Aluminium LME Price Forecasts

Limited increase in aluminium prices for the next two years

Published by Luca Sazzini. .

Forecast Aluminium Forecast

In this phase of reduced global demand, it is possible to distinguish between commodity prices that have remained relatively high, and those that have already experienced a decline that has brought them back to near pre-pandemic levels.

The first category includes the so-called sticky prices , while the second category includes elastic prices, namely all those prices that react significantly to both upswings and downswings in world demand.

Aluminium prices, together with zinc prices, belong to this second category, since among industrial metals, they are the ones that have recorded the largest decrease during 2022. In fact, comparing the price in October 2023, with the average price in 2019, it appears that the current price of aluminium is 'only' 22% higher, while the prices of other non-ferrous metals, such as copper, nickel and tin, are more than 30% higher.

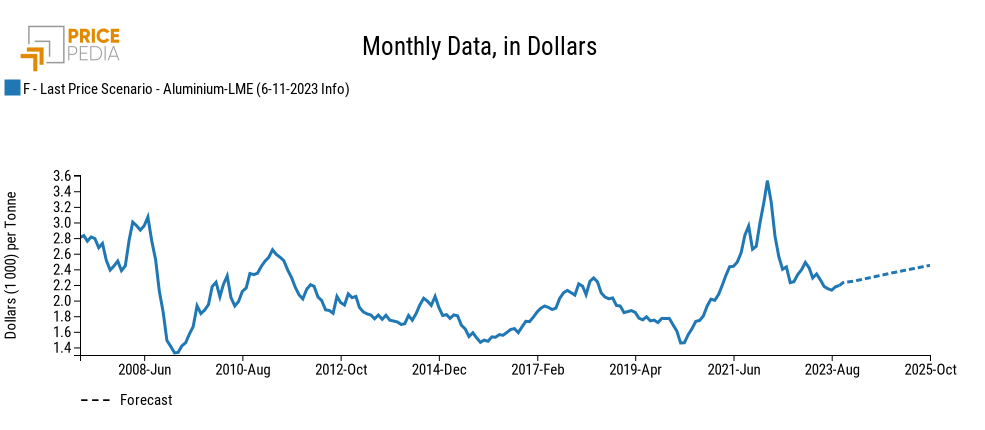

Below is a graph depicting LME aluminium prices, showing the speed at which the 2022 collapse occurred.

PricePedia's forecast of 6 November 2023

In addition to showing the historical series of LME aluminium prices, the graph above also shows a dashed line depicting PricePedia's forecast of the October 2023 Scenario.

In this scenario, the LME primary aluminium price is expected to grow slightly in both 2024 and 2025, reaching a value of $2451/tonne at the end of the forecast period (October 2025).

In order to qualify this forecast scenario, it may be useful to compare the forecast included in the PricePedia scenario with forecasts from other sources.

Implicit forecasts in futures

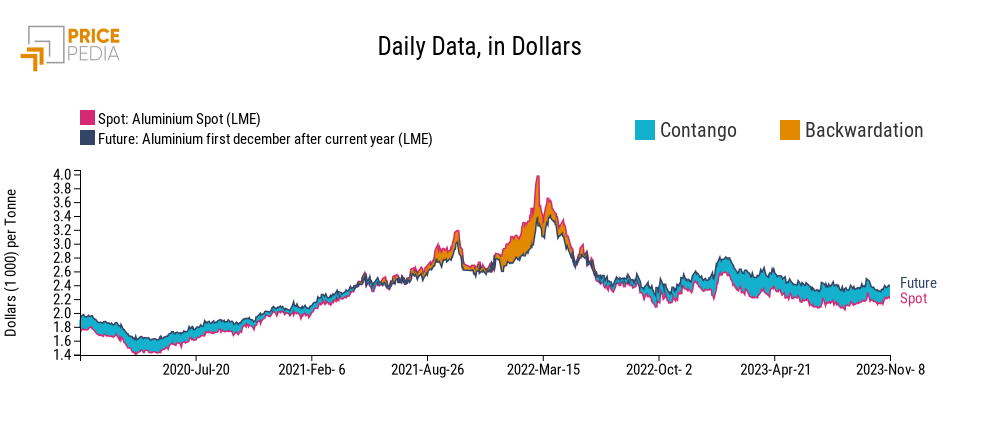

The first alternative source we consider is the aluminium price forecast implied in futures contracts.

