Will the price of zamak remain higher than that of aluminium?

Zamak price forecast determined by zinc price

Published by Luca Sazzini. .

Zinc Forecast Forecast Zamak is a metal alloy that is often used as a substitute for aluminium.

The most important characteristics of this alloy are its excellent strength and easy machinability, making it ideal for use in numerous industrial applications, including automotive components, building products, hardware and electronics.

For many years, zamak was cheaper than aluminium, but in recent years the situation has changed and currently zamak prices are more than $400/tonne higher than those of aluminium listed on the LME.

On the PricePedia website, in the Daily Data Prices section, daily zamak data are available, a time series constructed from the combination of the LME prices of zinc, aluminium and copper, with weights of 95%, 4% and 1% respectively.

Given the high weight of zinc in zamak alloy, it is the main determinant in explaining the alloy's price development.

For the purpose of analysing the relationship with the aluminium price, we will therefore directly consider the zinc price.

The graph here shows the price of zinc compared to that of aluminium from 1960 to the present day.

Both time series are characterised by high volatility, which has led them to record several peaks over the last fifty years.

The graph shows that until 2005, aluminium prices were higher than zinc prices, then zinc prices recovered, and between 2006 and 2007, they spiked to significantly higher price levels than aluminium.

From then on, zinc and aluminium prices started to align and maintain fairly similar price levels until 2016, when zinc prices started to distance themselves from aluminium prices again. In recent years, the gap between these two time series has narrowed again and currently zinc and aluminium prices have reached values of $2569 and $2,165/tonne respectively, with a difference of about $400 in favour of zinc.

In the analysis in this article, we will try to understand whether zinc prices will continue to be higher than aluminium prices in the coming years or whether they will return to lower levels than the latter. We will therefore proceed by carrying out the same forecast analysis for zinc as we did for aluminium prices in the article published on 13 November: "Aluminium LME Price Forecasts".

PricePedia's forecast

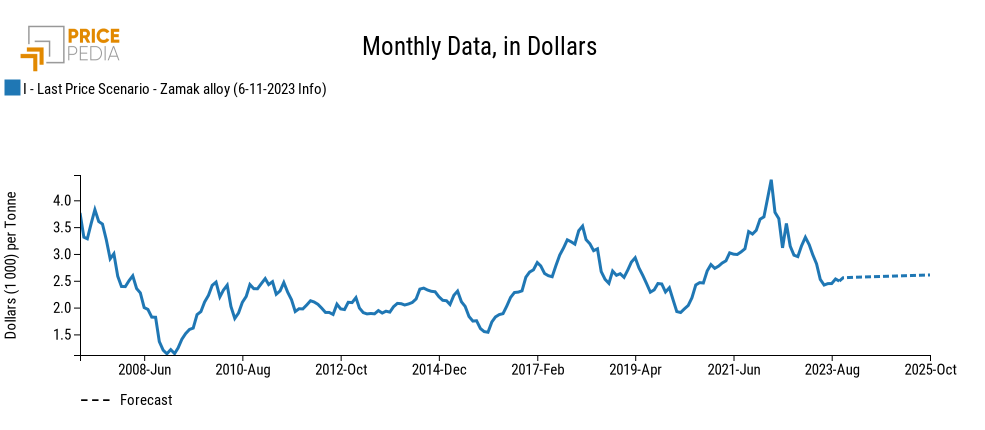

Within the PricePedia forecast scenario, an estimate on the future price development of zamak, derived from the zinc forecast, will soon be available.

Our forecast shows very little future growth for zamak alloy, which will rise from its average value of 2500, recorded last month, to a value of $2608/tonne at the end of the forecast period (October 2025). This price reflects the increase in zinc, which will rise from its current value of 2500 to a value close to 2600 $/tonne.

In order to qualify this scenario, as has already been done for aluminium price forecasts, it may be useful to compare these zinc forecasts with those made by other sources.

