Optimism falters: prices in partial retreat

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

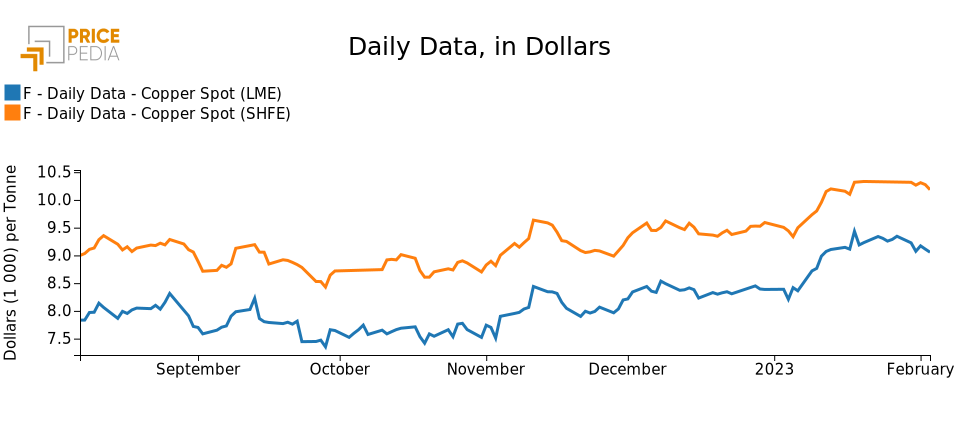

LME Copper Non Ferrous Metals Macroeconomics Doctor Copper SaysAfter the excitement on financial markets at the beginning of the year,

and the stabilization observed at the London Metal Exchange (LME) during the Chinese New Year, in recent days the price of copper has shown signs of a slowdown: more significant was the contraction recorded at the LME (-3.1% in dollars, compared to closing values of Friday, January 27), more modest at the Shanghai Futures Exchange (-1.3% compared to closing values prior to the Chinese New Year).

Let us then delve into this week's news and events that influenced market sentiment.

China: has the recovery really taken off?

This week, financial markets' early-year optimism about the recovery of the Chinese economy, and the resulting demand for copper in the face of an easing of health policies, began to falter. After the price rise observed in the first weeks of January, now markets seem more cautious, questioning the timing and extent of the rebound. As a result, copper prices are showing signs of a slowdown, correcting some of the previous rises.

Indeed, the Asian giant's economic recovery does not seem, for the time being, to be at full strength yet, as the latest data from S&P Global point out. This week saw the release of the Caixin China General Manufacturing PMI for January, which reports that the sector's output again showed a contraction, albeit at the most moderate pace in five months.

Overall, the index fell from 49, recorded in December, to 49.2: we are thus still below the 50 threshold, signaling that for the sixth consecutive month the health of China's manufacturing sector is in decline; however, the pace of this deterioration has slowed compared to December and turned out to be relatively marginal. The relaxation of Chinese measures thus seems to have helped ease the pressure on the manufacturing sector.

More optimistic, however, were the signs from the PMI released by the National Bureau of Statistics of China for January. The national index crossed the 50 mark for the first time since last summer for both the manufacturing and non-manufacturing PMI.

It should be noted that the two indices differ not only for their source (S&P versus National Bureau of Statistics of China), but also in the method of calculation and the sample of enterprises considered in the survey. Despite the discordance of the two indicators, the presence of signs of recovery for Chinese manufacturing seems common, but these cannot yet be said to be consolidated.

