From ore to metal: what explains the recent price divergence in the lead market?

Comparison between the prices of minerals and related raw metals

Published by Luca Sazzini. .

Non Ferrous Metals Lead Price DriversIn the metals market there is a close relationship between metal prices and those of the related ores used as inputs in production processes. Ores represent a fundamental component in the cost structure of primary metal production, consequently influencing price dynamics. In the long term, increases in ore prices tend to pass through to the prices of the corresponding raw metals, supporting their upward trend. Similarly, phases of declining ore prices contribute to reducing or easing the growth of the respective metal prices.

This link is the basis of the cost pass-through theory, according to which, in markets for highly homogeneous goods such as commodities, changes in input costs tend to be almost entirely transferred to output selling prices. This structural relationship results in significant correlations between ore prices and those of the corresponding raw metals.

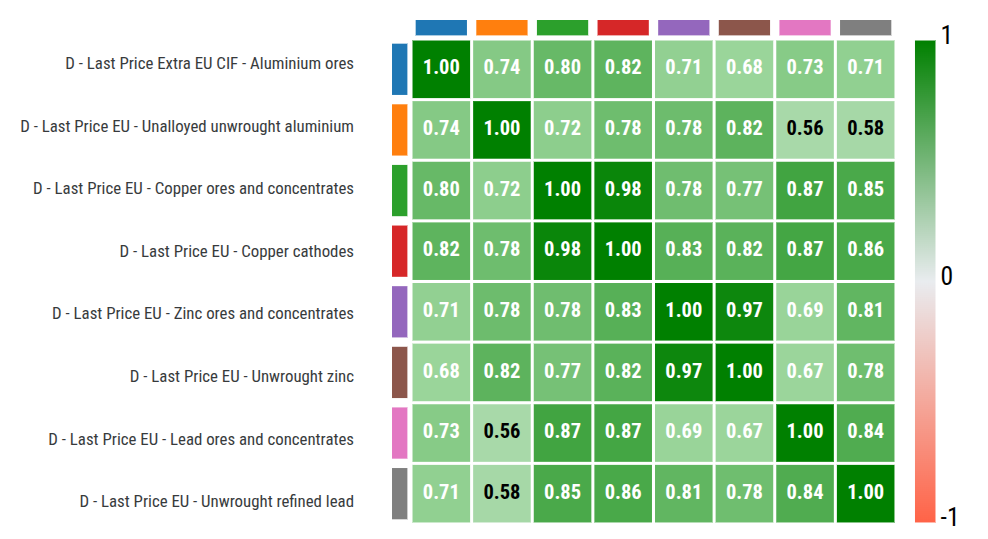

The table below reports the correlation coefficients between ore prices and the corresponding metal prices for 4 base non-ferrous metals: aluminium, copper, zinc and lead. The analysis of the correlation coefficients was carried out over a sufficiently long time span, from March 2000 to January 2026.

Correlation matrix between ore prices and related metals

Analysis of the matrix shows high correlation coefficients between ore prices and those of the respective metals. In particular, copper and zinc are the metals most correlated with ore prices, with correlation coefficients equal to 0.98 and 0.97 respectively, out of a theoretical maximum of 1.

Aluminium and lead also show significant correlations with ore prices, equal to 0.74 and 0.84 respectively. However, for both of these metals, prices are more strongly correlated with those of the respective scrap rather than ores, with metal–scrap correlation coefficients above 0.9. This reflects the high degree of recycling development in the European aluminium and lead markets, characterized by recycling rates above 90%.

Although these price relationships tend to hold over sufficiently long time horizons, temporary phases may occur in which the ore price diverges from the dynamics of the corresponding raw metal. It may therefore be interesting to analyze the main factors that can accentuate these divergences.

Factors of divergence between ore and metal prices

As previously mentioned, a first relevant factor capable of accentuating the divergence between ore and metal prices is the development of the recycling market. As the recycling rate increases, metal prices tend to follow scrap trends more closely than ore trends, since the input used in production processes is no longer ore but scrap.

However, there are additional factors that may influence ore price dynamics to the point of diverging from those of metals. Among these, the most relevant is the different degree of product standardization.

