Bearish week for commodities amid speculative liquidations and a strengthening dollar

Profit-taking in the industrial metals market after the collapse of precious metals

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekThis week, commodity prices followed a downward trend, supported by the strengthening of the US dollar following the appointment of the next Federal Reserve Chairman, Kevin Warsh, known for his historically hawkish stance on monetary policy.

Among energy products, both oil and natural gas experienced declines.

Brent opened the week with a 5% drop on Monday, February 2, following news of new talks between the United States and Iran, which began on Friday, increasing the likelihood of an agreement and reducing the geopolitical risk premium. In the following days, prices remained volatile, with some fluctuations due to the re-emergence of geopolitical tensions: the United States shot down an Iranian drone near an aircraft carrier, while the head of Iran's Islamic Revolution threatened to seize an American tanker in the Strait of Hormuz. Despite these events, President Trump confirmed that negotiations are still ongoing, reassuring the markets.

On the trade front, it seems a new compromise has been reached between the United States and India, with India halting purchases of Russian oil and the US reducing tariffs on Indian products from 25% to 18%, also removing the additional 25% punitive tariff previously imposed as a penalty related to Russian oil purchases. The announcement of a potential halt to Indian imports of Russian oil, combined with the recent drop in US oil inventories caused by damage to energy infrastructure from recent winter storms, helped mitigate the price decline during the week.

In the natural gas market, the price decline that began at the end of last week continued, supported by forecasts of milder-than-normal temperatures over large areas of the United States and relatively mild weather in Europe. This led to a significant drop in the US Henry Hub natural gas price, followed by the European TTF Netherlands price, despite still limited European inventories.

Precious metals prices, after last Friday’s crash, remained essentially at the same levels, though showing strong volatility. Despite recent gains in gold and silver being linked to economic fundamentals, such as increased demand in a macroeconomic context of high uncertainty and continued gold purchases by central banks, it is evident that a speculative component also contributed to the continuous new historical highs and sudden spikes. Last Friday, in fact, gold and silver recorded losses of 11% and over 30%, respectively, following the announcement of the new Federal Reserve Chairman.

