PricePedia Scenario for July 2024

Weak growth dynamics of industrial commodity prices confirmed in 2024

Published by Pasquale Marzano. .

Forecast ForecastThe PricePedia Scenario has been updated with the information available as of July 4, 2024, and confirms the weakness in the current global demand for commodities. Although inflation continues to slow down and last month saw a first reduction of 25 basis points in monetary policy rates in the Euro Area, uncertainty remains high about the path various central banks intend to follow. An example of this uncertainty is highlighted by the minutes of the latest meeting of the US Federal Reserve's board of directors recently published (see Positive rebound in financial commodity prices), which show the lack of a common stance within the board. This results in an increased probability that rates will remain high for longer, negatively impacting the demand for commodities, which cannot sustain a new growth phase, at least for 2024.

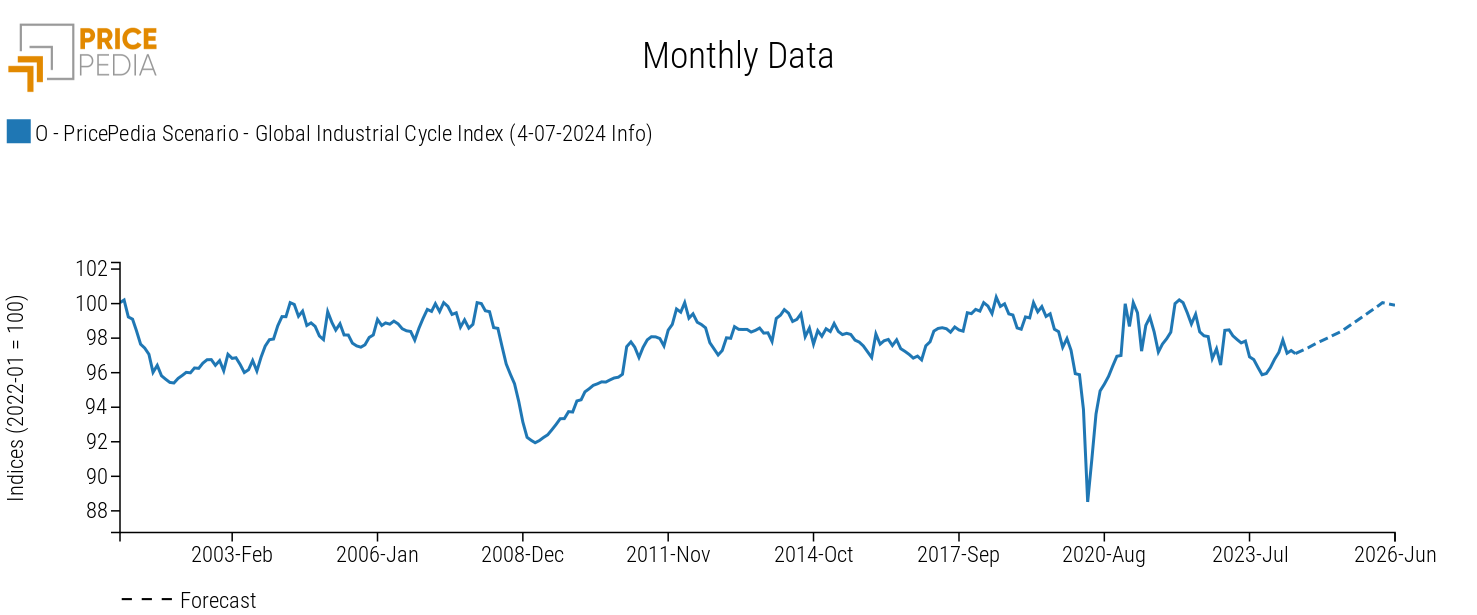

The following graph shows the global industrial cycle index[1] developed by PricePedia, which represents a proxy for global demand for industrial commodities.

On average in 2024, the global industrial cycle is expected to remain stable at the same levels as in 2023. Compared to December 2023 levels, June 2024 records an index growth dynamic of almost +1%.