Raw metals traded are generally highly standardized, especially when futures contracts exist on financial markets defining uniform characteristics, making them virtually identical to one another. By contrast, traded ores are often more heterogeneous and may contain elements other than the main metal.

At the customs level, different types of ores are grouped under the same CN8 code, meaning that the customs price may incorporate values relating to different ores, thereby accentuating price differences. To analyze these variations, PricePedia provides a measure of statistical dispersion, which makes it possible to quantify the price range within which a given commodity is traded at European customs. Given the lower degree of standardization of ores compared to raw metals, it is therefore logical to expect greater price dispersion for ores than for raw metals.

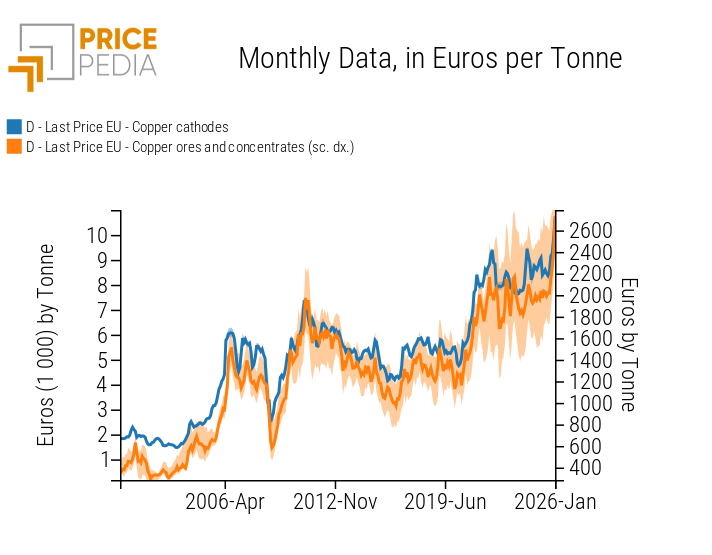

The following chart shows a comparison between the dispersion of European customs prices for copper ores and that of copper cathodes, both expressed in euros per tonne.

Comparison between the dispersion of copper ore and copper cathode prices

Analysis of the chart shows that, although the two prices tend to follow almost identical dynamics, the level of dispersion between ore and copper cathode prices is very different. In January 2026, the dispersion of copper cathode prices is practically zero, with a range between a minimum of 10537 euros/tonne and a maximum of 10782 euros/tonne. The difference between maximum and minimum is therefore only 245 euros/tonne, equal to about 2% of the customs price recorded by PricePedia (10643 euros/tonne).

By contrast, ore prices show much wider dispersion, with values ranging between 2428-3252 euros/tonne. In this case, the difference between maximum and minimum is 824 euros/tonne, corresponding to about 30% of the customs price recorded by PricePedia (2734 euros/tonne).

The lower degree of standardization of ores, which may contain different elements in addition to the main metal, can in some cases lead to price dynamics that differ significantly from those of the corresponding raw metal. This occurs because the value of the ore is influenced by the presence of other elements it contains. An example is lead, whose ore price has recently diverged from the trend of refined raw metal.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The case of lead: analysis of the relationship between ore and metal prices

