Plastics and Elastomers: China's Market Plays an Increasingly Key Role

Competitive pressure from China is helping shape prices in Europe

Published by Luigi Bidoia. .

Plastics and Elastomers Price DriversThe growth of China’s plastics and elastomers industry

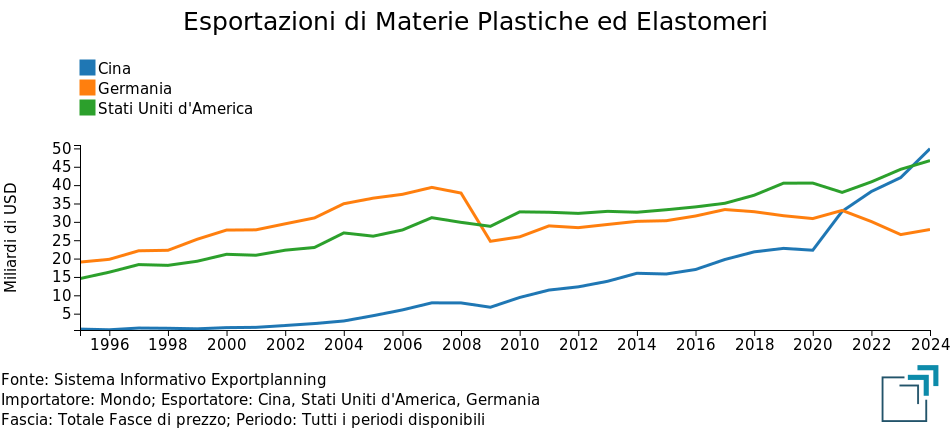

In recent years, one of the sectors in which China has experienced particularly strong development is the production of raw materials for plastics and elastomers. The success of the Chinese industry in this field becomes evident when comparing the export trends of primary-form plastics and elastomers from China with those of two long-standing global leaders: Germany and the United States.

The following chart illustrates the export volumes of China, Germany, and the United States over the past 30 years, adjusted to constant 2010 prices to eliminate the effects of price fluctuations.

Exports of primary-form plastics and elastomers from China, Germany, and the United States

Exports of China, Germany and the United States of plastics and elastomers in primary form at constant 2010 prices

The chart highlights China’s continuous and systematic export growth, which began in the early 2000s and accelerated significantly during the 2020 pandemic. This strong upward trend enabled China to surpass Germany in 2021 and the United States in 2024.

It is highly likely that this sustained growth has made the Chinese market increasingly influential in setting global market conditions, including in Europe.

The aim of this article is to explore whether there is significant evidence of the European market being affected by developments in the Chinese market.

Financial Market Prices of Plastics and Elastomers on Chinese Commodity Exchanges

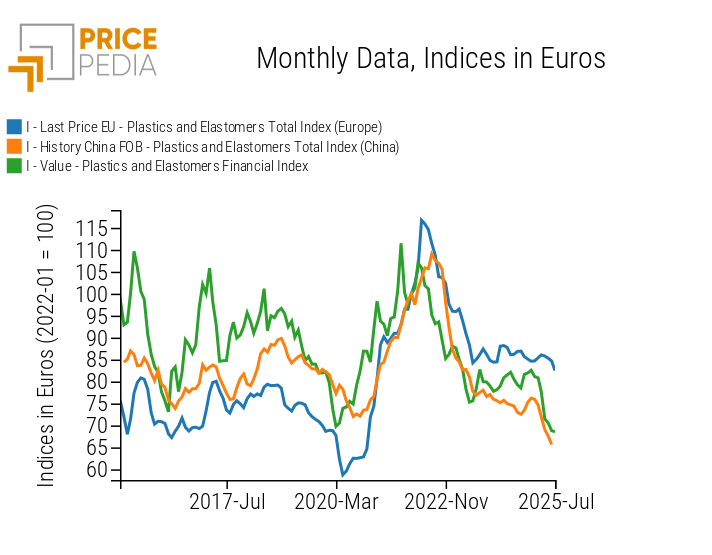

This hypothesis is further supported by the price trends recorded on Chinese exchanges for several raw materials related to the primary plastics and elastomers sector.

The chart below presents a time-based comparison between the aggregated financial index (Plastics and Elastomers Financial Index), the FOB price of Chinese exports of plastics and elastomers, and the customs prices of intra-EU trade. The comparison suggests that Chinese financial quotations may anticipate movements in Chinese FOB prices, and in turn, influence European customs prices.

Comparison of Chinese financial prices with Chinese and European physical prices

In China, there are two main commodity exchanges where plastics and natural rubber are traded:

- Shanghai Futures Exchange (SHFE): the Shanghai-based exchange specializing in industrial commodities.

- Dalian Commodity Exchange (DCE): based in Dalian, in Liaoning province, it focuses on agricultural commodities and plastics.

