Copper price clash between hedge fund bullish bets and weak demand

Expectations of strong increases in copper consumption support future prices, but weak demand reduces spot ones

Published by Luca Sazzini. .

Copper Non Ferrous Metals ForecastThe dynamics of copper prices have become a topic of debate among financial market experts and economists analyzing supply and demand. The main mutual funds, especially hedge funds, maintain bullish positions on copper prices based on predictions of future demand increases from electric vehicles (EV) and new technologies related to artificial intelligence and automation. Among these bullish predictions stands out the statement from Goldman Sachs, which recently forecasted a copper price of around $12000/ton by the end of 2024.

This forecast clashes with the current weakness in Chinese demand, which has caused the recent decline in copper prices, which have fallen below the $10,000/ton threshold on the London Metal Exchange (LME).

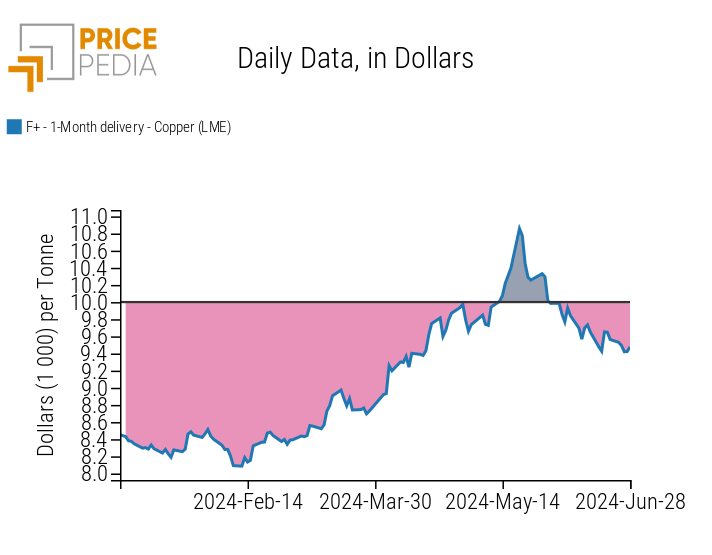

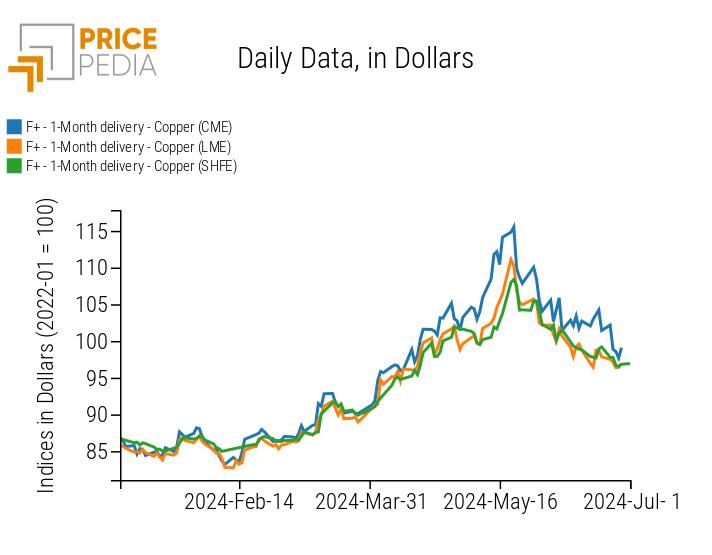

The following figure shows on the left the LME copper prices compared to the $10000/ton threshold, and on the right the comparison of copper prices across the three financial markets where it is traded.

| LME Copper Prices compared with the $10000/ton threshold | Comparison of financial benchmarks of copper prices |

|

|

The figure shows the recent cycle of copper prices, which has also seen a significant increase in the differentials between the three financial prices. The price of copper quoted on the Chicago Mercantile Exchange, the preferred financial market for traders to speculate on copper prices, has seen more intense price increases compared to those recorded in the financial markets of London and Shanghai. This aspect accentuates the hypothesis that the copper price rally, which reached a peak in May 2024, was mainly driven by speculative factors rather than an increase in real global demand.

The latter is heavily dependent on what happens in the Chinese market, where over half of the world's physical copper exchanges take place. An indirect indicator of the situation in the Chinese copper market is represented by copper ore imports. These increase (or decrease) when copper consumption and production rise (or fall).

