The slowdown of the global economy as the main driver of commodity prices in the next two years

PricePedia January 2024 Forecast Scenario

Published by Pasquale Marzano. .

Last Price ForecastThe PricePedia scenario has been updated with information available as of January 8, 2024.

2023 ended under the banner of the continuation of the phase of weakness of the world economy, marked above all by the reduction in European industrial production: the November 2023 data relating to the EU indicates a decrease, compared to November 2022, of -5.8% .

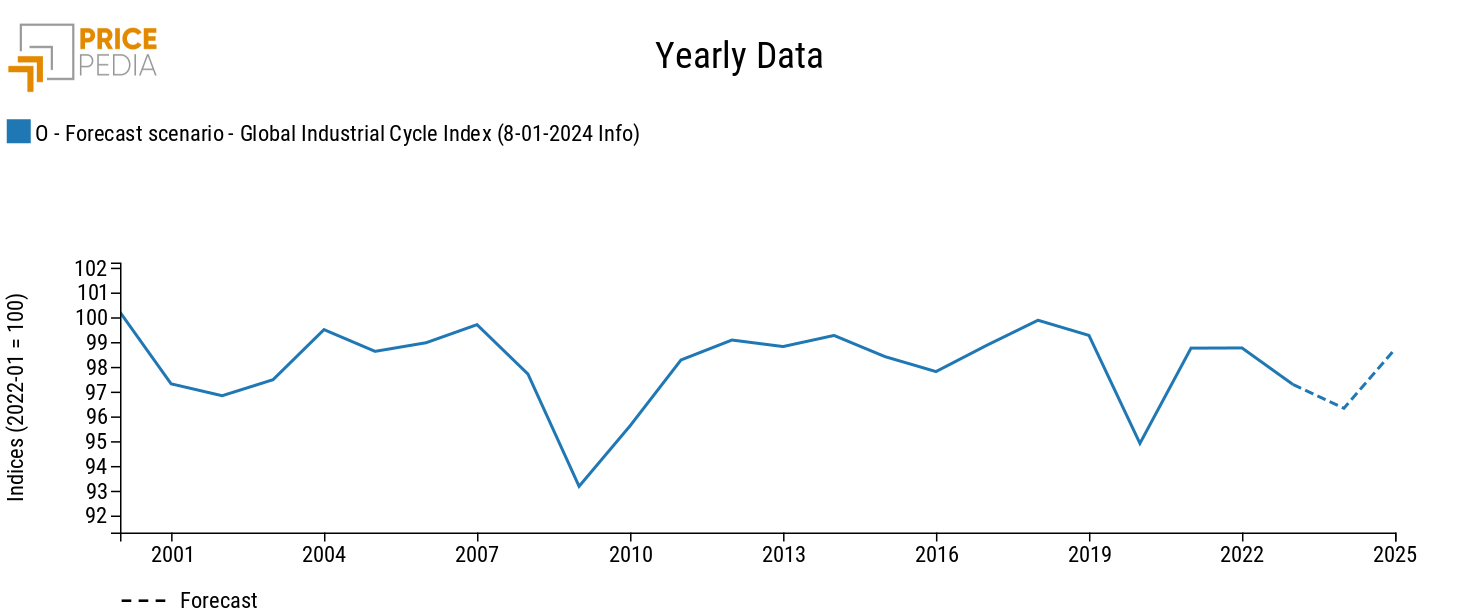

The following graph shows the forecast scenario for the next two years of the global industrial cycle index[1].

In the annual average of 2023, the index recorded a decline of -1.5% compared to the average of 2022. Monetary policy in the main economic areas remains restrictive, with interest rates stably high. In this context, global demand for commodities remains weak.

2024 is expected to be the year of gradual easing of measures put in place to quell inflation, although there is uncertainty regarding the timing of this change of course. Given the delay with which the effects of monetary policy are transmitted to the real economy, from the point of view of the global industrial cycle this means that 2024 will still decline in annual terms by almost -1%, albeit less intense than in 2023. However , in 2024 we observe a reversal of the decreasing dynamics of the index which lays the foundations for a more lively recovery in 2025: on average in 2025, in fact, the global industrial cycle records growth equal to +2.5% compared to the previous year.

