Recycling and commodity risk

The circular economy is becoming an increasingly important source of raw materials

Published by Luca Sazzini. .

Ferrous Metals Non Ferrous Metals Analysis tools and methodologiesThe raw material shock of the 2021-22 biennium has brought the relative risk to the center of attention for institutions and businesses, understood both as price increases and as material shortages.

Simultaneously, increasing attention has been paid to the circular economy as a new model of economic development that surpasses the currently dominant linear economy. One of the objectives of the circular economy is to contribute to solving the scarcity of raw materials and the volatility of their prices.

In this article, after briefly describing the characteristics of the circular economy, we will develop some analyses that can help us measure in which commodity markets it is already possible to observe a "circular economy" effect.

The Circular Economy

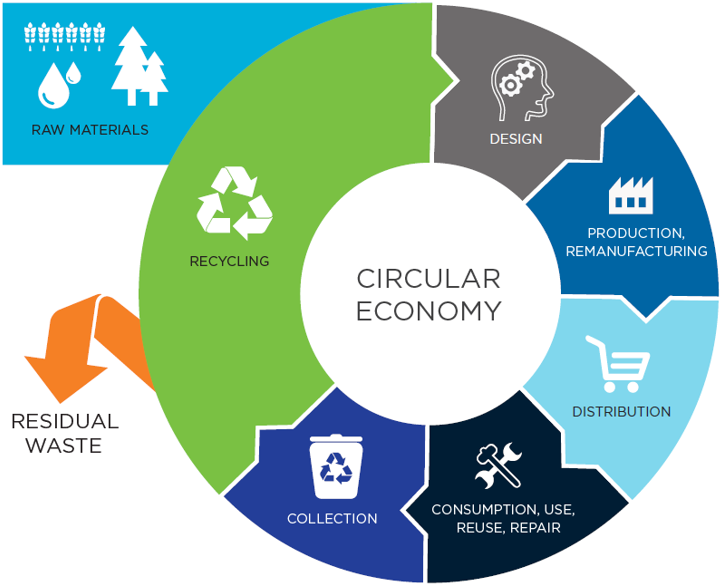

The following image depicts the representation commonly used to describe the different phases of the circular economy.

Circular Economy

In a nutshell, the various phases of the circular economy involve:

- Design: designing durable, repairable, and easily dismantled products for material recycling.

- Production and manufacturing: promoting efficient processes that minimize resource consumption and waste emissions.

- Distribution: optimizing logistics and reducing carbon emissions associated with product transportation.

- Consumption, use, reuse, and repair: increasing product maintenance and repair to extend their "useful life".

- Collection: maximizing the separate collection of urban and industrial products.

- Recycling: processing recyclable materials to reuse them as raw materials for new products.

From the perspective of the effects the circular economy can have on commodity markets, it is useful to distinguish three aspects of this circularity:

- Industrial waste obtained from processing raw materials;

- Recyclable goods: products that, at the end of their life cycle, can be transformed into recycled commodities;

- Recycled commodities or secondary commodities: commodities obtained from the recycling phase.

From an employment perspective, industrial waste and recycled commodities can be seen as substitutes. However, their potential to replace virgin raw materials differs significantly depending on the specific commodity. This substitution capacity varies considerably, reaching high peaks for precious metals such as gold and silver, while it decreases significantly for materials like wood.

One way to measure how the circular economy is impacting commodity markets is to measure:

- The different price levels of recycled commodities and virgin commodities;

- The degree of correlation of the prices of the two commodities.

The more similar the price levels and the higher their correlation, the greater their substitutability.