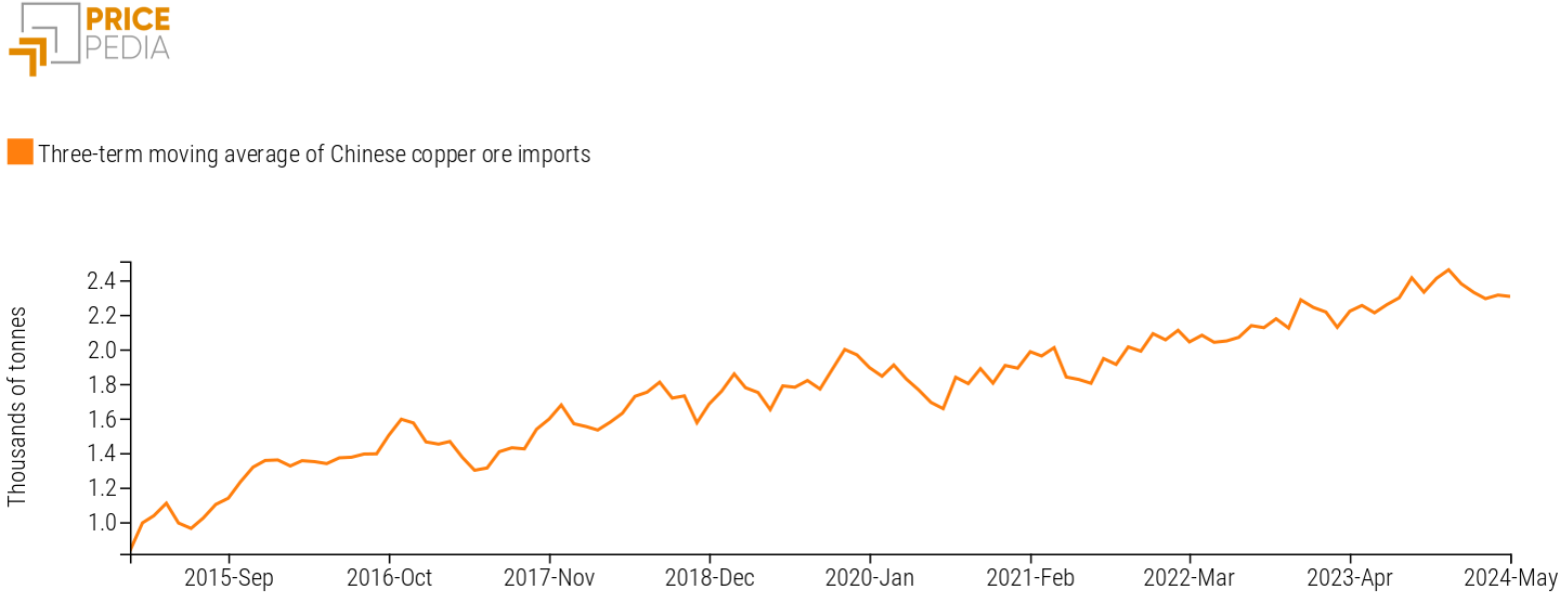

Analyzing China's copper ore imports, one can see a trend towards reduced imports during 2024.

Three-term moving average of Chinese copper ore imports

Excluding any fluctuations, there is a growing trend in Chinese copper ore imports that reached a peak in 2023, only to slightly decrease again in 2024.

These data confirm the current weakness in demand seen in the Chinese market, which has led, since the end of the Chinese New Year, to a 78% increase in copper inventories at the Shanghai Futures Exchange (SHFE) (source: Bloomberg).

This demand weakness is primarily due to the Chinese real estate market crisis, which has long been slowing the recovery of the Chinese economy.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Chinese Real Estate Market Crisis

The Chinese market crisis officially began in 2016 when the government started to limit credit access for real estate companies. In previous years, many real estate companies had heavily indebted themselves to increase the supply of real estate to meet the growing domestic demand due to rising population growth. In the following years, however, the demand for houses began to decline, especially during the years of the COVID-19 pandemic.

The crisis then reached its peak with the bankruptcy of Evergrande, the second-largest real estate company in China for apartment sales. This crisis, in addition to increasing the debts of real estate companies, had strong repercussions on the country's domestic demand, extending the real estate sector crisis to the entire Chinese economy.

In recent months, the Chinese government has repeatedly tried to support the real estate market, and the People's Bank of China recently announced a $42 billion loan to help local governments purchase millions of unsold homes.

Currently, the real estate market crisis seems far from being resolved, and house prices continue to suffer monthly reductions. In May, house prices in China fell by 0.7% m/m, compared to declines of 0.6% and 0.3% recorded in April and March, respectively.