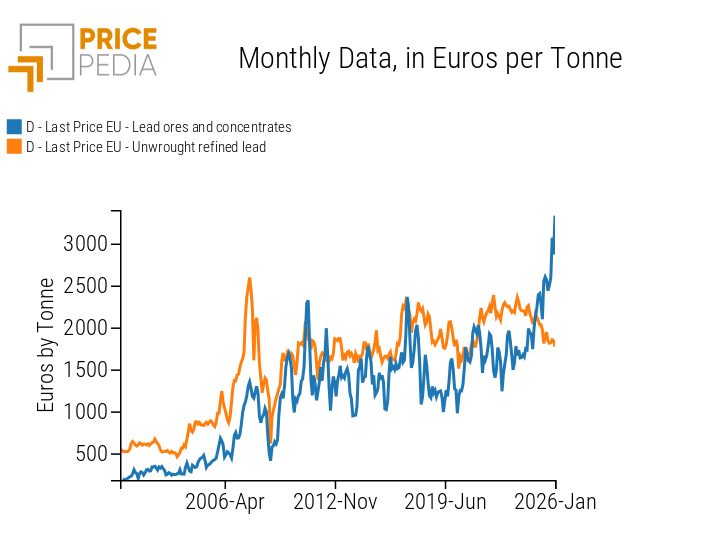

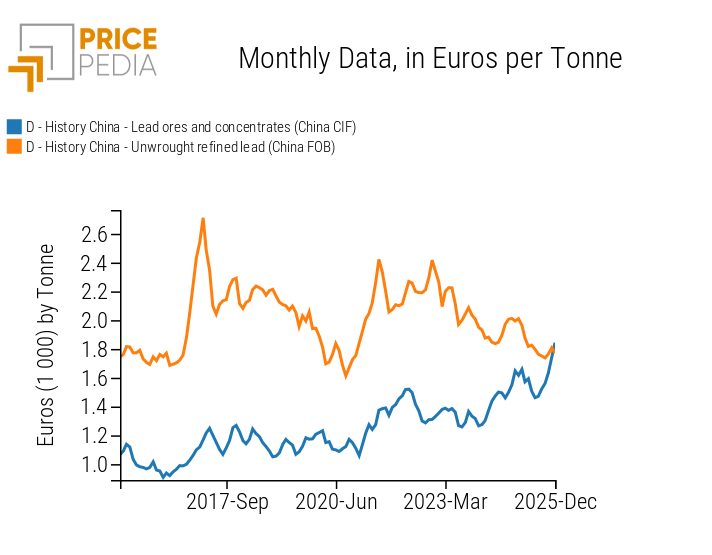

In the following two charts, a comparison is shown between lead ore prices and refined raw lead prices, expressed in euros/tonne, for both the European and Chinese customs markets.

Historical series of lead ore and refined raw lead prices

EU customs prices

China customs prices

Analysis of the historical price series shows that, in the most recent period, customs prices of ores and refined raw lead have followed divergent dynamics, both in Europe and in China.

In the European customs market, lead ore prices in January 2026 more than doubled compared to January 2024 levels, rising from 1641 to 3333 euros/tonne. By contrast, over the same period, refined raw lead prices decreased by -20%, falling from 2200 to 1771 euros/tonne.

In China a similar, though less marked, dynamic was observed. Between December 2023 and December 2025, CIF prices of lead ores increased by 40%, from 1316 to 1844 euros/tonne, while over the same period the FOB price of refined raw metal declined from 2007 to 1772 euros/tonne, recording a -12% decrease.

The current price dynamics of lead ores are entirely attributable to the strong increase in silver prices, which has indirectly affected ore prices. Galena, the main lead ore, often contains silver, to the extent that part of global silver production is obtained as a by-product of lead extraction.

The extraordinary increase in silver quotations which, on the Chicago Mercantile Exchange (CME), between January 2024 and January 2026 tripled from 22.9 to 90.4 $/ounce, led to a significant increase in lead ore prices, at a time when refined raw lead prices were declining. Currently, expectations of a future increase in supply, stemming from anticipated growth in global recycling rates,[1] combined with still relatively weak global demand, have led to the decline in international prices analyzed above.

Conclusions

Although in the long term ore and metal prices tend to show a strong positive correlation, several factors may generate divergences between ore prices and those of the related metal. A first factor is the development of the recycling market: as the recycling rate increases, the price of raw metal tends to be more influenced by scrap prices than by ore prices.

Another, even more relevant, aspect concerns the lower degree of product standardization. At the customs level, different types of ores containing different elements are classified under the same code. This results in greater variability in traded ore prices compared to metal prices.

The presence of additional elements within the ore can significantly influence price dynamics, sometimes generating trends that differ from those of the extracted metal. In the lead market, for example, in the most recent period a significant increase in ore prices has been recorded both in Europe and in China, alongside a reduction in the respective raw lead prices. In this case, the increase in ore prices is entirely attributable to the rise in silver prices, present in minimal but significant quantities in galena, the main lead ore.

[1] See the article: “Lead: a dangerous but indispensable metal for modern industry”