Growing uncertainty about future recovery

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

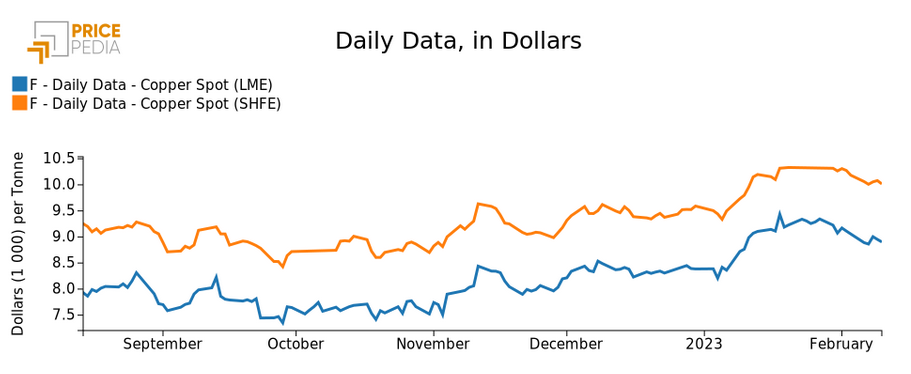

LME Conjunctural Indicators Copper Non Ferrous Metals Macroeconomics Doctor Copper SaysDespite some modest upward fluctuations, all in all over the past few days the price of copper confirms the downward trend set last week, as markets began to question the possibility of a rapid Chinese recovery. Compared to the closing values of Friday, February 3, this week draws to a close with a fall of almost -1.7% in copper price quotations in US dollars, on both the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE).

Against a background of general uncertainty, downward pressures thus seem to prevail. Let us then delve into recent news that can help us understand the reasons for these dynamics.

Hawkish or dovish, that is the question

Market sentiment in recent weeks seems to be significantly influenced by central banks’ comments. This week, market expectations would have caught some signs of optimism from Federal Reserve Chairman Powell's observation that the slowdown in inflation has begun, and thus from relative hopes for a moderation in upcoming rate increases.

Despite some modest rises in the price of copper, which reflected these fluctuations in investor sentiment, overall the price seems to remain defensive, letting the fears of the markets shine through; thus, the optimism of January now seems to have faded into the background.

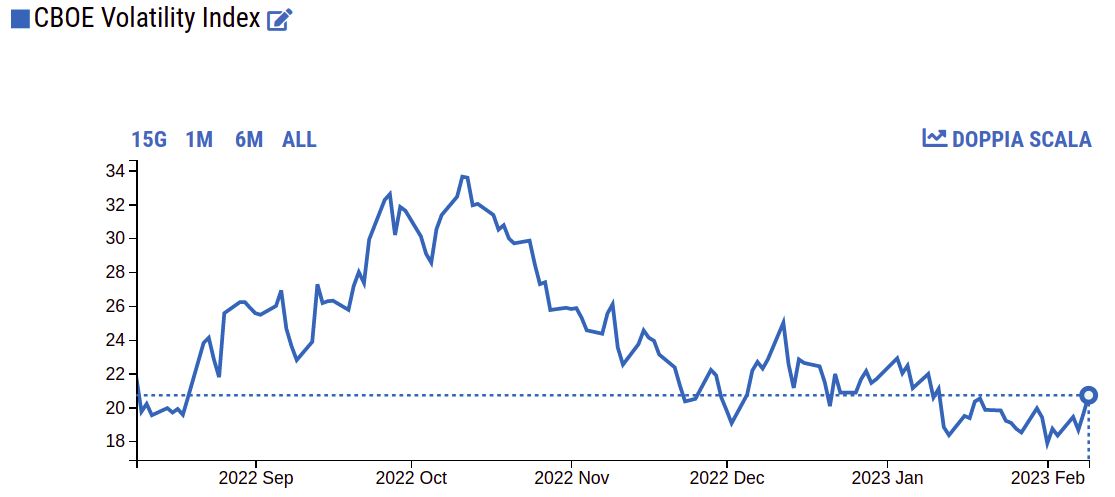

Along the same lines also the Vix Index, the famous "fear index," which measures stock market volatility expectations based on the S&P 500 Index: after hitting a low point, the index has shown an increase, albeit moderate, since the beginning of February.

CBOE Volatility Index

Shifting our focus from financial markets to European, American and Asian copper-intensive manufacturing, let us look at the S&P Global Copper Users PMI index, released last week for January. Although reaching the highest level of the past three months, the index remained below the 50 threshold, thus signaling a deterioration of the scenario in the three regions, albeit at a relatively modest pace compared to previous months.

Signals from economic indicators

The scenario coming from the copper front thus remains defensive, for the time being. Widening our gaze to the general economic picture in which Doctor Copper's evolution is set, let us focus on some recently released economic data.

Last week we reported how China's PMI had given some modest signs that the economy was restarting.

What about the corresponding US index? Unlike the Chinese PMI, the S&P Global US Manufacturing PMI for January reported a continuation of the falling trend of previous months, albeit at a slower pace than in December. Thus, from US manufacturing come signs of weak demand, both on domestic and foreign markets; at the same time, input costs are rising. S&P reports, however, an increase in business confidence, in the hope of increased demand in the coming months and greater stability for the value chain.

Thus, the mix of inflation and slowing economic growth is weighing on US manufacturing demand. With the exception of the healthcare crisis of 2020 and the financial crisis of 2009, the US PMI index remains at one of the lowest levels recorded in decades.

Moving from the American to the European picture, we report the recent release of the German industrial production index, which in December showed a larger-than-expected decline (-3.1% MoM); manufacturing declined, consumer goods grew modestly, while investment goods stagnated. Eurozone retail sales also fell in December, touching -3% compared to November and compared to the same period a year earlier. This indicator, too, thus suggests that inflation is impacting consumer purchases.

On the other hand, among the few upbeat reports is Italy's industrial production, which exceeded expectations in December, marking a 1.6 percent increase over the previous month.