Tungsten, antimony and silver: what do they have in common?

Chinese Export Restrictions Send Global Prices Soaring

Published by Luigi Bidoia. .

Precious Metals Antimony Critical raw materials

One of the first actions taken by the Trump administration, immediately after taking office at the White House, was the launch of a trade war with China. Among the retaliatory measures implemented by Chinese industry in the following days was the restriction of exports of several strategic metals used in the defense industry, electronics, and the renewable energy sector. These metals include tungsten, antimony, and silver.

All three metals are classified as critical by the European Commission[1] and are characterized by a strong concentration of international supply in the hands of China. In 2024, prior to the introduction of export restrictions, China’s share of global trade was close to 50% for antimony oxide, above 30% for tungsten, and around 15% for silver.

Effects of the Restrictions on Chinese and European Prices

One year after the introduction of the restrictions, it is now possible to assess their impact on Chinese FOB export prices and on intra-EU transaction prices. A comparative analysis of these dynamics makes it possible to understand whether, and to what extent, supply limitations have triggered tensions in international markets and transmitted inflationary pressures along European industrial value chains.

The Antimony Case

The case of antimony is undoubtedly the most striking. In a global market already under significant tension, Chinese export restrictions resulted in a sharp decline in China’s export volumes and an exceptional surge in international prices, as described in the article Antimony Market on Fire and as confirmed by the latest data on Chinese and EU prices.

Antimony: some price benchmarks

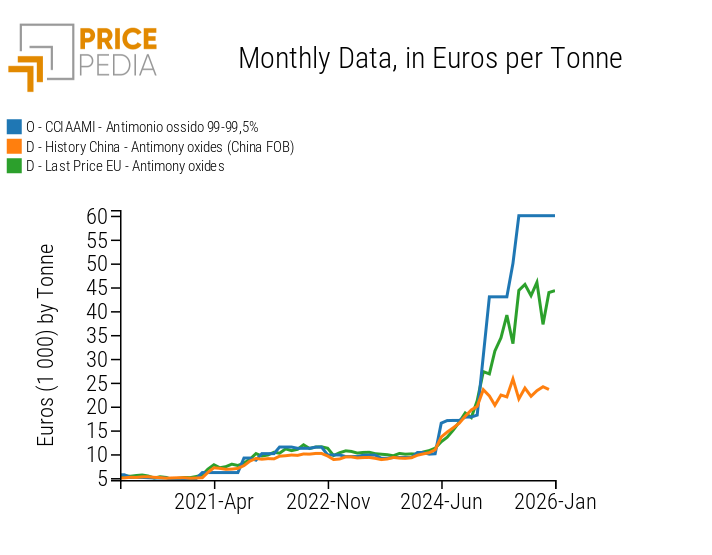

The chart above compares Chinese FOB export prices for antimony oxide with the corresponding prices recorded in intra-EU transactions and those published by the Industrial Chemical Products Price Commission of the Milan Chamber of Commerce.

As clearly shown, price tensions already originated in the Chinese market in 2024 and were rapidly transmitted to European ex-works prices — which can be considered comparable to intra-EU transaction prices — and to distribution prices recorded by the Milan Chamber of Commerce. In 2025, Chinese export prices increased only moderately; by contrast, in response to the export restrictions, European ex-works prices literally skyrocketed, rising well above 40,000 euros per ton. Distribution prices increased even more, reaching 60,000 euros per ton.

Considering that, for all three benchmarks analyzed, antimony oxide prices had been only slightly above 5,000 euros per ton before the escalation, the magnitude of the increase across different markets and stages of the distribution chain becomes fully evident.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The Case of Silver

Following the inauguration of the second Trump administration, financial markets experienced a sharp increase in uncertainty, prompting many investors to seek safe-haven assets capable of preserving the value of their portfolios. The result was a strong rise in precious metal prices, from which silver benefited significantly.

However, silver is not only a precious metal. In recent years, it has increased its importance as an industrial metal, particularly in applications related to the production of solar panels. Silver is in fact an essential material for all silicon-based photovoltaic technologies, which account for 97% of the global photovoltaic market. The amount used per cell is measured in milligrams, yet there are currently no truly viable substitutes.

