Raw material costs and prices in the furniture industry

After the 2021-2022 surge, raw materials have reduced their impact on the sector. What should procurement expect in 2026-2027?

Published by Pasquale Marzano. .

Forecast Analysis tools and methodologies

The cycle of extreme commodity price volatility recorded between 2021 and 2023 represented one of the most severe cost shocks of the past decades for European manufacturing. The furniture industry was no exception. Although raw materials historically account for a non-dominant share of total costs, lower than services and labor, they had a significant impact in 2021-2022 due to sharp price fluctuations in the European market, as illustrated in the article Commodity prices and their impact on the furniture industry.

For the sector, the decline in commodity prices during 2024-2025 reduced their incidence on total costs, likely allowing for a gradual margin adjustment after the compression observed in the previous phase.

Given the significant role that direct and indirect raw material costs have played in recent years, it is useful for procurement professionals to assess how they are expected to affect total sector costs over the next two years.

Commodity price outlook for the furniture industry

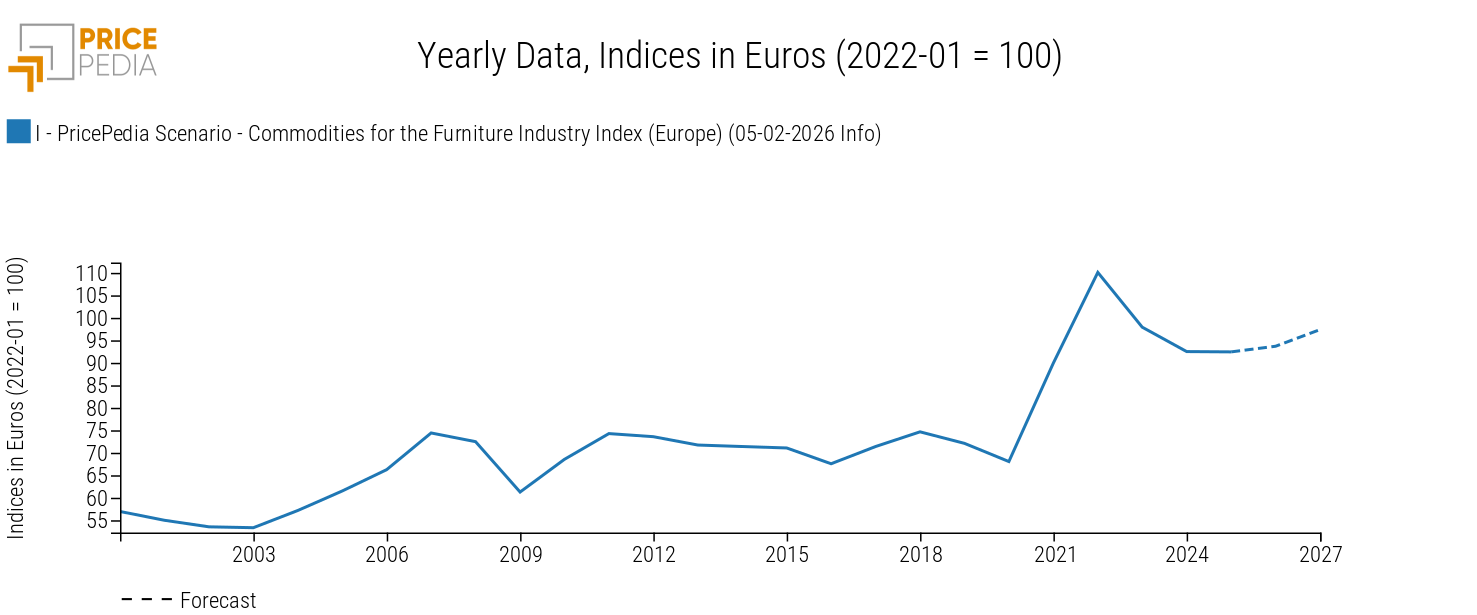

The chart below shows the historical and forecast dynamics of material costs for European furniture manufacturers[1]. The index is built by aggregating the prices of more than 100 industrial raw materials, excluding the energy component.

Forecast of the Commodity Index for the Furniture Industry

The chart clearly highlights the exceptional dynamics observed in 2021-2022, when prices reached levels approximately +50% above the 2019 average. Although prices declined thereafter, this did not imply a return to previous conditions: quotations stabilized at levels still more than +30% above the 2010-2019 decade average.

Over the next two years, prices are expected to resume moderate growth, with an average annual increase of about +2.6%, consistent with the broader trend described in the February 2026 scenario.

Production costs versus selling prices

Based on the projected dynamics of commodity prices for the furniture industry and the outlook for energy raw materials described in the February 2026 scenario, it is possible to estimate the total raw material cost incidence for the sector over the next two years.

For analytical purposes, it is also useful to compare this cost incidence with the projected evolution of EU producer prices for furniture manufacturing, which reflect the selling prices applied by European manufacturers. These price forecasts have been estimated through an econometric model based on the sector's cost structure. Within the model, service and labor costs, typically less volatile than material inputs, are approximated using the Euro area consumer price index.

The table below reports the contribution of price growth for the various production inputs to the estimated total cost dynamics of the furniture industry (industrial commodities and energy) and the projected change in sector producer prices.

Tab. 1 Furniture industry: Input costs vs. selling prices (var. %)

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026f | 2027f | |

|---|---|---|---|---|---|---|---|

| Contribution to total cost variation | |||||||

| Industrial commodity prices | +10.34 | +7.18 | -3.55 | -1.78 | +0.02 | +0.44 | +1.26 |

| Energy commodity prices | +1.49 | +1.66 | -0.54 | -0.14 | -0.24 | -0.25 | -0.09 |

| Total cost variation - furniture industry | +11.73 | +8.84 | -4.09 | -1.92 | -0.26 | +0.18 | +1.17 |

| EU Producer Price - AT3100 Manufacture of furniture | +3.73 | +11.18 | +5.75 | +0.59 | +0.86 | +1.27 | +1.95 |

After the strong impact of commodities on furniture industry costs in 2021-2022, cost dynamics progressively shifted downward during 2023-2025. In both phases, producer prices increased at a more moderate pace, broadly consistent with the evolution of other cost components such as labor and services.

Over the next two years, commodity prices are expected to contribute positively again. In 2026, total cost growth for the furniture industry is projected to remain very limited (+0.18%), compared with a forecasted increase in producer prices of +1.27%. In 2027, cost growth is expected to strengthen to +1.17%, while producer prices are projected to rise by +1.95%.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

1. The forecast of the Commodity Index for the furniture industry will be available on PricePedia in the coming days.