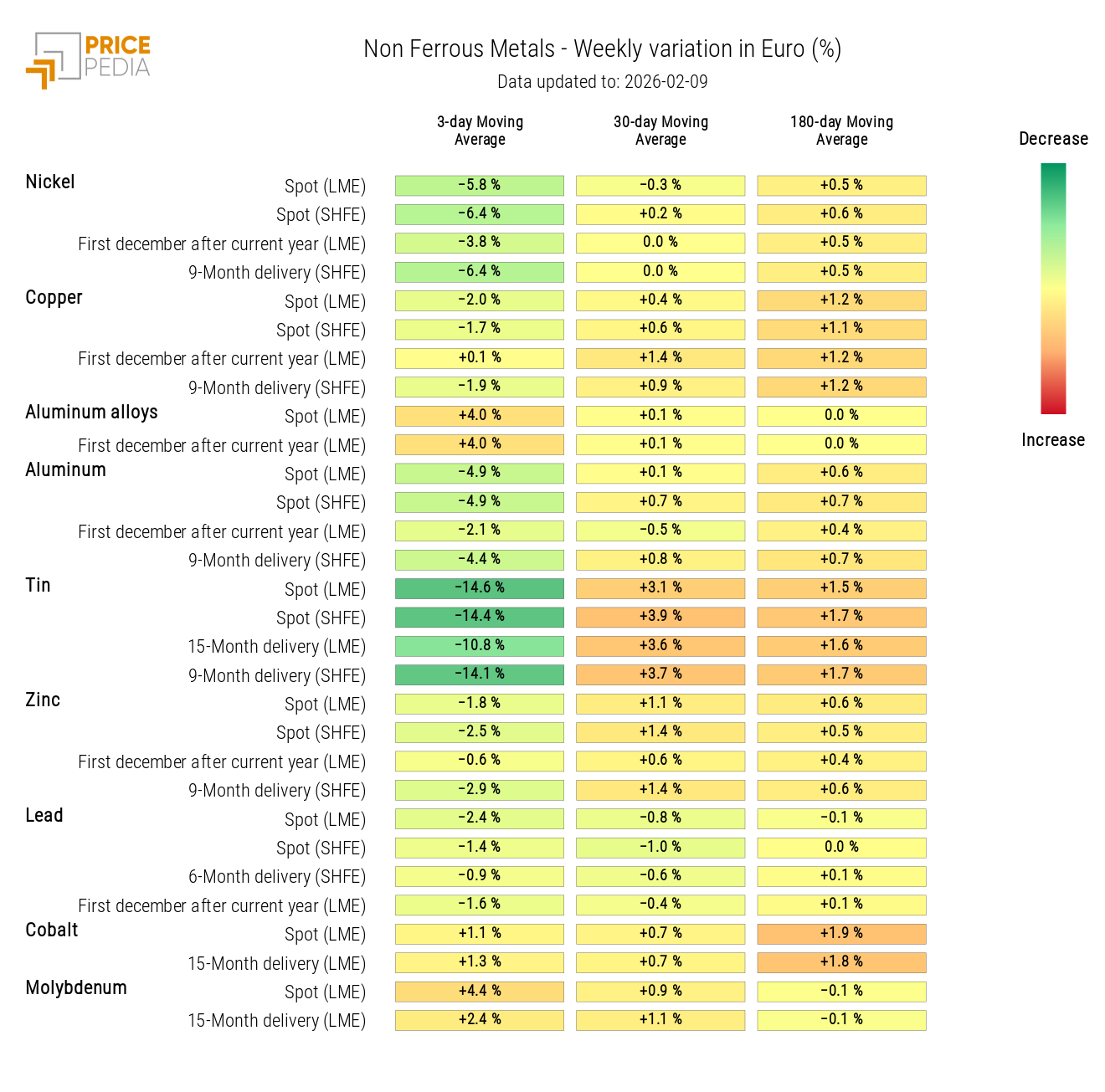

The industrial metals sector saw significant price declines, particularly among non-ferrous metals. Tin was the metal with the largest weekly drop in absolute terms, returning to $45,845/ton, with a -15% change compared to the previous Friday. Although recent tin gains were supported by declining stocks and concerns about a potential drop in Indonesian supply, they were also influenced by a speculative component. As reported in the article “Tin price forecast”, analysts agree that the bullish trend for tin is expected to pause during 2026-2027, partly due to the recovery of supply from Indonesia.

Regarding ferrous metals, prices fell in China, particularly for iron ore and stainless steel coils, while in Europe they remained relatively stable.

