From India to Bio-Based Polyamides: How Indian Castor Seed Prices Shape the Supply Chain

The Growing Role of China in the Supply Chain

Published by Luigi Bidoia. .

bioplastics Chinese industry

Among the polymer categories that have increasingly adopted bio-based feedstocks to replace petrochemical ones in recent years, polyamides stand out. These versatile materials are used in a wide range of applications: from nylon to technical elastomers, and from high-performance polymers for the automotive and electrical sectors to advanced textile solutions.

At the origin of this transformation lies the supply chain that begins with India’s cultivation and production of castor oil and continues with its conversion into sebacic acid—an intermediate now largely produced by China’s chemical industry, which has become the global leader in this segment.

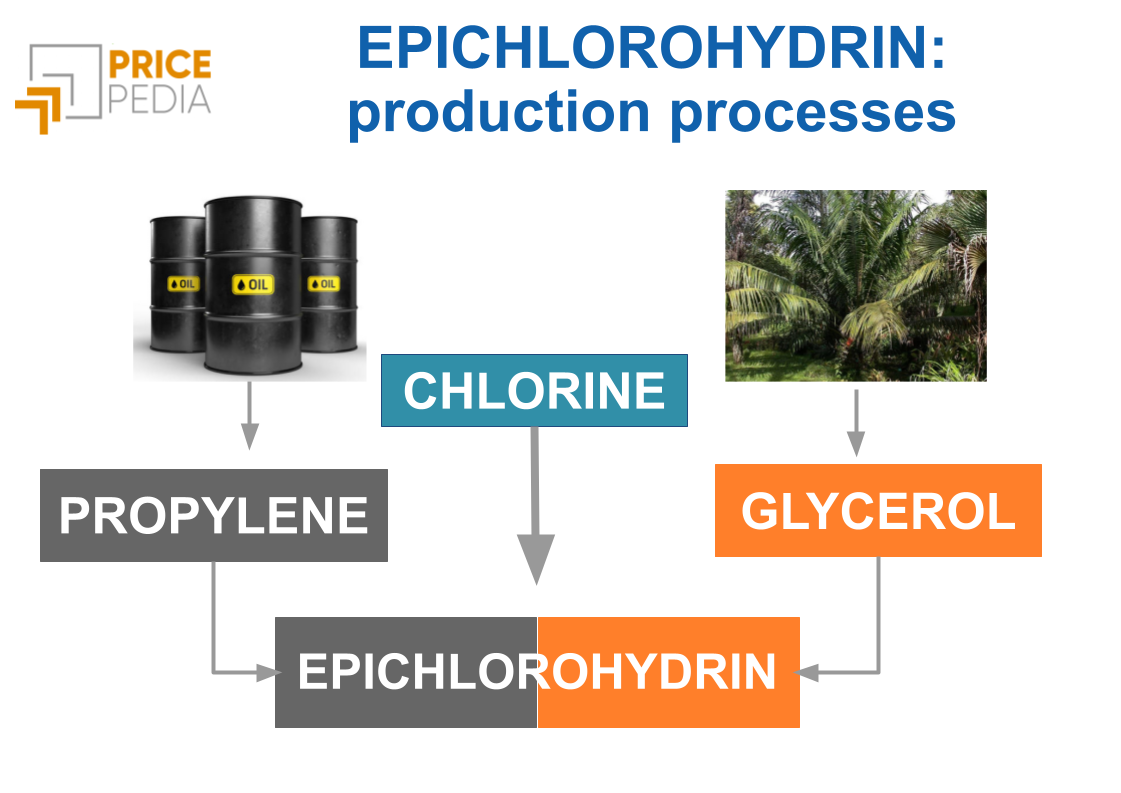

As seen in the development of glycerol as a bio-based feedstock (examined in Glycerol, a Commodity Under Pressure: Rising Prices in China and Europe – How China and Indonesia Are Redrawing the Global Market for a Key Input in Bio-Based Polymers), the European chemical industry once again tends to position itself downstream in the value chain. Its focus remains on high–value added transformation and application phases, rather than on developing upstream green innovations. This dynamic has further strengthened Asia’s leadership in the production of strategic bio-based raw materials.

India’s Leadership in the Global Castor Oil Market

Castor oil is obtained by pressing the seeds of the castor plant, a species native to East Africa and now widely cultivated both for ornamental purposes and, above all, for oil extraction. In international trade, castor oil clearly dominates — exceeding 1.2 billion dollars in 2024 — while trade in castor seeds remains marginal (less than 30 million dollars), and commercial exchanges involving the plant itself are virtually nonexistent.

