Markets in wait-and-see mode

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

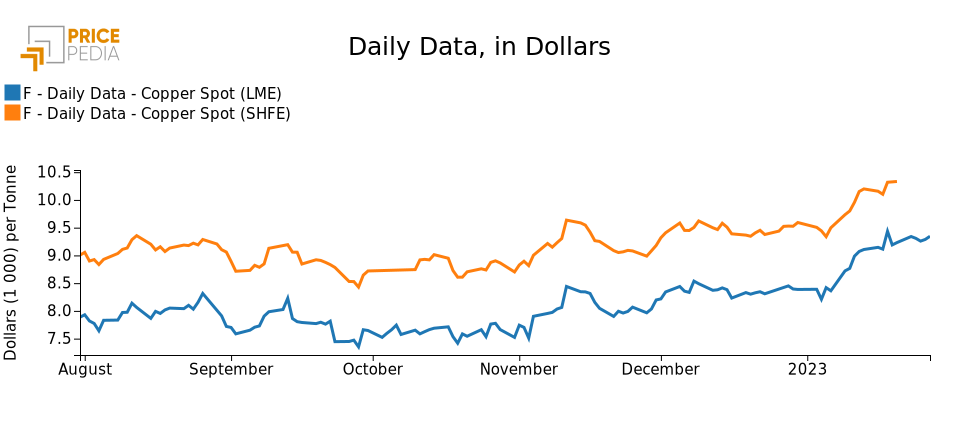

LME Copper Natural Gas Non Ferrous Metals Macroeconomics Doctor Copper SaysThis week, Asian financial markets mainly remained closed for the Chinese New Year holidays, which celebrated the beginning of the Year of the Rabbit. On the copper front, therefore, no updates came for the price quoted on the Shanghai Futures Exchange (SHFE); looking instead at the price quoted on the London Metal Exchange (LME), the week opened with a slight rise, followed by modest fluctuations. All in all, over the past few days the price in US dollars has shown a timid increase compared to last week's closing values.

Thus, no significant signals are coming this week from prices quoted on financial markets, which seem to fluctuate in a general wait-and-see mood for future developments. Instead, news came from South America.

While last week the Antofagasta mining company declared a decline in copper production in 2022, this week Codelco, the world's largest Chilean copper producer, also reported a 10 percent drop in production for the year just ended, mainly related to operational problems as well as delays.