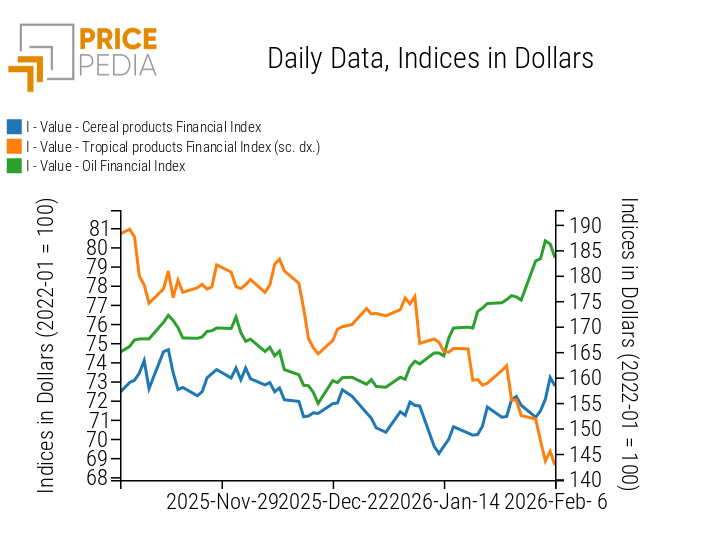

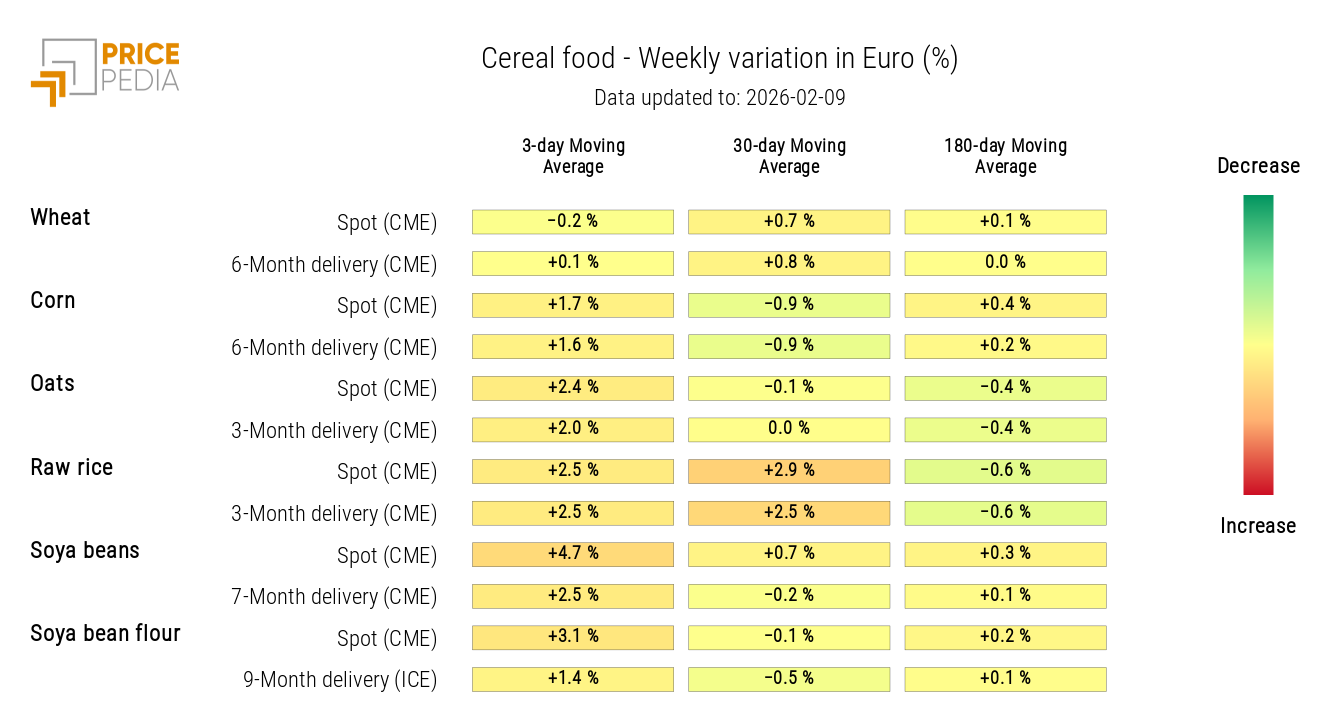

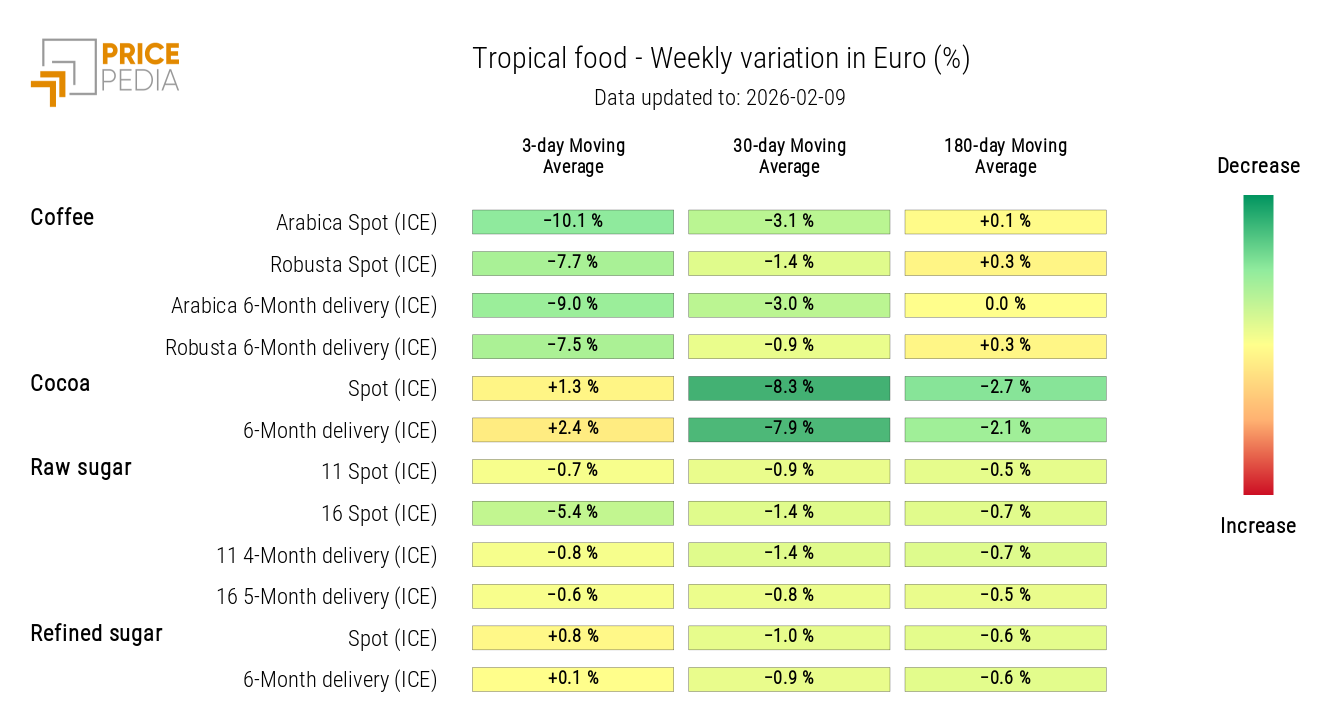

In the food commodities sector, there was a significant weekly decline in coffee prices, supported by prospects of a more abundant global supply, thanks to expected rainfall in Brazil that should favor higher production in 2026. Conversely, weekly increases were observed in the financial prices of cereals and edible oils.

ECB Monetary Policy

This week, the European Central Bank (ECB) left interest rates unchanged, in line with analysts' expectations.

