Positive rebound in financial commodity prices

Energy and, above all, metal prices lead the early July recoveries against a backdrop of weak growth in the world economy

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekAnalysis of Inflation

Euro Area

Eurostat data indicated a slight reduction in European inflation in June 2024.

The inflation rate in June reached 2.5% y/y, slightly down from 2.6% y/y in May.

On an annual basis, the core index (excluding energy, food, alcohol, and tobacco) remained steady at 2.9%, while the ECB core index (excluding only energy and food) decreased to 2.8% from 2.9%.

Overall, prices that showed a slowdown over the past month included: energy (-0.8% m/m), fresh food (-0.4% m/m), and non-energy goods (-0.1% m/m). However, the inflation for services remained unchanged, characterized by high price stickiness since the end of last year.

For the next meeting of the ECB (July 18), analysts expect unchanged interest rates.

If more significant reductions in the inflation rate are recorded in the next two months, the next rate cut by the European Central Bank could occur as early as the meeting on September 12, 2024.

USA Area

This week, the minutes of the Federal Open Market Committee (FOMC) meeting held on June 11-12 were released.

The minutes revealed significant uncertainty among board members regarding monetary policy decisions, with some members favoring a rate cut and others favoring an extension of the current phase.

Fed Chairman Jerome Powell stated that only one interest rate cut might occur in 2024, but the market continues to expect two 25 basis point cuts by the end of the year.

Despite recognizing improvements in inflation in May, the Fed needs more certainty on the inflation front to initiate an expansionary monetary policy phase.

China PMI

In June, the PMI index for the manufacturing sector reported by Caixin rose to 51.8 from 51.7, while the index reported by NBS remained unchanged at 49.5. While the manufacturing sector remained stable in June, the same cannot be said for the non-manufacturing sector, whose PMI experienced larger-than-expected declines.

The non-manufacturing PMI from NBS dropped from 51.5 to 50.5, below Bloomberg's expectations of 51 points. This decline is attributable to both the services sector, whose PMI fell from 50.5 to 50.2, and the construction sector, whose PMI dropped by more than two points to 52.3 (the lowest since August 2023).

The NBS composite PMI decreased from 51 to 50.5, indicating a general slowdown in the Chinese economic recovery in June 2024.

Dynamics of Commodity Prices

This week, the commodity markets saw positive price changes across various sectors.

The energy sector was marked by a price increase for liquefied propane and butane due to the price hikes by Sonatrach, driven by increased demand from the Mediterranean region.

Ferrous metals saw a slight upward trend caused by the rebound in Chinese iron ore prices due to expectations of new government support for the real estate market.

Except for aluminum alloys, non-ferrous metals also saw a slight positive oscillation in prices.

Food prices also registered increases, especially for soybean oil, due to expectations of possible export reductions from Brazil to meet growing domestic biodiesel demand1.

However, there were no particularly intense price variations for nickel, despite recent statements from the London Metal Exchange (LME) about suspending nickel deliveries from the Finnish plant of Russian giant Nornickel starting October 3, 2024. The financial exchange did not explicitly state the reasons behind this ban, but it is likely related to the responsible sourcing campaign and not the sanctions against Russia. The London Metal Exchange had already warned producers to provide responsible sourcing reports, threatening to refuse their metal deliveries if they did not comply.

[1] Soybean oil is used as an input for biodiesel production.

