Copper price down for two weeks

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

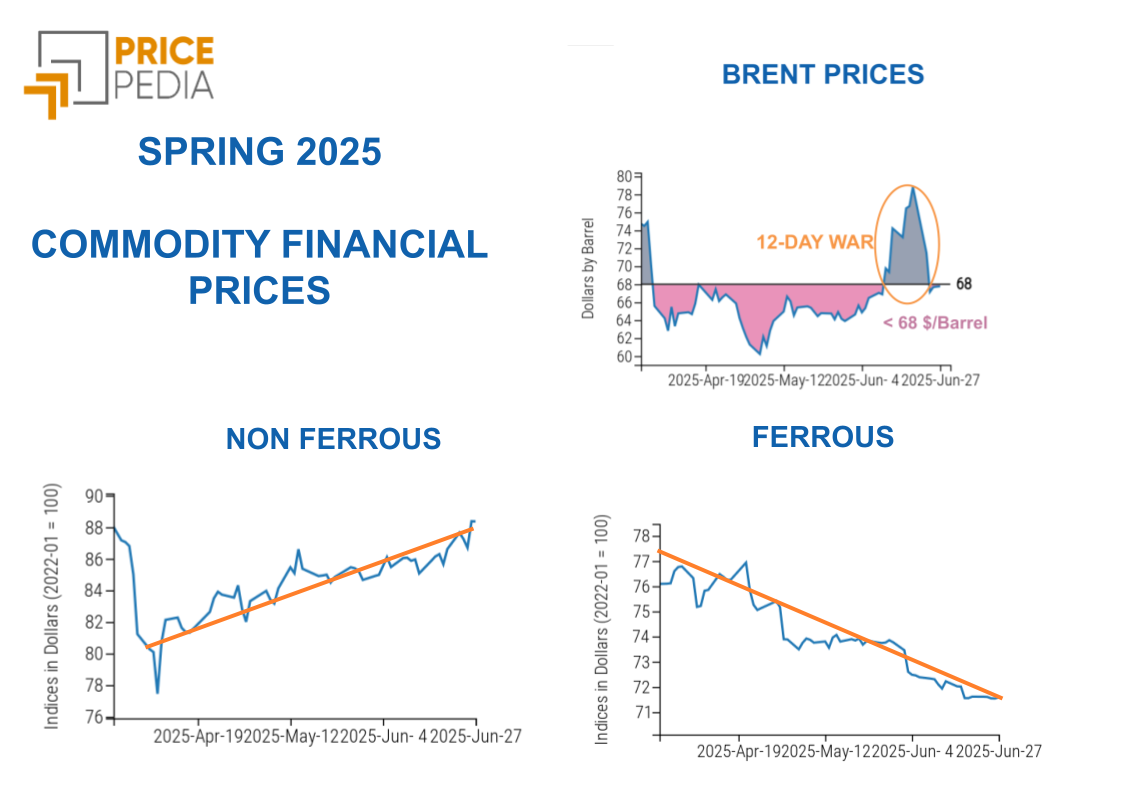

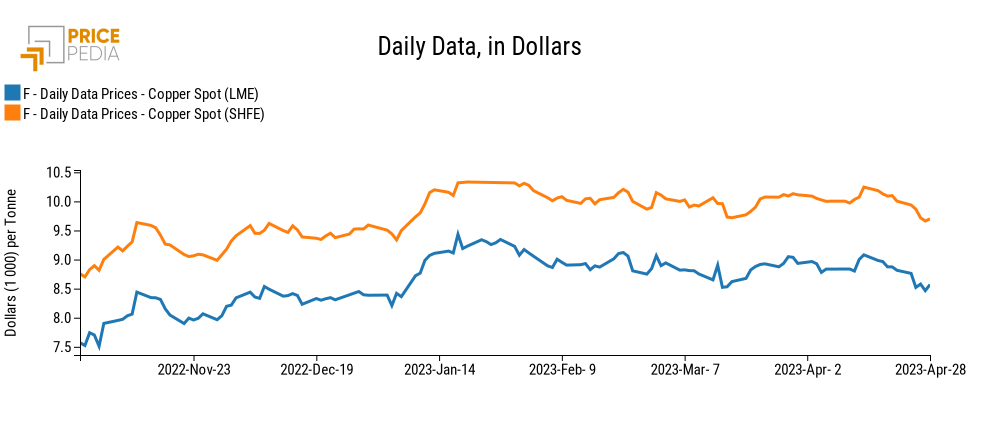

LME Conjunctural Indicators Copper Non Ferrous Metals Macroeconomics Doctor Copper SaysOver the past few days, copper has confirmed the downward phase started last week: at yesterday's market close, on Thursday, April 27, prices quoted on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE) were back to early 2023 levels, falling below the values touched in mid-March in connection with the banking sector shock, before showing a limited uptick today.

