Sulphuric acid: product scarcity and cost increases drive current high prices

Price increases vary greatly depending on geographical area and distribution stage

Published by Luigi Bidoia. .

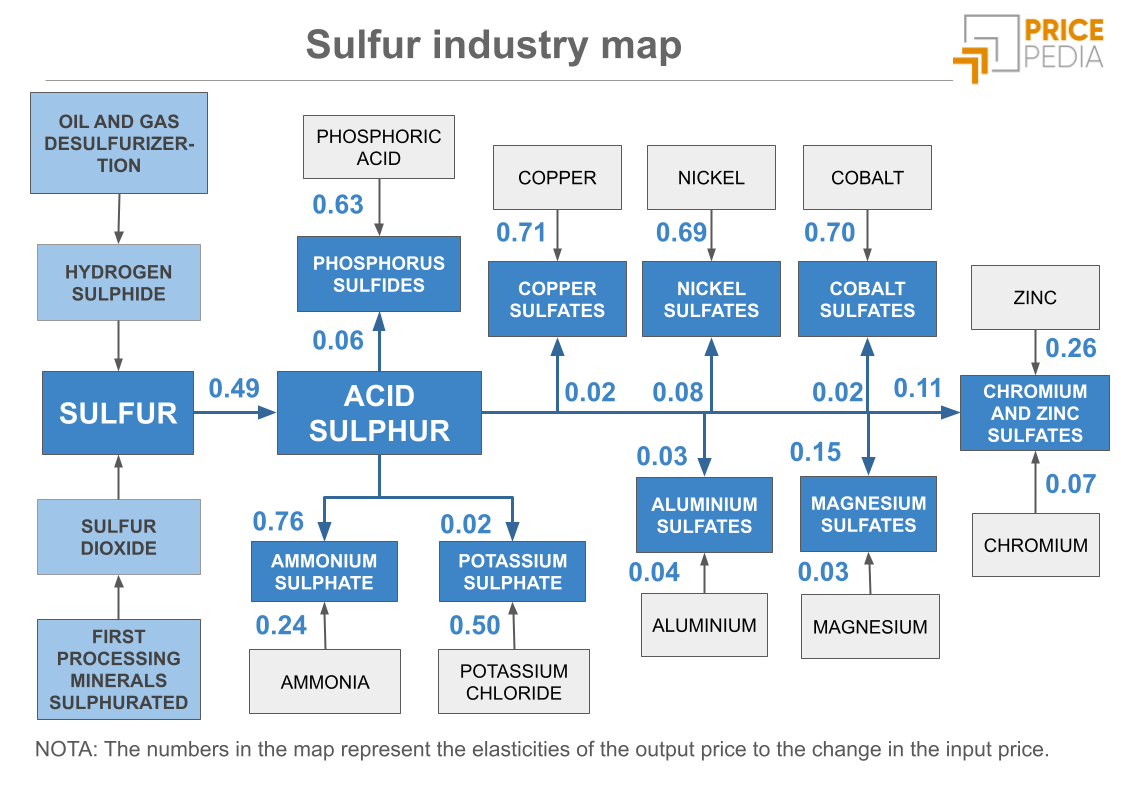

Sulphuric acid industry Price Drivers

On Tuesday, February 3, the Price Committee for Industrial Chemical Products of the Milan Chamber of Commerce convened. During the meeting, the experts in attendance confirmed a price range between 480 and 500 euros per tonne for 78–80% pure sulfuric acid. This price level had already been indicated at the previous meeting on January 13 and represents a 13% increase compared with December prices and around a 30% increase compared with January 2025 levels.

This figure is particularly noteworthy when placed in the context of a chemical commodity market that, in the short term, is broadly characterized by price stability and that, on a year-on-year basis, still shows predominantly downward price dynamics.

Within this broader market framework, sulfuric acid therefore stands out due to the presence of at least two elements of strong discontinuity compared with the rest of the sector:

- a particularly strong and persistent increase in prices

- a price level that is historically and commercially high.

Sharp increase in sulfuric acid prices

The 13% increase recorded in January 2026 compared with December, and the 30% increase compared with January 2025, appear particularly significant when set against the corresponding rates of change in the aggregated PricePedia indices for organic and inorganic chemical commodity prices. These indices remained broadly stable in January 2026 compared with December 2025 and showed a slight decline when compared with their levels in January of the previous year.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Historically high price level for sulfuric acid

The threshold of 500 euros per tonne had never previously been reached by the sulfuric acid price recorded by the Price Committee. This price level appears particularly elevated both when compared with the price recorded by the Committee in 2019 — the last year before the major disruption of global commodity markets — and when compared with other available sulfuric acid price benchmarks.

In 2019, the sulfuric acid price recorded by the Price Committee for Industrial Chemical Products of the Milan Chamber of Commerce stood at 250 euros per tonne, exactly half of the level reported in recent days.

The price gap becomes even more pronounced when comparing the Price Committee benchmark with other price observations, including both customs data and producer prices. The FOB price of Chinese sulfuric acid exports in December 2025 was, in fact, 58 euros per tonne, while the intra-EU price flows (average of CIF and FOB prices) estimated by PricePedia for January 2026 stood at 126 euros per tonne.

Further confirmation that a price level close to 500 euros per tonne for sulfuric acid can only be justified by conditions of severe product scarcity — at least in the Italian market — is provided by the analysis of ex-factory producer prices collected by national statistical offices across the European Union and published by Eurostat. The table below reports producer prices for selected EU countries, alongside intra-EU customs prices and Chinese FOB prices for comparison.

