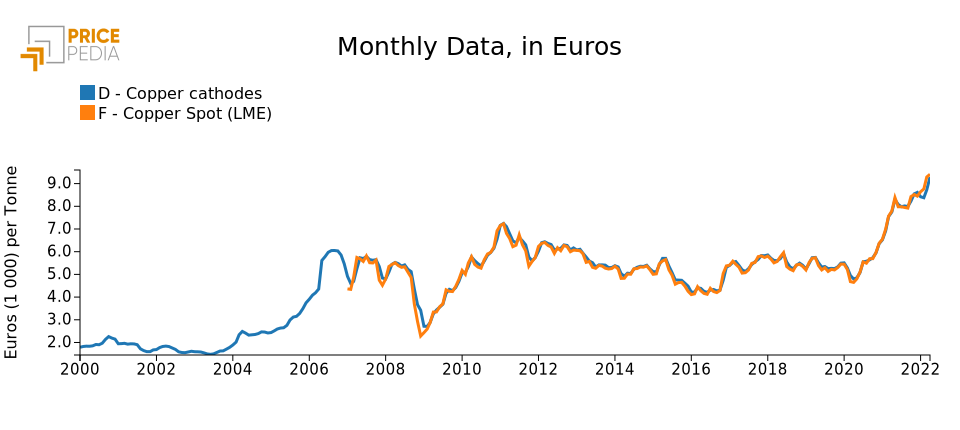

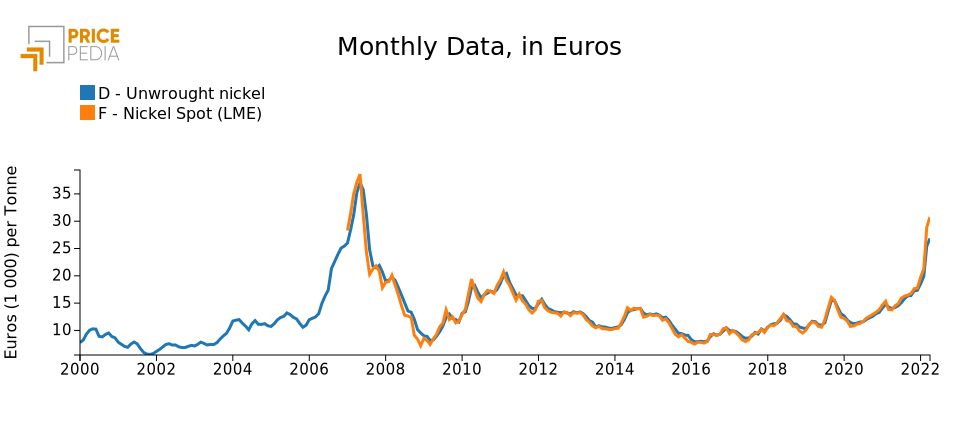

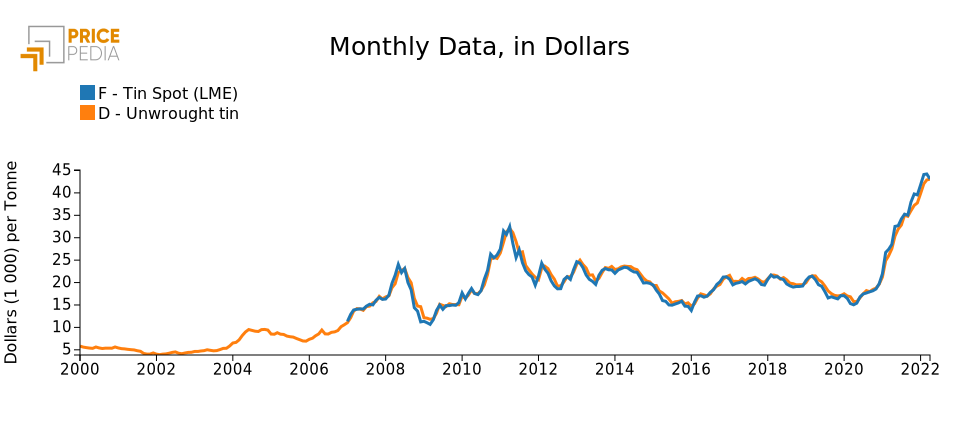

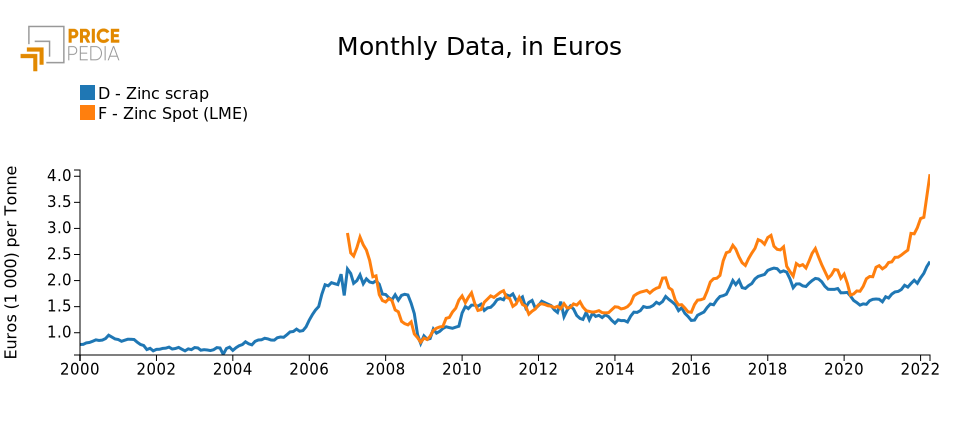