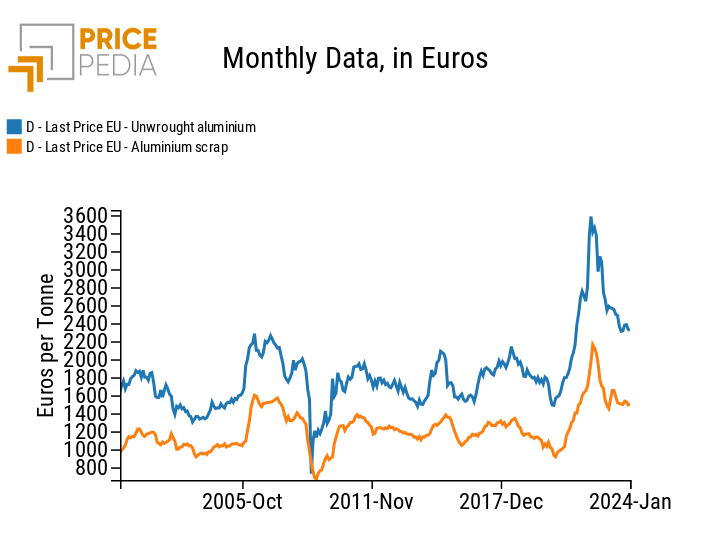

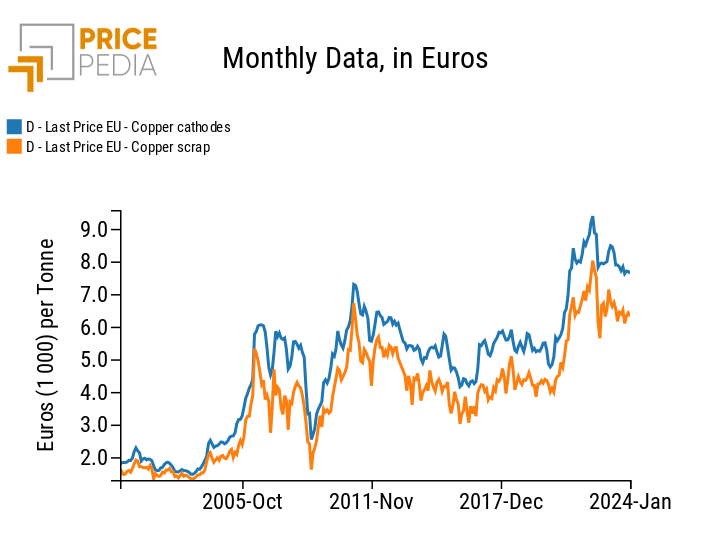

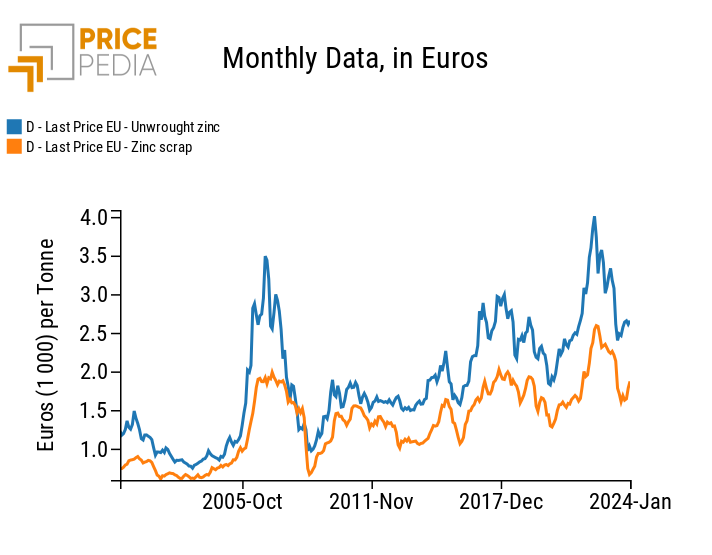

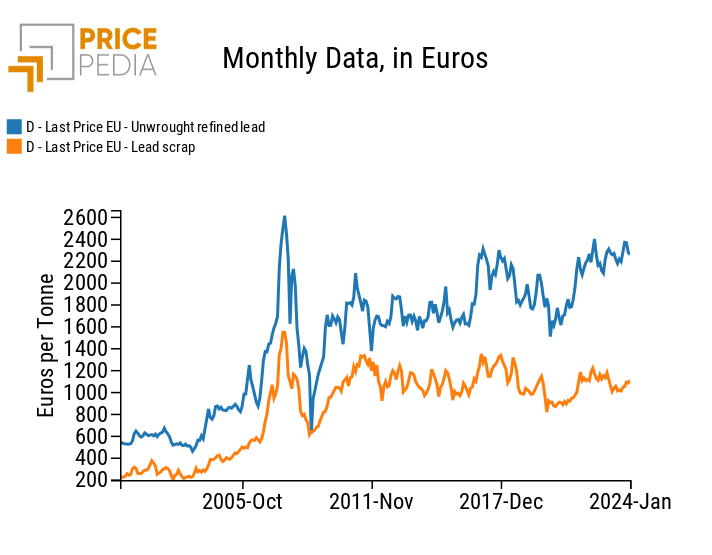

Below is a comparison between the price of recycled commodities and that of virgin commodities for eight different cases.

