Crashing of precious metals following the nomination of the new Fed chairperson

New free trade agreement between the EU and India

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekAt the first meeting of the new year, the Federal Reserve kept interest rates unchanged, in line with analysts' expectations. The statement and the tone of Powell's press conference, while still pointing to possible further cuts, were less accommodative than the previous meeting due to a stronger assessment of economic growth and signs of labor market stabilization. Nevertheless, during the week, the U.S. dollar weakened further, also due to President Trump's remarks, which downplayed the currency's decline, even at its lowest level in four years, emphasizing that the current dollar level is favorable to the American economy.

However, on Friday, the dollar partially recovered, supported by the appointment of the new Federal Reserve chairman, Kevin Warsh, a figure perceived by the markets as favorable to a tighter monetary policy. This change in expectations had a significant impact on commodity financial prices, particularly on the performance of precious metals.

Weekly Summary of Commodity Financial Prices

Financial prices of energy products recorded weekly growth, with Brent returning above $70/barrel. In addition to the weakening of the dollar, the oil recovery was supported by recent supply disruptions in Kazakhstan and the latest geopolitical developments in the Middle East. In particular, President Trump warned that the time to reach a nuclear deal with Iran is running out, while U.S. naval units are reportedly heading to the area. Added to this are the frosts in the United States, which temporarily halted part of oil production and increased demand for heating fuels.

