Machine Learning and Econometrics: Alternative or Complementary Tools?

Machine Learning may replace econometrics in forecasting, but not in analyzing and understanding the causes of a phenomenon

Published by Luigi Bidoia. .

Strumenti Machine learning and Econometrics

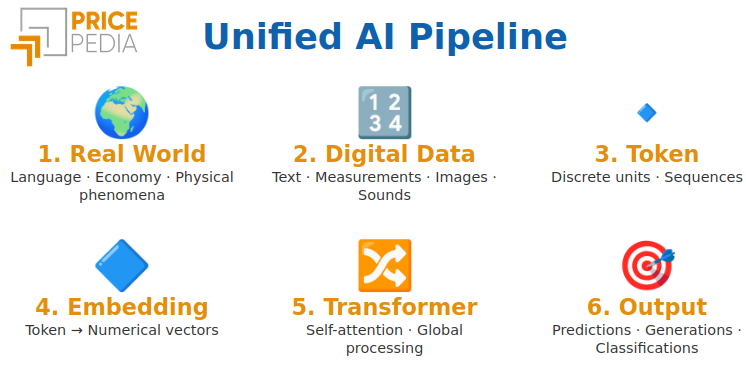

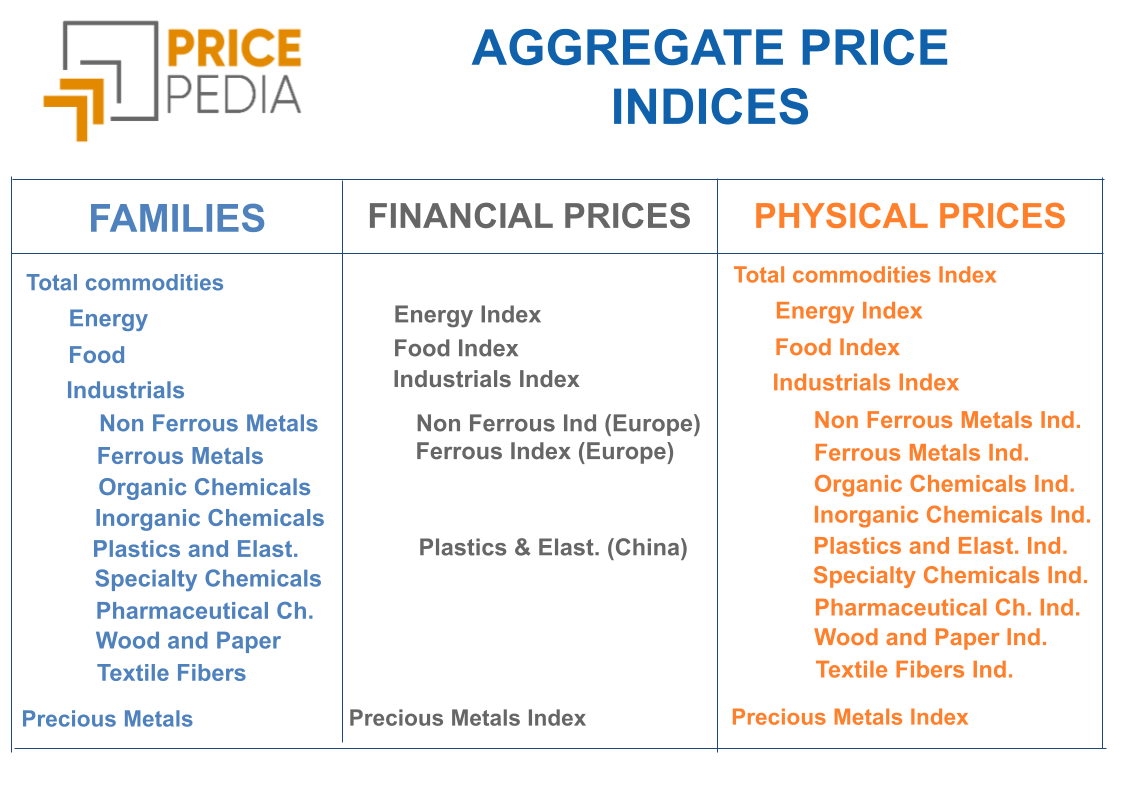

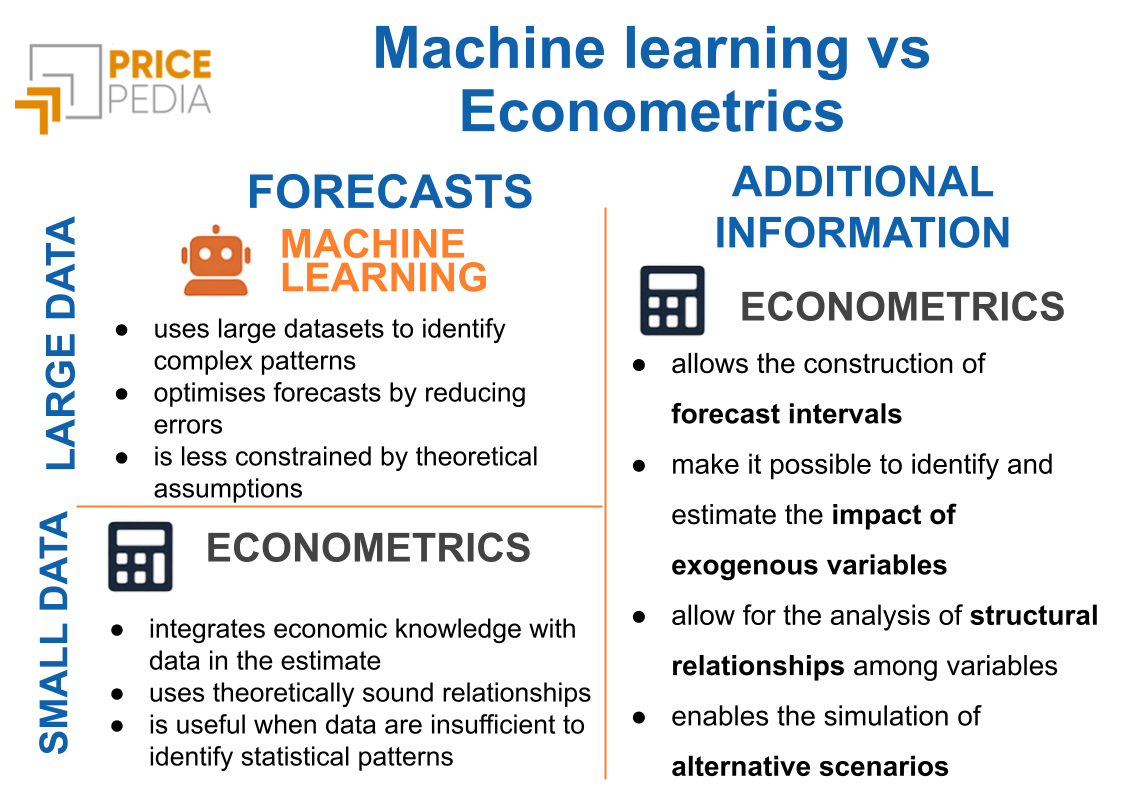

The development of machine learning in the field of economic forecasting could make the econometric approach appear less relevant. However, this risk arises only when a large number of observations of the phenomenon and its determinants are available.

When observations are limited, econometrics retains a significant advantage: it explicitly incorporates theoretical knowledge about the dynamics of the variable being studied and its relationships with the various explanatory factors. In such contexts, machine learning techniques are not yet able to match the predictive reliability of econometric models.

Conversely, when large datasets are available, machine learning techniques can outperform econometric models in forecasting. A concrete example comes from performance tests on the predictive accuracy of the hourly Italian electricity wholesale price (PUN), carried out within PricePedia by alternatively using structural econometric models, statistical models, and machine learning techniques, as described by Riccardo in several recent articles[1].