In the graph above, you can see a comparison of spot and futures prices (with delivery in December of the year following the month of survey) of aluminium.

The graph shows that, in the latter part of 2021 and in the first quarter of 2022, there was a backwardation situation, which is a situation where the spot price is higher than the future price. This type of situation signals cases where the seller expects a future price reduction.

Conversely, in late 2022 and throughout 2023, aluminium prices present a contango situation, with futures prices higher than spot prices. This situation is determined by storage costs, since, theoretically, the price of a future can never be higher than the sum of the spot price and storage costs. If, in fact, the futures price were to be higher than these two components, arbitrage operations would be created, based on simultaneously buying at the spot price and selling at the futures price, with the cost of keeping the purchased commodity in storage until the delivery date.

A comparison of the current value of the LME futures price ($2386/tonne) with the PricePedia forecast for December ($2355/tonne) shows a substantial alignment of the PricePedia forecast with the forecast implied by the futures price.

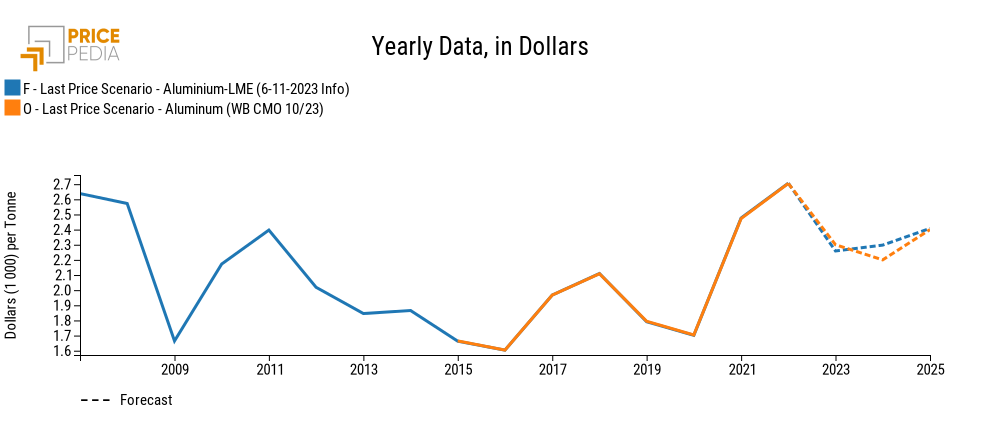

Recent World Bank forecasts

Analysing the World Bank forecasts and comparing them with those of PricePedia shows a weaker forecast for 2024, by the World Bank.

In fact, the World Bank predicts an annual estimate of $2200/tonne, which is about $100 lower than that reported by PricePedia.

The reasons behind the World Bank's estimate lie in the slowdown in global activity and the loosening of supply constraints.

As for the 2025 estimates, the World Bank also predicts an increase in aluminium prices ($2400/tonne), due to the slowdown in supply growth caused by higher energy prices and the growing demand for: electric vehicles (EVs), renewable energy and associated electric grid infrastructure.

Below is a graph of the World Bank's annual forecast of future aluminium price trends compared with the PricePedia forecast.

Consensus Economics' October forecasts

A final source that may prove to be important to scrutinise the possible future evolution of aluminium prices is that ofConsensus .

An advantage of this source is that it presents the results of estimates made by numerous practitioners in the field of commodity forecasting, and thus, in addition to providing a timely estimate, allows for the construction of a possible forecast range between the lowest and highest estimate (excluding otuliers).