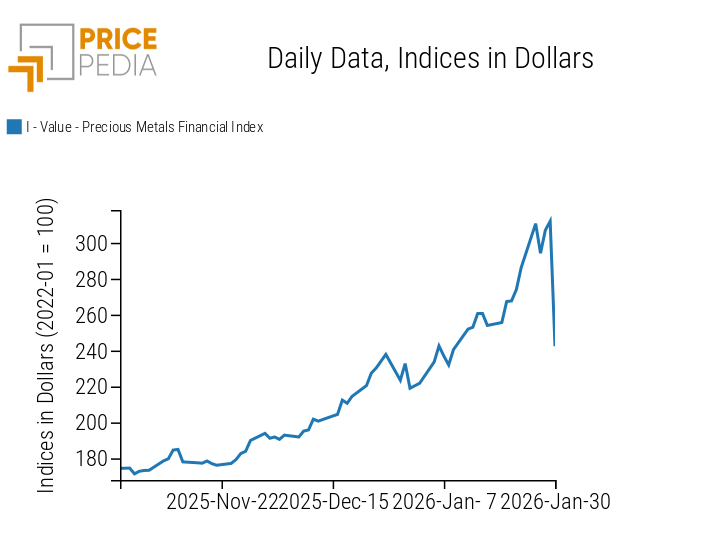

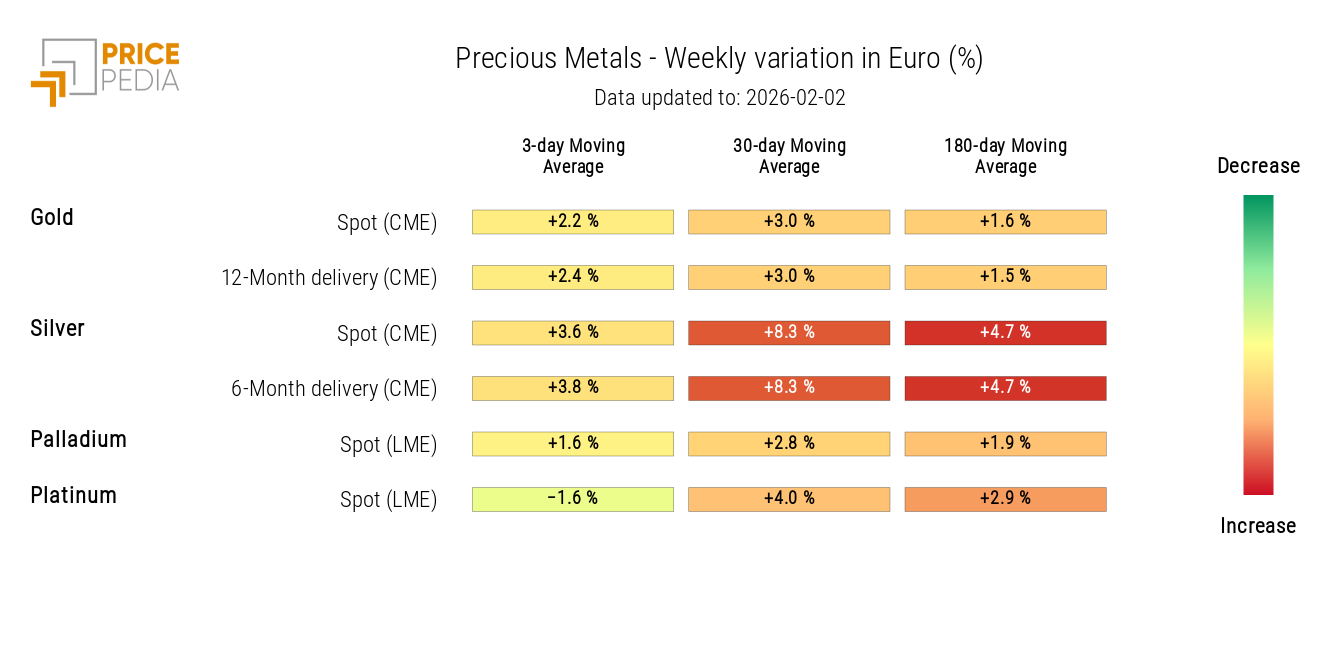

The precious metals sector started the week with new all-time highs, supported by escalating geopolitical tensions and the persistent climate of market uncertainty. The U.S. government announced an executive order authorizing the imposition of tariffs on goods from countries that sell or supply oil to Cuba, aiming to economically isolate the island amid its energy crisis.

Additionally, Trump revived tariff threats against Canada in case of trade deals with China, initially suggesting tariffs up to 100% and later reducing the threat to 50% on Canadian aircraft imported into the U.S. The increase in international tensions initially pushed gold and silver prices to new all-time highs, surpassing $5300 and $110/oz, respectively.

However, the price dynamics of safe-haven assets changed abruptly following Kevin Warsh's appointment as the new Fed chairman, which increased expectations of a less expansionary monetary policy. This triggered a sharp correction in gold and silver prices, which in a single day fell by -11% and -31%, returning to levels of $4700 and $78/oz.

Among industrial metals, ferrous metals remained relatively stable, while non-ferrous metals experienced high volatility. The copper price intraday exceeded $14,400 per ton on the London Metal Exchange (LME), with other base metals initially following an upward trend, supported by the weaker dollar, supply tensions, and speculative moves by traders. However, in the last day of the week, LME non-ferrous metals also underwent a significant price retracement.