The strengthening of this dynamic is expected in 2025. Overall, in December 2025, compared to the same month in 2023, growth amounts to +3.4%, bringing the cycle above mid-2022 levels.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Commodity Price Forecast

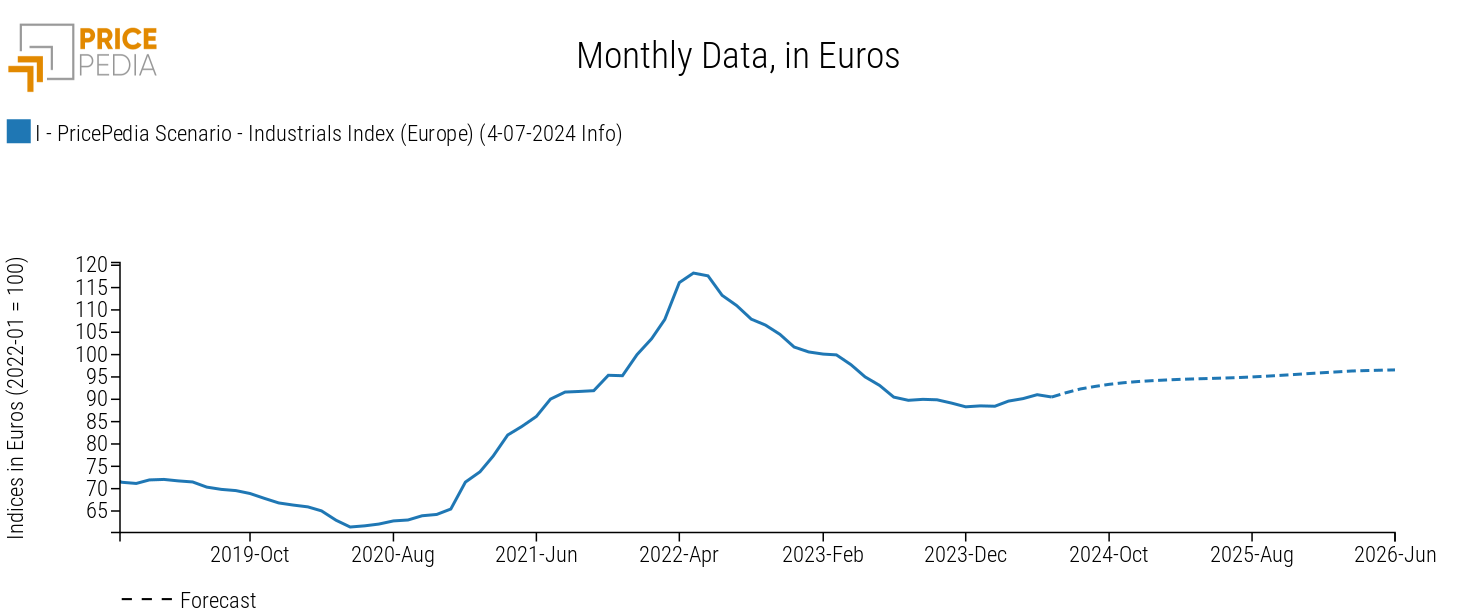

The weakness of the economic cycle is joined by the phase of adjustment in financial markets, following the increases recorded in May 2024, driven by the anticipation of future increases in commodity prices, particularly related to the energy transition and climate change.

Below is the table of annual price changes for the main commodity aggregates (Industrials[2], Total Commodities[3], Energy, and Food).

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| I-PricePedia Scenario-Commodity Index (Europe) (4-07-2024 Info) | −18.51 | −3.24 | −1.61 |

| I-PricePedia Scenario-Industrials Index (Europe) (4-07-2024 Info) | −14.09 | −2.51 | +3.90 |

| I-PricePedia Scenario-Energy Total Index (Europe) (4-07-2024 Info) | −23.91 | −4.58 | −5.56 |

| I-PricePedia Scenario-Food Total Index (Europe) (4-07-2024 Info) | −3.62 | +1.63 | +0.26 |

In aggregate, commodity prices are expected to decrease in 2024 compared to the previous year by -3.2%, following the sharp decline of about -20 percentage points that occurred in 2023.

The component of the aggregate recording the largest reduction is the Energy index, which is expected to decrease by -4.6% in 2024 compared to 2023. The dynamic of energy price reduction intensifies throughout 2025, when, on an annual average, the index tends to record a -6% compared to 2024 prices.

Conversely, Food commodities close 2024 with an increase of about +2%, with a 2025 that is generally stable at this year's high levels. Regarding core industrial commodities, 2024 ends with a reduction of -2.5% compared to the 2023 average values. However, as already reported in PricePedia Scenario for June 2024, the declining price trend stopped in the final months of 2023. By December 2024, cumulative price growth since the same month of the previous year is +6.4%.

1. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

2. The PricePedia Industrials index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Textile Fibres.

3. The PricePedia Total Commodity index results from the aggregation of the indices relating to industrial, food and energy commodities. Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.