Persistent inflation and a complex recovery

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

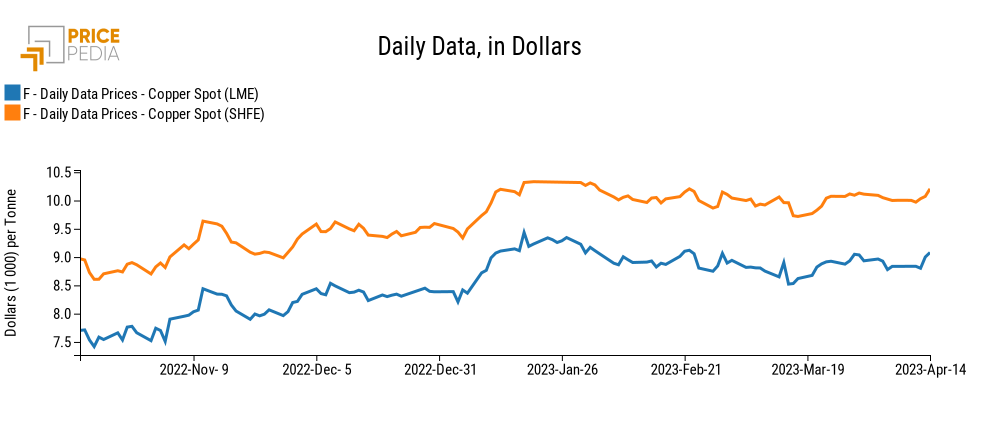

Exchange Rates LME Copper Non Ferrous Metals Macroeconomics Doctor Copper SaysThe reopening of markets following the Easter break provided, for copper, limited signs of fluctuation in the short term, suggesting a "hesitant" price in an uncertain economic picture. It was only yesterday that data reported the start of an upward trend, both on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE), which brought copper at the SHFE back above $10200 per ton, and copper at the LME back above $9000. What kind of news drove these movements?