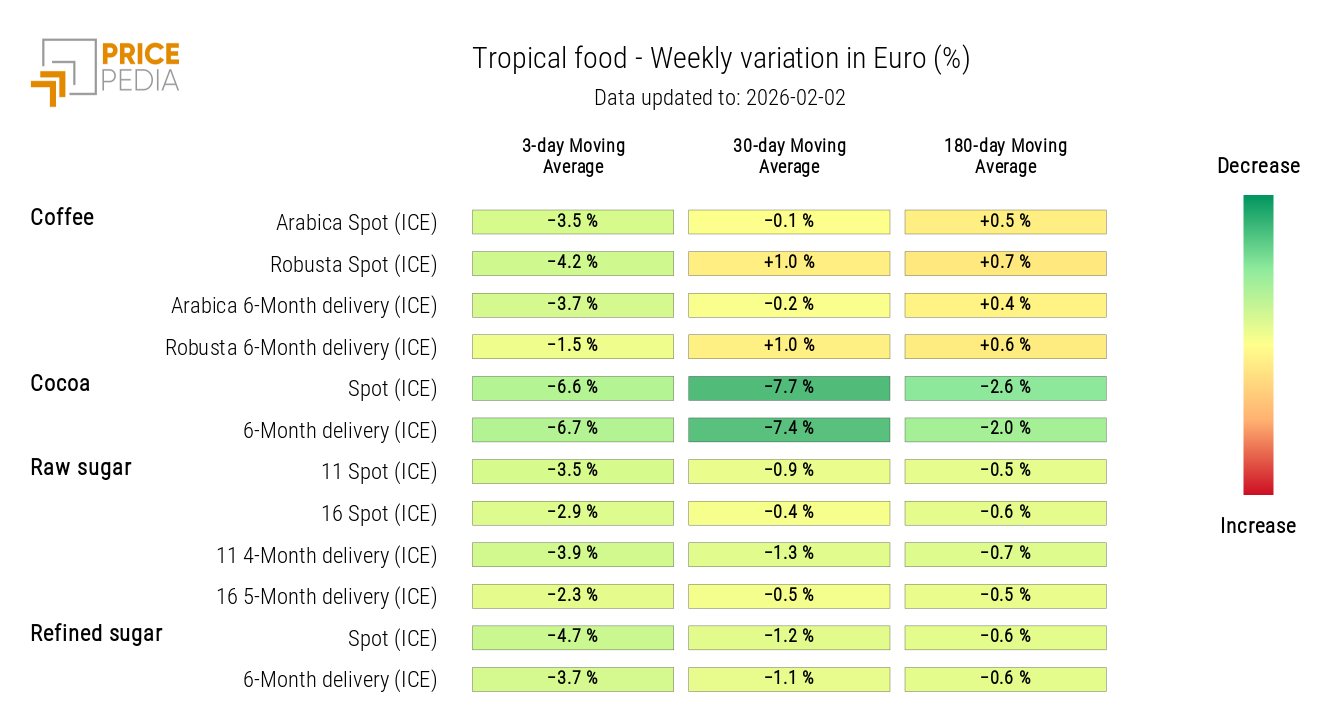

In the food commodities sector, cocoa prices declined following indications from the International Cocoa Organization, which highlight a surplus outlook and an increase in global stocks.

New Free Trade Agreement between the EU and India

The EU and India conclude a historic free trade agreement, aimed at strengthening economic and political ties between the two economies and creating the largest trade area ever established by both parties. The agreement provides for tariff reductions or eliminations on most goods, offering European companies significant advantages in the industrial, agri-food, and services sectors.

In return, India also gains tangible benefits, with easier access to European goods and services, greater integration into global value chains, and opportunities for key sectors such as textiles, seafood, and handicrafts, which will be able to compete more easily in the European market. The agreement also includes provisions on intellectual property, sustainability, and climate action, creating transparent and regulated trade conditions and fostering cooperation on innovation and sustainable development.

NUMERICAL APPENDIX

ENERGY

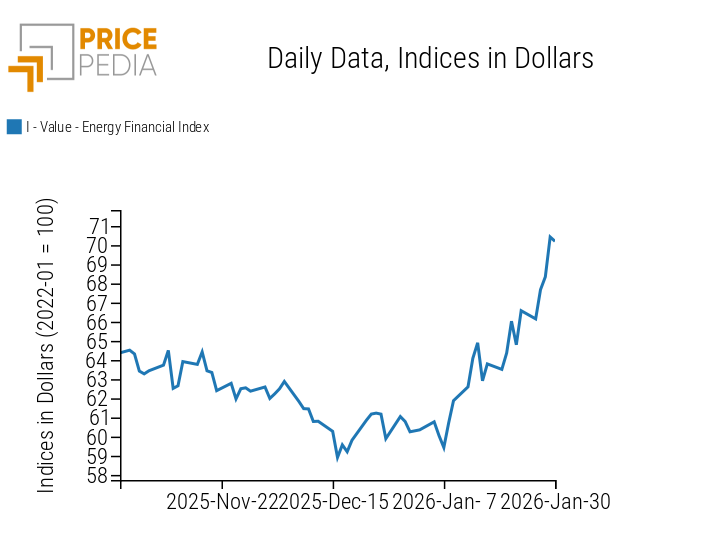

The PricePedia financial index for energy products shows weekly growth in energy prices.