These data highlight a clear trend of declining house prices, with the effect of reducing residential investments and the demand for all goods related to the building cycle, such as copper.

As long as the weakness in Chinese copper demand persists, due to the real estate market crisis, it will be difficult to register a significant increase in copper prices, as predicted by major hedge fund managers.

PricePedia Forecast

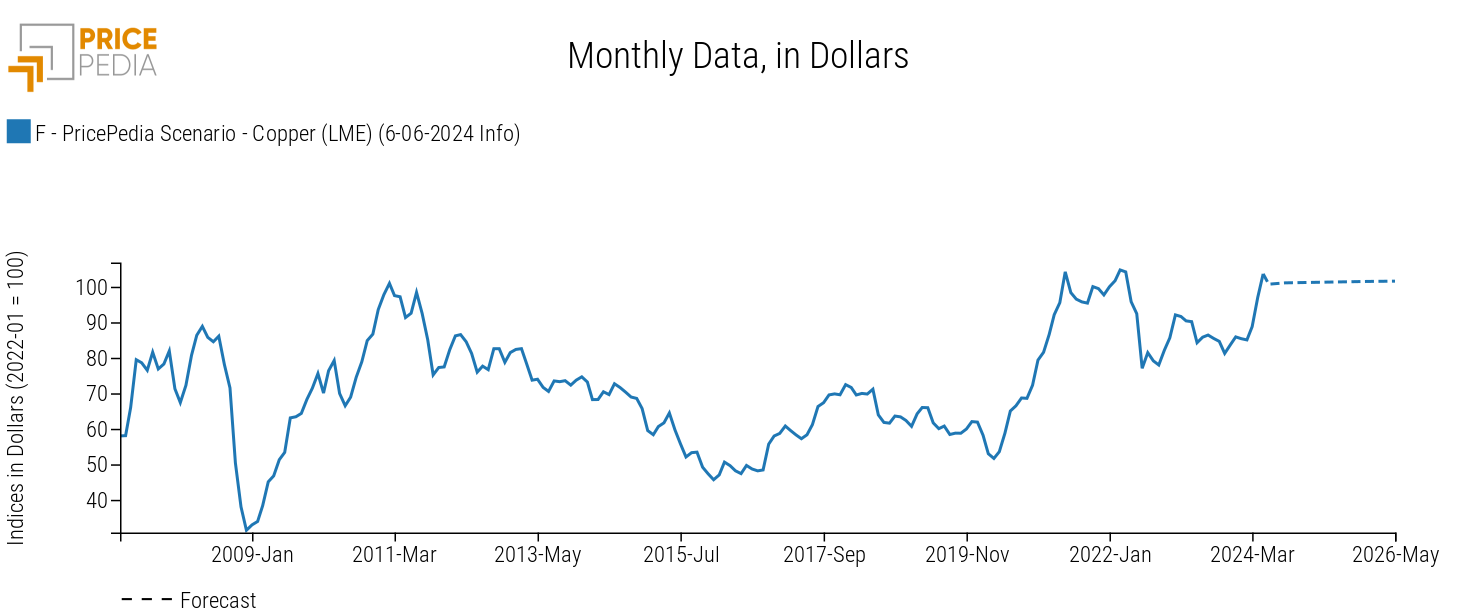

The following chart shows the PricePedia forecast scenario for the historical series of financial copper prices quoted on the London Metal Exchange (LME).

PricePedia Forecast of LME Copper Prices

The PricePedia forecast indicates a relative stability of copper prices, which are expected to reach levels close to the $10000/ton threshold in the last forecast month (May 2026). This contained price dynamic is due to the current crisis in the Chinese real estate market, which at the moment seems too strong to be resolved immediately.

Conclusions

The current weakness in Chinese copper ore demand contrasts with the strong price growth predicted by major hedge fund managers. Despite the current fall in copper prices, many private investment funds are confident in a price recovery driven by the growing demand for EVs and new technologies related to artificial intelligence.

Chinese buyers, on the other hand, state that if the weakness in domestic orders continues, copper prices will hardly return to the $10,000/ton threshold.

The PricePedia forecast stands in between these two different scenarios, indicating a copper price of nearly $10000/ton in two years. This forecast thus signals the persistence of a contrast between the price reduction effects due to the weakness in Chinese demand and the actions of financial operators aimed at anticipating the possible effects of the expected demand increase caused by the energy transition.