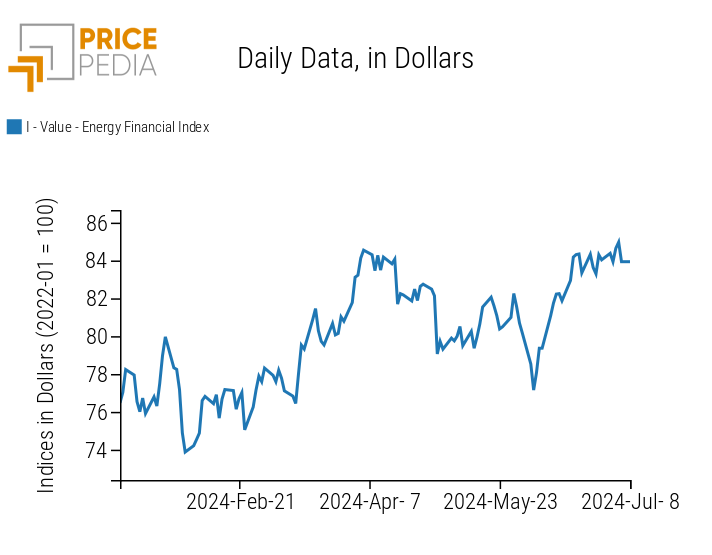

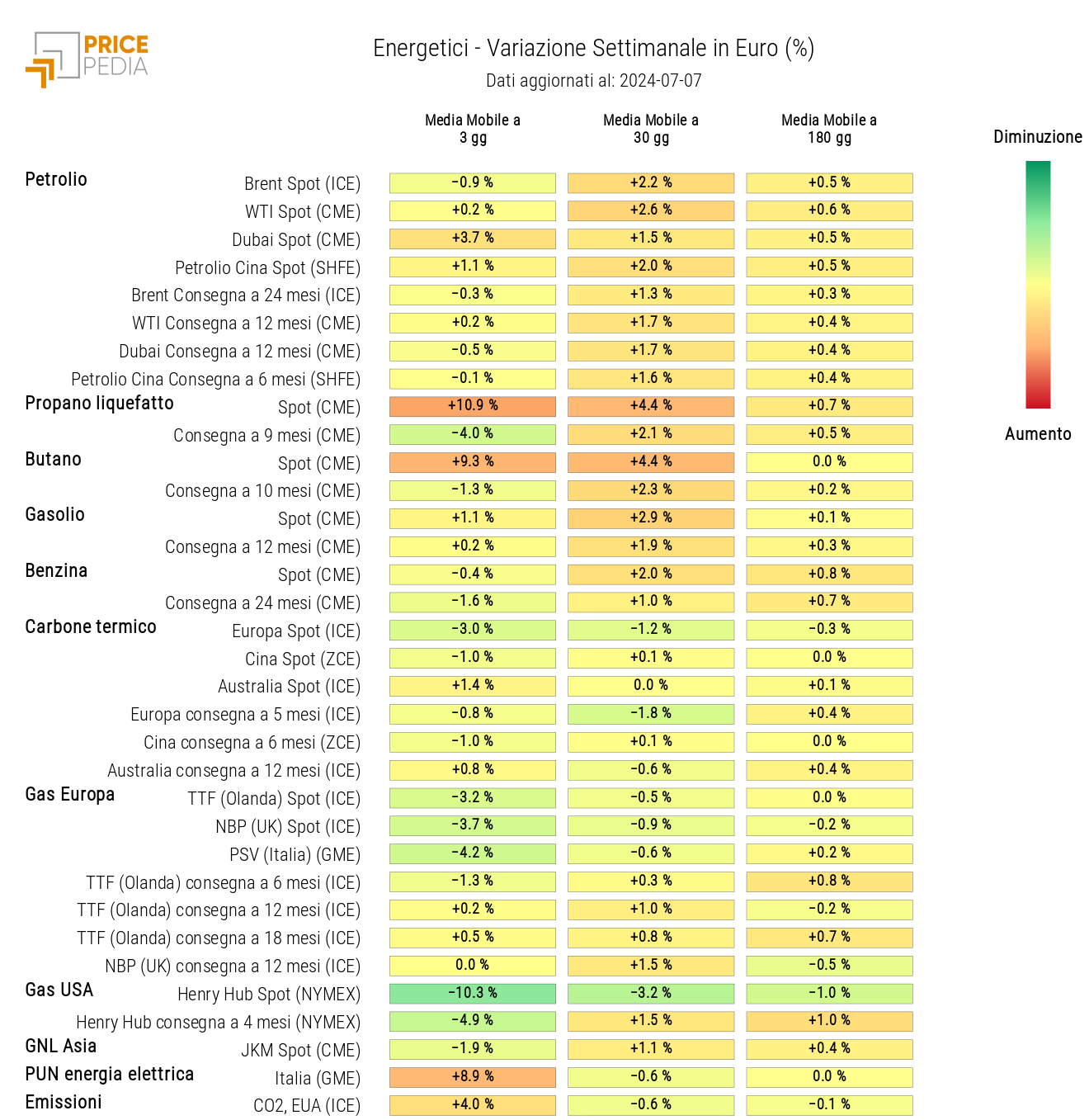

ENERGY

Despite many fluctuations, there was a slight weekly increase in the PricePedia financial index levels of energy products prices.