PricePedia Financial Index of Energy Prices in Dollars

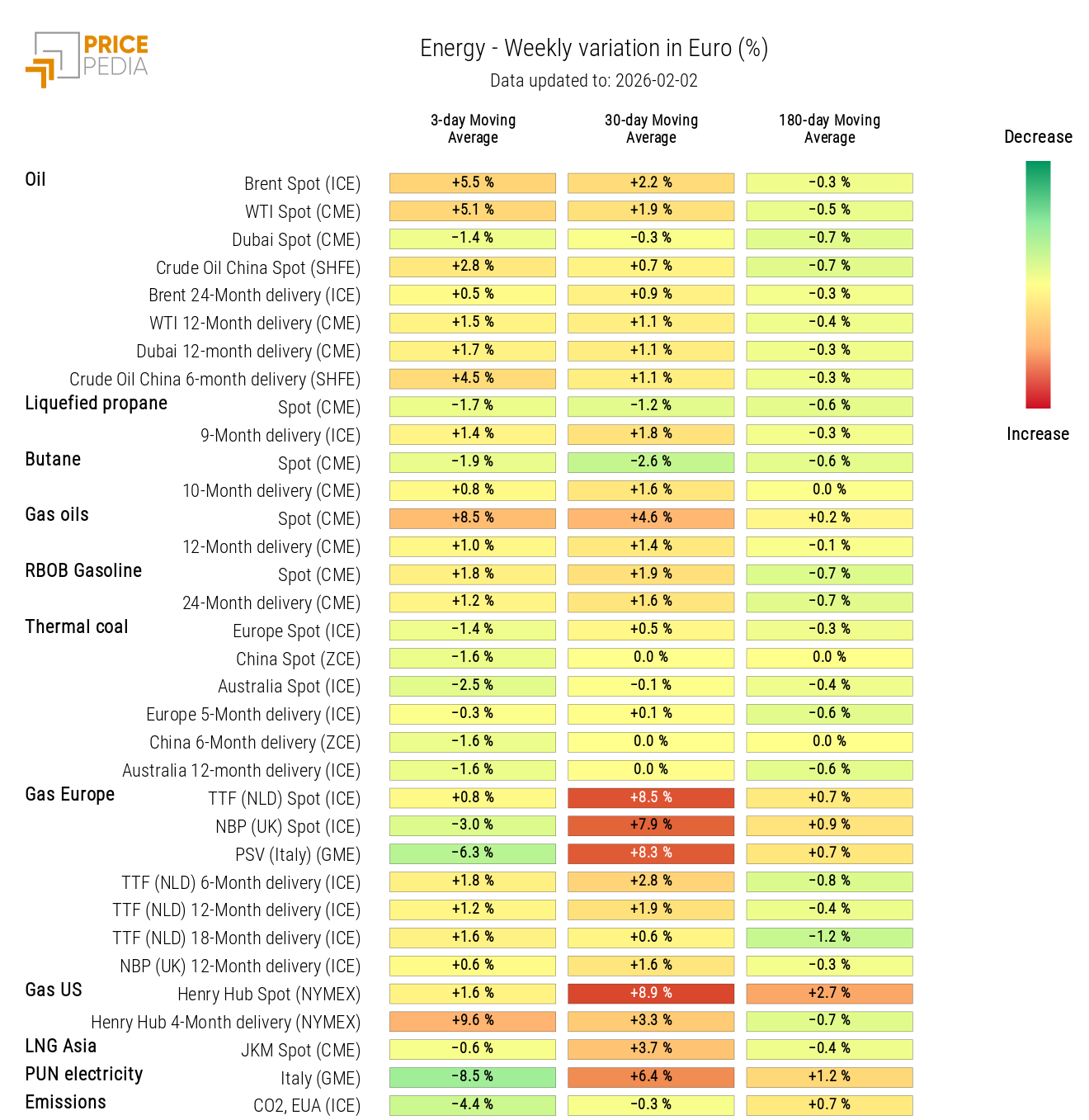

The energy heatmap shows a rise in oil and diesel prices.