Castor seeds contain ricin, an extremely dangerous toxin that makes both the seeds and the plant poisonous to humans. Castor oil, by contrast, is completely ricin-free: the toxin is water-soluble and is removed during the extraction process.

Globally, the limited volume of seeds traded internationally sees participation from several exporters — India, Ethiopia, Brazil, Pakistan and Myanmar — whereas in the oil market India is the undisputed leader, holding a share exceeding 80% of global trade.

Despite the small volumes traded internationally, the domestic market for castor seeds in India is so significant that it is formally regulated and monitored: their price is listed on the Indian NCDEX[1], highlighting the economic and agricultural importance of this raw material for the country.

The price of castor seeds listed on the Indian exchange is the primary determinant of the castor oil export prices set by processing companies. This relationship is clearly visible in the chart included in the text, which compares the two price series.

Comparison of Indian prices for castor seeds and oil

The trend of India’s FOB export prices for castor oil follows, almost perfectly and with a one‑month lag, the movement of castor seed prices on the NCDEX.

India’s dominance in the global castor oil market is further highlighted by comparing the FOB export price with the CIF import prices of China and the EU — the two main importing regions.

Castor oil price: Indian exports and Chinese and European imports

China’s import price is almost identical to India’s export price. The overlap becomes perfect when the Indian price is shifted by one month, clearly suggesting a cause‑and‑effect relationship. The price of EU imports from extra‑EU countries also closely mirrors India’s price trend, again with a one‑month lag.

The alignment between Indian castor seed prices, castor oil export prices, and the import prices of China and Europe signals the existence of a transmission mechanism that, within one or two months, transfers nearly all changes in seed prices to global castor oil prices.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

China’s Leadership in the Global Sebacic Acid Market

The availability of large volumes of castor oil from India for China has enabled the Chinese chemical industry to become, in recent years, the undisputed leader in the global sebacic acid market.

The treemap below shows the shares of the main exporting countries: China’s dominant position stands out clearly, followed — at a considerable distance — by India and, among European countries, the Netherlands and Germany.

The United States ranks only fifth.

Treemap of the main exporting countries of sebacic acid

China’s dominance in the sebacic acid market is also reflected in the benchmark role played by its export price.

This becomes evident when comparing China’s FOB export price with the EU’s CIF import price from extra-EU countries, as shown in the chart below.

Price of Chinese and European sebacic acid

The CIF price of EU imports from extra-EU countries is perfectly aligned with China’s FOB export price.

This alignment becomes even stronger when the Chinese price is shifted by one month, confirming a clear cause-and-effect relationship in which price movements in China are transmitted to European prices.

The Price Cost Pass-Through Along the Supply Chain

Analyzing the relationships between the different price levels makes it possible to reconstruct the entire supply chain linking the price of castor seeds to the European price of sebacic acid.

The transmission chain, illustrated in the image below, is particularly significant: in the long run, the elasticity of the European price (in euros) to changes in castor seed prices (in rupees) or in the rupee/euro exchange rate is equal to 0.5.

In practical terms, a 10% increase in the price of castor seeds traded on the Indian NCDEX — or a depreciation of the euro against the rupee — results in a 5% increase in the European price of sebacic acid.

Conversely, a 10% decrease in seed prices (or a corresponding appreciation of the euro) tends to reduce the European price of sebacic acid by 5%.

The analysis of the data shown in the map — which illustrates the price elasticities of the derived commodity with respect to the price of its input — clearly indicates that the main transmission channel for European polyamide prices is the one that runs through the price of castor oil imported from China and its subsequent conversion into sebacic acid.

Conversely, the channel linking the European sebacic acid price to the European castor oil price plays only a marginal role.

Conclusion

The green transition in polyamides has increased the importance of securing adequate supplies of sebacic acid, which is derived primarily from India’s castor crop.

Over the past years, the integration of the supply chain — from castor plantations in India to the European production of bio-based nylon and other green polyamides — has progressively strengthened.

Today, the determination of the European sebacic acid price depends, for at least half of its variability, on developments in the Indian agricultural commodity exchange in Mumbai.

[1] The two main Indian exchanges dealing in commodities are:

- NCDEX (National Commodity and Derivatives Exchange) for agricultural commodities;

- MCX ( Multi Commodity Exchange of India Limited) for non-agricultural commodities.