Implicit forecasts in futures

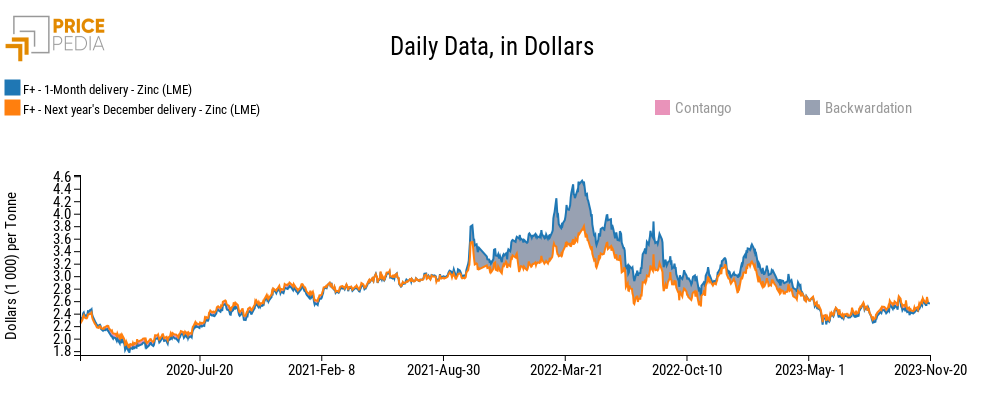

The first alternative source we consider is the zinc price forecast implied in futures contracts.

This first information source shows that zinc prices experienced a backwardation situation between the end of 2021 and the beginning of 2023. Afterwards, a contango situation occurred, which led the price of the future, with delivery in December of the following year of detection, to reach the current level of about $2600/tonne.

As already explained in the article "Aluminium LME Price Forecasts", the futures price analysed above is the current price of zinc plus the cost of holding the commodity in storage until the end of 2024. This figure is slightly higher than that estimated by the PricePedia scenario, which forecasts a zinc price close to $2550/tonne for December 2024.

Recent World Bank forecasts

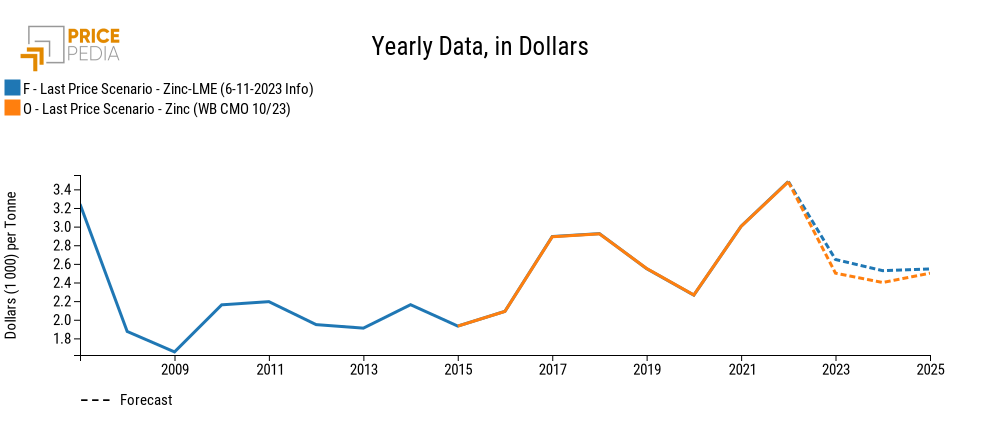

The second forecasting source analysed below is World Bank, ich recently estimated future forecasts for the annual average of zinc.

The graph comparing the annual trend of the World Bank forecast with the one made by PricePedia is then shown.

The above graph shows that in 2024, both forecasters expect a decrease in the average annual zinc price, followed by a recovery in 2025.

The change in the annual average is influenced by the price collapse that occurred in the first half of 2023 due to a slowdown in global demand.

This decrease results in an annual average in 2023 that is higher than current zinc price levels. The weak growth expected in 2024 will not be sufficient to raise the annual average so much as to make it higher than in 2023.

