Update of wood supply chain prices to April 2024

European softwood sawn wood prices follow the dynamics of the CME lumber futures contract

Published by Luca Sazzini. .

Wood Price DriversIn the article Prices of pallets still over 50% higher than pre-2021-2022 cycle prices, evidence has already been given of how the financial prices of lumber (sawn coniferous) quoted on the Chicago Mercantile Exchange can be used as a regressor to estimate the trend of customs prices for spruce pallets in the European market. Within the dynamic specification of the estimated model, the financial prices of CME lumber have been delayed by two months, indicating that news from the other side of the Atlantic tends to influence the physical prices of the European coniferous lumber market with a delay of about 60 days.

In this article, we will provide further analysis on the relationship between the financial prices of CME lumber and the customs prices of European sawn wood through a graphical representation comparing their respective historical series.

Later, we will present an update on the customs prices of the European wood industry by breaking down the European wood market into three major categories: sawn wood, rough wood, and processed wood.

Analysis of Sawn Wood

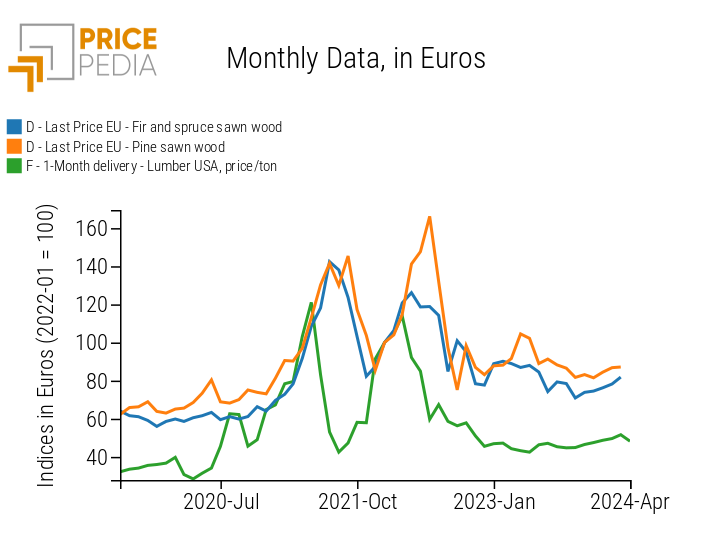

Within the sawn wood market, an important reference benchmark is given by the price of the lumber future contract quoted on the Chicago Mercantile Exchange (CME). This price refers to sawn wood in the American market, which has undergone significant fluctuations in recent times that have affected the dynamics of European customs prices for coniferous lumber.

The following graph compares the financial price of CME lumber futures (green line) with the customs prices of spruce and pine sawn wood.

Dynamics of coniferous sawn wood prices

From the graph, it is evident that the financial prices of CME lumber anticipate the dynamics of spruce and pine sawn wood customs prices by about two months.

The turbulence that has affected the financial prices of the United States market over the past 4 years has contaminated the dynamics of European customs prices, resulting in two major price cycles over the 2020-2023 triennium. Since the beginning of 2024, European customs prices have continued to show a slight upward trend, while CME lumber has begun to experience an initial decline as early as April 2024.

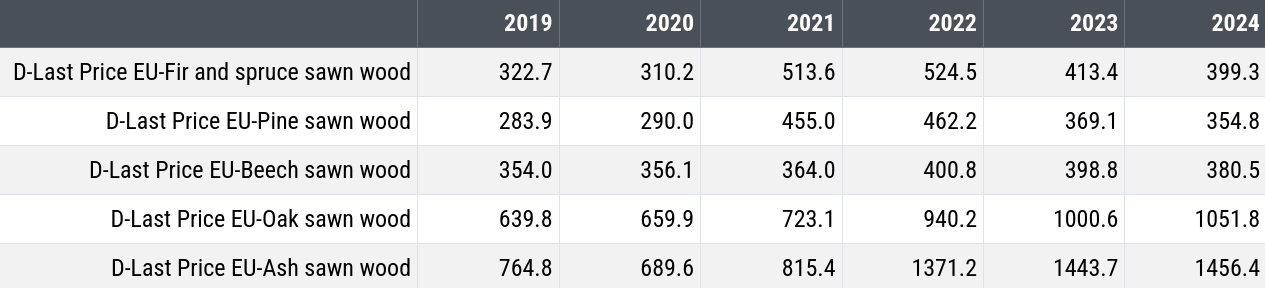

To analyze in more detail the actual dynamics of prices in the European sawn wood market, a table is provided with the annual averages of European customs prices expressed in euro/ton over the last 6 years.