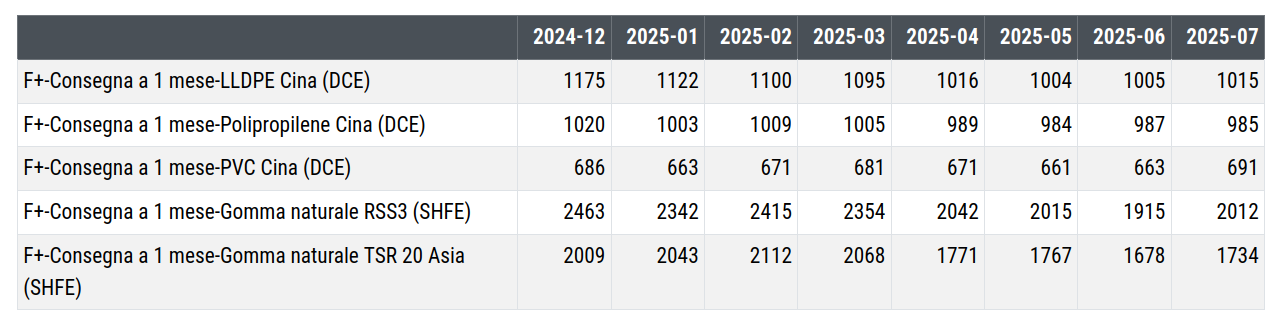

The table below shows monthly prices, expressed in US dollars per ton, recorded from December 2024 to the present, for some of the main products included in the aggregated index, which is published on PricePedia under the name "Plastics and Elastomers Financial Index."

Chinese Financial Prices of Plastics and Elastomers ($/ton)

The data analysis reveals a broad-based decline in dollar prices, with the exception of PVC, which has remained stable. The decline is particularly pronounced for natural rubber and linear low-density polyethylene (LLDPE).

When measured in euros, the price drops appear even more significant, due to the euro's appreciation against the dollar by nearly 10% from the beginning of 2025 to the end of July.

It is therefore reasonable to ask whether—and to what extent—these financial quotations influence domestic Chinese prices for plastics and elastomers, and, consequently, through export prices, affect price levels within the European Union market.

An Estimation Model of the Relationships Between Regional Physical Markets and Financial Markets

To validate these hypotheses, we developed and estimated a model designed to capture the relationships between the physical markets of the EU and China, as well as the links between financial and physical markets in the plastics and elastomers sector.

The model consists, for each of the two markets (EU and China), of three long-term equations:

- Cost equation: the customs physical price is explained by a proxy for the main production costs—namely, the price of Brent crude oil and the price of liquefied natural gas (LNG) on the Japan/Korea Marker (JKM).

- Substitution equation: the physical price in one region is expressed as a function of the physical price in the other region.

- Financial effects equation: the physical price is explained as a function of the financial market price recorded in China.

For each of the two regional physical prices, the model also includes a short-term dynamic equation, in which changes in the physical price are driven by two components:

- Shock effect: reflects the impact of deviations from the long-term equilibrium, estimated through the fit of the structural equations.

- Adjustment effect: captures the correction of the gap between the equilibrium value and the observed physical price in the previous period.

Long-Term Estimation Results

The table below reports the estimation results for the six long-term equations. Only the coefficients that are statistically significant are shown.

| Regional Physical Price | Cost Equation | Substitution Equation | Financial Effects Equation | ||||

|---|---|---|---|---|---|---|---|

| Brent Price | JKM LNG Price | EU Price | China Price | Same Month | Previous Month | Two Months Prior | |

| Intra-EU Customs | 0.21 | 0.12 | 0.93 | 0.62 | |||

| Chinese FOB Exports | 0.08 | 0.40 | 0.18 | 0.58 | |||

The analysis of these results highlights the following key points:

- There is a strong relationship between the intra-EU customs price and the Chinese FOB export price, indicating a high degree of substitutability between products from the two regions. However, the relationship is not symmetrical: Chinese prices exert a dominant influence on European prices.

- Both Brent crude and JKM LNG prices help explain price dynamics in the EU, while only LNG is significant in explaining China’s FOB export prices.

- Chinese financial prices have a statistically significant impact on physical prices in both regions, with a two-month lag.

Short-Term Estimation Results

The table below reports the estimation results for the two short-term equations. Only statistically significant coefficients are shown.

| Regional Physical Price | Cost Equation Fit | Substitution Equation Fit | Financial Effects Equation Fit | |||

|---|---|---|---|---|---|---|

| Shock | Adjustment | Shock | Adjustment | Shock | Adjustment | |

| Intra-EU Customs | 0.15 | 0.15 | 0.27 | 0.33 | ||

| Chinese FOB Exports | 0.43 | 0.36 | 0.13 | 0.10 | ||

The analysis of the short-term estimation results highlights the following key findings:

- The shock effect is statistically significant across all long-term relationships. This suggests that physical prices in both regions tend to respond within the same month to changes in the variables that define long-term equilibrium.

- The adjustment effect is significant only in the cost equation for EU customs prices and in the financial effects on Chinese FOB export prices. The lack of significance for many adjustment coefficients may indicate potential misspecification issues in the long-term equations.

Conclusions

The estimation results presented in this article confirm the existence, within the plastics and elastomers price sector, of a strong relationship both between Chinese and European regional physical prices and between financial and physical prices.

However, these relationships appear to manifest primarily in the short term, while their long-term effects seem more limited.

The estimates also point to potential misspecification issues in the long-term equations, which suggests caution in interpreting the results at this stage of the analysis.

Subject to these caveats, there is no statistical evidence to suggest that the decline in prices observed in the Chinese market during the first half of 2025—either in financial or physical terms—will have significant effects on the European market in the coming months.