PricePedia Financial Index of Energy Prices in Dollars

The energy heatmap shows a weekly increase in the financial prices of liquefied propane and butane, both due to Sonatrach's price hikes driven by increased demand from the Mediterranean region.

The heatmap also shows a slight increase in oil prices, despite a reduction in natural gas prices in both Europe and the United States. The oil price increase was caused by Hurricane Beryl, which temporarily disrupted oil production from U.S. platforms in the Gulf of Mexico, while the decrease in natural gas prices is attributed to high storage levels.

HeatMap of Energy Prices in Euros

PLASTICS

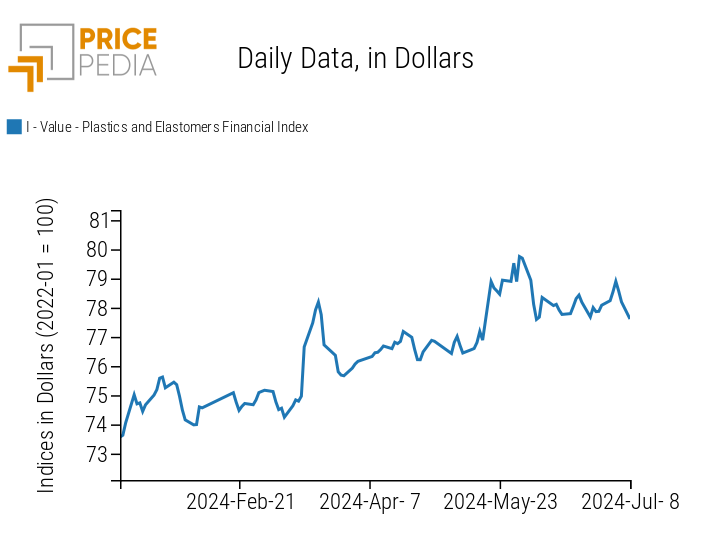

The financial index of plastics quoted in China shows a brief oscillation that does not significantly alter the price levels.