Euro area inflation data showed a further decline in January, at around 1.7% y/y, below the official 2% target, although the ECB considers this partly temporary and related to energy base effects.

Financial markets had largely priced in this monetary policy pause, in light of a gradual cyclical slowdown but an overall resilient macroeconomic backdrop. In the short term, expectations remain oriented towards a period of rate stability, with limited signals in favor of imminent monetary easing.

NUMERICAL APPENDIX

ENERGY

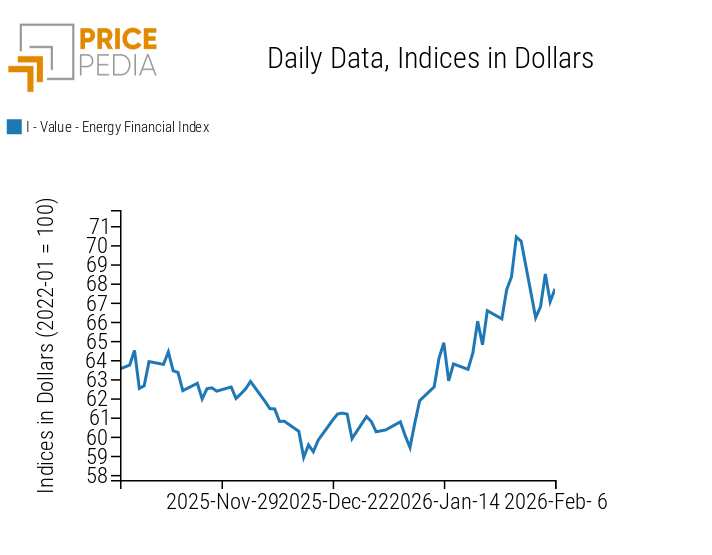

The PricePedia financial index for energy registered a significant decline at the start of the week, before stabilizing somewhat.