HeatMap of Energy Prices in Euros

PLASTICS

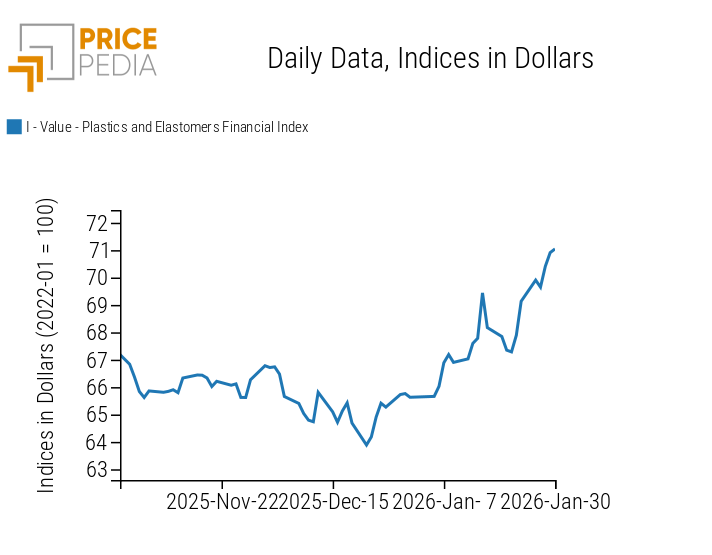

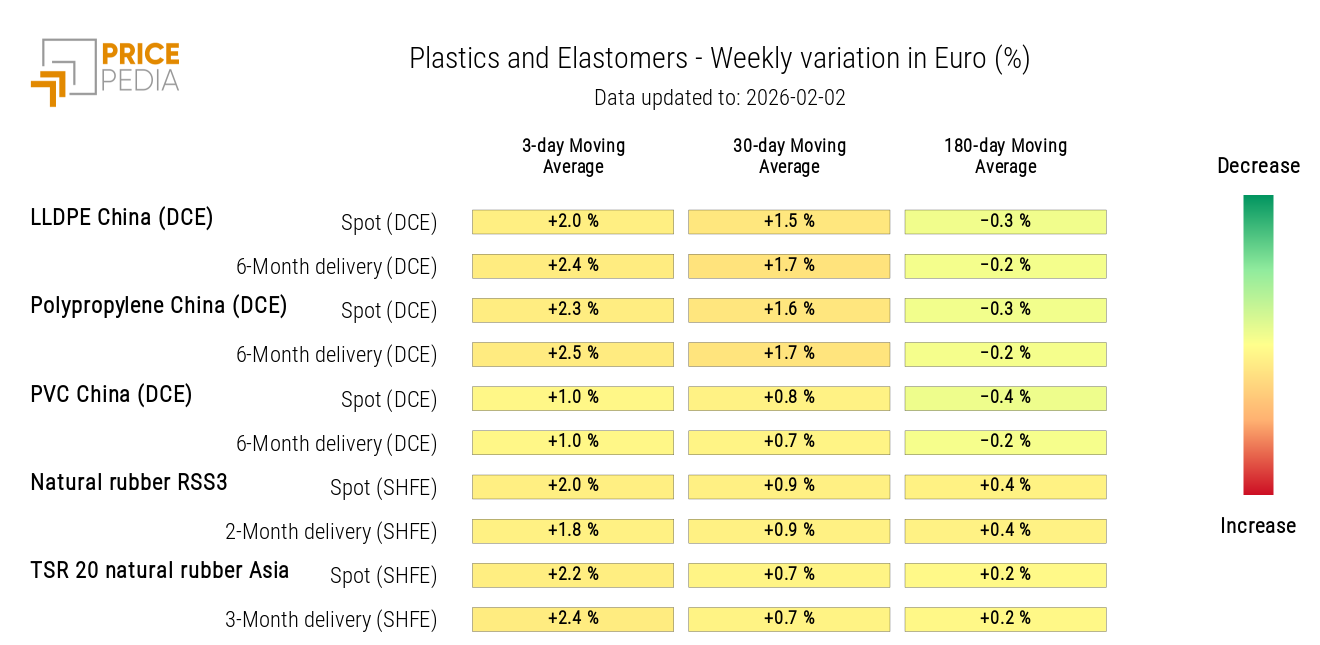

The Chinese financial index for plastics and elastomers follows a weekly upward trend.

PricePedia Financial Index of Plastic Prices in Dollars

The heatmap analysis shows a general weekly increase in plastic and elastomer prices.

HeatMap of Plastic and Elastomer Prices in Euros

PRECIOUS METALS

The financial index of precious metals, after reaching new all-time highs, underwent a sudden correction of more than -20% following the announcement of the new Federal Reserve chairman.

PricePedia Financial Index of Precious Metal Prices in Dollars

The precious metals heatmap shows that almost all weekly moving average price changes remain positive, despite the sharp drop recorded on Friday.

HeatMap of Precious Metal Prices in Euros

FERROUS METALS

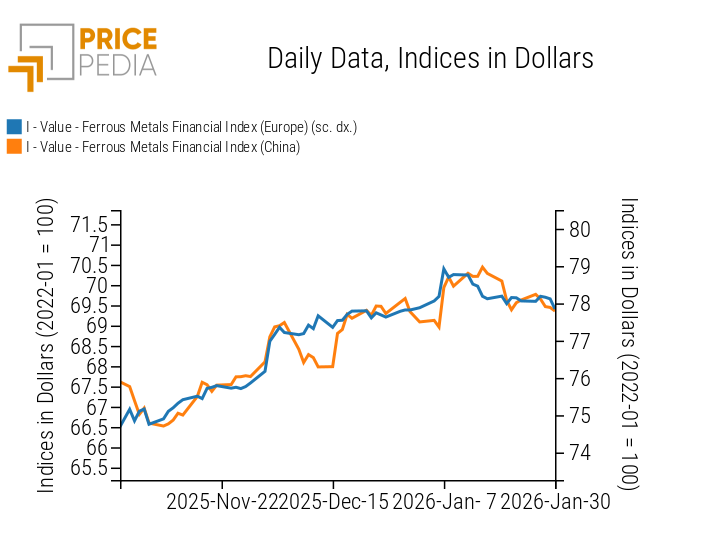

The two industrial metal financial indices remain relatively stable on a weekly basis, mostly following sideways dynamics.