PricePedia Financial Indices of Plastic Prices in Dollars

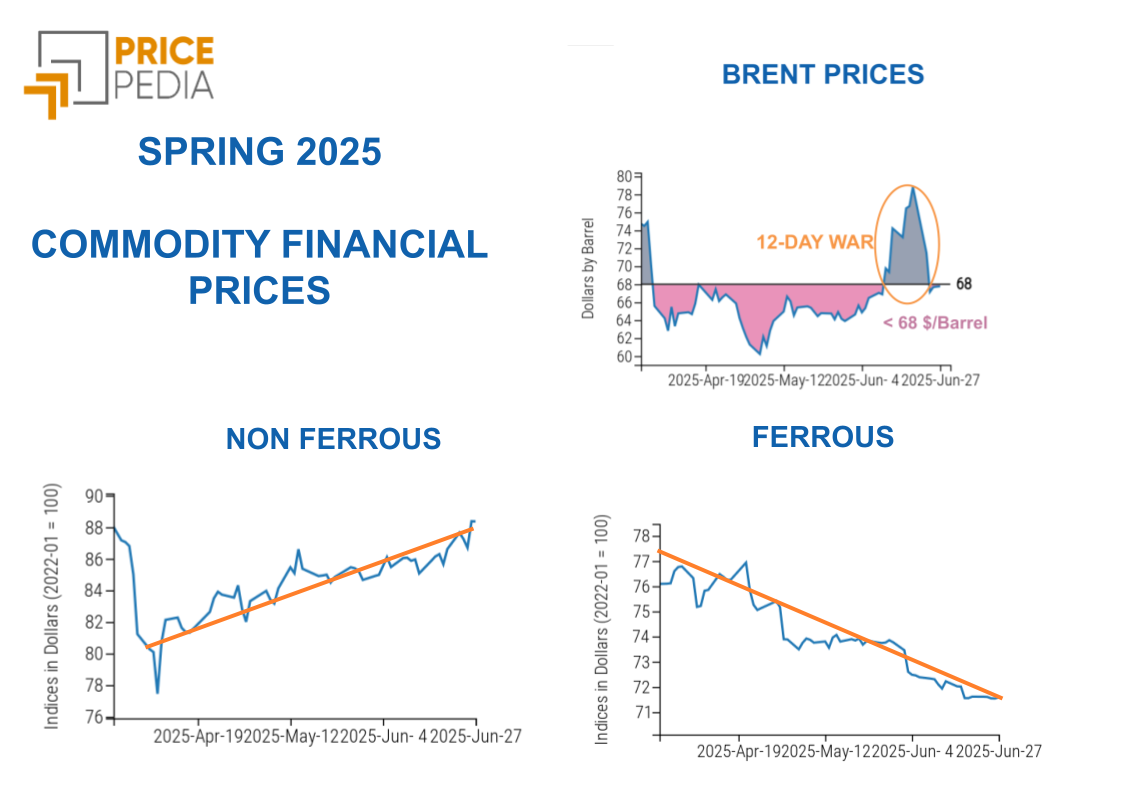

FERROUS METALS

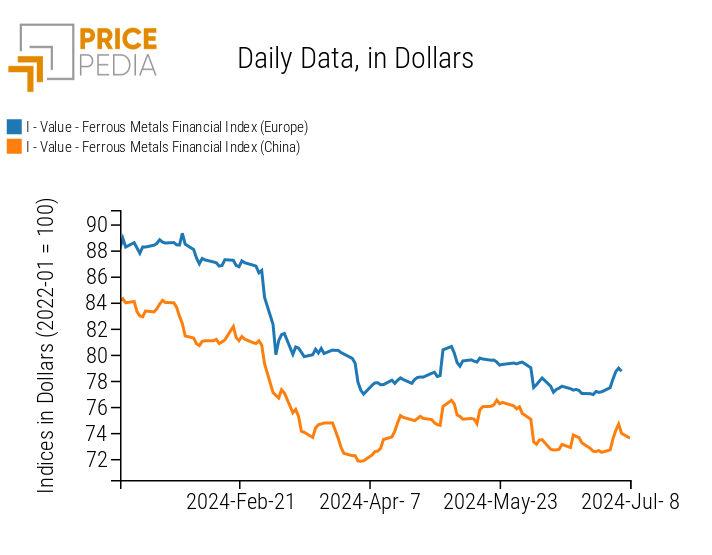

This week, the two financial indices of ferrous metals showed a slight upward trend due to the increase in Chinese iron ore prices.

Expectations of new government support for the real estate sector, which will likely be clarified at the Third Plenum meeting on July 15-18, have favored a slight rebound in financial prices of iron ore.