Sulfuric acid: Producer prices and customs prices (euro/tonne)

| Item | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|

| Ex-works producer price | |||||||

| Italy | 52.4 | 48.0 | 61.4 | 106.8 | 74.4 | 71.4 | N.A. |

| Germany | 69.1 | N.A. | N.A. | N.A. | N.A. | 80.3 | N.A. |

| Spain | 51.7 | 48.6 | 64.3 | 121.1 | 85.9 | 73.4 | N.A. |

| France | 106.3 | 97.9 | N.A. | 121.8 | N.A. | 122.8 | N.A. |

| Poland | 31.4 | 27.6 | 38.3 | 73.3 | 40.2 | 44.2 | N.A. |

| European Union average | 57.1 | 48.5 | 59.3 | 105.7 | 71.6 | 75.6 | N.A. |

| Customs prices | |||||||

| Intra-EU (CIF–FOB average) | 64.5 | 56.0 | 76.8 | 131.1 | 96.6 | 84.6 | 116.5 |

| China FOB | 46.0 | 7.4 | 80.7 | 107.9 | 21.0 | 31.1 | 61.9 |

As shown by the data reported in the table, price dynamics across the different benchmarks are broadly consistent, with a strong alignment in both declining and rising phases. Price levels also display differences that are coherent with the specific characteristics of the various markets, while remaining within an overall order of magnitude generally close to 100 euros per tonne.

In light of this evidence, the price level indicated in the latest two surveys of the Price Committee for Industrial Chemical Products of the Milan Chamber of Commerce appears to be explained not only by rising costs, as discussed later in this article, but also — and most likely — by a significant shortage of product. This shortage seems to affect the distribution stage of the Italian market and, very likely, the European market as well.

Since supply shortages, when confined to the distribution stage alone, can generally be absorbed over relatively short periods of time, it becomes crucial to extend the analysis to the situation of the global sulfuric acid market.

The global sulfuric acid market

With annual production close to 300 million tonnes, sulfuric acid is one of the main products of the inorganic chemical industry. Its primary use is in the fertilizer industry, but it is also widely employed in the synthesis of numerous other chemical products. The production process is based on the oxidation of sulfur dioxide at temperatures between 450 and 500 °C and is, from an industrial standpoint, relatively simple. As a result, variable production costs are determined almost exclusively by energy costs and, above all, by the price of sulfur.

As discussed in Sulfur prices: a new global upcycle?, sulfur prices recorded sharp increases throughout 2025, which continued into the first months of 2026. The reasons behind this trend can be traced both to a reshaping of global supply — with reduced exports from Kazakhstan and Turkmenistan and increased shipments from Gulf countries — and to a strengthening of sulfuric acid demand, driven by two main structural dynamics.

- a growing requirement for high metallurgical purity and material quality along precision engineering value chains, which depend on upstream chemical–metallurgical processes with high sulfuric acid intensity;

- the expansion of sulfuric acid use in the extractive industry, particularly for nickel production in Indonesia and for copper production in Chile and the Democratic Republic of the Congo[1].

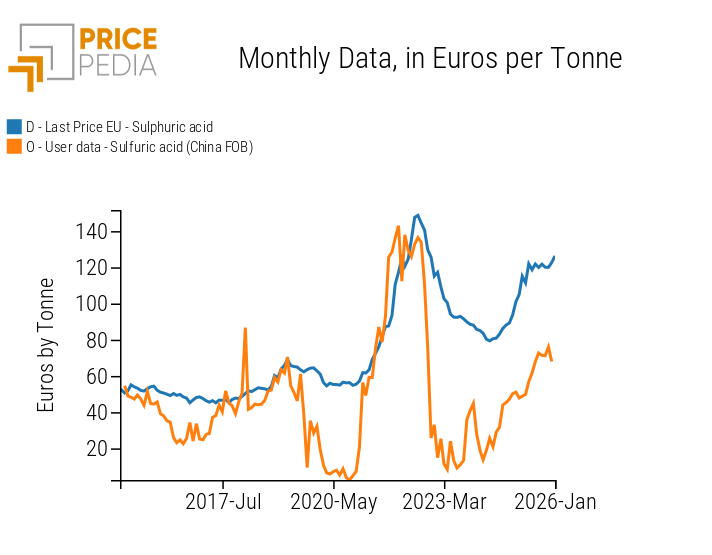

Cost-side pressure at the global level also emerges clearly when jointly analyzing recent sulfuric acid price dynamics, as shown in the chart that follows. These dynamics refer both to prices derived from trade flows among EU countries and to export price declarations from China, the world’s largest sulfuric acid producer and, in recent years, also its leading exporter.

Sulphuric acid: comparison between EU prices and Chinese export prices

Conclusions

The evidence gathered in this analysis makes it possible to outline more clearly the current configuration of the global sulfur and sulfuric acid market.

- the growing need for high “metallurgical purity” and the intensification of mining activities are driving a structural increase in global demand for sulfuric acid and, consequently, for sulfur;

- against a backdrop of sulfur supply that is relatively inelastic in the short term, rising demand is triggering a new global upcycle in sulfur prices. Higher sulfur prices are, in turn, feeding into a phase of pronounced growth in sulfuric acid prices;

- the increase in sulfuric acid prices is affecting the entire distribution chain, pushing price levels to values never experienced before, not even during the most acute phase of the 2022 commodity crisis.

- in a context of heightened uncertainty regarding price dynamics and supply availability, downstream users are likely increasing precautionary inventories, thereby contributing — particularly at the distribution level — to tighter sulfuric acid supply conditions.

[1] Sulphuric acid is widely used in the leaching processes of oxidised copper minerals. High copper prices are encouraging the exploitation of lower-grade minerals, which require significantly higher amounts of sulphuric acid per unit of metal produced.