The results show that machine learning methods are indeed more accurate in terms of forecasting performance than all other approaches considered.

In light of these findings, it is reasonable to ask whether, when abundant data are available, the econometric approach should be replaced by machine learning techniques.

In my view, the most effective strategy is to combine forecasts produced by machine learning with those generated by structural models, for two main reasons:

- the comparison between forecasts obtained from structural models and those derived from machine learning provides valuable insights into the overall reliability of the predictions;

- structural models offer additional information, going beyond the mere point forecast of the phenomenon under study.

Forecast Reliability

Using an econometric model in parallel with the TTM helps strengthen the reliability of forecasts. Econometric forecasting provides a benchmark based on theoretically defined relationships among variables, allowing analysts to verify whether the results generated by the machine learning model fall within acceptable margins of economic and statistical consistency.

In this sense, the econometric model does not compete with the TTM in terms of numerical performance but serves a methodological validation function, contributing to the overall credibility of the forecasting process.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Additional Information

Even when machine learning models prove to be more accurate in numerical forecasting, econometric models retain a specific analytical value, linked to their ability to generate additional insights beyond the simple point forecast.

Thanks to their explicit theoretical structure, they make it possible to understand how and why predictive results are produced, enabling a more articulated analysis of the determinants of the phenomenon.

First, econometric models allow the construction of forecast intervals that quantify the degree of uncertainty associated with point estimates, providing a direct measure of potential variability in the results.

Second, they make it possible to identify and estimate the impact of exogenous variables, highlighting the extent to which each factor contributes to the dynamics of the dependent variable.

Third, they allow for the analysis of structural relationships among variables, offering insights into causality directions and the stability of relationships over time.

Finally, their explicit formulation enables the simulation of alternative scenarios by modifying assumptions or values of exogenous variables to assess how the system might evolve under different conditions.

Overall, this information transforms forecasting from a mere quantitative exercise into an interpretive tool, capable of combining the predictive power of machine learning models with a coherent and transparent economic understanding of the results.

In summary

When data availability is limited, the econometric approach remains the only reliable path for developing credible forecasting scenarios. In such situations, machine learning techniques do not have enough observations to identify sufficiently robust dynamic patterns for predictive purposes.

The perspective changes significantly when the phenomenon under analysis is described by a large number of time-series observations: in this context, machine learning techniques generally achieve superior predictive performance compared to econometric models. Nevertheless, even in these cases, econometrics continues to play a crucial role.

On the one hand, comparing forecasts generated through machine learning and econometric models allows for the assessment of forecast reliability; on the other hand, econometric models provide additional information essential for a comprehensive interpretation — including forecast intervals, estimates of the impact of exogenous variables, analysis of structural relationships among variables, and the simulation of alternative scenarios.

Overall, the integration between econometric approaches and machine learning techniques is not a matter of overlap but a methodological evolution[2]: combining the two allows for both analytical rigor and predictive power, transforming forecasting into a more robust and insightful process of understanding.

[1] The comparison between the forecasting capabilities of different models on the hourly PUN is described in the following articles:

- Machine Learning in Time Series Forecasting: Introducing Tiny Time Mixers

- From Econometrics to Machine Learning: The Challenge of Forecasting

In recent years, the relationship between machine learning and econometrics has become a central topic in the international scientific debate. The most recent studies highlight that these two approaches should not be seen as competing, but as complementary methodologies.

While machine learning excels in prediction and the processing of large volumes of data, econometrics retains a fundamental role in causal explanation and theoretical validation of results.

Among the most relevant contributions: When Econometrics Meets Machine Learning (ScienceDirect, 2022), The Relevance of Econometrics in the Era of Artificial Intelligence (De Econometrist, 2023), and research from the Federal Reserve Board (2024), all emphasizing that combining the two approaches improves the overall quality and reliability of forecasts.

In summary, today’s prevailing perspective supports methodological integration: econometrics provides structure and interpretability, while machine learning offers flexibility and predictive strength. Their combination represents a natural evolution in quantitative analysis and the understanding of complex economic phenomena.