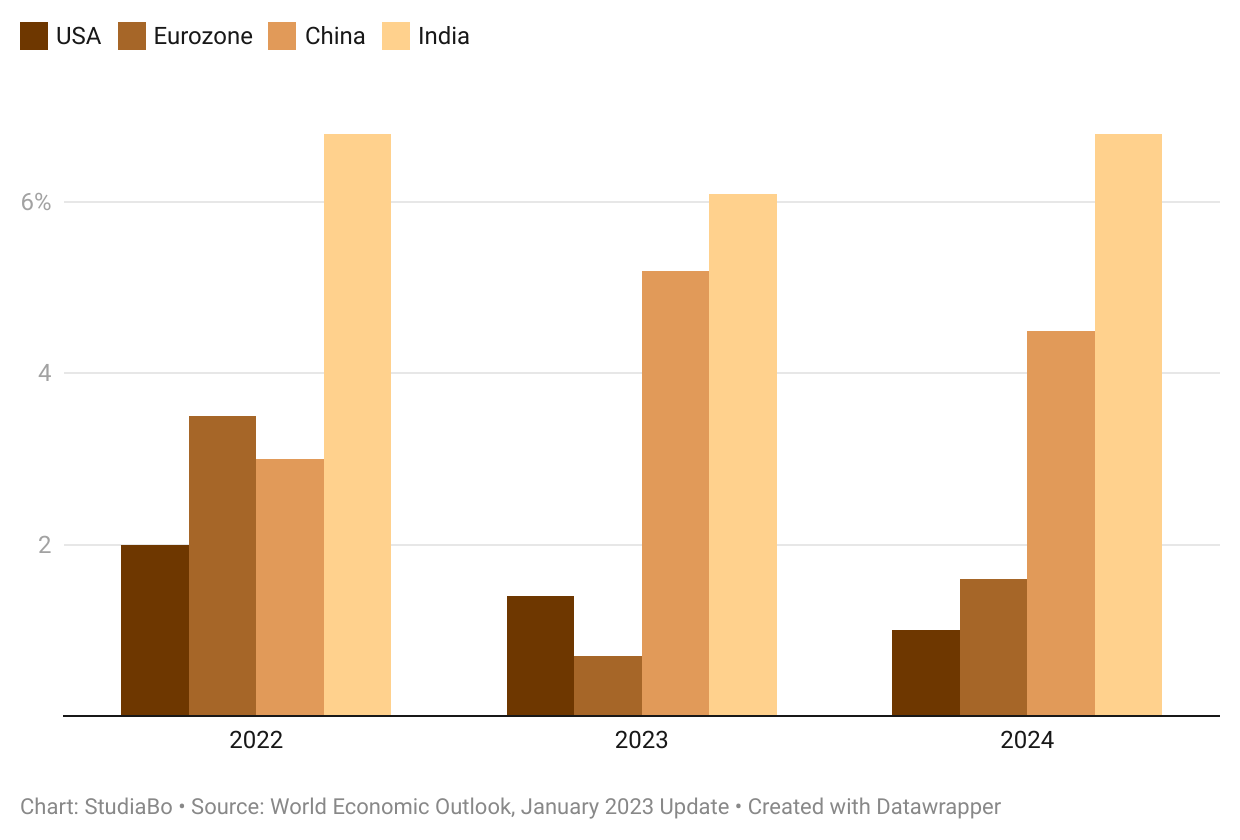

To get a general picture of the health of the Chinese economy, we can also look at the latest update of the World Economic Outlook. In fact, in January the International Monetary Fund (IMF) revised upward its estimates for the current year: while the October scenario predicted a +4.4% increase for China's GDP in 2023, with the latest update the IMF revised its forecasts to +5.2%; in general, the outlook for the world economy shows signs of improvement. The IMF estimates that India and China, jointly considered, will be the main drivers of growth this year, contributing half of economic growth on a global scale - compared with one-tenth for the US economy and the Eurozone jointly considered.

International Monetary Fund: GDP forecasts 2022-2024

Las Bambas halts operations

Looking instead at the latest updates on the supply front, warning signs are coming this week from Las Bambas mines in Peru, which cover 2 percent of world-scale copper production. In fact, since Feb. 1, the owner company MMG Ltd. has been forced to halt production for safety reasons, after months of blockades and protests, amid a general political crisis in the country.

“Although inflation has moderated recently, it remains too high”

To monitor financial markets' sentiment, let us finally look at recent developments on the monetary policy front. Indeed, this week several central banks' meetings have taken place, on both sides of the Atlantic.

While all three institutions continued on the contractionary line, the Federal Reserve stood out by limiting its increase to 25 basis points, in line with market expectations, compared with the 50 bps increases announced by the European Central Bank and Bank of England.

The FED is thus confirming that to be on a path of monetary policy normalization, following the 50 basis point increase in December and previous increases of 0.75 percent, against the backdrop of a disinflation process that is now underway, but still far from its conclusion. More restrictive, on the other hand, was the ECB, which made it clear that "in view of the underlying inflation pressures" it would most likely continue on the 50 basis point line at its next meeting in March, "and it will then evaluate the subsequent path of its monetary policy".