| Comparison between recycled commodity and virgin commodity | |

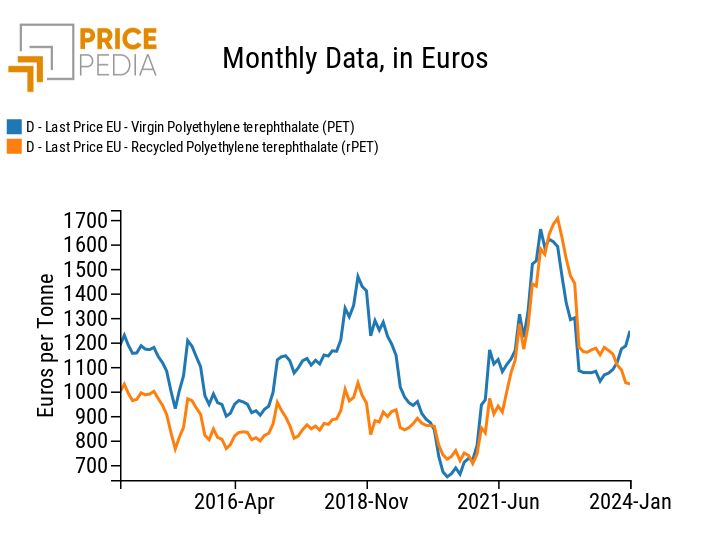

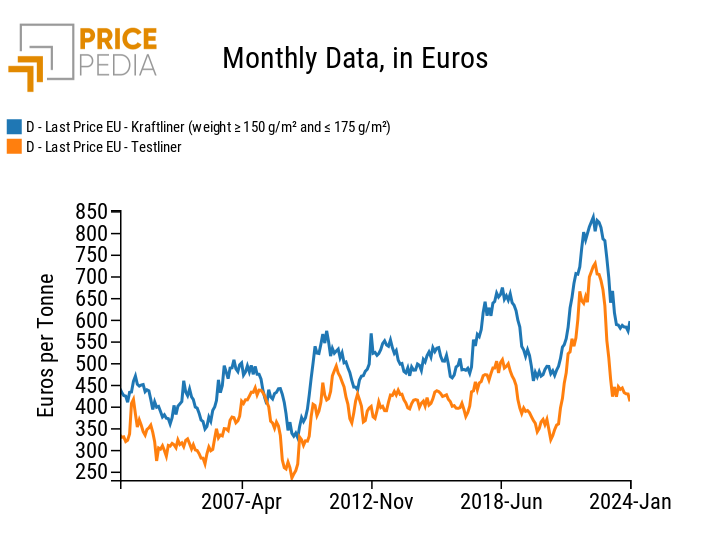

| PET | Kraft |

|

|

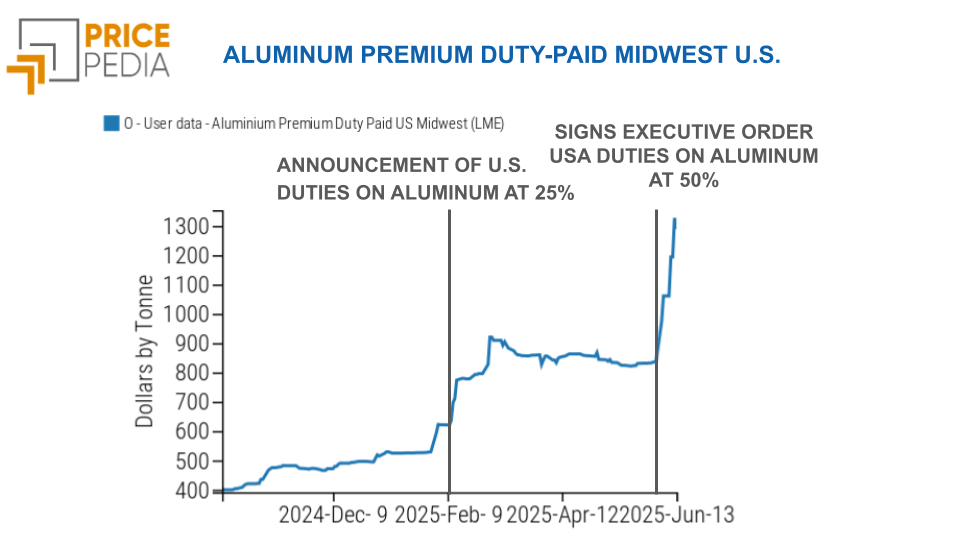

| Aluminium | Copper |

|

|

| Zinc | Lead |

|

|

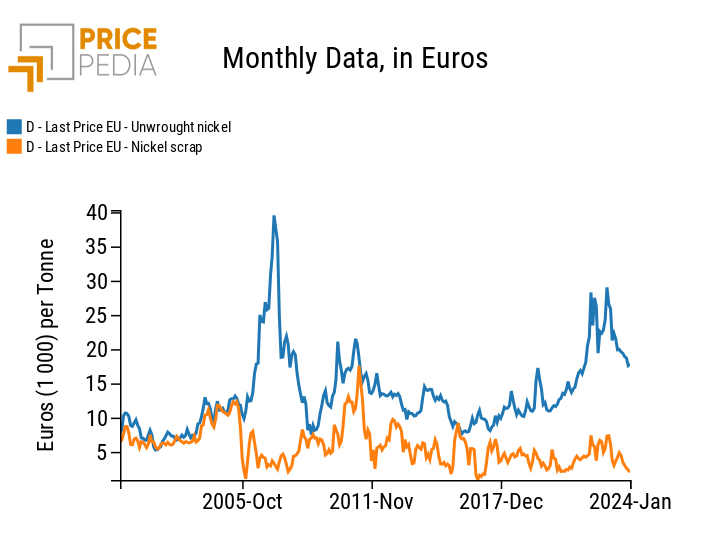

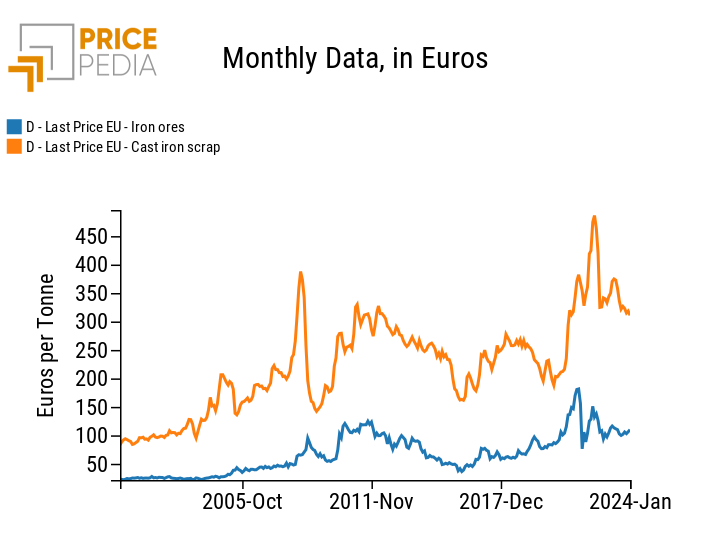

| Nickel | Iron ores |

|

|

From the analysis of these graphs, a high degree of substitutability emerges for: PET, kraftliner, aluminum, copper, and zinc. Conversely, substitutability is limited for nickel and iron ores. Lead is instead in an intermediate position.

Since the production costs of recycled commodities are generally lower, the substitutability effect between the two types of commodities results, for 5 out of the 8 analyzed raw materials, in a price of the virgin commodity lower than what would be in the absence of the recycled commodity.

Similarly, if the percentage of recycled commodity is high, for 5 of the 8 commodities analyzed, the existence of the recycled commodity significantly reduces the risk of material shortage.

An interesting case is that of PET, where the price of recycled PET has surpassed in some months the price of virgin PET under the push of an "environmental" demand for the use of recycled raw materials.

Conclusions

The raw material risk can find within the recycling economy a mitigation, through the substitution of virgin commodities with the corresponding recycled ones. The comparison between the prices of a virgin commodity and those of the recycled commodity signals an important substitution effect for many of the analyzed raw materials, which include: pet, kraftliner, aluminium, copper, and zinc.

This substitutability between the recycling market and the virgin market does not appear for other commodities such as: nickel and iron ores.

The challenge of the circular economy is to try to increase this substitutability as much as possible within the entire commodity market in order to better exploit the resources at our disposal.