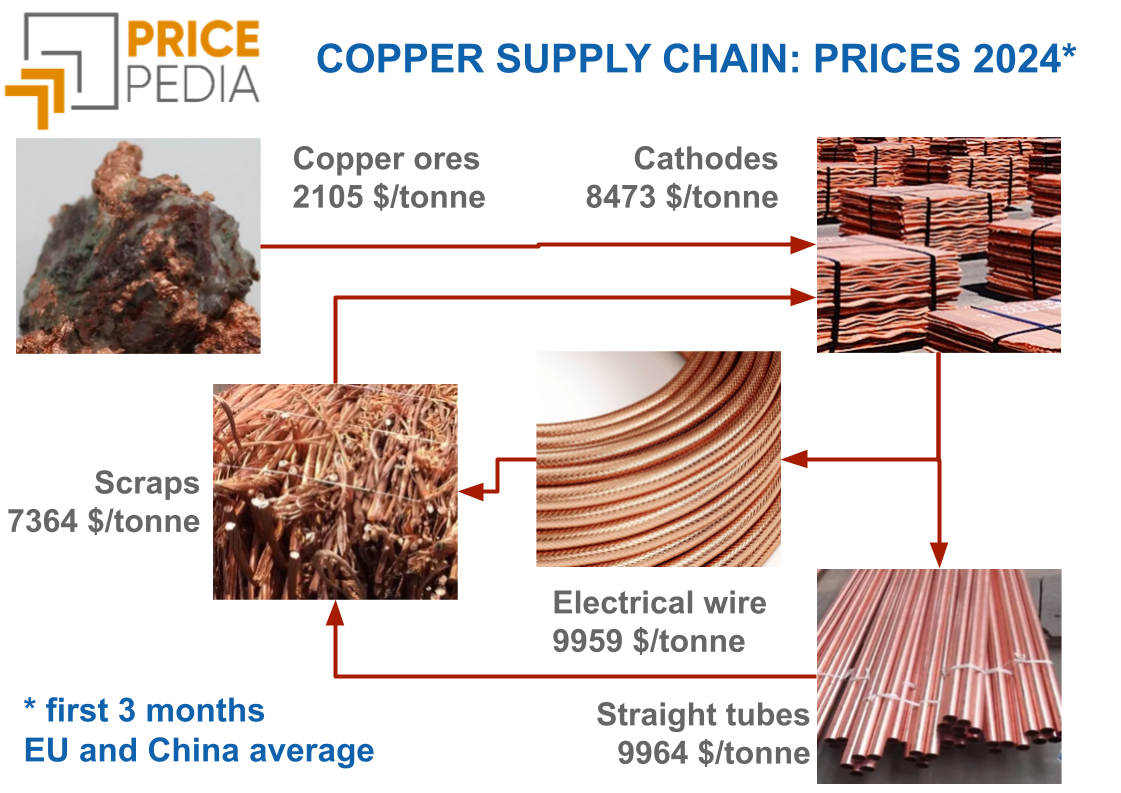

Thus, signs of supply-side risk are confirmed in a scenario in which copper demand is expected to increase, both due to the Chinese restart and the gradual energy transition.

A snapshot of the economy

Let us now broaden our gaze to additional key indicators that support the understanding of the current economic picture.

United States. The Bureau of Economic Analysis has recently released its first estimates of US GDP for Q4-2022: it reported a +2.9% QoQ increase, slowing from the +3.2% recorded in Q3. Thus, the US economy keeps on growing, albeit at a more modest pace, in the face of a central bank aimed at curbing inflation.

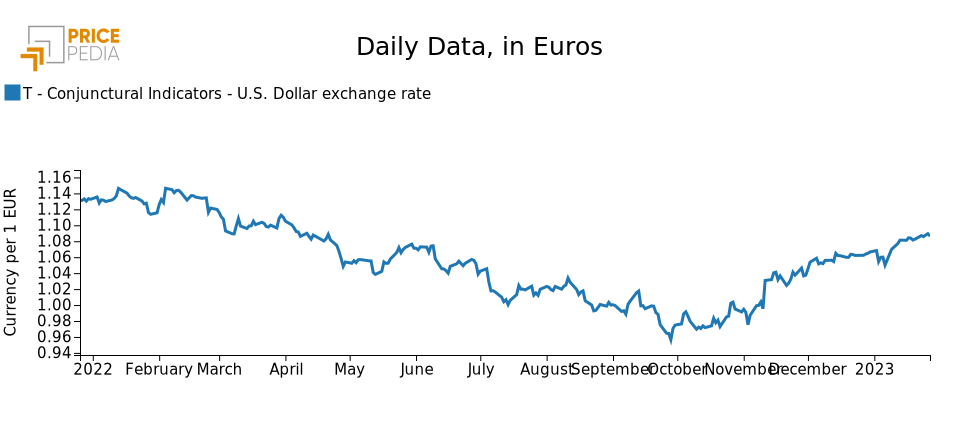

According to analysts' forecasts, at next week's meeting the Federal Reserve is expected to slow the pace of rate hikes, limiting to an increase of 25 basis points. Markets are betting on this scenario, and the dollar continues its weakening, returning to the levels of spring 2022.

Looking more closely at the various components of US GDP, we can see a particular weakness for consumer spending, which rose in October 2022 but then declined in the following two months; thus, prospects emerge for a weakening on the consumption front in 2023.

Europe. Moving to Europe, we report the release of the Ifo index for January, an index that measures the German business climate. After recovering in December, the index rose again in January, signaling that German business expectations continue to improve in the face of a contraction in gas prices and the reopening of the Chinese economy.