PricePedia Financial Indices of Ferrous Metals Prices in Dollars

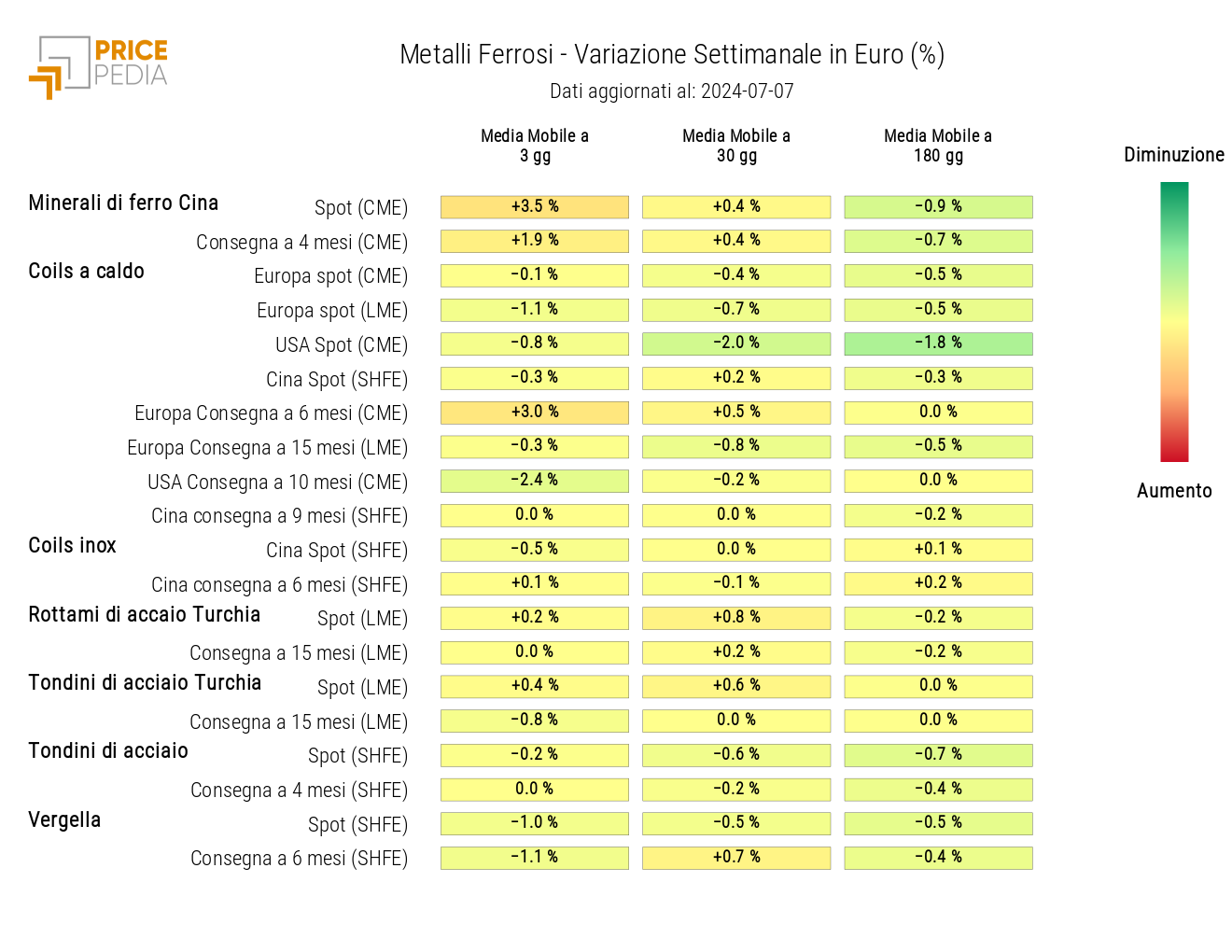

The heatmap of ferrous metals prices shows a rebound in Chinese iron ore prices.

HeatMap of Ferrous Metals Prices in Euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