PricePedia Financial Index of Ferrous Metal Prices in Dollars

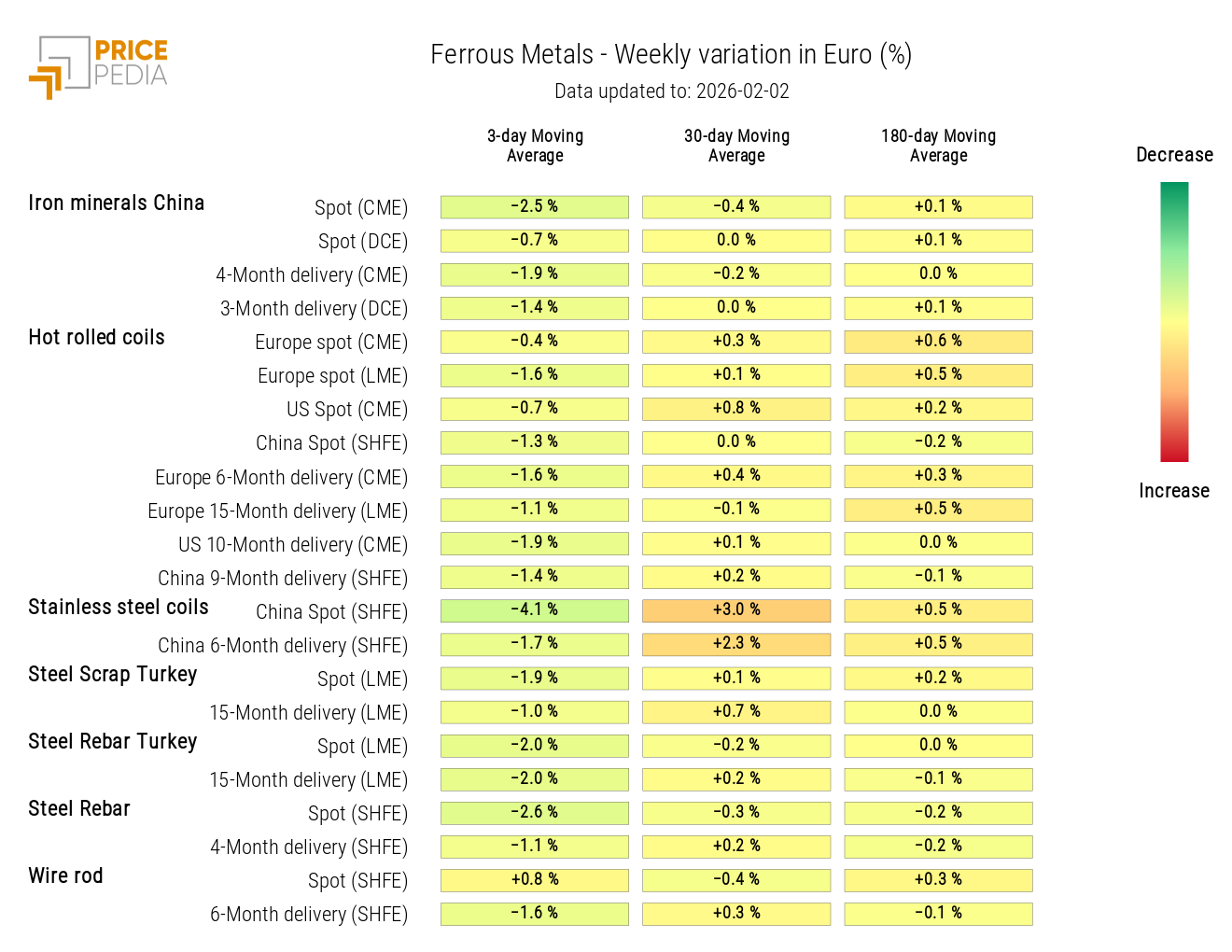

The heatmap analysis shows a decrease in Chinese stainless steel coil prices.

HeatMap of Ferrous Prices in Euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

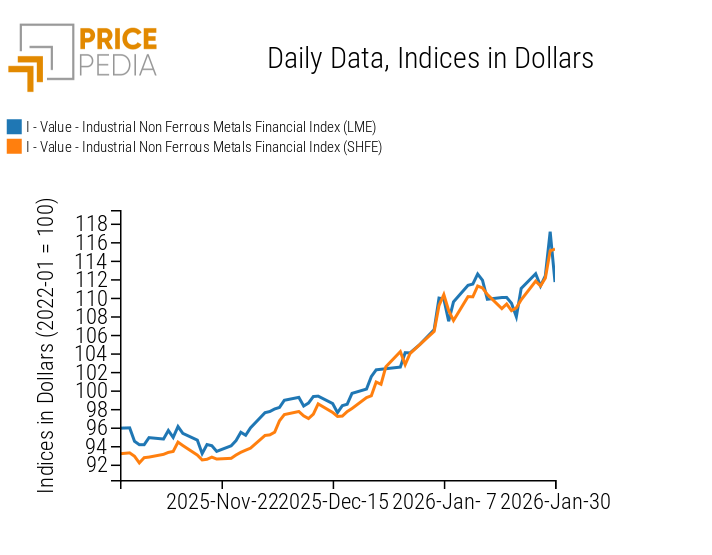

NON-FERROUS INDUSTRIAL METALS

The financial index of non-ferrous metals listed in Shanghai continues its recent upward trend. The LME index, after initially following a price recovery, underwent a significant correction on Friday.