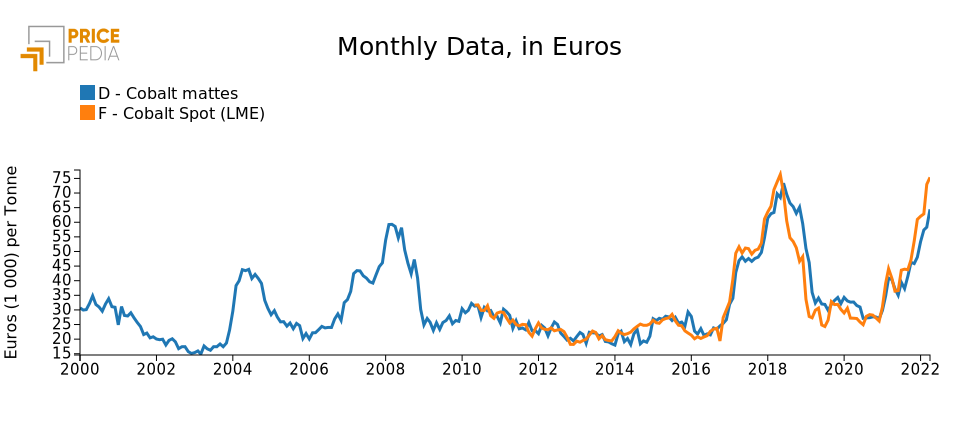

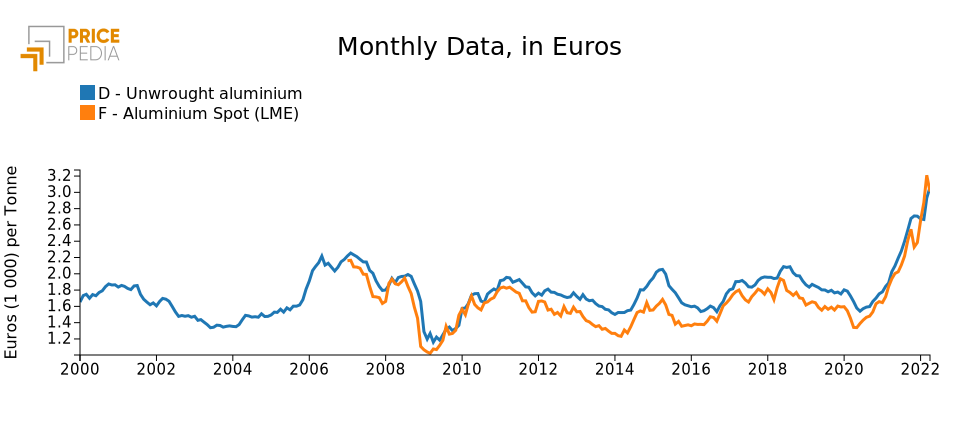

The following six graphs compare the LME spot financial prices and the customs prices of 6 non-ferrous metals.