An indication of how much Chinese export restrictions may have affected the global price of the metal can be obtained by comparing the financial price performance of silver with that of gold, both traded on the Chicago Mercantile Exchange (CME). Since the beginning of 2025, the price of silver has increased by 123%, compared with a 59% rise in gold prices. This stronger growth in silver prices represents an anomaly within the precious metals segment.

Over the long term, it is generally gold that records the largest increases. In this century, for example, the price of gold has risen by approximately 12 times, while silver has increased by “only” 9 times.

The Case of Tungsten

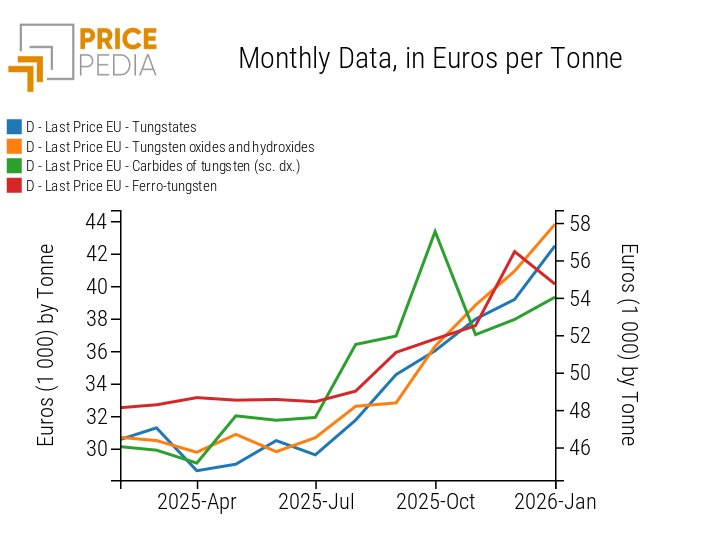

In the first months following the introduction of Chinese export restrictions, FOB prices for Chinese tungsten exports remained relatively stable, suggesting an initial phase in which the market absorbed the new measures. The first signs of upward pressure, however, emerged toward the end of last summer.

Between August and December 2025, Chinese export prices for tungstates, oxides, hydroxides, and tungsten carbides increased within a range of 30% to 60%, depending on the specific product category. The impact of these increases on intra-EU prices becomes evident when analyzing the chart below, which highlights the gradual transmission of price tensions to the European market as well.

Tungsten: price increases on the EU market

Recently, reports have circulated of sharp increases in tungsten prices on the Chinese market in January. However, to obtain more precise information through FOB export price data, it will be necessary to wait until March 20, as the Chinese government will not publish February data due to the Chinese New Year holiday.

Conclusions

During 2025, commodity financial markets began to price in a regime shift in international raw material trade, triggered by the new foreign policy launched by the second Trump administration. When supply becomes uncertain, the first response by downstream firms is often to increase inventory levels for precautionary purposes.

If stockpiling is also driven by speculative motives aimed at anticipating possible price increases, the resulting surge in demand can be strong enough to generate exceptional price spikes. This is what occurred, for example, during the crisis of 2022, when a significant share of the extraordinary rise in EU commodity prices was linked to “overbought”[1] behavior by many user industries.

Similar dynamics emerged last year, limited in number but lacking in impact. Once again, tensions originated in the Chinese market. In 2021-2022, it was the lockdowns imposed by the country that disrupted normal trade flows to foreign markets.

In 2025, tensions are generated by restrictions on exports of certain metals, introduced in response to the trade war launched by the Trump administration.

For some commodities, the price effects have been particularly intense. The most striking case has been antimony. A second extraordinary episode has involved silver. Another case, whose effects became visible at the end of 2025 and may continue into the first months of 2026, is tungsten.

The lesson that emerges from the commodity markets is one of growing instability, in which, faced with possible supply constraints, demand may accelerate not because of fundamentals, but because of genuine “overbought” dynamics, with potentially disruptive effects on prices.

[1] “Overbought” is a financial term used to describe a situation in which the price of an asset has been pushed upward by massive purchases not linked to normal demand conditions, but driven by attempts to anticipate expected price increases.