Furthermore, by comparing the results of two surveys carried out at different times, it becomes possible to grasp whether or not the risk associated with a given forecast has increased from one survey to the next. To understand the trend in risk, it will be sufficient to observe the change in the standard deviation calculated on the professionals' forecasts.

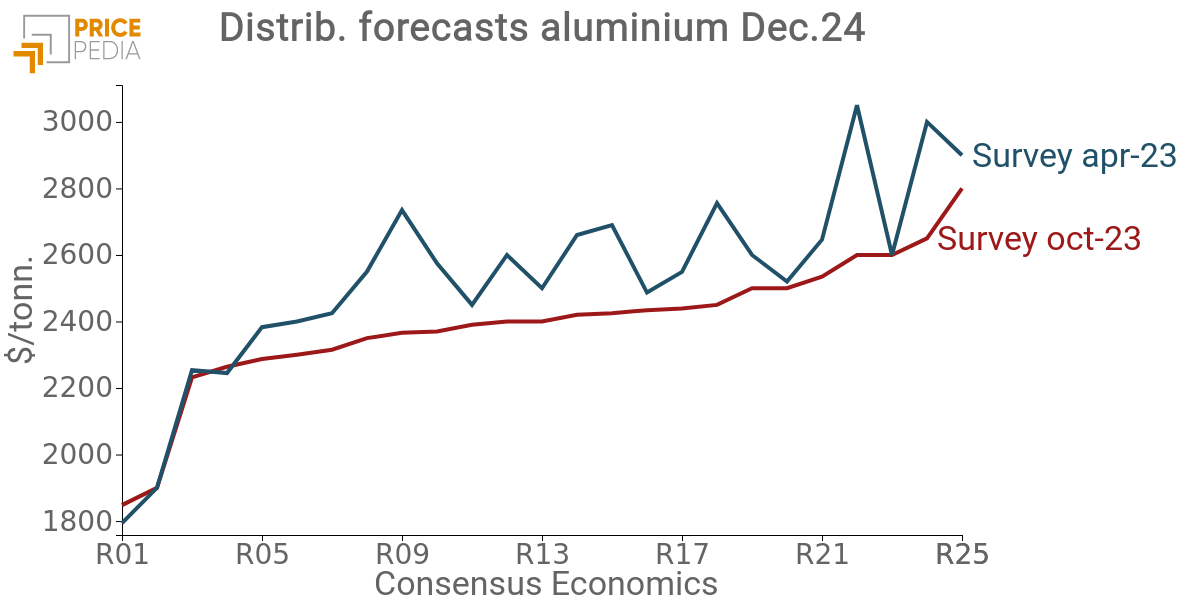

The graph below shows the results of two surveys, carried out in April and October 2023, to 25 aluminium price forecasters for December 2024.

Comparing the results of the two surveys shows that in October, compared to April, there was a reduction in both the average price level and the associated risk.

Between April 2023 and October, in fact, there was a decrease in the average forecast price from $2553/tonne to $2389/tonne and a decrease in the standard deviation of 20%.

The forecast range of the October survey has decreased and, excluding the two outliers (1789 and 2800), is between 2200 and 2600$/tonne.

These results are consistent with the PricePedia forecast (2355) and the current trend of future prices (2386).

Conclusions

The analysis carried out on the future development of aluminium prices predicts a very moderate increase in the next two years, with limited likelihood of crossing the $2,500/tonne threshold.

Demand in the next two years will not be such as to trigger a significant phase of price increases. On the other hand, world supply is very competitive, leading producers to compete strongly on price.

The forecast results reported in this article show a partially different assessment by the World Bank, compared to other forecasters, including PricePedia. While Wolrd Bank sees a continuation of the current weakness of the world industrial cycle (and thus of aluminium demand) throughout 2024, with an average aluminium price in 2024 lower than in 2023, PricePedia and the other forecasters see a recovery phase already in 2024 with the effect of bringing the aluminium price at the end of 2024 to between $2,300 and $2,400/tonne.

Finally, as far as the 2025 forecast is concerned, all forecasters agree on an increase in aluminium prices.