PricePedia Financial Index of Energy Prices in Dollars

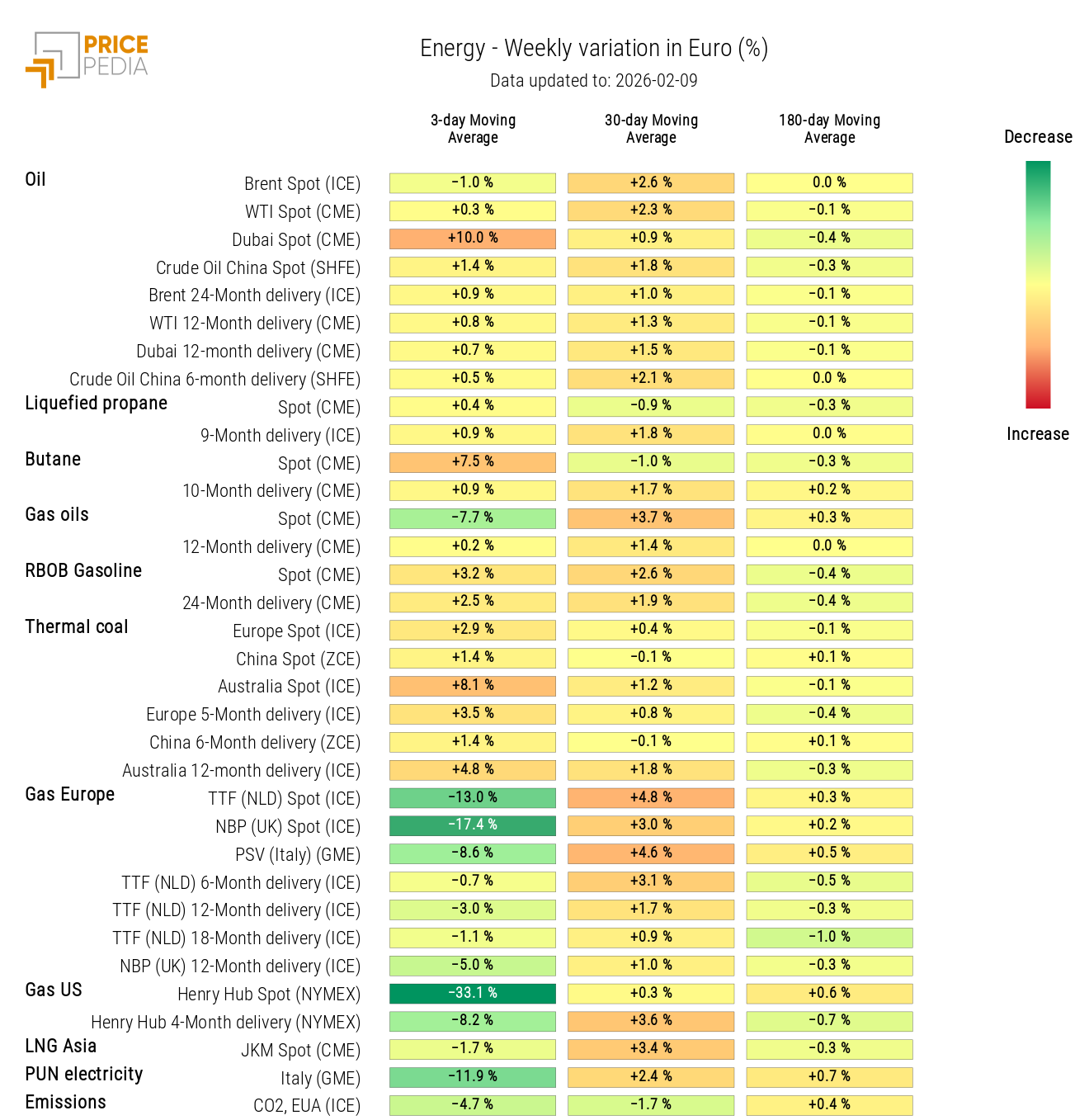

Analysis of the energy heatmap shows a collapse in financial natural gas prices in both the United States and Europe.

HeatMap of Energy Prices in Euros

PRECIOUS METALS

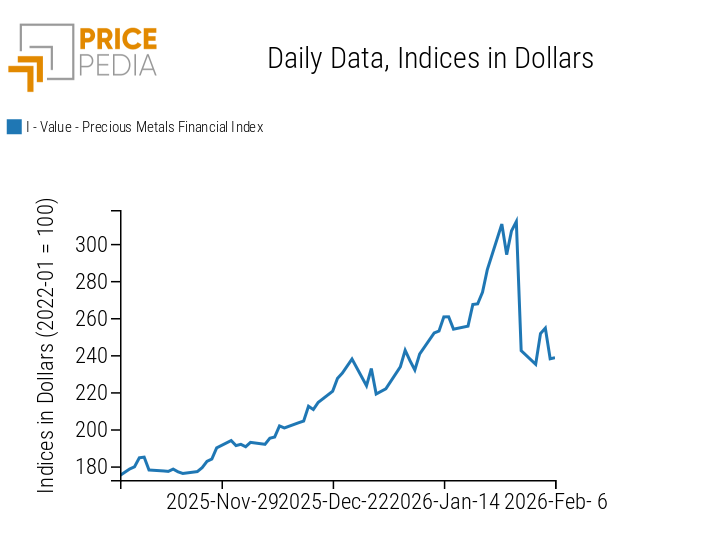

After last Friday’s sharp correction, the precious metals financial index stabilized, with mixed price movements.