PricePedia Financial Index of Non-Ferrous Industrial Metal Prices in Dollars

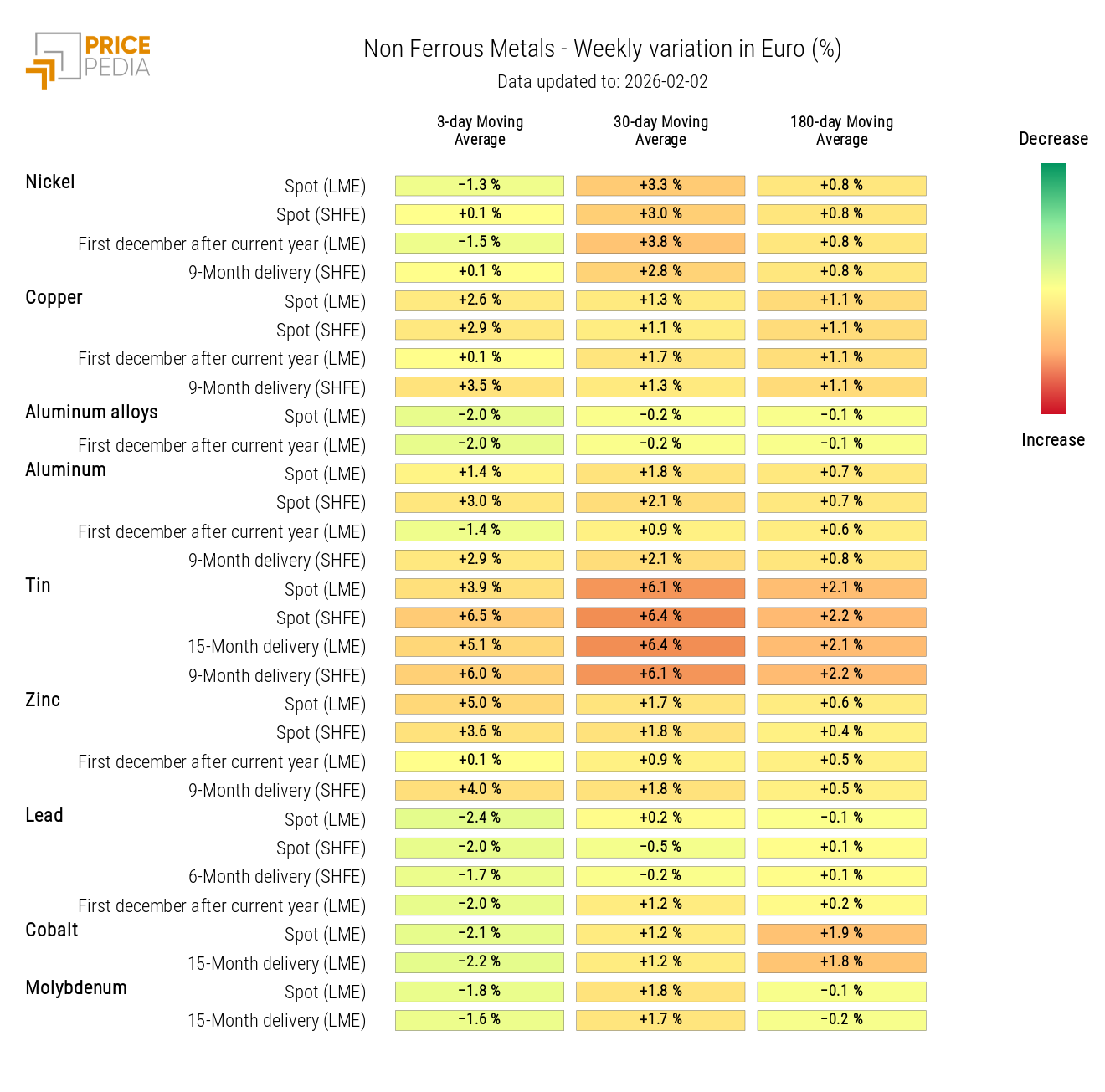

The non-ferrous heatmap shows an increase in prices of major base metals.