Table of European customs prices for annual averages of sawn wood

From the analysis of the table of annual averages, a significant increase in the prices of oak and ash wood is evident over the last 6 years. These two types of wood are the only ones that have continued to register increases even in the first months of 2024.

From 2019 to date, customs prices for oak and ash wood are respectively 64% and 94% higher. All other sawn wood prices have recorded much lower increases compared to their 2019 levels, and, in terms of annual average, they are also undergoing a price reduction phase, even in 2024.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Analysis of Rough Wood

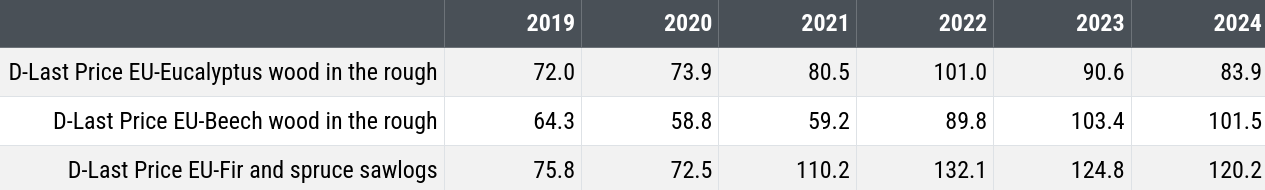

In the European customs market, prices for different types of rough wood are present. Among these, the most important prices are those related to eucalyptus, beech, and spruce wood.

Table of European customs prices for annual averages of rough wood

The table above highlights the dynamics of the annual averages of the main European customs prices for the rough wood market. From the analysis of the table, it emerges that the price of eucalyptus wood is the only one to register a reduction in prices starting from the 2022-2023 biennium and also, over the last 6 years, it has recorded price variations much lower than those of beech and spruce rough wood.

Overall, the price levels of beech and spruce rough wood have increased by almost 60% compared to their 2019 prices, while eucalyptus wood prices have increased by only 17%.

Analysis of Processed Wood

All types of wood fiber panels fall within the category of processed wood: from plywood, to chipboard, to plywood.

Below is a table containing the average annual price for the main types of processed wood panels on the European market.

Table of European customs prices for annual averages of processed wood

From the analysis of the table, it emerges that the prices of processed wood have undergone dynamics in the 2021-2024 period, all characterized by a growth phase followed by a reduction phase, but with different peaks. On one hand, OSB panels, which reached their peak already in 2021, are highlighted; on the other hand, birch plywood and tropical wood plywood are positioned, with a peak in 2023 and a still very weak decrease phase.

Prices that currently continue to maintain relatively high levels compared to previous years are those of tropical wood plywood, which remain almost 60% higher than the 2019 average price. Other prices that, despite the decrease, remain higher than 2019 levels are those of various MDF panels, which maintain an average price level about €100/ton higher than the 2019 average1.

Among the prices where we have returned to the same levels as 2019 are those of sanded panels (OSB), which, after rising from €402/ton to €621/ton in the 2019-2021 triennium, have returned to levels of €407/ton in the first months of 2024.

Conclusions

The analyses conducted on the European wood market have highlighted different price dynamics depending on the type of wood analyzed. European customs prices for coniferous sawn wood have shown alignment with CME lumber financial prices delayed by about two months. Among all the products in the European wood market, the only ones that have continued to register increases over the past two years have been those of oak and ash sawn wood.

In the rough wood market, eucalyptus wood prices have shown smaller price increases compared to beech and spruce wood.

Regarding processed wood, there has been a general decrease in prices in the last two years, but with prices of some products maintaining relatively high levels compared to those recorded in 2019. Among these is certainly the case of tropical wood panels, which, compared to 2019, record levels about 60% higher.

[1] This data is consistent with the analysis carried out in the article "Russia effect" on wooden panels where it was reported that it is unlikely that MDF panels will return to the same levels as in 2019.