PricePedia Financial Index of Precious Metals Prices in Dollars

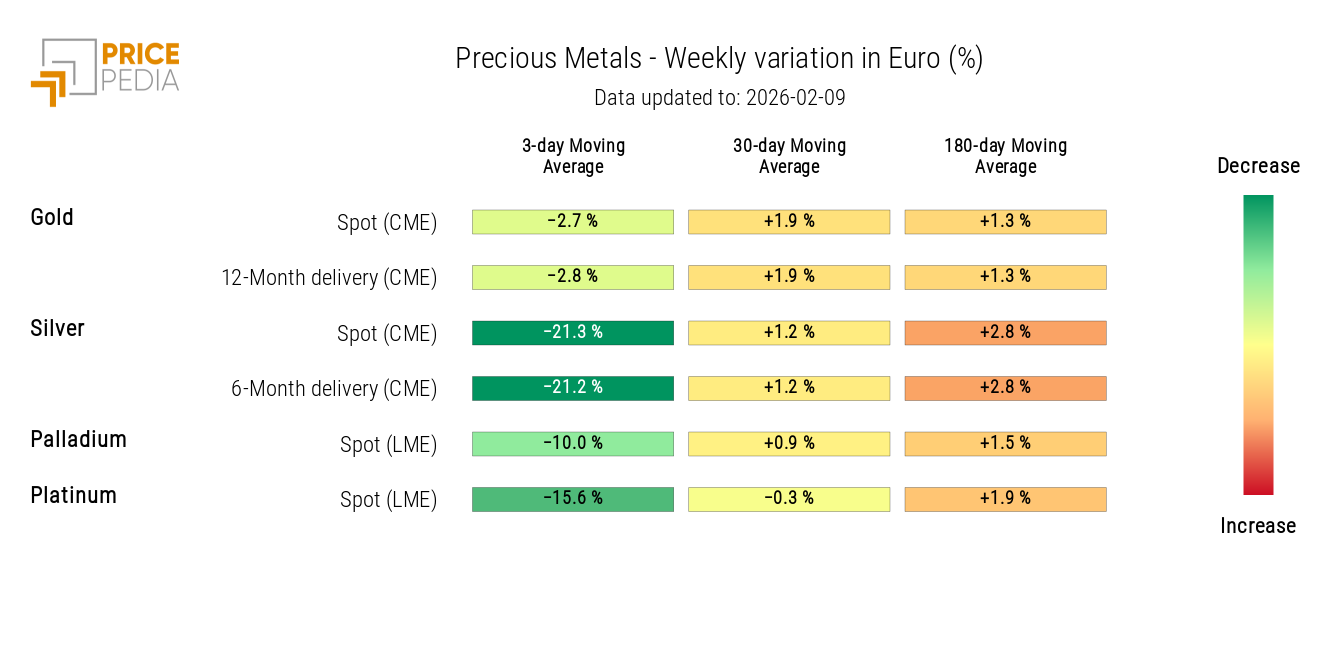

The precious metals heatmap turned green, indicating a generalized decline, especially for silver and platinum.

HeatMap of Precious Metals Prices in Euros

FERROUS METALS

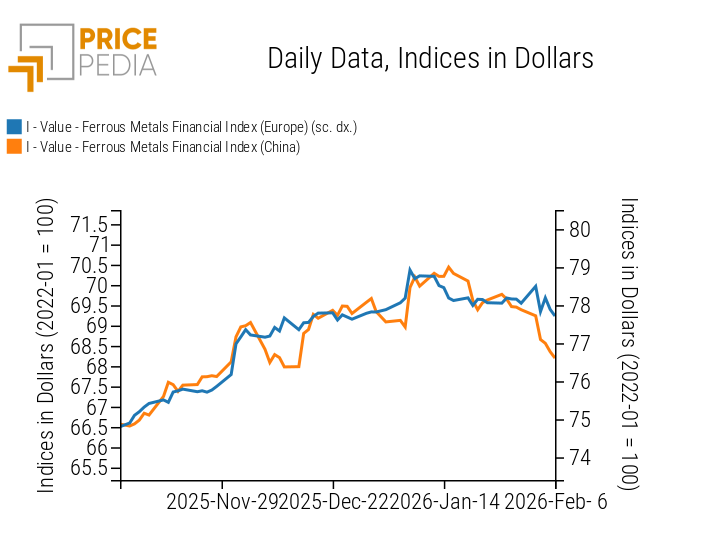

The China ferrous metals index registered a price decline, while the Europe index remained relatively stable.