Along the same lines, the composite index of Italian business confidence, released by ISTAT for January, reports an increase for the third consecutive month. In contrast, after two months of growth, Italian consumer confidence recorded a contraction, weighed down by the burden of inflation.

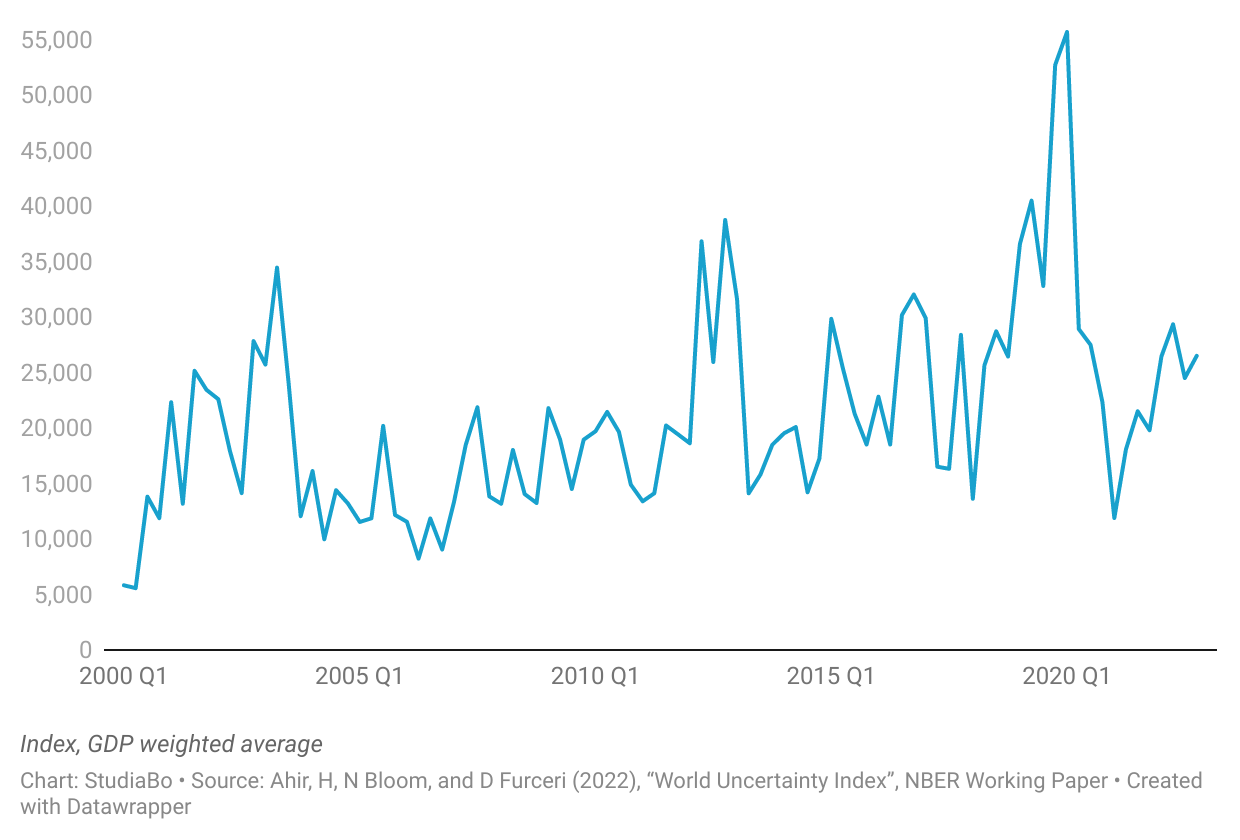

Thus, the international economic picture provides some signs of recovery, in the face of uncertainty that remains significant, as measured by the World Uncertainty Index (WUI)1. After hitting a low point in early 2021, the index embarked on a gradual upward climb; despite some fluctuations, uncertainty has remained at relatively high levels in 2022, weighing on the recovery prospects for the world economy.

World Uncertainty Index (2000 Q1-2022 Q4)

1. The World Uncertainty Index tracks uncertainty around the world through analysis of country reports from the Economist Intelligence Unit (EIU).