Market risk of a commodity due to unexpected accelerations in demand

Phases of rapid price increases provide a robust measure of this risk component

Published by Luigi Bidoia. .

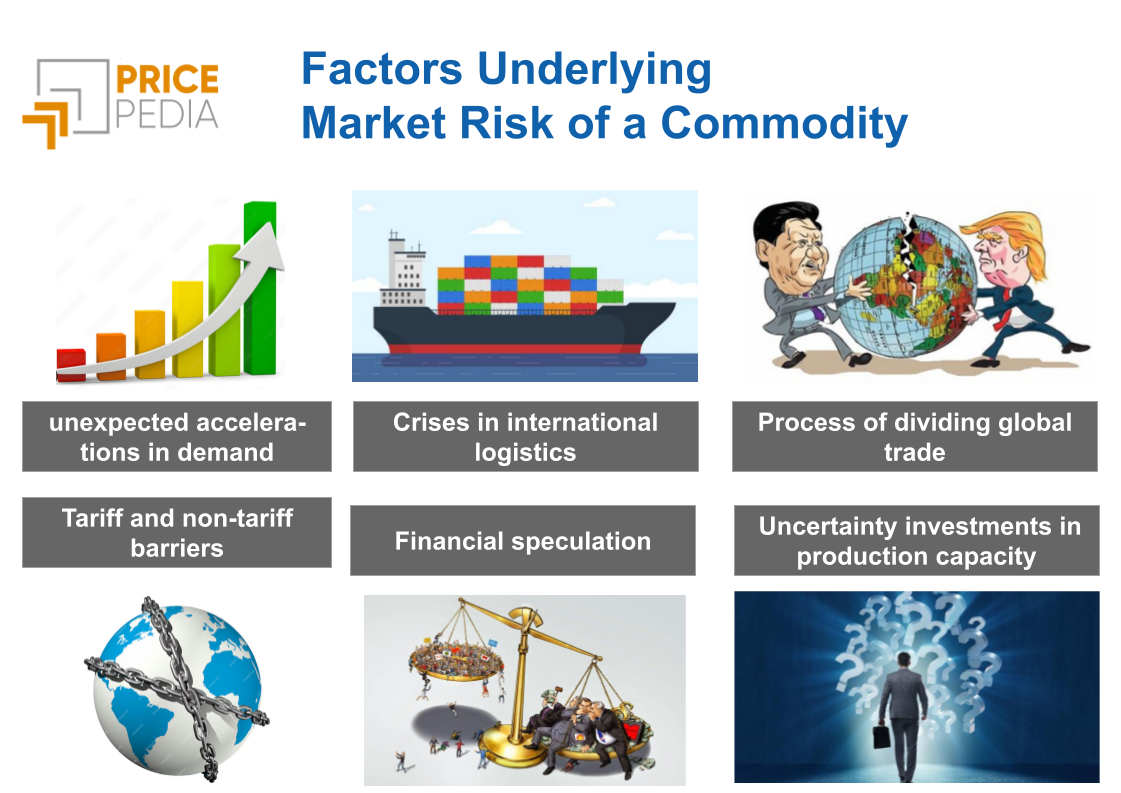

Management Procurement Risk ManagementOne of the factors contributing to the determination of market risk for a commodity is represented by unexpected accelerations in demand[1].

Generally, changes in demand for a commodity, both globally and regionally, occur gradually, supported by the growth of destination sectors or by a process of replacing other materials. In most cases, supply tends to quickly follow increases in demand, either because they are anticipated or due to the incentives for supply growth driven by rising prices. The increase in prices is the signal that indicates to producing companies the growth in demand and the opportunity to gain market share by increasing their supply. The increase in prices is more contained the faster the supply responds. Price variations within a certain range are thus physiological and functional to maintaining the balance between supply and demand.

However, in some cases, demand growth occurs suddenly, without the supply being able to increase consistently, leading to a sharp price variation, which signals the risk of not finding the desired quantities on the market. As the perception of this risk grows among user companies, demand growth accelerates, driven not only by increased use but also by precautionary purchases, with stockpiling in upstream warehouses.

Structural Market Factors

The hypothesis that structural factors exist in different commodity markets, making this situation more likely for some commodities than for others, suggests that this risk element should be analyzed through the history of commodity price fluctuations. If a commodity has experienced numerous cases of significant price increases, it is reasonable to assume that the characteristics of its market make it more susceptible to frequent and substantial price increases, both in the past and in the future.