PricePedia Financial Indices of Ferrous Metals Prices in Dollars

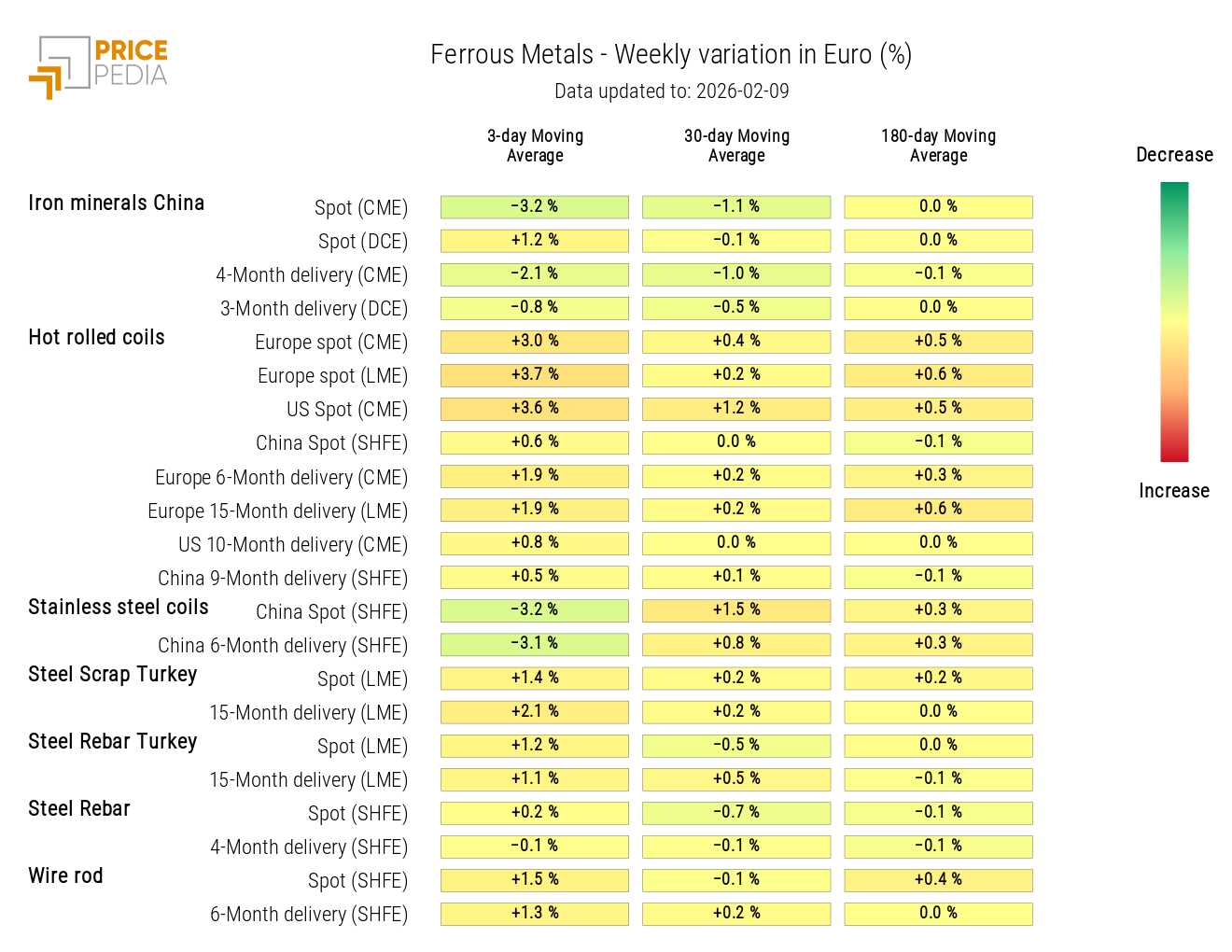

Heatmap analysis highlights the decline in Chinese prices of iron ore and stainless steel coils.