Non-ferrous metal price (euro per ton)

| Copper | Nickel |

|

|

| Tin | Zinc |

|

|

| Cobalt | Aluminum |

|

|

From the analysis of these graphs it is evident that for copper, nickel and tin, the prices of spot contracts at the LME are almost perfect benchmarks of real prices, detected through customs flows.

A little less perfect is the relationship for zinc and cobalt. For aluminum, the relationship is high only in terms of dynamics, while the level of prices at the LME is on average 10% lower than the price recorded at customs.

Overall, there is no doubt that LME quotes play the role of benchmarking real-market trading for the price of many metals. This is not true, however, in the case of lithium.

The case of the price of lithium

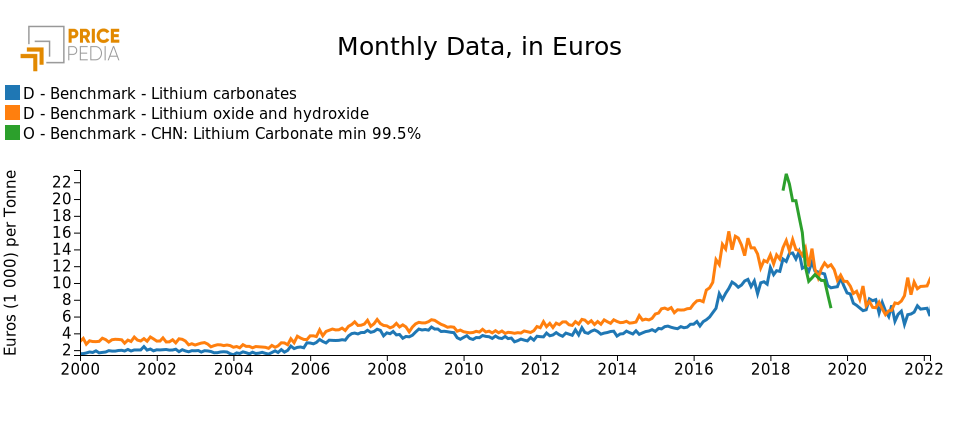

The following graph shows the customs prices of lithium traded in the form of carbonate and in the form of oxide and hydroxide.

The graph also shows the Chinese ex-factory price of lithium carbonate with a purity of more than 99.5%, as measured by Fastmarket between May 2018 and June 2019.

The analysis of this graph reports the following facts:

- the data of lithium carbonate and lithium hydroxide from customs sources are aligned with each other in dynamics and consistent in levels. In fact, lithium carbonate is produced by calcination from minerals containing lithium. Subsequently this is transformed into lithium hydroxide, to be used, with adequate purity, in the production of the cathodes of lithium-ion batteries;

- from mid-2018 to the end of 2020, the price of lithium has registered a significant decrease which disproves the hypothesis of a continuous growth trend in the price of lithium since lithium-ion technology has become the most used in the battery production;

- customs data also seem to deny the existence of a phase of strong price growth during 2021-2022. Indeed, the two lithium prices recorded significant increases, but far lower than those recorded by other non-ferrous metals.

Conclusions

Lithium is certainly a metal whose demand will be very sustained by the expected energy transactions. However, its current prices, unlike the prices of cobalt and especially nickel, mainly reflect the current conditions of supply and demand, rather than the expected scenarios, linked to the future energy transaction. In the absence of a financial market that quotes the price of lithium, also reflecting the expected future market conditions, the forecast scenarios of strong increases in the demand for lithium, supported by the energy transition, seem to affect only marginally the prices of current real transactions between sector operators.

This observation is consistent with the results of many analyzes on the financialization of commodities which indicate the strong role of financial markets in discounting, in current prices, the tensions that operators fear may arise in the future. In the absence of a financial market, the prices of raw materials tend to reflect mainly, if not exclusively, the contingent conditions of costs, supply and demand.

[1] The characteristic of futures contracts, unlike forward contracts, is their high degree of standardization necessary for the contract to be traded on a regulated market. However, this standardization is made difficult by the different degrees with which lithium is traded in over the counter (OTC) markets, directly between operators in the sector.