For 2025, the World Bank predicts a slightly higher price change than PricePedia, bringing the two forecasts in line at levels above $2,500/tonne. In both scenarios, price growth is expected to be driven by the recovery of global demand and the importance of zinc within the energy transition.

Consensus Economics' October forecasts

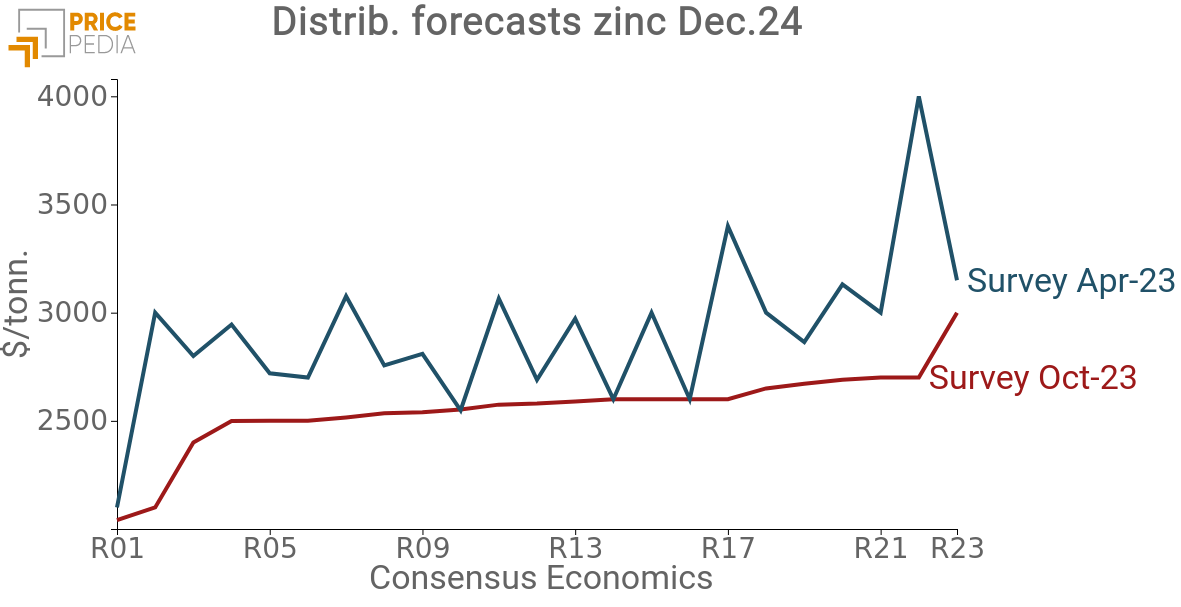

A final very useful source to analyse is that of Consensus Economics, whose advantage is to allow the construction of a forecast range and to monitor the variation in forecast risk from one survey to the next.

The graph below shows the results of two surveys, carried out in April and October 2023, by 23 zinc price forecasters, both referring to the expected price in December 2024.

The graph shows that in October, compared to April, there was a reduction in the average forecast price and a reduction in the associated risk.

Between April and October 2023, there was a decrease in the forecast price from 2907 to 2529 $/tonne and a decrease in the standard deviation of 46%.

Excluding outliers, the forecast range of the latest survey is between 2400 and 2700 $/tonne.

These forecasts are consistent with the forecasts implied by the futures and are aligned with the PricePedia forecast scenario.

Conclusions

Zamak prices are strongly aligned with those of zinc, given the significant weight of this metal within the alloy considered. Zinc forecasts can therefore be used as a basis for forecasting zamak.

The implied forecasts in the LME zinc price futures, those made in October by the World Bank and the results of the October survey by Consensus Economics, are in line with PricePedia's forecast of a slight increase in the zinc price over the coming months. The monthly price curve will not, however, be such as to lead to an increase in the average annual price by 2024. An increase in the price of zinc, and thus of zamak, is expected in 2025.

When comparing zamak prices with those of aluminium, zamak prices in the near future will probably remain even higher than those of aluminium, although this difference will tend to decrease.