HeatMap of Ferrous Metals Prices in Euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

NON-FERROUS INDUSTRIAL METALS

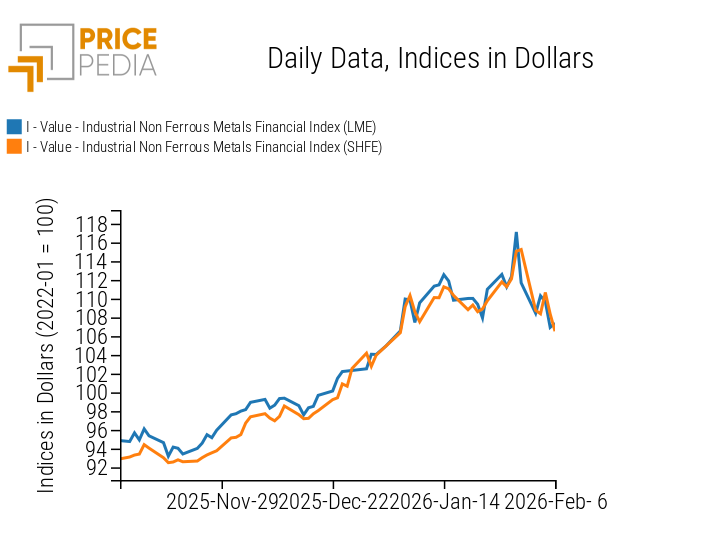

On a weekly basis, both indices for non-ferrous industrial metals reversed their trend, experiencing price declines.

PricePedia Financial Indices of Non-Ferrous Industrial Metals Prices in Dollars

The non-ferrous metals heatmap highlights significant price declines for tin, nickel, and aluminum.

HeatMap of Non-Ferrous Metals Prices in Euros

FOOD COMMODITIES

The tropical products index continued its price decline, while cereals and edible oils prices increased.

PricePedia Financial Indices of Food Prices in Dollars

CEREALS

The cereals heatmap shows a generalized weekly price increase.

HeatMap of Cereals Prices in Euros

TROPICAL PRODUCTS

The tropical products heatmap shows a weekly decline in the 3-day moving average of coffee prices.

HeatMap of Tropical Food Prices in Euros

OILS

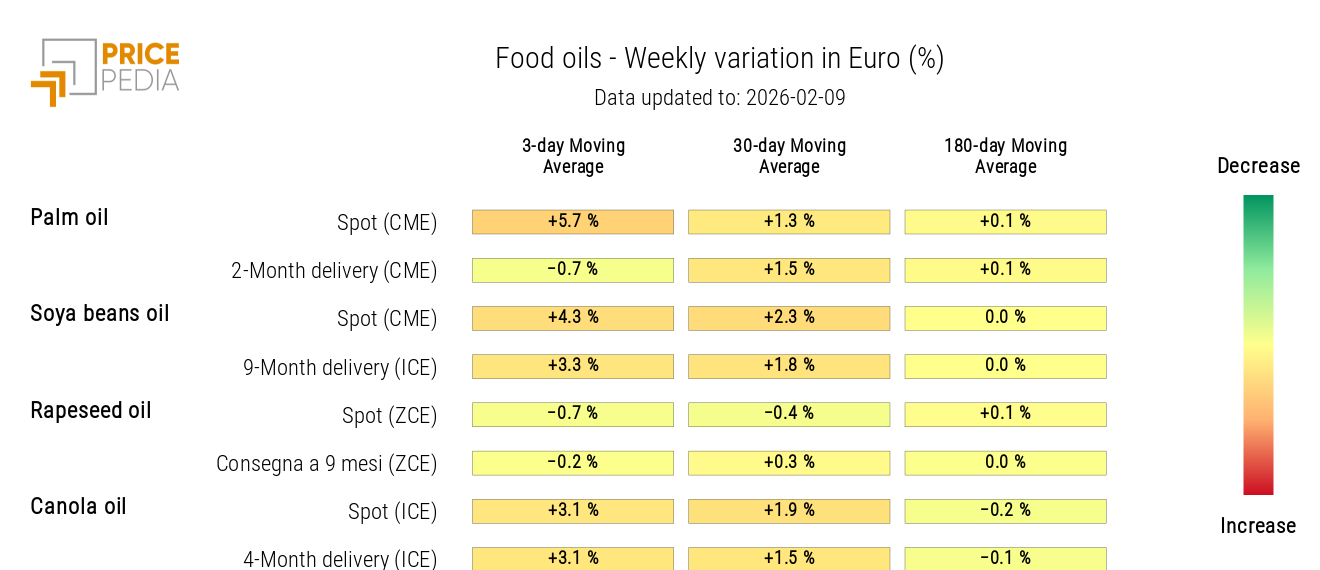

The edible oils heatmap shows price increases for palm oil, soybean oil, and canola oil.

HeatMap of Edible Oils Prices in Euros