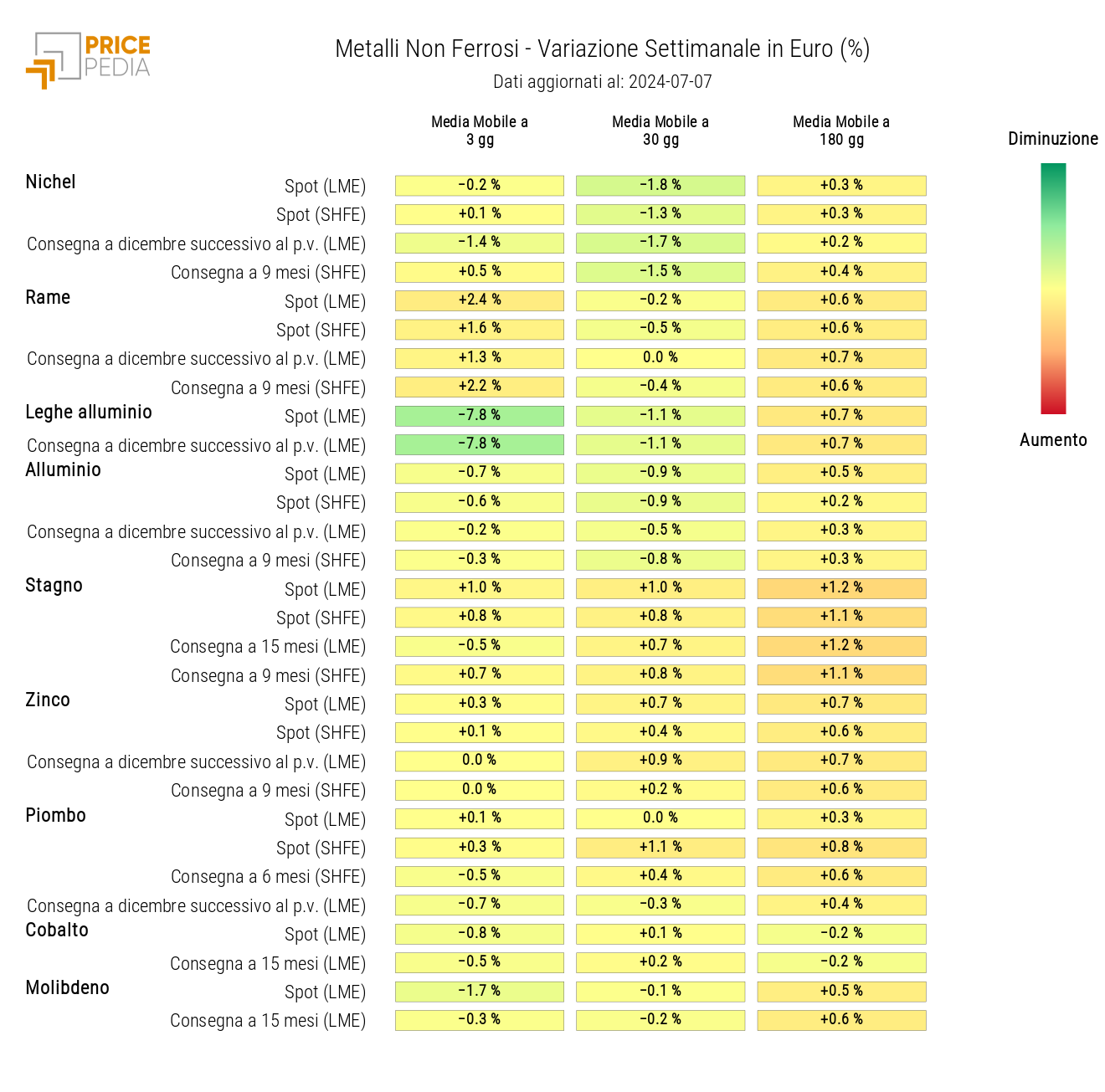

INDUSTRIAL NON-FERROUS METALS

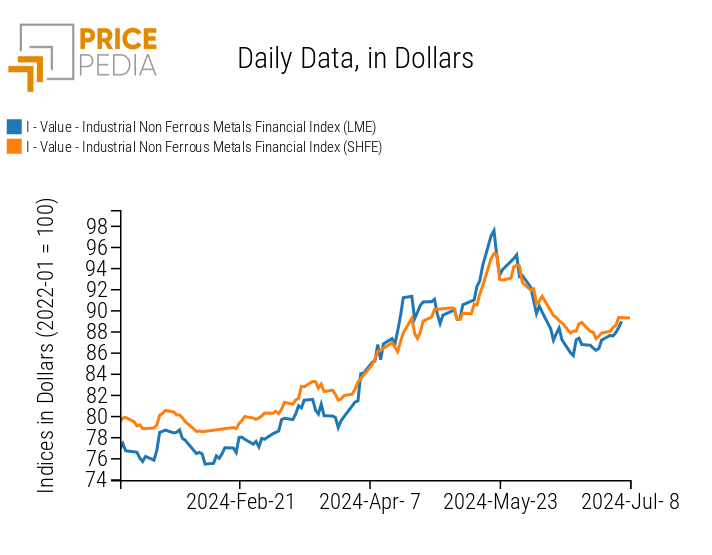

The indices of the two financial markets for industrial non-ferrous metals showed slight increases during the week, indicating a general rise in prices quoted on their respective financial exchanges. However, the aluminum alloys market saw a significant drop in price levels this week.

PricePedia Financial Indices of Industrial Non-Ferrous Metals Prices in Dollars

The non-ferrous heatmap shows positive weekly price changes for copper and tin, with a negative price change for aluminum alloys.