HeatMap of Non-Ferrous Prices in Euros

FOOD COMMODITIES

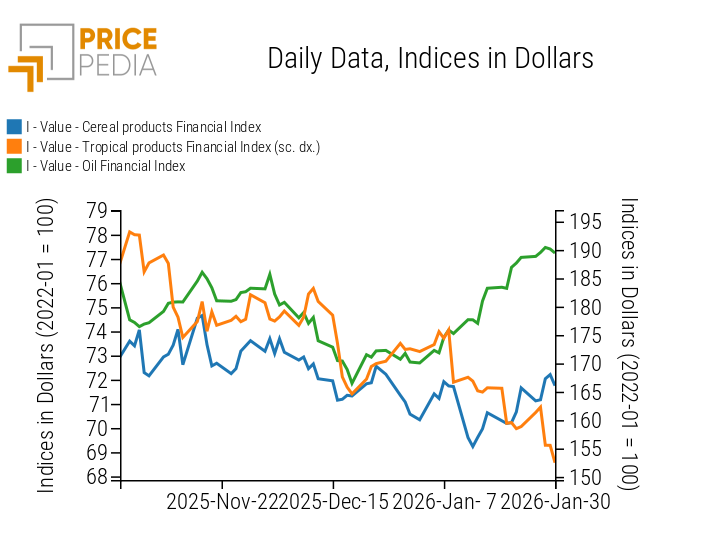

The tropical commodities index shows a price decline, the edible oils index a slight increase, while the cereals index shows weekly fluctuations.

PricePedia Financial Index of Food Prices in Dollars

TROPICALS

The tropicals heatmap shows a general decline in prices, especially for cocoa.

HeatMap of Tropical Food Prices in Euros

OILS

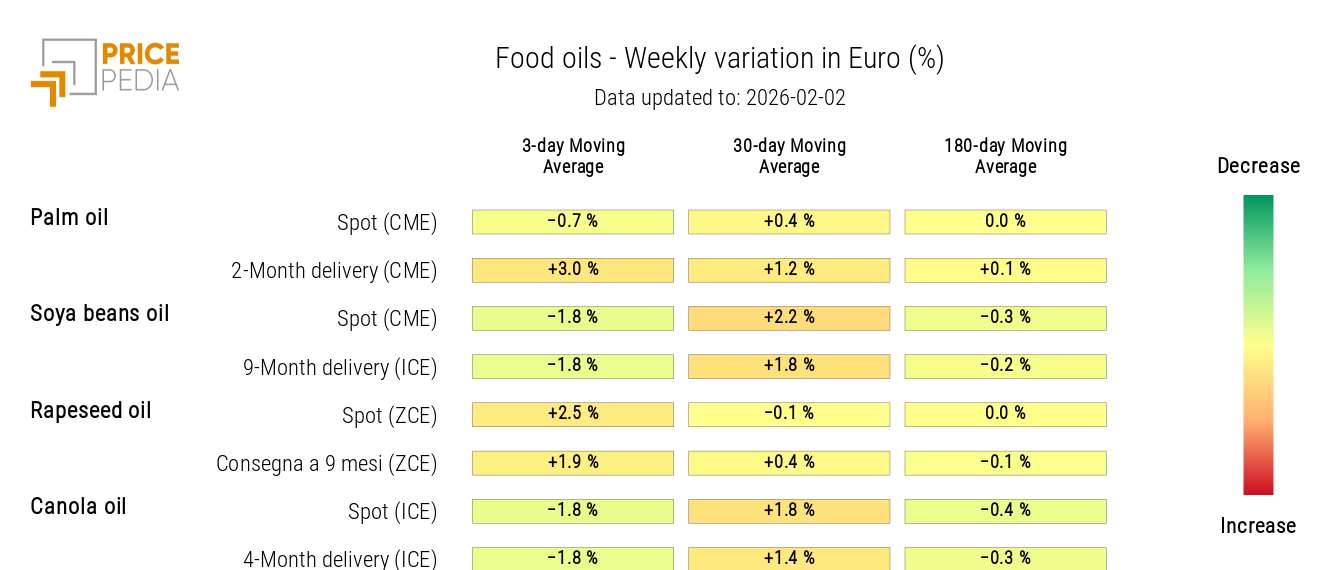

The edible oils heatmap shows a rise in rapeseed oil prices, while canola and soybean oil prices fell.

HeatMap of Edible Oil Prices in Euros