US inflation and monetary policy prospects

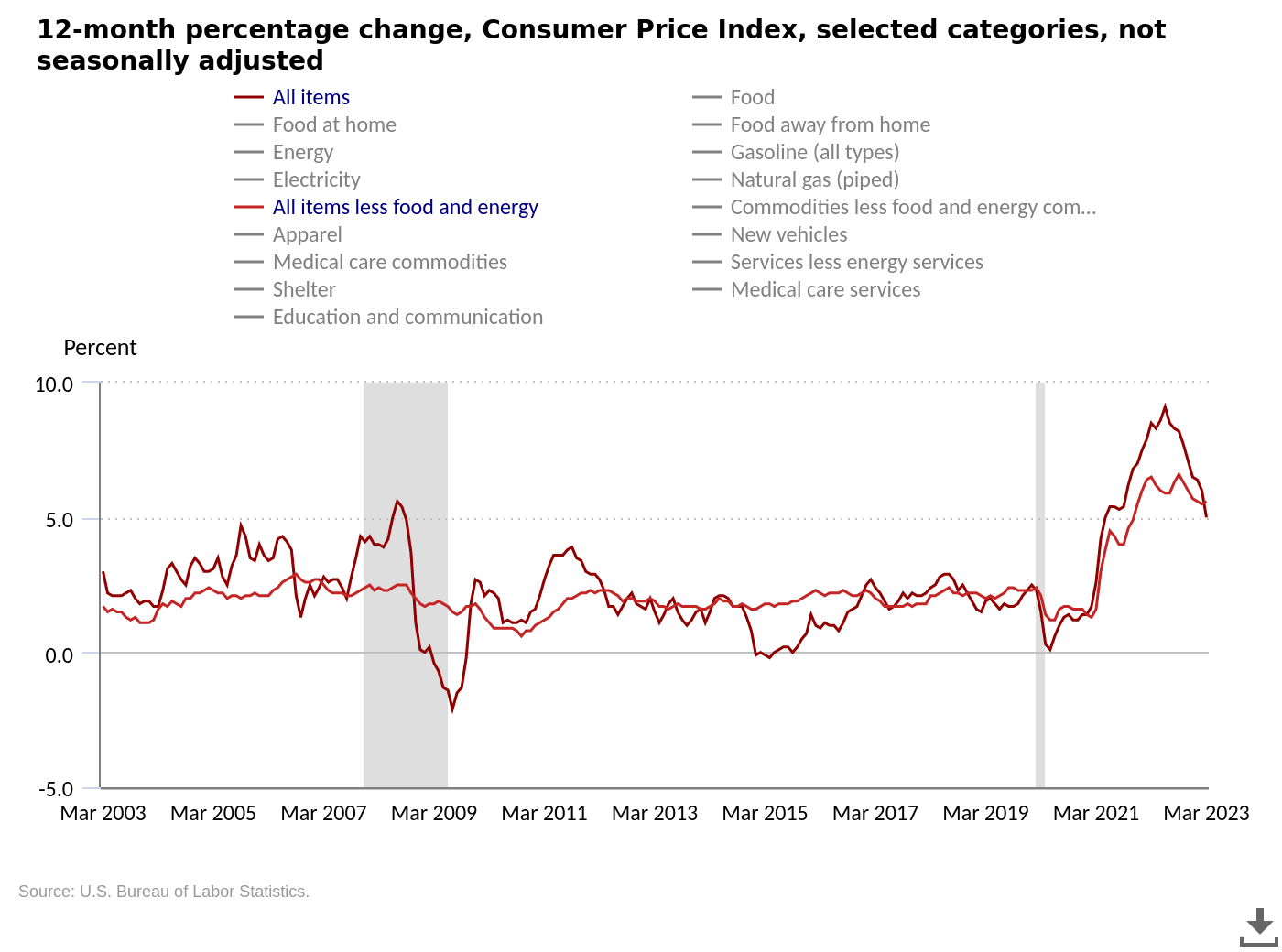

On Wednesday, the US Bureau of Labor Statistics released inflation data for March, confirming the presence of an ongoing normalization trend.

As can be seen from the graph below, the Consumer Price Index (All items) marked a +5% year-on-year change, returning to the levels of early 2021; the increase recorded by the food sector was stronger (+8.5%), compared with a contraction (-6.4%) for energy. Looking instead at the core index (All items less food and energy), data show a 5.6% increase over March 2022, up slightly from the previous +5.5% recorded in February.

So, while the contraction in the CPI as a whole has been welcomed by both markets and institutions, eyes remain on "underlying" inflation and its relative persistence.

In the price scenario just described, what is the outlook in terms of monetary policy?

From the minutes of the last Federal Reserve meeting, held in late March, a complex picture emerges. We can see the different positions of the committee members, ranging from those who did not think a rate hike was appropriate, in order to have a chance to assess the economic and financial effects of the banking shock, to those who, in the absence of the shock, would have opted for a 50 bps hike, in the face of a persistent high inflation. If the balancing of positions led to opt for a 25 bps hike, the outlook for the next meeting, to be held in early May, suggests the possibility of a final hike in the current round of restrictive monetary policy.

Further point of attention signaled at the meeting was the prospect of a "mild recession" for the US economy, which is expected to begin at the end of this year, and a subsequent recovery in the two years to follow.

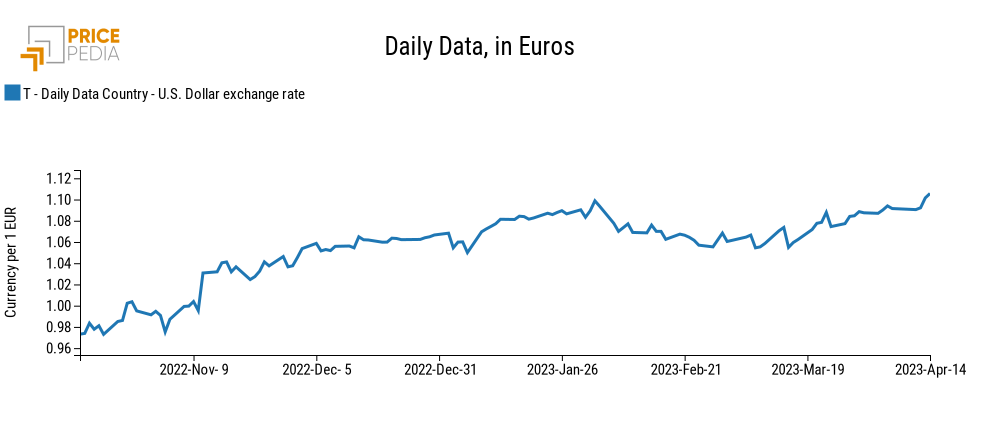

Market reaction. The dollar weakened on Thursday and Friday, favoring the optimistic picture of a slowdown of the overall CPI. The exchange rate against the euro returned to last spring's levels, also supporting the price of copper to the upside.

News from China

In recent days, partial support for copper price also came from foreign trade data, released by the General Administration of Customs of the People's Republic of China. Following the contraction of both imports and exports in the first two months of 2023,

positively surprising the markets and supporting copper price was the news that in March China's exports in USD grew by 14.8% year-on-year; on the contrary, imports showed a modest contraction (-1.4%).

On the copper front, however, imports declined: for copper ore and concentrates, customs report a 16.1% YoY drop, while imports of unwrought copper and copper products fell by 29.4%. However, the drop in imports was partially offset by a 14% increase in domestic production of refined copper, compared to March 2022, according to the state research institute Antaike.

"A rocky recovery" for the global economy

Broadening our gaze to the economic picture as a whole, we note the recent release of the April World Economic Outlook, the International Monetary Fund's scenario.

The outlook remains uncertain, marked by the mix of financial turmoil, persistent high inflation, the effects of the pandemic and the conflict in Ukraine. A 2.8% growth rate for world GDP is forecast for 2023, and a slight increase to 3% in 2024. It will mainly be the advanced economies to experience a slowdown in growth rates (from 2.7% in 2022 to 1.3% in 2023), while emerging countries will perform better. In contrast, inflation on a global scale is expected to slow from 8.7% in 2022 to 7% in 2023, but in any case a return to normalcy is ruled out before 2025.

Compared to the previous scenario, the picture partially improves for Italy, for which GDP is expected to increase by 0.7% this year, compared to the 0.2% contraction estimated last October.