The Indicator Considered

To identify products with a higher risk of demand acceleration, characterized by significant price increases, we analyzed, for each product listed on PricePedia, the distribution of price change rates from January 2000 to August 2024. As a risk measure, we used the third quartile of the distribution. This value represents the threshold above which 25% of historical cases related to the price change rates of the commodity are located. If market conditions do not change in the future, we can assign a 25% probability that, in a given period, the annual price change will be greater than or equal to the value of the third quartile.

In order to isolate the signal of price increases exceeding the average, the original price series were adjusted by dividing them by the PricePedia index relative to the total commodities. The third quartile value of the distribution of this relative price change was then normalized into a score[2], by multiplying it by 2 and subtracting a constant equal to 10.

The Results Obtained

The price with the highest risk score for demand accelerations is that of rhodium, for which the graph of the EU monthly customs price over the last 24 years is reported.

EU customs price of rhodium in euros

Rhodium is a precious metal, known for being one of the rarest and most expensive in the world. Its main characteristics include corrosion resistance, brilliance, stability, electrical conductivity, and unique chemical properties. These features make it almost irreplaceable in some applications, leading users to purchase it at nearly any price.

The graph above clearly highlights the wide price fluctuations this metal has experienced, with a peak of 750 euros per gram in March 2022. Considering that the highest price ever reached by gold is just over 70 euros per gram, the extremely high price levels achieved by rhodium become evident.

Analyzing the risk scores for demand accelerations, the three product categories with significantly higher-than-average values are inorganic chemicals, non-ferrous metals, and food products.

A preliminary analysis of inorganic chemicals and non-ferrous metals shows relatively high scores in the supply chain of less common metals, such as titanium and lithium, with high market risks for minerals, metals, and chemical compounds. This indirectly suggests the crucial role played by stockpiling decisions in driving demand accelerations.

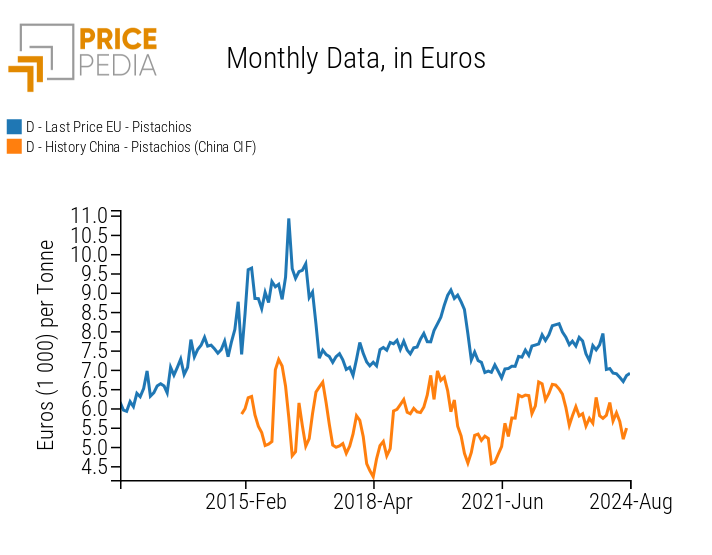

In the food sector, the product with the highest risk is cocoa, whose physical market is strongly influenced by the financial market. The second food product by market risk is pistachios, for which the graph of EU and Chinese import prices is provided.

EU and Chinese customs prices of pistachio nuts in euros

The world's largest producer of pistachios is the United States, which is also the main supplier to the EU. China is the largest global importer, sourcing part of its pistachios from the United States and part from Iran, the second-largest producer worldwide. Imports from Iran allow China to reduce its average import price. Since there is no financial market that quotes the price of pistachios, their price is determined by the interaction of supply and demand in various regional markets. Several times, an expected shortage in supply has triggered a demand acceleration, leading to a strong price growth cycle.

Conclusions

By analyzing phases of significant price growth, it is possible to identify, for the various commodities analyzed on PricePedia, the periods in which the market experienced unexpected demand accelerations. Studying these past events allows for the calculation of a demand acceleration risk score, which can be used to identify the commodities most susceptible to this risk.

Based on the customs prices collected by PricePedia, the product category most exposed to this risk is that of precious metals. Following this, we find inorganic chemicals and non-ferrous metals. The food commodity category also includes many products characterized by significant risk.

[1] For a comprehensive analysis of all the factors that contribute to determining the market risk of a commodity, see the article Commodity market risk.

[2] The score is a rating obtained by measuring one or more phenomena, generally normalized on a scale from 0 to 100 to facilitate comparison between different datasets or evaluations that might originally be on different scales.