HeatMap of Non-Ferrous Metals Prices in Euros

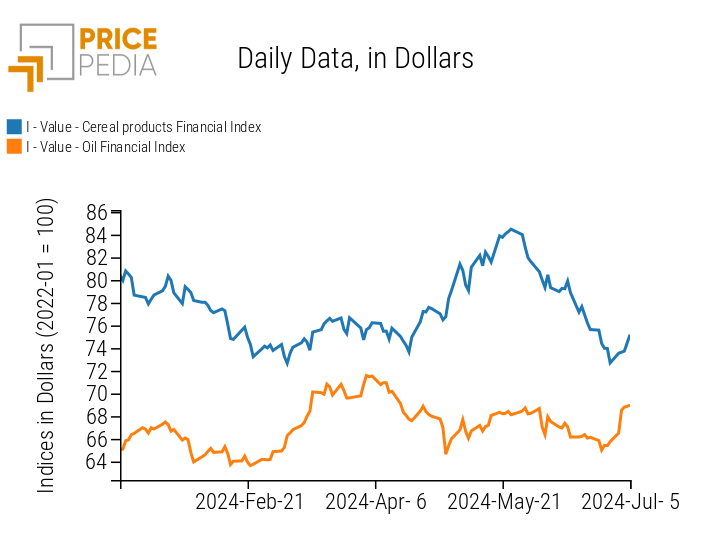

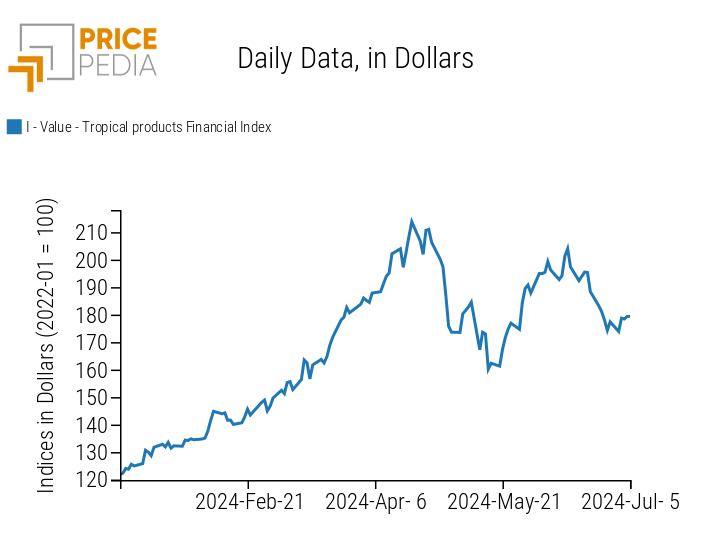

FOOD

This week, financial indices of food products interrupted their price reduction trends and registered positive oscillations. The index with the largest price increase was the food oils index due to the rise in soybean oil prices.

| PricePedia Financial Indices of Food Prices in Dollars | |

| Cereals and Oils | Tropical |

|

|

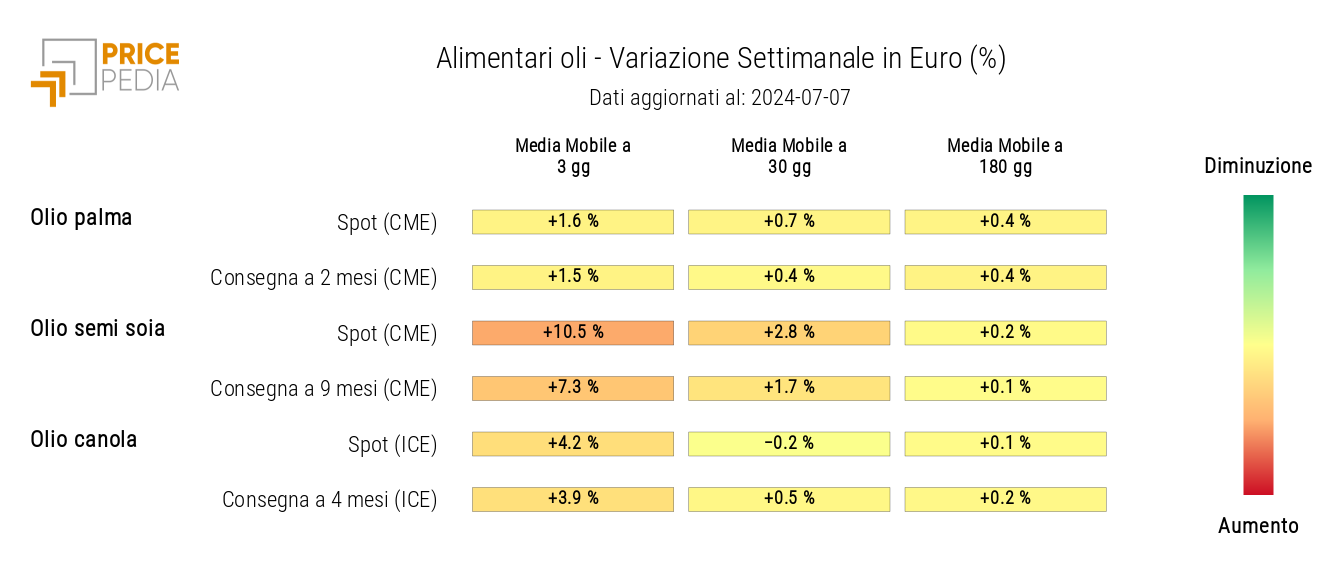

OILS

The food oils heatmap shows a rise in soybean oil prices due to fears of possible export reductions from Brazil, the world's second-largest producer and exporter.

HeatMap of Food Oils Prices in Euros