Forecasting commodity prices

The trend of the global industrial cycle is a proxy of the existing tensions between supply and demand on the commodity markets and therefore influences the trend of the prices of the latter.

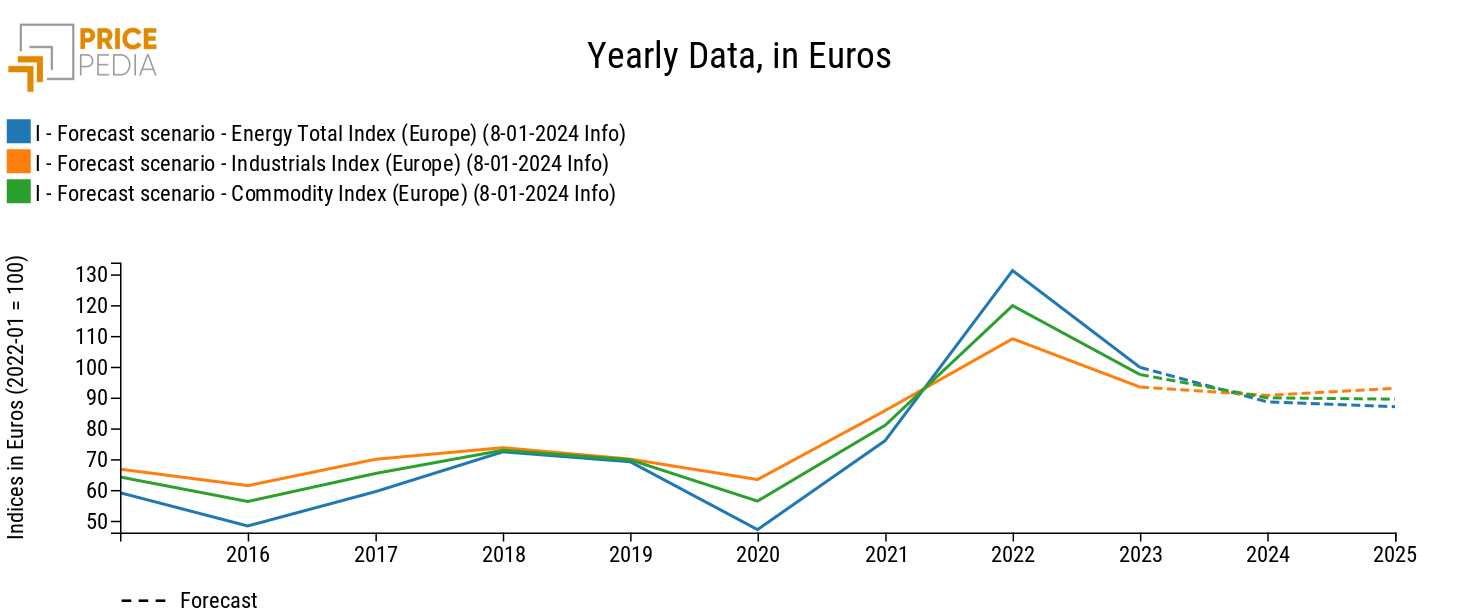

The forecast of commodity prices for the main product aggregates is illustrated below.

The graph shows how a normalization of raw material prices is underway starting from 2023, after the turbulent two-year period 2021-2022 which inflamed prices, bringing them to historic highs. This normalization, however, is not to be understood as a return to pre-pandemic values. It should be noted, in fact, that the 2024 levels are higher than those of 2019 for all three aggregates considered by almost +30%.

After a further reduction of -2.9% in annual terms in 2024, the prices of industrial commodities[2] show growth of +2.5% in 2025, supported by recovery in global demand for commodities.

As regards energy raw materials, in 2025 prices will record further declines, on average equal to -1.8% on an annual basis. The reductions are driven by the price of oil: the latter has not been affected in the short term by the conflict in the Middle East and in the long term is influenced by an excess supply, despite the voluntary cuts in oil production expected by OPEC+ members for the next year. Gas is also expected to decline sharply over the next year.

1. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

2. The PricePedia industrial commodities index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialties, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Fibers Textiles.

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.