Over the past two weeks as a whole, we can see a -5.6 percent decline for LME-listed copper and a -5.3 percent contraction at the SHFE, bringing dollar prices to lower values compared to the average of the past four months. Let us then delve into the causes of this market downturn.

News from China: weakness and signs of support

Yesterday, the National Bureau of Statistics of China released data on the profits of national industrial companies, showing a -19.2% year-on-year decline in March 2023 (-21.4% for Q1 as a whole). Thus come signs of fragility from a sector that is a key player in metal consumption, weighing also on the price of copper.

Against a backdrop of global demand that remains tepid, the indicator therefore confirms that China's recovery cannot itself be said to be consolidated, especially for the industrial and construction sectors, despite the abandonment of the zero-Covid policy.

Along these lines are statements made earlier today by the Politburo of the Communist Party of China, the main decision-making body led by President Xi Jinping, which confirmed a cautious approach and the intention to support the country's demand. The focus is thus on reassuring investors that the government wants to continue to support a solid recovery, despite a dynamic GDP in Q1, which is, however, combined with persistent signs of weakness from other economic indicators.

US GDP growth slows down

In recent days, signs of weakness from the US - for which the FED is betting on a "mild recession" - have also weighed on the price of copper.

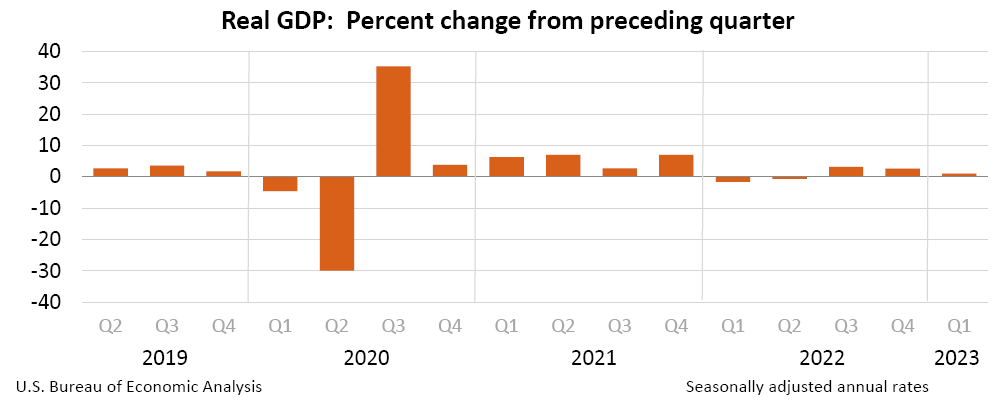

In addition to some fears on the banking front, related to the latest developments at First Republic Bank, it is the macroeconomic side that worries markets more broadly. Indeed, yesterday an estimate of US GDP for Q1-2023 was released by the Bureau of Economic Analysis, confirming the prospects for a slowdown. GDP increased by 1.1 percent (seasonally adjusted annual rates) over the previous quarter, signaling a clear slowdown from the +2.6 percent increase recorded in Q4-2022; the extent of this rise was lower than markets had expected. On the other hand, growth on a year-on-year basis was higher, at +1.6%.

Compared with the fourth quarter of 2022, the deceleration of real GDP in Q1-2023 mainly reflected a decline in private inventory investment and a slowdown in non-residential fixed investment. These movements were partly offset by an acceleration in consumer spending, a recovery in exports and a smaller decline in residential fixed investment. Consumer spending increased for both goods and services; among goods, the largest contribution came from automotive.

In contrast, in the face of modest economic growth, US inflation confirmed its resilience. In Q1, the Personal Consumption Expenditures (PCE) price index rose 4.2% from the previous quarter, accelerating from the +3.7% increase recorded in Q4-2022. The index is even higher excluding food and energy prices (+4.9%, accelerating from +4.4% in the previous quarter).

It will be the FED that, early next week, will clarify the next monetary policy moves aimed at managing the current complex picture.